ESG (Environmental, Social, and Governance) investing often does not work for early-stage VC-backed technology companies due to the nature of their evolving business models, products, and focus on growth. In addition, ESG and impact frameworks offer limited methodologies when it comes to anticipating negative technological consequences or harms in the long term.

Moreover, it is not just the responsibility of startup founders or regulators to assess and mitigate the potential negative effects technology has on society. Investors, who take credit for innovation, must also take responsibility for public risks. That is why we created a software tool, the Venture Capital Public Purpose Indicator (VCPPI).

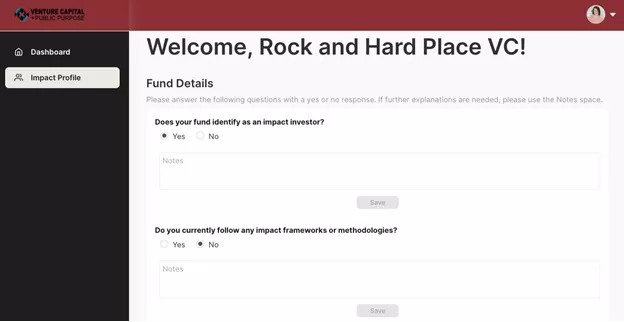

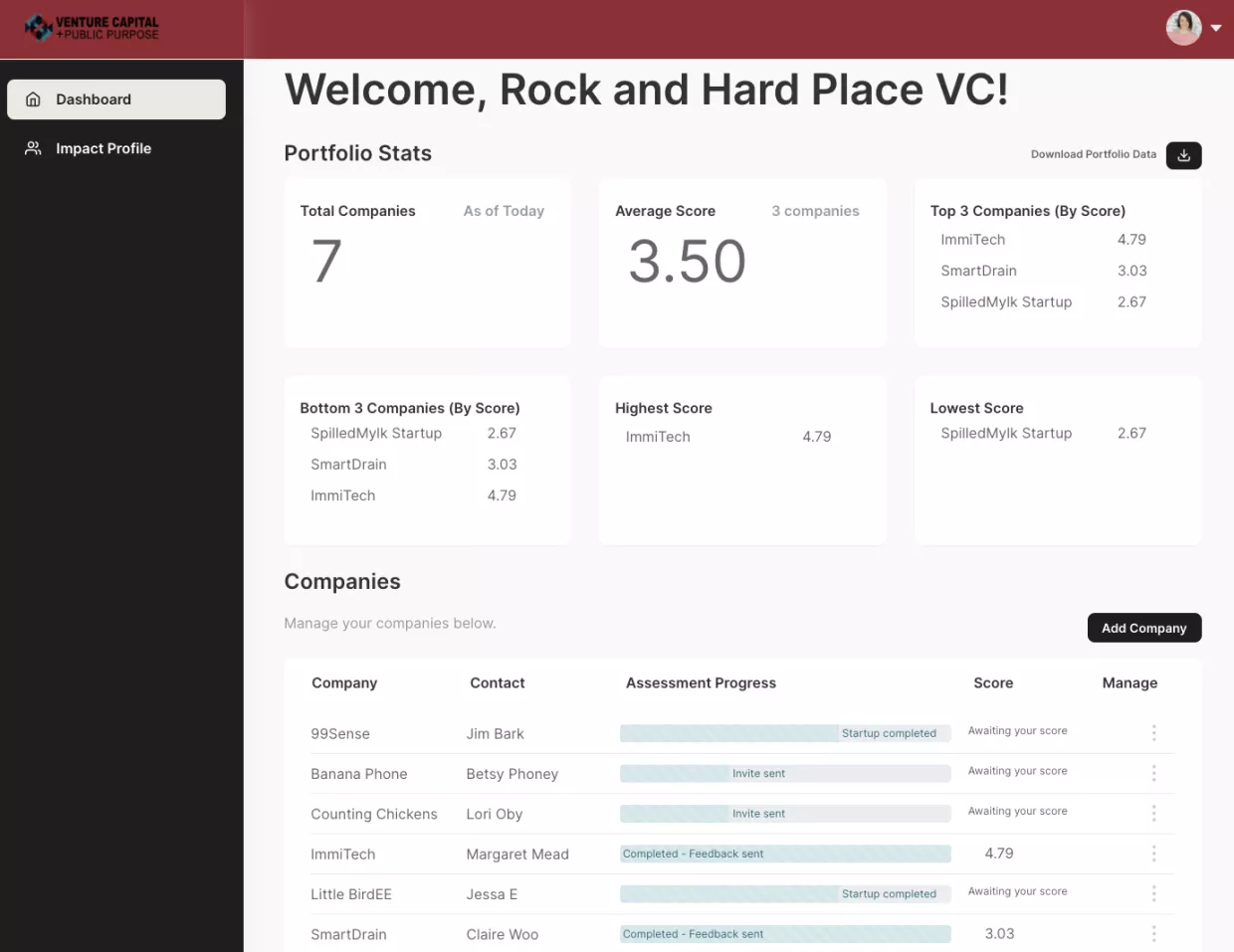

The Venture Capital and Public Purpose Indicator helps VCs and early-stage startups assess companies and technology for public purpose and value. VCPPI will help VCs evaluate their portfolios to ensure startups are planning for business and public risks related to the environment, labor, inequality, privacy, security, diversity, inclusion, governance, anti-corruption, and long-term value creation.

