Introduction

by Nicola De Blasio

Senior Fellow at Harvard Kennedy School’s Belfer Center; former Vice President, Head of R&D International Development at Eni

Providing secure, reliable, affordable energy that is needed to fuel prosperity for all without causing devastating environmental consequences is perhaps the greatest challenge of the 21st century. Over the coming decades, global energy systems will need to transition from an era which relied on fossil fuels to one more dependent on clean energy. This transition will not simply consist of replacing one energy source with another. Rather, it will affect the systems, networks, and partnerships that embody the energy industry as we have known it for the last century. Many of these changes will be driven by technological innovation, which in turn will impact the nature and value of existing assets, supply chains, and regulatory and policy institutions. But innovation by itself is not the goal; the real objective is to deploy innovation at scale and bring the ensuing products and services to market in a secure, reliable, and affordable way.

Academia, business, governments, and civil society are all searching for innovative solutions to actively decarbonize all energy systems and sectors, and yet today’s pace of energy innovation is simply not fast enough to meet the challenge. Why is this not happening more rapidly? What needs to be done to speed up the innovation effort?

Success is possible, but it will require close coordination of policy, technology, capital, and society. Partnerships between the public and private sector will be central to this effort and must be complemented by the ability to educate all stakeholders on the challenges and opportunities inherent in the energy transition.

By focusing on real-world energy companies and eliciting the perspective of stakeholders, our goal is to uncover lessons learned from the private sector and recommend new paths to lead in the transition to a low-carbon economy. What steps is your company taking to adapt and change in response to the climate crisis? What is the role of the private sector in meeting or exceeding the Paris Agreement targets? Where are there opportunities for leadership? As part of the new Global Energy Technology Innovation (GETI) initiative at Harvard Kennedy School’s Belfer Center we asked these and other questions of industry leaders around the world.

In the spring of 2020, I convened the inaugural student study group “Energy Innovation and the Transition to a Low-Carbon Economy: Advising Fortune 500 Companies.” This report, part one of a broader series of interactions with leaders in energy and innovation and Harvard students, dives into these issues through the lens of a multinational utility. We present the insights of ENGIE’s Executive VP Shankar Krishnamoorthy, who is leading the company’s strategy and innovation efforts, and provide the study group participants’ advice on how ENGIE could continue its low-carbon transition into the future.

How Decarbonization, Decentralization, Digitalization and New Players Are Changing the Power Industry

No one really knows how fast the transition to a low-carbon economy will move, but one thing is certain—electricity is at the heart of this transformational change, with power demand increasing in the building, transportation, and industrial sectors. This growth is creating new challenges and opportunities for how to meet demand while addressing climate change and accelerating the transition to a low-carbon economy. Technological innovation will be key to driving the deep decarbonization of energy intensive sectors such as power, mobility, buildings, and industry; and where direct electrification is not feasible, green synthetic fuels or hydrogen produced from renewable electricity have the potential to tackle “hard-to-abate” sectors.

The power industry has been experiencing a disruption of unprecedented scope and speed in the way electricity is generated and in the associated business models. In a way, much of the industry was caught unprepared by the move from large fossil fuel powered plants to distributed renewable generation and by the need to manage revenue downturns, while meeting the demands of environmental and technology conscious consumers. These rapidly emerging trends of decarbonization, decentralization and digitalization require fundamental changes to the structure of the energy system as we know it and the design of appropriate market structures identifying cross-cutting benefits and costs, to recognize the full value of all generation options.

If this were not enough, the power industry is also facing a new competitive threat—the entrance of traditional oil and gas companies (IOCs) into power markets. Historically, IOCs had considered a move into electricity as a step too far, with the sector seen as oversupplied and highly politicized. However, the recent decision by Shell and others to sell electricity directly to retail customers is yet another example of how quickly the sector is changing. Why are IOCs entering the electricity markets?

The need to address climate change and play a role in the transition to a low-carbon future is one obvious reason, but there are many more, including the state of the energy landscape. Global markets are flush with natural gas and at the same time we are seeing record investments in new supplies of liquefied natural gas (LNG). Like all commodities, natural gas goes through cycles. However, this is more than just cyclical behavior—markets are facing a downward super cycle—where record oversupply coincides with record investments in new supply. This was a challenge even before the COVID-19 pandemic, which has also drastically reduced demand. In a buyer’s market, it is logical to try to get closer to final customers, establishing long-term agreements to reduce risk. An integration along the value chain also gives IOCs access to new business areas such as smart mobility, connected home services and/or demand side response. For traditional utilities and retailers, whose business models are already under pressure, this represents a dangerous competitive threat.

In this context of increasing competition, technology innovation will be even more critical for both incumbents and new players, not only as a means to gain a competitive advantage but also to accelerate the transition to a low-carbon economy at scale. Success is possible, but to achieve it, technological innovation must be complemented by:

- Redesigning policy and regulatory frameworks: Advance and reform regulation to enable full integration of distributed energy resources, spur innovation, and define new roles for distribution network operators and end-consumers as active market participants. Define clear and stable decarbonization targets. Design market structures identifying cross-cutting benefits and costs, to recognize the full value of all generation options—a key step in reaching decarbonization targets an optimizing cost, while guaranteeing security of supply.

- Deploying enabling infrastructure: Define clear market-wide rules around ownership and cost-recovery of physical assets, decarbonization targets, data ownership and cybersecurity. This will reduce the risk of stranded assets, allow planning security, and provide needed legal protections.

- Redefining customer experience: Incorporate the new reality of a digital, customer-empowered, interactive electricity system. Simplify and tailor services.

- Embracing new business and public-private partnership (PPP) models: Pursue new revenue sources from innovative distribution and retail services. Shift from asset-intensive business models to service provider platforms. Spur innovation and the ability to educate all stakeholders on the challenges and opportunities inherent in the energy transition. Bolster clean energy solutions by de-risking investments and lowering the cost of capital.

Analysis: ENGIE’s Strategy Toward a Low-Carbon Transition

by Zul Kapadia, Abigail Mayer, Johanna Schiele, and Rees Sweeney-Taylor

The Role of Innovation in the Transition to A Low-Carbon Economy

Innovation will be critical in the transition to a low-carbon economy. Meeting the goals of the Paris Climate Agreement requires reworking our existing energy infrastructure, but it is easier said than done. Rethinking energy systems hinges on reconciling the interests of many existing stakeholders: investors, banks, governments, energy companies, and consumers. Developing and fostering new ideas is the first step toward illuminating the frontiers of what is possible.

Our discussion with Shankar Krishnamoorthy drives this concept of innovation. We begin by trying to understand what innovation is, why it matters, and how to support it. We then provide a breakdown of innovative technologies that Krishnamoorthy sees as critical for the transition to a low-carbon economy. Next, we investigate how ENGIE commercializes innovative technologies in the context of current initiatives and projects. We conclude by offering recommendations designed to build on and accelerate ENGIE’s innovation efforts.

Understanding Innovation in the Energy Context

The meaning of innovation is inherently nebulous. In the energy context, it can be a new approach to providing a service, the creation of a new product, a novel development for previously inaccessible markets, or an altogether revolutionary technology. Innovation diverges from what came before and charts a new path into unknown territory. At its core, it is the seed of opportunity. We agree with Krishnamoorthy’s view that innovation matters because it offers a mindset—the notion that something original can be done—full of possibility to those working toward a low-carbon energy future.

