Democracy for Sale? Corporate Spending and Its Impact on American Politics

The role of money is one of the most controversial debates in contemporary American politics because of its complex and nuanced impact on elections shaping the public perception and influencing policy priorities. This debate intensified post the 2010 Supreme Court's ruling in Citizens United v. Federal Election Commission which deregulated the corporate political spending.1 By lifting prior bans and restrictions on the use of corporate treasuries, corporates can now advocate to support or oppose political candidates exercising their First Amendment rights. This has also paved the way for the rise of super political action committees (Super PAC) that can funnel unlimited campaign contributions from corporations, unions, and individuals significantly shaping the landscape of political influence.2

The landmark ruling has fueled concerns over the rising influence of corporations and wealthy donors’ power to exert disproportionate influence on political outcomes. In fact, corporations and wealthy donors have been accused of their efforts to “buy the elections” by actively supporting candidates that align with their political interests or willing to advocate for them.3 This often contributes to skewed political representation, one that prioritizes donors and corporations’ interests over the public interests. On the other side, this has also encouraged candidates to shape their political agenda based on projected corporations’ contributions and their desired outcomes, which in some cases can be considered extortionary.

On several occasions third-party donations have undermined corporate commitments to a wide range of issues like climate action or social issues. Through political spending some companies were accused of inadvertently empowering lobbying efforts that shape laws counter to the company’s stated values, and more broadly influence the democratic system. For example, various companies have publicly supported the reduction of carbon emissions, yet their donations have funded lawmakers who opposed environmental policies.4 This misalignment raises questions about the broader impact on policy formation and regulatory outcomes and agency for control.

Further corroborating to this dilemma is the exponential political spending by the crypto industry in the 2020 and 2024 election cycles. During the past years, the American crypto industry has endured fragmented regulations with a wide spectrum of propositions. This ranged from complete banning on one side to restricted regulation or possible enablement on the other side, however, none were conclusive.5 Amidst this ambiguous environment and in the absence of a cohesive regulatory framework, crypto stakeholders and industry leaders were left in disarray. This situation was further aggravated under the Biden administration which imposed a tighter stance and called for stricter regulations. The emergence of pro-crypto super PACs as influential political players was a result of these conditions. The PAC’s primary objective is to support candidates that will advocate for a crypto friendly environment. For instance, in the 2024 cycle, crypto PACs have contributed $119 million, more than one-third of all the total corporate political spending money in the 2024 election cycle. These contributions were allocated for both House and Senate candidates that are expected to champion legislations that benefit the crypto industry.

The increasing influence of crypto oligarchy on the U.S. electoral outcomes risks the creation of autocratic political environment, one that can potentially favor the interests of digital finance stakeholders over the safety, transparency and security of the financial system.6 These risks exacerbate the vulnerabilities and democratic erosion of the American political landscape as noted by the Economist Democracy Index.7 Political power increasingly centralizes by substantial political spending, which undermines institutional checks and balances.8 This environment is further aggravated by anonymous contributions through complex channels.9 It also opens the door for autocratic manipulation under the guise of maximized legitimate political support and reflects crypto oligarchs' growing sway over political outcomes.

In response to these trends, progressive policymakers are advocating for campaign finance reforms aimed at enhancing transparency. This includes lobbying regulation with tighter restrictions like capping corporate contributions and revisiting the Citizens United decision. Furthermore, encouraging individual financing to make campaigning more economically accessible. Although these changes alone cannot fully restore public trust, they represent a step toward a fairer, more stable electoral system that better reflects democratic values and fosters an equitable policy landscape.

Money, Influence, and Power: Examining the Business Power in U.S. Federal Elections Spending

Over the past two decades, the US Federal Elections Spending have seen dramatic increase tripling from $5.6 billion in the 2000 federal election cycle to $15.9 billion in 2024 (inflation adjusted).10 The surge in spending can be partially attributed to the supreme court decision allowing corporations to contribute to third-party groups for outside spending, amongst other factors.

