Executive Summary

In the United States, buildings account for approximately 40% of total primary energy consumption and about 30% of operational greenhouse gas (GHG) emissions. Further, approximately 80% of all buildings that will be standing in 2050 have already been built. Thus, while updating building codes to increase the efficiency of new buildings is essential to reducing GHG emissions, decarbonizing existing buildings is a key component of GHG emission reduction strategies.

We estimate that approximately $100 billion to $150 billion per year of financing will be needed over the next 30 years to retrofit existing buildings in the United States alone, if their operational emissions are to be reduced significantly to contribute toward reaching net zero emissions economy-wide by 2050. Currently, some jurisdictions offer public and ratepayer funding to help pay for the upfront capital necessary to retrofit both commercial and residential buildings, but this is not enough. It is essential to attract private funding into this area of investment to achieve any of the stated climate targets.

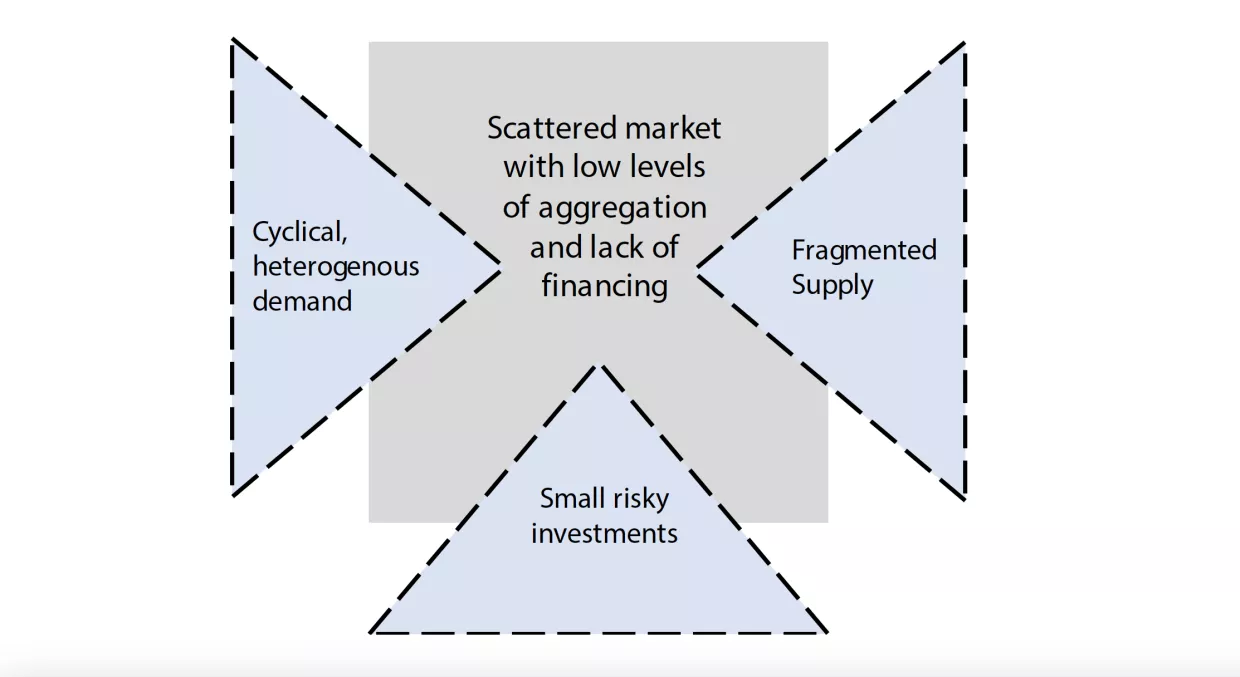

Private investors have been slow to finance existing residential decarbonization projects because of a range of barriers. Chief among them is a highly disaggregated and diverse market. Residential buildings include both single and multi-family buildings and retrofit solutions are highly heterogenous. Further, many building owners are unfamiliar with the upgrades necessary, unclear about their options for the near and longer term, and uncertain about their costs (both upfront capital and ongoing operational costs). On the supply side, each building’s retrofit needs are met with tailor-made solutions, while contractors with varied levels of training and knowledge are just beginning to expand their expertise to help building owners find the most efficient and effective solutions.

Overall, building retrofit projects range from investments that can yield positive returns because certain low-cost energy efficiency interventions are sufficient to capture large energy cost savings, to costly investments that are unlikely to pay for themselves through energy savings alone. Since the supply and demand for building decarbonization investments and services are quite diverse, there is little economy of scale to be captured to reduce the costs of retrofits, particularly for residential buildings. In addition, the financing need for each project is typically relatively small and the transaction costs are high for financiers to meet individual one-off needs. This is particularly challenging when the same financiers can finance large-scale renewable energy projects that have become much more standardized over the past decade. These challenges are particularly acute for residential properties compared to commercial buildings. In fact, commercial building owners typically work on a larger scale and have better access to capital, contractors, and planning techniques.