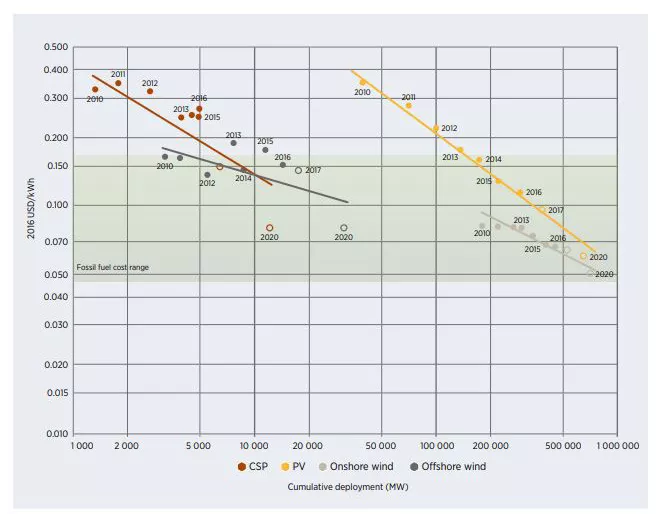

To illustrate the impact innovation can have in the energy sector, Krishnamoorthy recalls the success story of renewables. Just in the last decade, for example, the price of solar has dropped by a factor of five, whereas global installed capacity has grown by a factor of 10 to about 540 GW.1 Although solar and wind are intermittent and provide less than 10 percent of global power generation,2 the speed and scale of their penetration is heartening for those who are working to address climate change and accelerate the needed energy transition.

Innovation is, however, a difficult endeavor. It requires countless iterations and even then, is likely to result in failure. Some studies put the failure rate of new products and technologies at a staggering 95 percent.3 Moreover, innovating is expensive, so cost considerations become central to the process as well.

Krishnamoorthy recommends collaboration as a key strategy to foster innovation and help share the associated risks and costs. His example of gasoline stations illustrates how many companies can benefit from working together in developing a standard technology. In such endeavors, the initial development costs are shared, hence there are more resources available to try different technological solutions, and if successful there are significant positive network effects.4 While we agree that this approach is helpful, we also believe it is important to dwell on the dynamic of such cooperative agreements. How are they formed? Is it mostly organic? Does the implementation pace match the urgency of the climate crisis? Is there a diversity of perspectives and issues being considered? How can we meaningfully track and accelerate such efforts? Properly fostering innovation will be crucial if we are to meet the goals set out in the Paris Climate Agreement.

Finally, when a successful innovative technology has been developed, we recognize that its value might range from being incremental to a disruptive game-changer. By understanding what innovation is, the challenges it encounters, and how to foster it, we hope that we can better set our expectations for how the energy transition may unfold.

In terms of key technologies needed for the transition, as Krishnamoorthy indicates, we agree that it is helpful to focus on those related to anthropogenic emissions. Energy-related emissions make up approximately 73 percent of global greenhouse gas (GHG) emissions.5 On the one hand, this makes the energy industry a sector with huge transformational potential. On the other, the sector is characterized by long-term investments, making changes of direction difficult and slow. This duality is at the heart of the question: what role will innovation play in the energy transition?

Innovative Technologies to Watch in the Energy Transition

In this section, we dive into key technologies that will play a critical role in the transition, as outlined by Krishnamoorthy. These include renewables; short- and long-term storage; carbon capture, utilization, and storage (CCUS); hydrogen; and biomass. We also provide an analysis of how the public sector can support their development and deployment, as well as how companies can access the needed capital.

The path for a successful global transition is relatively clear, and supported by a large body of research and system costs modelling. On the demand side, energy efficiency is the backdrop for all low-carbon scenarios. Without lower energy demand, the Paris climate goals will be hard to achieve under any transition scenario.6 On the supply side, emission efficiency improvements of fossil fuel-based technologies are insufficient to reach meaningful reductions. Fortunately, independent of GHG-emission goals and demand projections, the least-cost power system is likely one based on large-scale renewables, in particular solar PV and wind,7 complemented with some gas peakers in the medium term, and green synthetic fuels and hydrogen in the long run.

Once more, renewables’ success story offers some context on the speed and impact that innovation can have on energy systems. Solar and onshore wind levelized cost of energy (LCOE) are already competitive with newly built coal or gas plants. In some cases, renewables are even cheaper than fully depreciated fossil fuel assets.8 While the costs of fossil-fueled power plants have stagnated for decades and those of nuclear plants have escalated, LCOE for renewable energy continues to fall steeply.

At the same time as renewables penetration increases, intermittency issues need to be addressed, together with the cost of the required grid improvements. This makes storage technologies a key part of the low-carbon energy puzzle. In the area of short-term imbalances, grid-scale batteries, smart charging of electric vehicles, heat pumps and digitized demand-side response will be crucial. The successful implementation of these options also hinges on the digitalization of energy services. Addressingmid- and long-term imbalances is more challenging and innovation will be key. Storage solutions that can bridge several days or weeks are unlikely to be feasible without liquid or gaseous fuels. Green hydrogen,9 ammonia, and synthetic fuels are potentially promising solutions.

In more general terms, the successful deep decarbonization of all energy intensive sectors—including mobility, buildings and industry—will require the deployment at scale of clean energy carriers, like hydrogen.10 Whilst some sectors can be directly electrified, hydrogen has the potential as well to tackle “hard to abate” industrial processes, like steel production. Hydrogen can also be used to make fertilizers, chemicals, green ammonia, and synthetic fuels. As green hydrogen capacity is being ramped up, blue hydrogen, made from natural gas with CCUS, could be a bridge technology.

The importance of investing in long-term decarbonization solutions now for a future with much larger renewables penetration is being acknowledged by more and more stakeholders. In July, the EU announced the most ambitious green stimulus in history with a 500 billion euros plan.11 The European Commission had also announced the formation of a Hydrogen Alliance,12 and is committing 10 billion EUR to hydrogen infrastructure projects as part of the COVID recovery package. This is combined with a clean hydrogen strategy exploring how to make the EU climate-neutral by 2050.13 National recovery plans of member countries also focus on hydrogen, for example the dedicated German Hydrogen Strategy, pledging nine billion EUR for R&D, industrial scaling, and hydrogen trade partnerships.14

Biofuels and biogas are also likely to play an important role. However, agricultural land use, forest protection, and fuel crops land use are already in competition. Without improved governance around land use change (LUC), biomass from fuel crops will not necessarily be low- carbon.15 Especially in regions with weak regulation around deforestation, fertilizer use, and land management practices, carbon abatement effects would be low. Areas of innovation include new sources of bioenergy for fuels, such as algae, as well as BECCS (bioenergy crops with CCUS).

The breakdown of the above technologies offers some insight into where innovation will be needed to accelerate the transition. In the next section, we investigate how ENGIE supports innovative technologies and where it is focusing its efforts.

Where ENGIE is Headed

In recent years, ENGIE has turned to earlier-stage innovative companies to leverage and access external innovation in the markets. In 2014, the company established a corporate venture arm, ENGIE New Ventures. It is a “€180 million fund dedicated to making minority investment in technology startups driving the energy transition.”16The fund targets Series A to C funding with typical investment amounts ranging between three to five million euros.17 The investment mandate includes companies that are creating technology solutions and new business models for “green gases (hydrogen, biogas), carbon capture and usage, energy efficiency, digital applications for industrial services, renewable and decentralized energies, energy storage and management.”18 We believe the fund’s purpose is well aligned to support the energy transition. Since its founding, the strategic fund has made 26 investments. Since venture-backed companies usually take between eight to ten years to go to market,19 it remains to be seen which of ENGIE’s earliest investments might have a transformational impact. Overall, while the venture capital model helps to support early-stage companies, we must consider whether ENGIE’s capital is making a difference or whether it is a way to jump onto the venture capital bandwagon, while externalizing R&D activities. While ENGIE’s fund size is a drop in the bucket compared to the over €1.5 trillion invested by venture capital globally over the last decade,20 we believe ENGIE brings additionality thanks to its market access, business insight, technological expertise, and ability to scale-up technologies and companies. However, we believe these same competitive advantages need to be made available to a broader set of start-ups, far beyond the original 26 companies targeted for investment, if ENGIE is to lead in the energy transition.