During this time, independent spending has witnessed a notable increase, averaging around 20% of election spending. Specifically, these expenditures have more than doubled, growing from $1.294 billion 2000 to $3.31 billion in 2020. In the current elections, independent expenditures have reached $2.8 billion, with outside groups spending an additional $1.2 billion compared to the same point in the 2018 election cycle, this emphasizes the greater influence of independent spending in shaping electoral outcomes.11

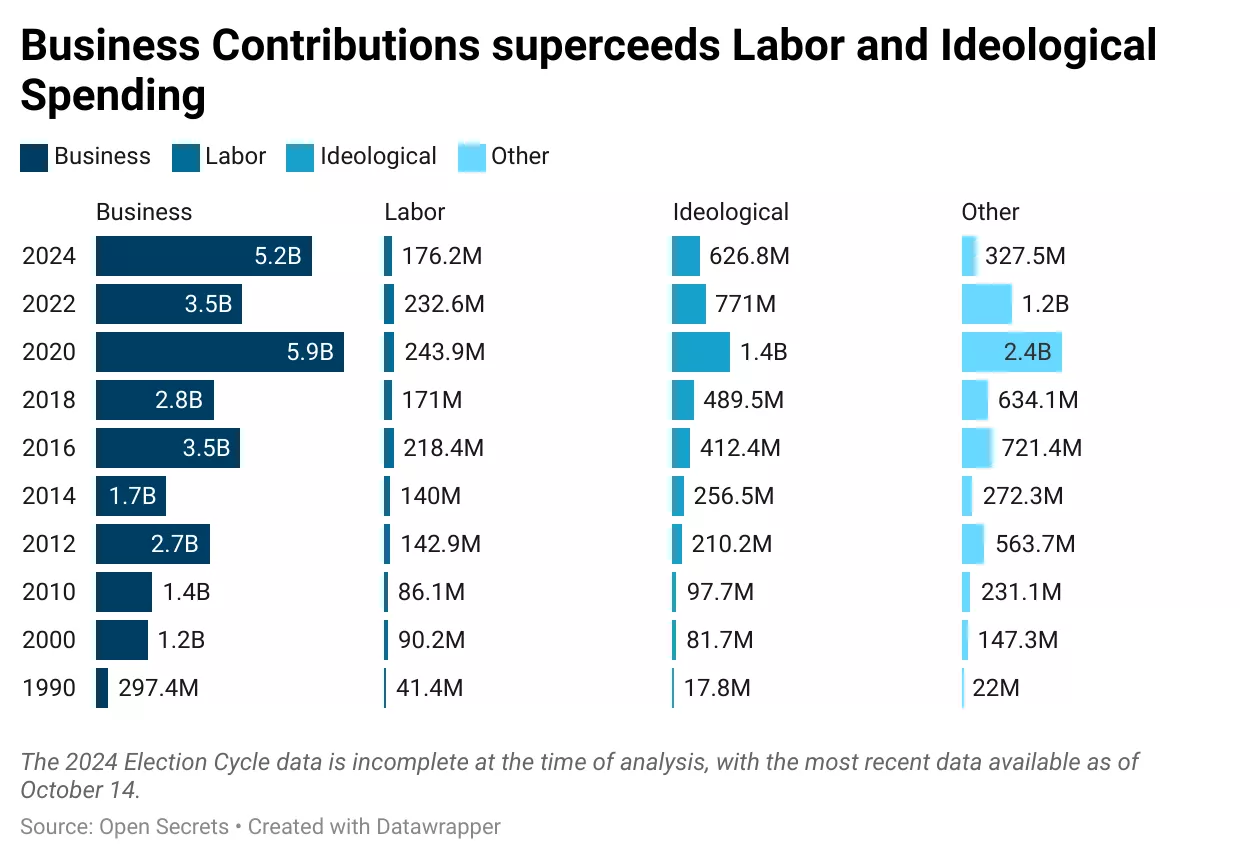

Political campaigns donors are broadly categorized into three categories: business, labor, or ideological interests. Business contributions have consistently dominated, outpacing labor donations, by a substantial ratio of 16- to-1. Even in PACs where labor unions are known to be more active, business holds a nearly 7-to-1 advantage. In 2024, business contributions are estimated around $5.24 billion, a figure that is projected to grow as the election cycle concludes.12 In the meantime, industry lobbyists and corporations’ donations have been playing an increasingly important role, particularly with the crypto industry dominance.13