Figure 1 summarizes the challenges:

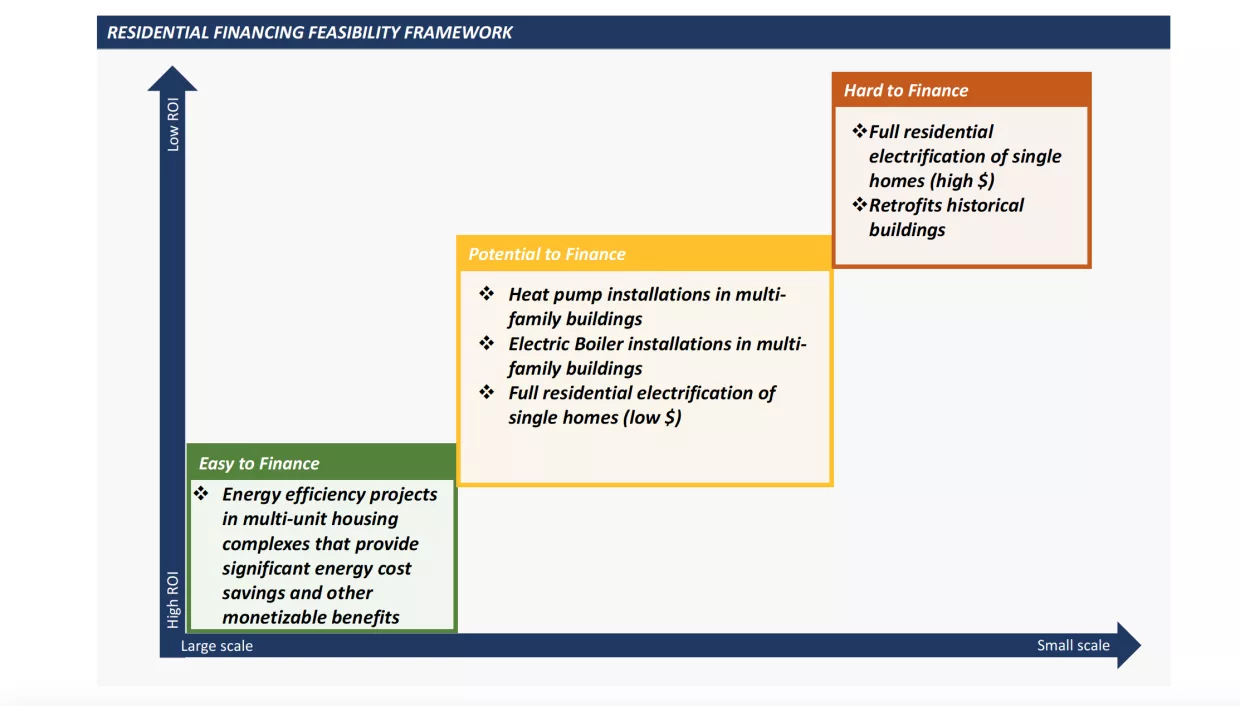

To address the market segmentation issue, we developed a “Residential Building Financing Feasibility Framework” (see Figure 2) that groups residential building retrofit projects into three categories of projects based on their economics and ease of financing. The first category of projects can be served by established business models and can obtain financing today since the anticipated energy cost savings substantiate the upfront capital investments. We designate this first category as “Easy-to-Finance” projects. The second category of projects have limited access to private financing; we designate them as “Potential-to-Finance.” The third category of projects are those that have very challenging economics; thus, we designate them as “Hard-to-Finance.”

Using such a framework in prioritizing building retrofit projects strongly suggests that resources (both public and private) should aim at delivering the most efficient solutions while growing the experiences of building owners, service providers, and financiers. Classifying building retrofit projects by their economics, with a particular focus on return on investments (ROIs), would focus near-term efforts on those that can maximize the benefits of investments and create a pathway for private investors to gain experience in financing building decarbonization efforts.

Our research, based on qualitative interviews of businesses, financiers, and project developers, highlights an opportunity to attract more private financing to the “Potential-to-Finance” segment. Projects in this segment are expected to receive slightly below market-level ROIs but provide enough energy and emissions savings that can be justified with a relatively modest pseudo-carbon price.

We believe a green bank could help unlock public and private financing for these projects. In our analysis, we find that a green bank could go a long way towards addressing the two biggest challenges private investors have described as key barriers: low ROIs and small project size. A green bank can help aggregate capital, including mission-driven dollars that require lower returns in exchange for non-strictly financial value. Based on the European experience, green banks can also blend public and private funds to channel investments that typically have not been able to be financed by private investors alone. Additionally, either directly or indirectly, green banks can help build and grow the decarbonization market by investing in and by aggregating service providers, thereby accelerating the market’s development and creating project economies of scale.

Additionally, our choice to focus on a green bank and the “Potential to Finance” market segment derives from the following insights that we have gathered:

- Starting with residential buildings that are in a relatively good position to contribute toward emission reductions in a potentially cost-effective manner will help service providers learn by doing and improve their services over time.

- Many “Potential to Finance” projects face financing gaps that are relatively small such that they can be bridged by using green banks, even within existing regulatory and market environment.

- There is abundant capital that is ‘stuck’ and eager to be deployed to help advance decarbonizing residential buildings.

Although this paper focuses on the use of green banks as one of the solutions to advance financing for residential decarbonization projects, it recognizes the importance of more substantial government policies to guide the development of a market for decarbonization services. Carbon taxes, emission targets and green building codes, and regulatory incentives are approaches that governments are and should be using or exploring. If implemented well, they can increase the economic viability of new decarbonization business models and private financing will follow.

Chang, Judy, Marco Fornara and Rushabh Sanghvi. “Financing Building Decarbonization: The Roles of Government and Private Sector Investors.” Belfer Center for Science and International Affairs and the Mossavar-Rahmani Center for Business and Government, January 22, 2024