From our discussion with Krishnamoorthy, it is clear that ENGIE has many assets, other than their corporate venture fund, that can be instrumental in the transition. ENGIE’s internal R&D capacity includes more than 900 researchers and scientists. The Technology-Watch program has decades of data and insights into novel technologies; and ENGIE has a history of creating partnerships with a variety of organizations in the energy ecosystem, including universities, national laboratories, government agencies, and other stakeholders.21 Moreover, ENGIE has a broad global footprint spanning 70 countries,22 providing the company with a diversity of perspectives and the ability to diversify risk across their portfolio. Finally, as an A-rated utility, the cost of capital it can access is low, which is a valuable competitive advantage. All of these strengths should be developed further with an aim toward supporting innovation and accelerating the energy transition.

ENGIE is particularly focused on green hydrogen. Krishnamoorthy believes hydrogen offers a holistic solution when coupled with renewables, and notes that hydrogen value chains still have plenty of room for innovation. At the same time, while companies are entering the space more decisively than they did 15 years ago, Krishnamoorthy believes the key challenge is still economics: “by some estimates, hydrogen is expected to be economical by 2030. Others say that by 2040, you will have consumption of green hydrogen all over the world.” There is no clear consensus, however, on annual demand for hydrogen, as estimates range widely between 5 and 78 EJ, equating to around 14 percent of the world’s total energy demand by 2050. The key drivers for this growth include feedstock, transportation, and industrial needs.23 The cost to produce green hydrogen today ranges from 2.5 to 6.8 USD/kgH2. By comparison, producing hydrogen from coal or natural gas ranges from 1 to 2.5 USD/kgH2.24 The price gap between these alternatives indicates how much innovation will be needed before hydrogen will become cost-competitive.

We also discussed a series of ENGIE’s ongoing projects to reveal deeper insights into green hydrogen innovation. In Marseille, France, a consortium coordinated by GRTgaz, the gas transmission subsidiary of ENGIE, has launched the Jupiter1000 project25 to compare two hydrogen production technologies: proton exchange membrane (PEM) electrolysis and alkaline electrolysis. The produced hydrogen will then either be mixed into the natural gas grid or used to produce synthetic methane. In a second project, GRHYD, ENGIE’s team is testing the injection of hydrogen in a gas distribution grid (for residential heating uses) up to 20 percent. Finally, ENGIE is working with the ammonia and fertilizer industry to explore green hydrogen value chains in Chile. We believe in the promise of this versatile molecule to not only bridge some of the shortcomings of renewables but also to play a central role in paving the path toward a low-carbon energy future. ENGIE’s variety of projects in both geography and scope reveals its seriousness and commitment to decarbonization efforts. We support studying these real-world applications of hydrogen technology through pilot projects and encourage ENGIE to consider how these might complement its venture capital investment strategy.

We hope that by analyzing how companies like ENGIE approach innovation, innovators might find new opportunities for collaboration. To decarbonize our energy systems, a variety of stakeholders will need to cooperate across the value chain. Ultimately, innovation will need to lead to new products and services that can sustainably support a robust energy market. Continuous research and development is required to ensure that hydrogen technologies are technically improved, highly efficient, and as competitive as possible. In the next section, we offer recommendations to ENGIE on how it can better support and accelerate innovations in the transition to a low-carbon energy future.

Recommendations for ENGIE

ENGIE could take a more direct approach to leverage its market and technological knowledge by further developing partnerships with research universities. As Krishnamoorthy notes, businesses and universities have had remarkable success partnering to confront the COVID-19 pandemic. ENGIE can similarly direct more research funds and create scholarships to spur early innovation in academia as a complement to its venture capital strategy. Moreover, ENGIE could expand its internship opportunities, not only in research and innovation roles but also in more managerial settings to further spark a valuable intergenerational dialogue.

While ENGIE has not traditionally focused on basic research, the organization could easily develop the required skills, and thus better leverage its external partnerships. Furthermore, ENGIE should increase its cooperation with innovators and developers on specific projects, thus sharing its expertise with far more teams than the VC model supports. ENGIE could make a difference in accelerating the transition as it has the credibility, access, and proven track record to do so. ENGIE support would also go a long way to help overcome barriers by incumbent stakeholders. We think the lessons learned from real-world applications will be instrumental for creating new markets.

Additionally, ENGIE should continue fostering industry collaboration to advance new technologies. This could be done more deliberately, as well as organically. Goals could be publicly stated, and criteria made clear for how to participate and what is to be achieved by specific deadlines. ENGIE could convene an internal task force to vet its existing intellectual property in order to discover untapped opportunities from which the industry would collectively benefit. Moreover, as a leader in the transition, ENGIE could better leverage its convening power among peers and other stakeholders. Communication and outreach will be key, but while ENGIE has numerous partnerships and sponsorships, its website only lists a handful and does not offer clear indications of the objectives.26

Keeping in mind the needs of developing markets will also be key to achieving a low-carbon future. The developing world has a rapidly growing energy demand that still relies heavily on fossil fuels. These countries must balance their desire to industrialize and electrify with the responsibility of addressing climate change, and innovation will again be key. ENGIE’s historic footprint across 70 countries implies a unique perspective and voice to make a difference. Hence, ENGIE should increase its focus on innovative distributed and off-grid energy solutions in rural and developing country contexts. ENGIE New Ventures should play an active role in supporting budding companies in developing countries. We commend ENGIE for leveraging its identity as a French company to support francophone countries, especially in Africa. Finally, as Krishnamoorthy notes, the ability to raise capital and make investments in these locations, especially in demonstration and deployment stages, will also help to create the needed market demand.

The Role of Policy and Regulation in Supporting Green Innovation

Entrepreneurs, economists, environmentalists, and business leaders agree that appropriate policy and regulatory frameworks are necessary to support the transition to a low-carbon future. In the absence of active public intervention in shaping energy systems to encourage decarbonization, there are numerous market failures that prevent the socially optimal outcome of greater decarbonization. Most obviously, the negative externality of carbon emissions is borne by the entire society rather than being addressed at the source by energy companies. 27 Furthermore, relying exclusively on private research and development often proves insufficient; because successful technological innovation eventually becomes a public good, there is often insufficient incentive for private companies to invest in R&D at the level global society requires to avoid the worst impacts of climate change. 28 As has been seen with renewables, early support can help industries progress rapidly on the cost curve. Finally, the tendency to overvalue short-term payoffs jeopardizes future wellbeing for the sake of immediate consumption.29

Policymakers must address the right levers to effectively promote environmental sustainability; involving the business community can be helpful in developing the needed cross-cutting support to make regulations and market incentives effective and durable. Companies like ENGIE can speak to what has worked in the past and where the gaps remain for policymakers to fill so that they can competitively pursue decarbonization. Given the complexity of these market failures, Krishnamoorthy underscored that it will take several diverse and targeted approaches to accomplish the transition rather than a single panacea. Understanding business needs is even more important today as governments look to stimulate the economy in the wake of the COVID-19 pandemic.

Below, we examine three notable policy approaches that Krishnamoorthy identifies as supportive of the transition to a decarbonized economy. Each of these helps to solve the above-mentioned market failures: a price on carbon addresses the negative externality created by carbon emissions; subsidizing sustainability programs encourages critical research and development in nascent industries; and creating long-term market opportunities for hydrogen overcomes a narrow mindset of immediate returns based on business as usual practices.