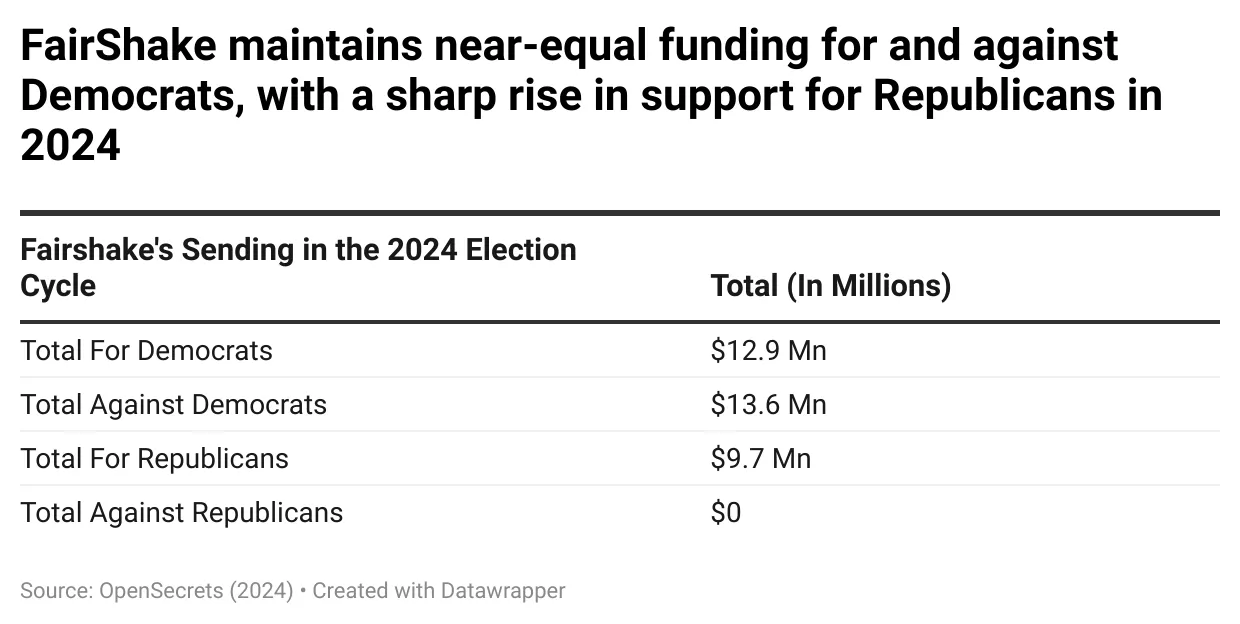

Pro-crypto super PACs have emerged as influential players in the political landscape contributing $119 million, nearly half of all corporate money contributed, $310 million. This is a significant escalation, as their spending is nearly 5 times higher compared to what the industry has invested in the 2022 election cycle and 20 times more than the amount spent in 2020. Most of the donations have been directed towards the super PAC Fairshake. Funded by major cryptocurrency firms and advocates, the PAC is committed to support candidates that “provide blockchain innovators the ability to develop their networks under a clearer regulatory and legal framework.” Accordingly, this is important for “the broader open blockchain economy... to grow [up] to its full potential... in the United States.”14 This influx of spending highlights the growing influence of the crypto industry in shaping the U.S. political landscape.

Coinbase and Ripple, have emerged as the largest pro-crypto spenders in the 2024 election cycle, together both companies have spent around $144 million. Among the individual contributors, the largest contribution of $44 million was made by Andreessen Horowitz Venture Capital.15 Combined, these three donors make up 71% of the total $202 million raised by Fairshake PAC and 65% of $132 million already spent in the 2024 cycle. The increasing flow of funds reflects the sector's strategic efforts to align with political allies amidst increasing regulatory scrutiny. By aligning with policymakers who are sympathetic to the needs of the blockchain industry, crypto firms aspire to shape a more favorable regulatory landscape for their operations, thus ensure that the long-term growth and innovation within the U.S.