All questions asked on the Venture Capital Public Purpose Indicator and accompanying VC + Public Purpose Playbook (publishing date late April 2021) are backed by business cases and research in the social sciences and humanities under the premise that building companies with the public in mind can also improve performance via growth, profitability, competitive advantage, and liquidity. This tool can be used by generalist investors in addition to impact investors and can complement other diligence or planning processes. The outcome of the tool is to show public purpose improvement over time and to create a checklist of items a VC and startup should prioritize before, during, and after an investment.

Features of the VCPPI Tool:

-

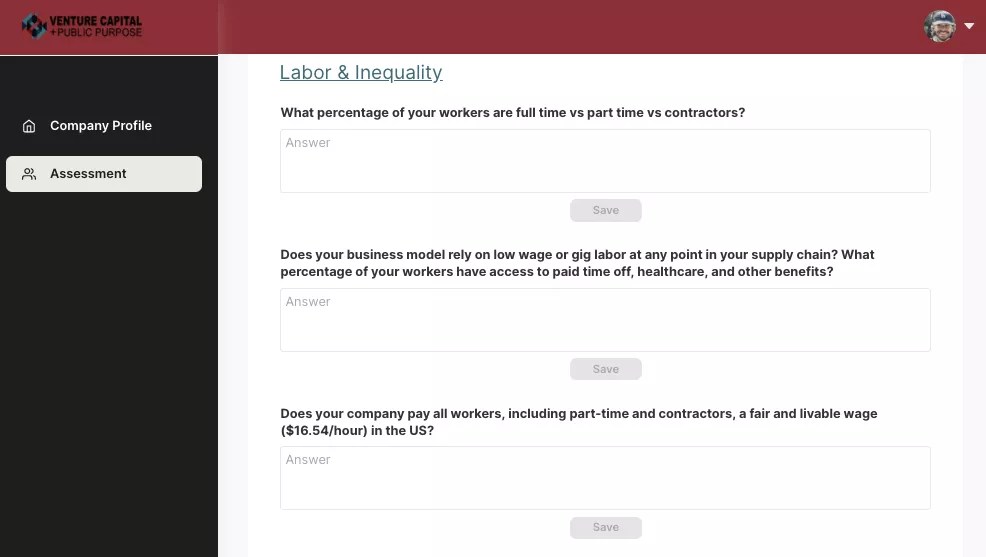

Questions: Startups answer a series of questions related to various public purpose themes.