Pricing Carbon

A well-designed economy-wide price on carbon can efficiently incentivize the transition to a low-carbon economy. Understanding how companies are considering the cost of carbon can be helpful to policymakers as they design and advocate for carbon pricing policies. In fact, Krishnamoorthy explained that ENGIE has been using an internal price of carbon for over a decade, and it has proven an important consideration among a diverse set of investment risk variables.

Many policymakers hotly debate a carbon tax versus a cap-and-trade program when designing their policies. As noted by Krishnamoorthy, some economists consider a carbon tax more business-friendly for driving down emissions because businesses can rely on price stability. 30 A cap-and-trade program, on the other hand, limits the amount of emissions, but can have wide price volatility, as indeed occurs at times in the European Union’s Emissions Trading System (EU ETS).31 However, as Krishnamoorthy indicated, we agree that settling on any policy is preferable to quibbling over the specifics of the policy. Having a policy in place is most important since it indicates that the government considers decarbonization a priority, which attracts investment in environmental technologies.

Krishnamoorthy also indicated that business leaders cannot count with much certainty on the specific carbon prices set by regulators. Given how legislation can be regularly updated and amended, prices are not set in stone. Therefore, unless policymakers can sufficiently guarantee businesses some certainty of a policy’s permanence, there is no particular advantage to the supposed price certainty of a carbon tax over, for instance, a cap-and-trade system.

However, the current low price on carbon encourages firms to continue to invest in long-term carbon-producing assets that will continue to function even as carbon prices climb in the future, precluding new fossil-fuel infrastructure investment. Therefore, it is critical that carbon prices rise sooner rather than later. Indeed, Krishnamoorthy noted that the EU ETS should be stricter, driving down emissions and further incentivizing decarbonization. This is an encouraging statement, and we support ENGIE’s recommendation for higher prices on carbon than the EU ETS market currently dictates. ENGIE’s 2016 press release recommending “a significant increase in CO2prices”32 was a positive step, and we strongly encourage the company to press this recommendation forward now by providing suggestions to the EU ETS that would accelerate the transition to a low-carbon economy.

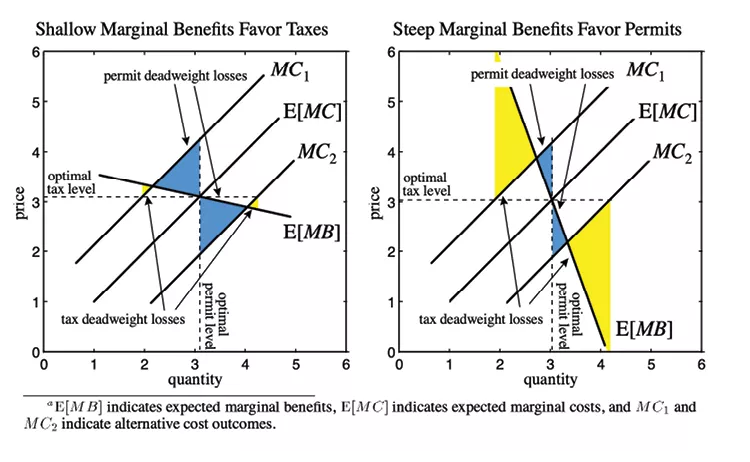

Economists are clear that given the relatively steep marginal cost curve and the relatively flat marginal benefit curve for abatement of carbon emissions, a tax is more efficient than a permit system for reducing GHG emissions (Figure 3).

However, it has also been noted that a hybrid system can approach or even exceed the efficiency of a pure tax.33 A hybrid system adds a price collar to the permit system, which restricts the price from going too high or falling too low. This promotes the overall efficiency of the system. It ensures that society neither pays an exorbitant price to mitigate the pollution, nor fails to reduce emissions significantly, should mitigation prove cheaper than expected. Based on this economic theory and given Engie’s recommendation that the carbon price be higher, we recommend that the company actively advocate for a price collar. This is especially critical in the wake of COVID-19, when carbon prices per ton collapsed to €15.34 To address this and future price craters, given that economists estimate the social cost of carbon as more than €45,35 we recommend that a sensitivity analysis be conducted at various price floors. Ultimately finding the correct floor price ensures that persistently low prices for the ETS will not slow stakeholders’ willingness to invest in the necessary technologies for a carbon-neutral future.

In addition to the price collar, ENGIE should advocate to keep a high percentage of permits eligible for the market stability reserve (MSR), which banks excess permits when the price per permit falls too low. In fact, the EU ETS permit price rebounded quickly after COVID due to the MSR. However, while the MSR is currently set at 24 percent of the total number of allowances in circulation, it is scheduled to decrease to just 12 percent in 2023. We recommend that ENGIE advocate that the MSR remain at 24 percent or increase after 2023, and not revert to 12 percent.

Supporting Biofuels and Energy Efficiency

When we asked Krishnamoorthy what regulatory framework would best support ENGIE’s decarbonization efforts, he focused his response on two areas of government subsidy: energy efficiency and biogas. We agree with his general recommendation that governments should support emerging technologies to accelerate decarbonization, and we see the stimulus response to COVID-19 as an excellent opportunity for the French government and the EU to spur investments in green technologies. ENGIE should use the prospect of economic stimulus and job creation to advocate for strong incentives for green solutions in the next round of stimulus.

We support the specific focus on energy efficiency as well. Krishnamoorthy noted that “efficiency is core to our business,” and he suggested government programs that would provide credit for energy efficiency upgrades or more stringent building codes. Energy efficiency is a critical component of decarbonization. Innovation in the area of energy efficiency is much needed to support the integration of large amounts of intermittent generation. Smart meters and smart home applications will not only help to save energy, but also enable small-scale demand response. Intelligent charging tariffs for electric vehicles and heat pumps will also be crucial to support rather than burden the electricity grid.

On the other hand, we view Krishnamoorthy’s suggestion of subsidies for biogas with greater skepticism. Specifically, Krishnamoorthy suggested that if the French government invested €30 per MWh to subsidize the commercialization of biogas, this would be good for the environment while also driving down biogas production costs dramatically, just as happened for wind and solar technologies. This advocacy is unsurprising, given that ENGIE has invested in three biogas generation technologies, including an approach using pyro gasification of solid biomass that is expected to reach “industrial scale” sometime in the coming years.36 In fact, just ten days after our call, ENGIE announced a partnership with Mirova to “boost the biomethane sector in France.”37

Current biogas tariffs in France are between €90 and €95 per MWh, three to four times the cost of natural gas,38 and at least €30 more than the most recent solar auctions.39 Generally speaking, society benefits when the cheapest technologies succeed in order to keep transition costs down. Therefore, subsidies should be technology neutral and oriented around CO2abatement, regardless of how this is achieved. This goal is best accomplished through auctions rather than feed-in tariffs. Of course, for nascent industries, with good chances of succeeding and proving critical to the energy transition, such as offshore wind or hydrogen, higher subsidies are justifiable.

It is an open question as to whether biogas falls into that category. True, biogas is storable and dispatchable and therefore more valuable to the system. But this value should be reflected by market mechanisms through the revenues biogas creates when selling electricity during “expensive” hours—when the use to the system is large. Where biogas is nonetheless the more expensive technology, other sources of generation should be used.

Furthermore, while Krishnamoorthy suggested that biogas investments have generally not received government subsidies and tax credits in the same way that solar and wind have, this is not the case everywhere. Companies in Denmark, Germany, and Italy enjoyed feed-in tariffs for biogas production and directly supported biogas infrastructure build-out going back to 2008 and 2009.40 However, the industry has remained reliant on such programs, and as government support has started to be rolled back in those countries, biogas investments have stalled.41 France, on the other hand, has tied its support of biofuels to price reduction thresholds that may simply be out of reach for this technological approach.