Shifting Alliances: Finance and Crypto Sector Contributions In the 2023-2024 Election Cycle

More broadly, the finance sector has consistently been one of the largest contributors to elections. In 2020, the sector spent $2.02 billion through PACs and independent donations, with 52% going to Democrats and 47.57% to Republicans. However, in the current election cycle, the trend has shifted, with 50.19% of contributions being allocated to Republicans, compared to 49.18% to Democrats, signaling a more balanced bipartisan distribution. Parallels can be drawn in the crypto industry which has also diverted their attention towards the republican candidates. Recent estimates show that equal contributions were allocated both against and towards Democrats.

Although Fairshake has not disclosed the exact value allocated to the 2024 presidential campaign, millions of dollars have been funneled post Trump’s announcement of Sen. J. D Vance (R-Ohio) as his running mate. This strategic choice came amidst aggravated tensions under the Biden administration due to the challenging regulatory environment. This is because the administration has held a tougher stance with stricter oversight while pushing for clearer regulatory frameworks. On the other hand, crypto advocates have argued that these measures stifled innovation.16

In contrast, Vance is known to be a prominent supporter of the crypto industry and one of the vocal advocates for Web3.17 During his term as a senator sitting on the banking committee, he proposed legislation to reshape the US regulation of digital assets and govern with an industry-friendly and simpler approach.18 This move was recognized as part of the broader republican efforts to rally the crypto industry support, particularly after the collapse of FTX and the downfall of Sam-Bankman-Fried, one of the most prolific donors and strongest advocates in the industry.19

Fairshake PAC has shown considerable influence in election cycles, achieving notable success in securing victories in 33 out of 35 contests in the primary races they have contributed to. The PAC played a significant role in the defeats of several of the Democratic Congress members like Rep. Katie Porter in California and Rep. Jamaal Bowman in New York. Its strategy focused on targeting candidates with critical ads rather than advocating for cryptocurrency-related issues.20 This approach was built on the understanding that cryptocurrency regulations do not stand among the top priorities for American voters. As a result, the PAC was prompted to focus its messaging on broader issues that resonate with the electorates.

The Case for Transparency and Reform in Political Financing

Conflicting opinions and growing concerns on the role of money in politics. This raises concerns regarding the undue influence exercised by wealthy donors and interest groups impeding elections’ transparency and fairness. While money does not necessarily guarantee victory in elections, there is no doubt that it plays a significant role in swaying outcomes. Through increased political spending, candidates can either gain more visibility or leverage negative campaigning, both of which can potentially distort the election's dynamics.