-

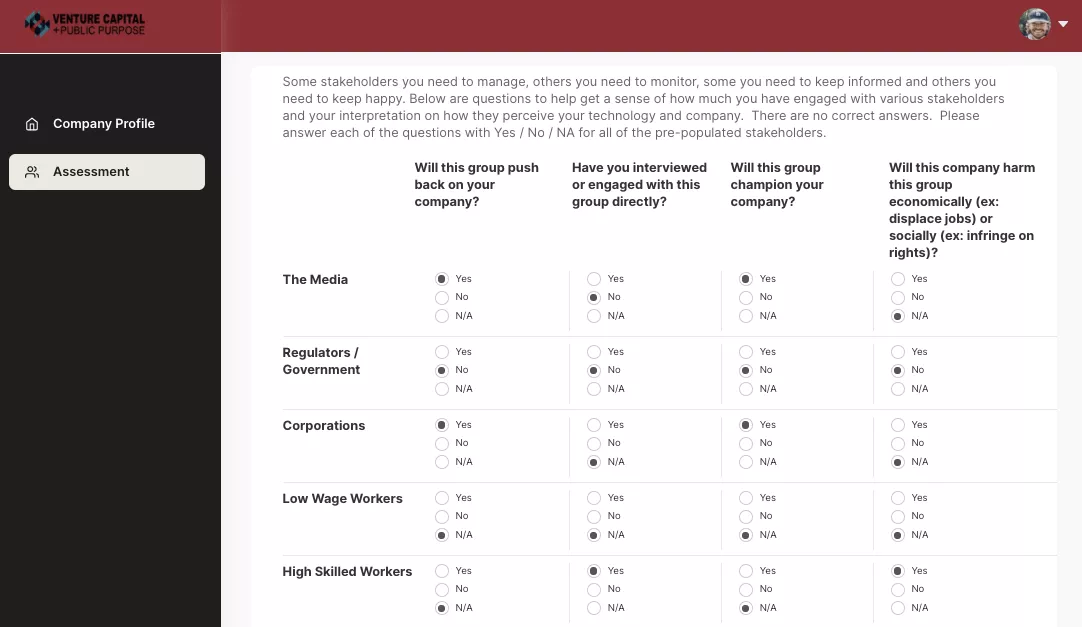

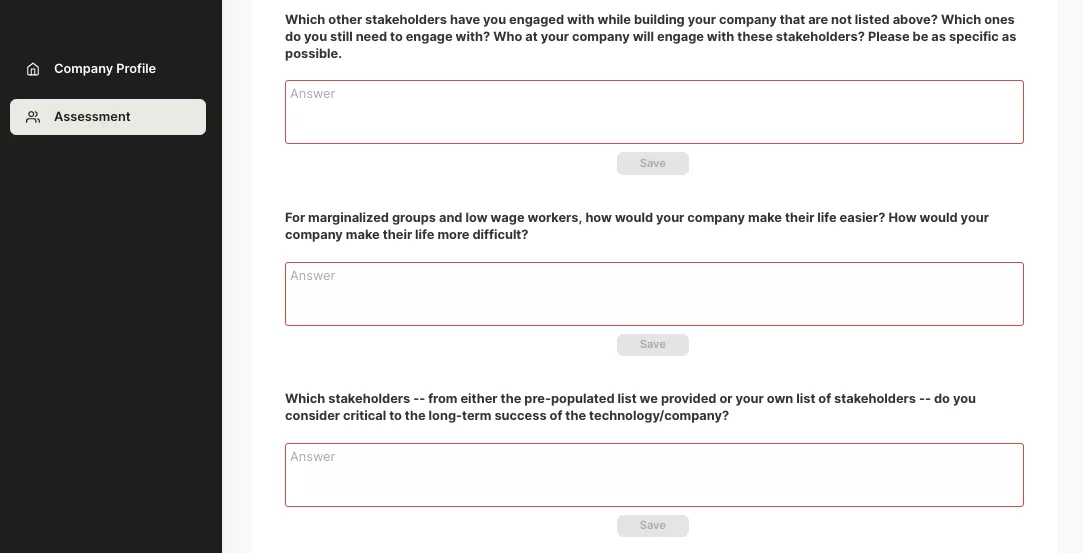

Evaluate: Startups use a provided framework to evaluate their stakeholders beyond customers and investors with an emphasis on the stakeholders’ access to power and resources.

-

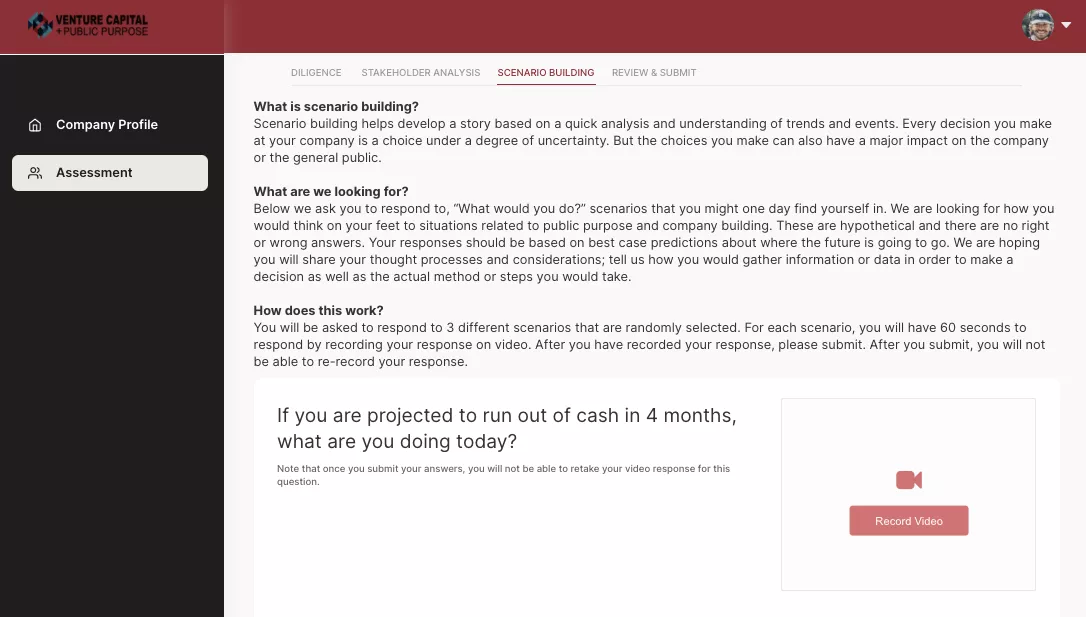

Simulate: Startups respond to scenarios related to public purpose to give an investor a sense of how the startup takes actions and makes decisions during tough situations.

-

Score: Investors analyze the startup’s responses to the sections and the startup is provided a score for benchmarking.

Screenshots of the VCPPI tool are below. For a full demo of the VC + Public Purpose Indicator, please visit our website.

Content and research by TAPP Fellow, Liz Sisson and Graduate Research Assistants, Nathalie Gazzaneo and Campbell Howe. VCPPI platform was developed by Nick Squires of Modeselekt.

Sisson , Liz . “Building Startups With The Public In Mind.” April 26, 2021