Additionally, the environmental and social impacts of biogas are nuanced: whereas biogas from waste or plant residues clearly has positive impacts for climate and the environment, the experience with dedicated fuel crops has been mixed. We see significant concerns around land use competition, deforestation for fuel crops, and the impact on ecosystems of monocultures, especially when looking beyond Europe.42

Finally we concur with researchers at Ghent University that likely the best market for biogas is as raw materials for green petrochemicals rather than as a natural gas substitute.43 We are also skeptical of large government subsidies with uncertain time horizons on the promise that a next-generation technology, such as biogas from micro-algae, will become price competitive. In fact, hundreds of millions of venture capital dollars were spent on efforts to make biofuels from algae in the US44 without success. Therefore, we are not convinced that specific biogas subsidies are the best focus of ENGIE’s policy advocacy.

Designing Policies for Hydrogen

Designing the right set of policies is crucial to create demand and reduce investment risk. By bearing some of the risks, governments cost-sharing in the development of the technology. By developing markets, governments bring stability to a nascent industry and can spur both demand and supply. Below is a list of policy schemes that governments could pursue to support hydrogen development and deployment at scale. No one of these is a silver bullet and it is likely that a combination of these policies will be needed to serve an individual country’s unique constraints and reward stakeholders.

Cost-sharing policies serve as subsidies to help mitigate investment risk.

- Issue grants for research and development (R&D) focusing on building hydrogen capacity: High priority R&D topics should include capital intensive projects, such as lowering electrolyzers costs and developing new membrane technologies.

- Provide equity or debt investment funds: Governments can help to de-risk and stabilize projects by taking a position in the capital stack. Like most infrastructure projects, building hydrogen infrastructure bears risks, like counter-party non-payment, market fluctuations, treasury rate price volatility, regulation changes, and permitting delays.

- Subsidize per-unit production costs: The scheme hedges the price of hydrogen by establishing a floor price. One way to structure this subsidy is by setting a euro or dollar value per kilogram of hydrogen produced.

- Offer tax credits: The policy supports investment by allowing developers and investors to deduct costs from their tax liability dollar-for-dollar.45 Tax credits can be based on the amount of capital invested or on units of hydrogen produced.

- Allowing accelerated depreciation: The policy is another measure to help reduce tax liabilities. Instead of following a straight-line depreciation method for federal income tax purposes, special provisions are made in the tax code to allow for deductions to be made in the first few years of the asset’s useful life.46 This is particularly attractive to investors in energy infrastructure, as assets can have a several-decades-long useful life. Being able to reduce the tax basis upfront helps mitigate risks associated with holding the investment long-term. For example, the US Modified Accelerated Cost Recovery System (MACRS) program allows for solar energy assets to be depreciated over five years.47

Market-building policies range from regulating that hydrogen be blended into the gas grids to creating direct purchasing schemes.

- Blending hydrogen into gas pipelines by mandatory quotas: The regulation helps to create a market for hydrogen by forcing demand. According to experts, around 5-20 percent can safely be blended into existing natural gas pipelines without any upgrades or adjustments to the grid.48 Per Krishnamoorthy, in France ENGIE can achieve up to 20 percent blending with minimal to no adjustment. This policy alone can spur multibillion-dollar investments as developers and investors will work to fulfill the created demand.

- Mandating that gas utilities issue purchase agreements for green hydrogen: There are a variety of mechanisms by which these contracts can be issued, including tenders, feed-in-tariffs, and bilateral agreements.

Sample legislation has been included in the appendix to illustrate how a collection of these policies might be used in the US context to support the hydrogen economy. The approach may not be the most straightforward globally, but has been designed to take US political and historical considerations in mind. It draws on the Renewable Fuel Standard Program that was developed to support the production of ethanol and its blending into gasoline.49 It also draws from the successes of renewables as seen in the tax credit and accelerated depreciation provisions. Both of these latter measures are specifically aimed at spurring private investment. As companies like ENGIE consider where to launch additional hydrogen projects, a careful understanding and advocating for the right policies will help to develop new business practices that can accelerate the transition to a low-carbon economy.

Recommendations for ENGIE

In advocating for these policy mechanisms, ENGIE should further leverage this coming period of stimulus packages to earn considerably greater support for green hydrogen technologies, as well as energy efficiency. Such regulatory support will drive job growth and establish a competitive edge in the coming decade in these critical emerging fields. Additionally, in order to gain greater certainty of future carbon prices in the EU, we suggest that ENGIE and other stakeholders advocate for a price floor and price ceiling for the EU ETS as well as a marginal stability reserve of at least 24 percent. A price collar will reduce price volatility while enabling the success of enhanced decarbonization efforts. Finally, as countries consider new policies to be put into place to support the hydrogen economy, ENGIE can help the dialogue by sharing what they have learned from their hydrogen blending projects and playing an active role in public advocacy.

Building and Enhancing Shareholder Support for the Transition

In addition to innovation and enabling regulation, transitioning to a low-carbon business model will require shareholder buy-in. Krishnamoorthy highlighted how contingent success is upon a CEO’s ability to convince shareholders of the longer-term financial advantages of implementing this transition. This past February, ENGIE had to face the challenge when ENGIE’s Board removed CEO Isabelle Kocher, who had made environmental sustainability a cornerstone of her corporate strategy.50 Communicating the business case for the transition is incredibly straightforward if government regulation supports the needed investments. However, when regulation is absent or uncertain, as it has been for the past several decades, convincing shareholders to invest in sustainability may be challenging.

Fortunately, shareholder perspectives are beginning to shift toward placing a deeper value on environmental sustainability. Across the globe, shareholders are citing environmental sustainability as a key investment consideration51 and calling for financial institutions such as Barclays52 and Commonwealth Bank53 to divest from fossil fuels. As a result, it will hopefully be less necessary for companies to convince investors about the need for the transition and more critical to demonstrate progress toward environmental goals. We believe that this trend presents an opportunity for ENGIE, a leader in the environmental transition, to differentiate itself by highlighting its achievements through more extensive quantitative reporting. In the following section, we explore these recent trends and propose ways for ENGIE to more effectively showcase its environmental work to shareholders.

Shareholder Interest in Environmental Investments

In recent years, investors have increasingly begun to consider environmental sustainability in their decisions. This is highlighted by the significant growth in buy-in for the UN-backed Principles for Sustainable Investment (PRI). From 2006 to 2019, the number of investors who had signed on to the PRI rose from 63 to 1,715 companies, with an associated increase in assets under management from $6.5 trillion to $81.7 trillion.54 Furthermore, in his 2020 letter to CEOs, Larry Fink, Chair and CEO of Blackrock, the world’s largest asset manager, argued that “sustainability- and climate-integrated portfolios can provide better risk-adjusted returns to investors.”55 In his speech at Davos 2020, Mr. Fink expressed surprise that, at least in private conversations with clients, they were “99:1 in favor” of his letter emphasizing the need for increased consideration of climate-related financial risk.56 Hopefully, this shift in investor sentiment will make it easier for companies like ENGIE to convince shareholders of the longer-term benefits of environmental investment, allowing companies to make short-term tradeoffs to mitigate longer-term environmental and financial risks.

As Krishnamoorthy mentions, the COVID-19 pandemic may accelerate the growth of shareholder interest in environmental investments. In light of the pandemic, many leaders and journalists are calling for a similar focus on the climate threat to prevent a future crisis of equal or greater magnitude.57 While some environmental advocates feared citizens would de-prioritize climate due to the all-consuming threat of COVID-19, recent polling suggests that concern about climate change remains a top priority for the majority of Americans.58 According to an April 2020 survey, 66 percent of Americans reported being “very” or “somewhat” worried about global warming, up from 62 percent in April 2019.59 Increasing public concern about environmental sustainability, coupled with low fossil fuel demand, may further persuade shareholders to support an accelerated transition to a low-carbon economy. In line with this trend, Krishnamoorthy believes ENGIE should seize the moment to push for business model innovations that advance the climate agenda.