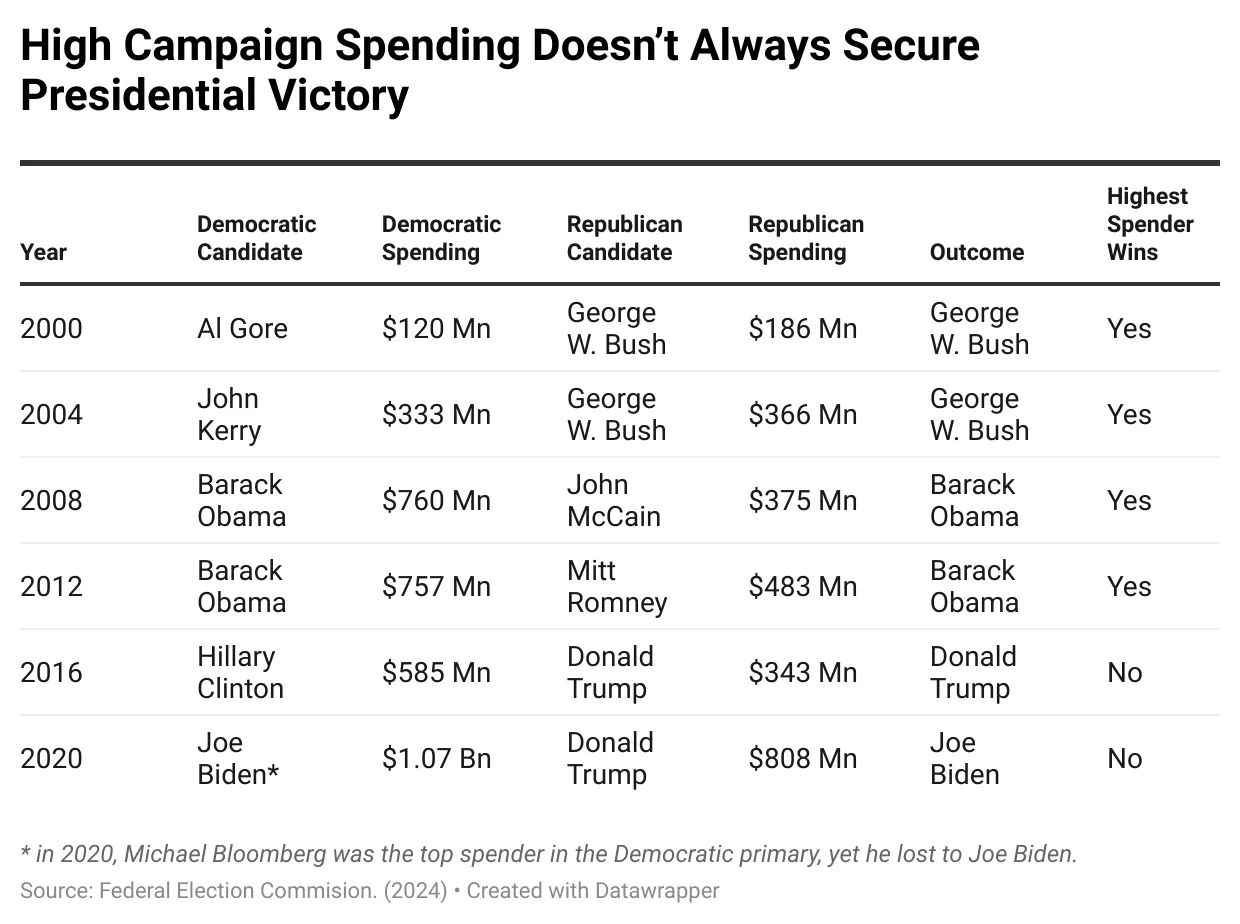

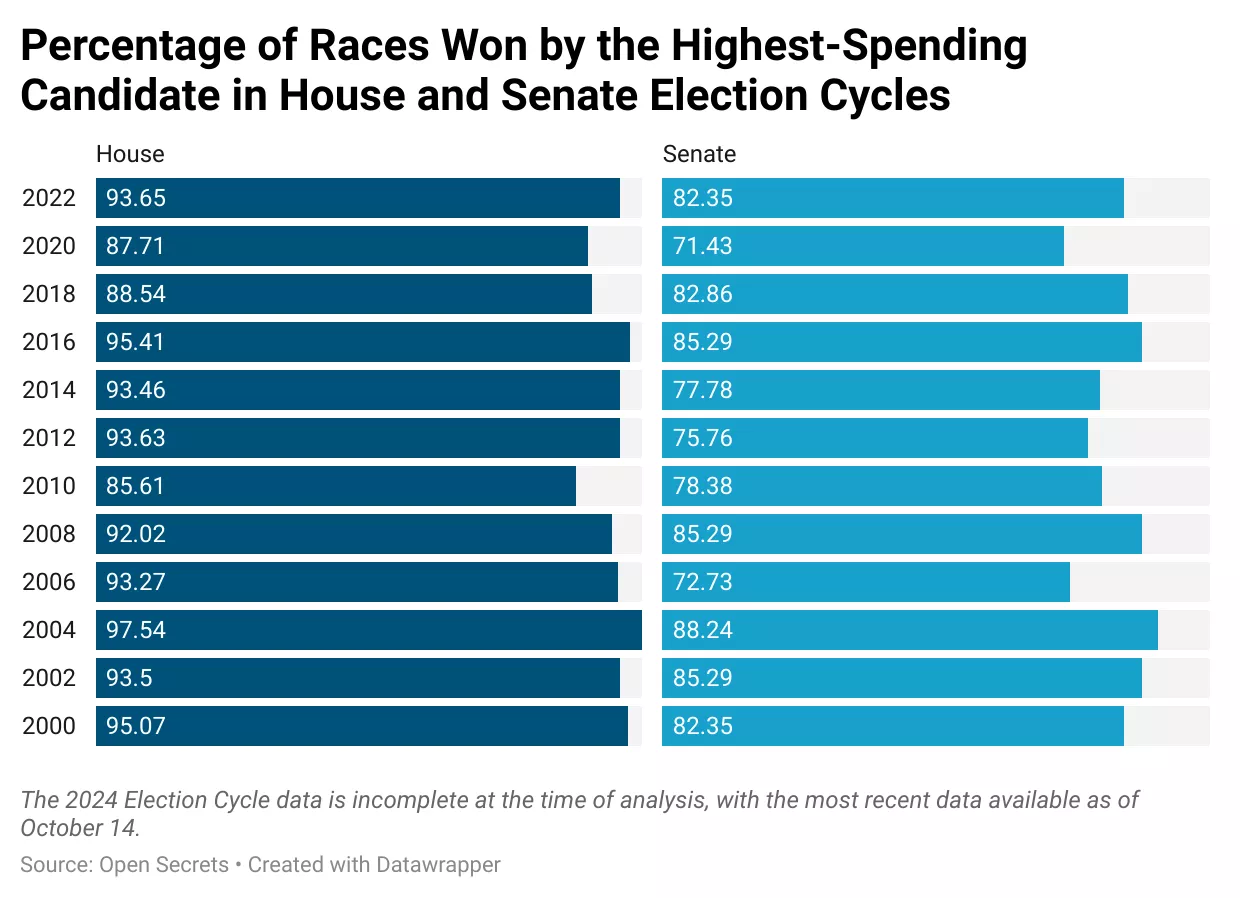

Although literature and research have failed to establish a causal relationship between political spending and its ability to distort election outcomes, evidently there is a positive correlation between electoral spending and success.21 Other factors like incumbency and partisan alignment to key states also contribute to the likelihood of winning. By studying historical trends and comparing winnings to political spending, it is commonly witnessed in congressional, and senate races that candidates who invest more money in campaigns, frequently win. On the other hand, in the presidential races, the impact of political spending tends to be less consistent with the winnings frequency. For instance, in the 2016 race, Donald Trump won despite spending significantly less than Hillary Clinton’s campaign. Similarly, in 2020, Michael Bloomberg was the top spender in the Democratic primary, yet he lost to Joe Biden. These instances underscore the need for a more nuanced understanding of money’s role in politics.22

The court’s assumption that unlimited corporate campaign spending would not pose any threats to the election outcomes has been contentious and increasingly disputed. Super PACs have been heavily invested in spending on candidates that are aligned with their policy goals. This doesn’t only contribute to shaping the political narrative, but also, potentially marginalizing other candidates, particularly those with differing perspectives who may excel in other policy areas. This influence creates an uneven playing field which affects the overall discourse where certain viewpoints receive disproportionate attention compared to others.

The growing role of the crypto industry in U.S. elections, particularly through independent spending, underscores the complexities of political finance in the digital era. The United States has continuously suffered from a fragmented and decentralized regulation of digital assets. The past years have witnessed the introduction of various regulatory bills with multiple regulators overseeing their implementation, all of which have failed, leaving stakeholders in disarray.23 This explains the increased spending during the 2020 and 2024 election cycle. Moving forward, it is crucial to have a more nuanced regulatory framework for the evolving crypto sector. This will enable the industry’s integration into the U.S. economy and promote technological innovation, while upholding the American democratic values.