Communicating Environmental Progress to Shareholders

As more shareholders adopt a climate-conscious mindset, the burden for companies will shift from justifying environmental investments to explaining their strategy and demonstrating their commitment through quantitative metrics. According to a June 2019 article in the Harvard Business Review, lack of high-quality data on sustainability metrics is one of the greatest limitations to environmentally based investment.60 Though there have been several initiatives to create impact-related progress metrics, such as the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Carbon Disclosure Project (CDP), company-reported environmental metrics remain scarce and non-standardized.61

One of the most widely used frameworks for tracking corporate social responsibility is the UN Sustainable Development Goals (SGDs). The SDGs consist of 17 priorities to improve society at large, including “taking urgent action to combat climate change” (SDG 13).62 While more companies are tracking their performance against SDGs, it is often done inconsistently and anecdotally. According to PWC’s 2019 annual report exploring over one thousand companies’ SDG reporting, 72 percent of companies surveyed mentioned SDGs in their reporting publications, but only one percent reported quantitative measures to show progress toward SDG-related targets.63 Historically, simply having environmental language in one’s report was sufficient to signal environmental consciousness, but as investors increasingly prioritize sustainability in their financial decisions, they will want to see more consistent and trackable metrics against which to measure companies. Reporting extensive quantitative environmental metrics is an area where ENGIE can differentiate itself from competitors by highlighting its environmental returns on investment in a consistent and easy to track way for shareholders.

ENGIE has produced several reports showcasing its environmental sustainability work, including its “2020 Integrated Report”64 and a section on New Corporate Social Responsibility Objectives in its 2019 annual financial reporting,65but none of these reports showcases ENGIE’s environmental progress in an extensive quantifiable way. Going forward, ENGIE should help ensure that shareholders better understand and appreciate its climate work by increasing the number, consistency, and clarity of its key climate metrics in all financial reporting. Rather than stating just one or two goals, ENGIE should incorporate tables of consistent environmental reporting into its annual and quarterly reports so that shareholders can track the company’s progress and performance as compared with its peers. Notably, in the 2019 annual report press release, ENGIE announced a quantitative goal to achieve a reduction in greenhouse gas from electricity production from 149 CO2equivalent metric tons in 2016 to 43 metric tons by 2030.66

We recommend incorporating this metric into a broader suite of metrics, which could showcase the holistic social impact of ENGIE’s environmental investments. Given that the industry has yet to align on such metrics, this is an opportunity for ENGIE to develop and present those that showcase its strengths and leadership.

The importance of metrics is more than just “greenwashing” the corporate report. By setting ambitious quantitative goals and tracking its progress, ENGIE can begin to foster numbers-based debate in boardrooms on the tradeoffs between financial returns and social impact and place pressure on others in the industry to take more ambitious environmental action.

Recommendations for ENGIE

In summary, ENGIE should capitalize on the increased investor interest in environmental sustainability (in particular in the wake of the COVID-19 pandemic) to push for an accelerated environmental transformation, leveraging the innovation opportunities previously discussed. Additionally, ENGIE should highlight its sustainability achievements to investors by developing quantitative metrics to track environmental progress and displaying them prominently and consistently in quarterly and annual reporting. This will help foster investor interest in ENGIE’s environmental investments and illustrate the returns of these investments. As ENGIE develops these metrics, it should automate environmental metric tracking as part of the company’s overall financial reporting to minimize cost and ensure it is well-integrated with existing reporting processes. Finally, the company should work with financial leaders to standardize environmental metrics across the industry so shareholders can track ENGIE’s environmental performance as compared to its peers.

Analysis: Summary & Recommendations

ENGIE has made significant progress transitioning to a low-carbon business model and should continue prioritizing environmental sustainability in order to remain an industry leader in this space. Some of the ways it can do so are as follows:

Continue to invest in the development and deployment of innovative low-carbon technologies and efficiency measures:

- Work with research universities to develop grant programs and scholarships for students developing innovative solutions for the low-carbon energy transition.

- Develop additional pilot projects with developers and innovators as a complement to the ENGIE New Ventures strategy, while offering credibility, access, and expertise.

- Look for opportunities to collaborate with peers on technology development and consider how innovation and associated patents might better serve the industry holistically.

- Develop solutions, like distributed energy systems or low-cost financing, to support developing nations.

Work with regulators and policymakers to implement regulation that incentivizes low carbon innovation and nurtures a hydrogen economy:

- Use the COVID-19 stimulus packages to earn considerably greater support for green hydrogen technologies as well as energy efficiency.

- Conduct a sensitivity analysis of various carbon price floors to maximize investment.

- Advocate that the current marginal stability reserve of 24 percent continues past 2023.

- Share operational lessons learned from hydrogen-blending projects.

- Continue public advocacy for a hydrogen economy.

Improve reporting on environmental progress to better capitalize on newfound public support for sustainability and highlight ENGIE’s industry leadership in this area:

- Seize the current opportunity presented by the COVID-19 pandemic to push for accelerated environmental transformation.

- Develop quantitative metrics to track environmental progress and display them prominently and consistently in quarterly and annual reporting to highlight environmental returns on investment for shareholders.

- Automate environmental metrics tracking as part of overall financial reporting by establishing clear data pipelines and dashboards to minimize cost and ensure it is integrated with other reported quantitative metrics.

- Work with financial leaders to standardize environmental metrics across the industry so that shareholders can track ENGIE’s environmental performance as compared with its peers.

Interview Questions & Responses: Transcript

What strategic path would you suggest a company like ENGIE take to address the needs of its stakeholders while pushing for a transition to a low-carbon economy?

Krishnamoorthy’s Response:

ENGIE is a good example of a large and complex company which has been balancing both priorities. Historically, we owned many coal plants, and we have had to spend the past five years transitioning away from coal. Throughout this journey, we have simultaneously managed the following priorities: communicating with stakeholders, leveraging our strengths, carefully integrating the needed innovation, and identifying financial partners with shared priorities.

In determining our stakeholder communication strategy, we prioritize two key groups: our shareholders and our employees. Firstly, we emphasized that at the end of our transition, we would look like a very different company. Highlighting this reality was critical to gain both groups’ buy-in to the changes we were planning to make to our core business model. Secondly, we set forth clear goals grounded in the company’s financial realities and shifting risk portfolio. We emphasized goals that were realistic and addressed the financial concerns of our stakeholders, rather than focusing on high-level concepts such as “decarbonization.” Many shareholders agreed with our vision because they feared that the company would lose value if it did not transition to lower-carbon practices, so in a way communication with shareholders was easier than with employees. As for our employees, since their lives depend upon their jobs, we had to be very careful and it took us a long time to gain their full buy-in and support. We took a top-down approach, beginning with the top tiers of management and eventually spreading our message to the entire company, proving that our decision to exit coal went hand-in-hand with care for all stakeholders. Throughout this process, we had to be agile and continually adapt our message as public sentiment and business realities continued to shift.

As we transformed our company, we focused considerably on how to leverage our inherent strengths. In our case, one of our four key business units, client solutions, was in a position to greatly benefit from a speedy transition to decarbonization. Therefore, we focused on how to grow that business throughout our transition.

In addition to leveraging our strengths, we recognized that innovation would be key to reinvent ourselves and achieve our vision. We thoughtfully identified a portfolio of needed changes and acquisitions and then proceeded to integrate them piece by piece into the company. We have avoided making too many large acquisitions. Instead, we identified many small and medium-sized acquisitions to accomplish our goals. Even with this intentional approach, we had a steep managerial learning curve through the middle of our transition because we had many new pieces that our managers had no experience with. We put a lot of emphasis on helping managers learn about the new tasks and responsibilities required throughout this process.

Finally, we focused on leveraging financing aimed at decarbonization projects. For example, we are the largest issuer of green bonds. Many of our business models today are based on what we call DBSO, which stands for Develop, Build, and partially Sell Out. We start from scratch, but don’t hold the asset forever because there are other investors, some with lower capital costs, who want to invest in projects that are green.

In your experience, do companies always get clear indications of what shareholders expect? Additionally, do shareholders perceive a tradeoff between profitability and going green?

Krishnamoorthy’s Response:

We see discussions with our shareholders as a two-way street; we want to discover their preferences and at the same time guide them. We pitch them our strategy, present the associated risks, and create an environment for engagement. The reality is that the shareholders’ expectations change as a function of the environment around them, so we do our best to get consensus on our strategy while balancing their changing needs.

Sometimes shareholders do not like the short-term trade-offs when, for example, we pull out of investments like coal and move toward a greener business model. In these cases, we have to explain why we believe that, although in the short term these investments do not guarantee the same return levels, over time they will be much more profitable as consumers continue to shift away from coal. It’s a lot of give and take because it’s very hard to model these long-term returns across the entire portfolio. These conversations often feel like a negotiation. Ultimately, you have to tell a story that will stick and not change that story too often.

What role will innovation play in this transition and what technologies do you think will be key?

Krishnamoorthy’s Response:

The energy transition, as can be seen with the withdrawal of the United States from the Paris Climate Agreement, is still a debate. In a 2.2 trillion-dollar industry, there are many stakeholders, like major coal players, who are still fighting for their share. How these competing interests will be addressed remains to be seen.

What role does innovation play in this debate? It gives hope, to start, and it gives a bit of strength to those companies who want to push in the direction of change. Change, after all, is driven by technology innovation, as we can see from solar and wind technologies. Finally, innovation is a powerful tool to reach carbon neutrality. In other words, innovation arms those who want to change with the means to go against a rigid and long process, while giving hope.

Innovation, however, is very expensive. After investing in 100 startups, two of them might make some money. After investing in 10,000, maybe only then you will find a winner. Innovation requires imagining something that does not exist. Most of these efforts are not successful—something goes wrong, and this is why it is so expensive.

The way to make innovation work better is through cooperation. It means having the willingness to approach a competitor with a simple proposition: to collaborate rather than both working separately on the same ineffective idea. In ENGIE’s case, we do this often. For example, there is this company called Heliatek, which is investing in organic photovoltaics. We are partnering with them even though they are a subsidiary of RWE, which is a big competitor of ours. This is also happening in the electric vehicle industry. Instead of Tesla setting up their own chargers everywhere, for instance, car manufacturers are talking amongst themselves to create a shared network of superchargers. Without this collaboration, there would be a phenomenal amount of wasted resources. Imagine if General Motors and Ford each had their own gas stations—this type of inefficiencies are especially problematic with new technologies.

In terms of the technologies needed for the transition, it is helpful to focus on those related to human-made anthropogenic CO2 emissions. Everybody understands and accepts that renewables are here to stay, forever. They will continue to grow and evolve—whether it is batteries, artificial intelligence to manage intermittent power, supply and demand, or the absence of inertia on the grid. Essentially, these are one big technology that will play a prominent role. Over the last ten years at least, people have begun talking about renewables as if they can solve all the problems on Earth. However, we do not believe electricity can fix everything; we will need other technologies beyond renewables.

One technology we are particularly excited about is renewable or green hydrogen because it is the cleanest one. Moreover, it has a lot of characteristics that renewables do not have. In time, the two will coexist. Today, companies are moving into hydrogen more decisively than they did 15 years ago; more and more investments are going into building a hydrogen economy.

Everything around electric mobility also must survive because hydrogen does not currently have the needed level of fuel economy. Electric mobility works and it has just started to improve like crazy. If you look at next year, 2021, there will be 15 different models of electric vehicles that can do 500+ kilometers. This is a drastic improvement from the 100+ kilometers which were the standard two to three years ago. Again, I do not think this alone will solve all the problems. For example, by converting all internal engine vehicles to electric, you would save three to four gigatons of CO2. However, there are 200 gigawatts of new coal-based electricity being built or recently commissioned around the world, so coal will not just go away for the next 30 years.

These numbers clearly show that we will need technologies like carbon capture, utilization, and storage (CCUS). We will have to capture and store CO2—there is no alternative. Today, there are 17-18 CCUS plants. There could be ~20,000 in the next 10 to 20 years.

Finally, marginally, there will be a need for biofuels, particularly in air transportation. Air transporting has been deeply impacted by coronavirus, and it will probably never fully recover from it. It will take a long time for people to stop being scared of traveling, and this does not help the industry. On top of this, there are environmentalists saying it is bad to fly, regardless. The entire industry is suffering and will become smaller, but biofuels could solve some of the transportation problems.

Overall, innovation will be key to accelerating the transition to a low-carbon economy, and I believe we need to focus on: renewables (including green gas and green hydrogen), electric mobility, CCUS, and a bit of biofuels.

Follow-Up Question:

When does a company like ENGIE start to look into these innovations and act on them?

Krishnamoorthy’s Response:

At a company as big as ours, we have a process for everything. One of our processes is called “Technology Watch.” It has been part of our innovation scouting forever, so you could say that we have many people looking into the future at all times. They monitor what is evolving and what is not, they participate in conferences, meet companies and startups. At ENGIE, innovation opportunities are tested and challenged in several ways until we come to an internal agreement and if warranted, we put research money into these ideas. We spend about 100 million euros every year in research and technology. It is not billions like Intel or Google, but it is significant.

For example, today, we are working on “greening” natural gas. We are launching pilots and will then develop demonstration plants. But we only do this if our research activities have proven that these opportunities are promising, and it might take a few years. We start by investing a few million into a new idea, never tens of millions, and we will get a feel of it. Only when we are convinced that we have a concrete chance at commercialization will we invest tens of millions.

Back to the process, internally we do not do that much fundamental research, we operate by looking at the technology readiness level (TRL). Today, we start looking at technologies with a TRL of two, three, or four, but in the past, we were looking only at TRL seven. We take this approach because we are not technology inventors per se. We are early users of riskier technologies as a means to gain a foothold in industry sectors which are rapidly changing.

After our teams look into “everything” on Earth, we have another process by which we narrow down these technology opportunities. When we finally find something that makes sense to invest in, it is usually because these companies are different from us. If it is a startup, they can invent technologies, but they cannot easily access markets or the knowhow needed to deploy technologies at scale, and we can help.

After we invest, we try to secure preferred rights in Europe for a period of time. We also want our team to sit on the board—people with, let us say, a little bit more grey hair than the people in a startup. We introduce an element of experience and global vision.

Overall, our process mostly involves scouting, researching, and investing in startups. One or two of these startups eventually get it right, at which point we try to acquire them. For example, we took a risk and acquired an electric charging company that looked like it would only be a five percent investment for us. Now we are the second largest electric charger company in the world outside of China with 100,000+ chargers installed all over the world.

We have invested 125 million euros in startups since 2014 via our corporate venture capital fund ENGIE New Ventures. We focus on taking positions in many different companies. Some will sink, but they are balanced by the ones that succeed. If we can maintain the overall value of our investments over time, even without a financial return, and at the same time create additional strategic value, we consider it a decent result.

What regulatory framework in France or elsewhere would most support ENGIE’s efforts to decarbonize its activities?