Nevertheless, this is not only a cryptocurrency industry problem, one that is further induced by the crypto oligarchy, but rather an electoral funding regulation problem. To counter that, policy advocates have been pleading for the reversal of the citizen united court decision, calling for enhanced transparency through improved disclosures as well as capping the corporate political spending contributions. Additionally, to induce transparency, it is essential to introduce campaign finance reform clauses with stricter limits on individual and corporate contributions. Furthermore, promoting public campaign financing and reducing the reliance on large donors can make campaigning more economically accessible.24 Although these proposed reforms would not completely restore the public trust in the electoral process, they will contribute towards creating a more stable and transparent regulatory environment. This will ultimately benefit the economy and enhance the integrity of the democratic system.

This article is the first in a series exploring the challenges both imposed by and affecting the cryptocurrency industry.

Kolkaila, Ala’a. “Crypto-Oligarchy And Its Impact on U.S. Electoral Outcomes.” October 29, 2024

- Federal Election Commission, Citizens United v. Federal Election Commission, 2010, https://www.fec.gov/legal-resources/court-cases/citizens-united-v-fec/.

- Sarah Afaneh, Campaign Funding in US Elections: How Do Donors Control Presidential Nominees? (Washington, DC: Fiker Institute, 2024); Rui Albuquerque, Zicheng Lei, Jörg Rocholl, and Chendi Zhang, “Citizens United vs. FEC and Corporate Political Activism,” Journal of Corporate Finance 60 (2020), 47. According to Open Secrets, the Super Political Action Committee was established after the U.S. Court of Appeals decision in Speechnow v. FEC in 2010. Generally, PACS are not allowed to make direct contributions to campaigning candidates or their supporting parties, however, they are allowed to make independent expenditures in federal elections. This includes media campaigns, and advertisements whether digitally or through mail as well as all other forms without any limitations or restrictions on the usage of those funds in any of the listed expenditures. PACs are obligated to file regular financial reports with the FEC listing their donations, contributions and expenditures. For more, see “What Is a PAC?” OpenSecrets, https://www.opensecrets.org/political-action-committees-pacs/what-is-a-pac/.

- Maggi C. Karagosian, “From War Chests to Internet Fundraising: How Campaign Finances Influence Presidential Election Outcomes,” The Macksey Journal 2 (2021), 35.

- Center for Political Accountability, “Conflicted Consequences,” https://www.politicalaccountability.net/conflicted-consequences/.

- World Economic Forum, Digital Assets Regulation: Insights from Jurisdictional Approaches, October 2024, https://www3.weforum.org/docs/WEF_Digital_Assets_Regulation_2024.pdf.

- “Nowadays, authoritarians are elected throughout democratic elections, however as soon as they are in power, they manipulate the levers to secure their favorable outcomes. The growing influence of dark money coupled by the absence of transparency signals a drift toward autocracy.” Anne Applebaum and Peter Pomerantsev, “Introducing Autocracy in America,” The Atlantic, August 16, 2024, https://www.theatlantic.com/podcasts/archive/2024/08/introducing-autocracy-in-america/679474/.

- “Recent surveys indicate that Americans’ trust in their governmental system of government is reaching historic lows. Both the widespread mistrust of elected officials and perceptions of corruption are primary causes for low score of the American government Functionality sub-index.” The Economist, “Why America Is a ‘Flawed Democracy,’” March 21, 2024, https://www.economist.com/graphic-detail/2024/03/21/why-america-is-a-flawed-democracy/; Vanessa Williamson, “Understanding Democratic Decline in the United States,” Brookings Institution, October 17, 2023, https://www.brookings.edu/articles/understanding-democratic-decline-in-the-united-states/.

- Kate Andrias, “Separations of Wealth: Inequality and the Erosion of Checks and Balances,” University of Pennsylvania Journal of Constitutional Law 18, no. 2 (December 2015), 419-504.

- Campaign Legal Center, “How Does the Citizens United Decision Still Affect Us in 2024?” January 15, 2024, https://campaignlegal.org/update/how-does-citizens-united-decision-still-affect-us-2024; Organisation for Economic Co-operation and Development (OECD), “Recommendation of the Council on Transparency and Integrity in Lobbying and Influence,” OECD Legal Instruments, amended May 2, 2024, https://legalinstruments.oecd.org/en/instruments/OECD-LEGAL-0379.

- Sarah Bryner and Brendan Glavin, “Total 2024 Election Spending Projected to Exceed Previous Record,” OpenSecrets, October 8, 2024, https://www.opensecrets.org/news/2024/10/total-2024-election-spending-projected-to-exceed-previous-record/.

- Jimmy Cloutier, “Outside Spending in 2024 Federal Election Tops $1 Billion,” OpenSecrets, August 15, 2024, https://www.opensecrets.org/news/2024/08/outside-spending-in-2024-federal-election-tops-1-billion/.

- OpenSecrets, “Business-Labor-Ideology Split in PAC & Individual Donations to Candidates, Parties, Super PACs and Outside Spending Groups,” https://www.opensecrets.org/elections-overview/business-labor-ideology-split. Although business contributions are often overstated, open secrets classify individual donations based on their occupation/employer industry, which understates the labor’s influence. On the other hand, most often, the largest individual donors tend to be business executives and professionals, reinforcing the dominant role of business in political fundraising. In fact, Citizen United identifies 25 ultra-wealthy individuals’ billionaires contributing around $1.4 billion, accounting for nearly half of all super PAC donations. For more, see Bryner and Glavin, “Total 2024 Election Spending Projected to Exceed Previous Record.”

- Dorothy S. Lund and Leo E. Strine, Jr., “Corporate Political Spending Is Bad Business,” Harvard Business Review, January-February 2022, https://hbr.org/2022/01/corporate-political-spending-is-bad-business.

- Fairshake PAC, “About Us,” https://www.fairshakepac.com/.

- Andreessen Horowitz (a16z), founded in 2009 by Marc Andreessen and Ben Horowitz, is a venture capital firm focusing on investments in entrepreneurs building revolutionary technology across multiple sectors such as enterprise, bio/healthcare, crypto, fintech, and gaming. For more, see Andreessen Horowitz (a16z), “About Us,” https://a16z.com/..

- Maia Cook, “Pro-crypto Super PACs Pouring Tens of Millions into 2024 Elections,” OpenSecrets, July 29, 2024, https://www.opensecrets.org/news/2024/07/pro-crypto-super-pacs-pouring-tens-of-millions-into-2024-elections/.

- Alex O’Donnell, “Trump’s VP Pick, JD Vance, Could Mean a New Era for Crypto,” Cointelegraph, July 16, 2024, https://cointelegraph.com/news/trump-vp-pick-jd-vance-could-mean-new-era-for-crypto.

- Eleanor Mueller, “Vance Floats Crypto Plan,” Politico, June 26, 2024, https://www.politico.com/news/2024/06/26/vance-crypto-00164859.

- Jasper Goodman, “Crypto Titans Target Ohio, Montana Races That Could Flip Senate,” Politico, March 9, 2024, https://www.politico.com/news/2024/03/09/crypto-super-pacs-ohio-montana-00146138.

- Emily Wilkins, “Crypto Industry Super PAC is 33-2 in Primaries, with $100 Million for House, Senate Races,” CNBC, June 26, 2024, https://www.cnbc.com/2024/06/26/crypto-pac-house-senate-elections.html.

- Steven Sprick Schuster, “Does Campaign Spending Affect Election Outcomes? New Evidence from Transaction-Level Disbursement Data,” The Journal of Politics 82, no. 4 (2020), 1502-1515, https://doi.org/10.1086/708646.

- Charles Hua, “Campaign Finance: How Did Money Influence 2020 U.S. Senate Elections?” Harvard Political Review, May 8, 2021, https://harvardpolitics.com/campaign-finance-how-did-money-influence-2020-u-s-senate-elections/.

- World Economic Forum, Digital Assets Regulation: Insights from Jurisdictional Approaches.

- Campaign Legal Center, “How Does the Citizens United Decision Still Affect Us in 2024?”; Organisation for Economic Co-operation and Development (OECD), “Recommendation of the Council on Transparency and Integrity in Lobbying and Influence.”