Krishnamoorthy’s Response:

As I mentioned before, electrification is not a panacea for all ills. You need to look at something else as well, so our current conversations with regulators in the EU and France stress this need to support green solutions outside of electricity. In France, for instance, we have a big presence as a gas company (we own practically all of France’s transportation and distribution gas infrastructure) As we are convinced that green gas will play a major role in the energy transition and beyond, we would like to see a regulatory environment prevail in which, much as was done for renewables such as solar and wind, the government provides support for pursuing environmentally friendly solutions, such as industrializing biogas. Today, you can supply natural gas in France at a cost of €50/MWh, but biogas is more like €80/MWh, so nobody will buy it. As a result, you need state support, such as government subsidies, to make up the €30/MWh difference.

Additionally, we are pushing for regulatory support for improved efficiency. Efficiency is indeed the first step towards a carbon-neutral society: first you need to consume less energy, and then you can decarbonize the remaining part. Different tools can help to improve the energy efficiency: certificates that provide credit for a low-energy consumption, guidelines for buildings, etc.

In its financial analysis and risk analysis, does ENGIE currently operate with an assumed cost of carbon (aka “shadow cost of carbon”)? If so, how are those calculated?

Krishnamoorthy’s Response:

We have worked to estimate the cost of carbon for over a decade (since 2007 or 2008). As a large company with ~€60 billion in revenues we deal with a lot of uncertainties. To address these uncertainties, we have a process that looks at every big variable (e.g., electricity prices, foreign markets, gas, etc.) and makes projections for how these will affect prices. We do the same thing for carbon. As a company, we forecast carbon prices biannually. Once we have approved them, we publish the numbers and use them for our internal modeling.

Carbon price modelling is part of our overall forecasting, but even once we have a number, we still debate the business implications on a case by case basis. For example, about ten years ago when we started doing wind, we looked into a 300-megawatt project in Morocco called Tarfaya, which had been running for several years. We made a case that carbon prices would go up and we should factor that into our evaluations. We had an internal debate and acknowledged that there might be a case for that, but it was risky, so if we accepted that risk, we would need to balance this risk elsewhere. Ultimately, even though you have numbers for carbon prices they need to be contextualized based upon all of the risks and uncertainties you’re dealing with.

Follow-Up Question:

Would it be helpful and provide certainty if there were an economy-wide price on carbon that was applied beyond the EU Emission Trading System (ETS)?

Krishnamoorthy’s Response:

There needs to be a price on carbon, but the problem is that even where there is a price, regulations often change. We were complaining a lot four years ago when the price of carbon in Europe declined to 6-7€. Then, it came back up; it increased to above 20€. But now because of coronavirus, it dropped to 17€. So, it keeps going up and down, making investment decisions more complex.

Overall, we think that the price of carbon is not high enough. But there needs to be some price because even just having a price helps to inform the decision-making process. At least you can say, “Yeah, I want to invest there because they have some price on carbon and I believe that carbon has to have a price.” The price itself might not provide much support, but you might be more willing to have a solar project with a high merchant risk in a country that at least believes in green.

How would you respond operationally if governments required, let’s say a five percent blending of “green” hydrogen, into natural gas? What technologies are you investing in? Would companies need to raise prices?

Krishnamoorthy’s Response:

As many of our gas assets are in France, we can look there to contextualize this question. French law today allows you to inject hydrogen into the natural gas grid, but there is a cap of six percent. We already have a couple of projects today to test hydrogen uses.

The first project, called GRHYD, is near Dunkirk where we are producing hydrogen to inject into the existing natural gas distribution network of a new neighborhood, Le Petit Village, with hundreds of consumers. The purpose of this test is to see the impact of hydrogen on end-use equipment without any changes to the existing network. The project started at five percent hydrogen, with the goal of getting to twenty percent in the coming years.

The second project, Jupiter 1000, is near Marseille where we are producing hydrogen using two different technologies: proton exchange membrane (PEM) electrolysis and alkaline electrolysis. The produced hydrogen is then either injected directly into the natural gas transportation grid or used to produce synthetic methane, through a methanation process with carbon dioxide. Our purpose is to test the transportation grid functionality when either injecting hydrogen, synthetic methane, or both.

These pilot projects are in France, but what is important is that we are getting experience that we can then translate to our global operations. The major question is whether the transportation and distribution grids can handle hydrogen up to twenty percent without requiring any modification to the existing infrastructure. Then, there are also questions about end-use equipment and when it will need to be changed. In Germany, hydrogen trains are still being manufactured and running; they are starting to run in France too. These are the early days with hydrogen.

Follow-Up Question:

Let us assume these projects will show that it is technologically feasible and safe to go beyond five percent, could you comment on the process of doing so and how could this work economically for companies?

Krishnamoorthy’s Response:

The problem today is the production of hydrogen in an economic way. ENGIE is already in action to commercialize and industrialize renewable hydrogen in many applications. In Australia, for example, we are working with the ammonia and fertilizer industry to jointly demonstrate that renewable hydrogen could achieve the decarbonation of the ammonia production today based on fossil hydrogen. Engaging in concrete projects at industrial scale, in parallel to innovation, is key to trigger the virtuous circle and reach competitiveness by 2030, as assumed by an international consensus of experts.

At the same time, we should also consider today’s realities. Places like Chile, Australia, and Saudi Arabia, where the prices of solar energy are extraordinarily low, already have a competitive advantage. But I think that right now we need to focus on making hydrogen much more economical, by improving the electrolysis process itself. For example, we are investing in a novel high temperature electrolysis process, but there are dozens of companies all over the world investing hundreds of millions of dollars in similar projects to make hydrogen economical over the next decade or two.

In terms of transitioning to a green energy sector, what are ENGIE’s advantages compared to other utilities and/or oil and gas majors?

Krishnamoorthy’s Response:

I don’t think we have one particular strength that others don’t have, but we have a unique combination of several factors.

First, as a utility we are much better positioned to raise debt than oil and gas companies, because oil and gas is seen as a riskier industry. This results in a lower cost of capital. Second, we are one of the only A-rated utilities, which gives us an advantage over many other utilities when we borrow money. Third, and more specific to us, we’re running many businesses across many continents. Each business goes up and down a little bit, but fluctuations within one unit don’t affect our whole portfolio. This diversity helps keep us more flexible and enables us to make better decisions. Although we don’t always recognize this as an important strength, it is one.

Additionally, we are a global company. Although historically we came out of a French state-regulated gas company, two-thirdsof our businesses face global competition. This has made us much more competitive. When you successfully run businesses for decades you have tens of thousands of people who can do slightly better than someone else on the other side of the table, more often than others would. Our strike rate in winning new projects is high simply because of our history of competitiveness and human capital. We win more than we lose. Finally, we have a relatively modern culture, which enables us to work in a decentralized fashion. This, coupled with our global nature, means you’ve got people from different cultures and experiences in positions to influence our decisions. In other words, we’re able to capture the positive impact of our diversity.

Our strength is not based on one technology we own; it’s the combination of all of these factors.

Twenty years from now, what do you imagine ENGIE will look like and how will it compare to today? How would this impact ENGIE’s revenue breakdown?

Krishnamoorthy’s Response:

ENGIE can be broken down into four parts. Let’s talk about how each of these parts might look 20 years from now.

The first part is our networks—our gas transportation and distribution businesses. I imagine in 20 years we’ll still be doing these, but we’ll be doing them differently. I expect distribution will become more significant than transportation because we will be producing more and more biogas and/or hydrogen locally. As a result, the molecules that will flow in the old pipes will be greener. Additionally, the network will need to accommodate flows in both directions. I would imagine we will still be running a regulated business because there will still be monopolies. Therefore, you’ve got to run them in a regulated way, either inside small regions or bigger aggregated ones. In summary, our networks will still be regulated, but they will have different molecules and a bigger distribution component.

Next is our thermal business. Right now, we still use natural gas, but 20 years down the road I imagine we will be using hydrogen. Hopefully, carbon capture, utilization, and storage will be deployed at scale where hydrogen will not be an option. Additionally, operations will not be base load but mostly peakers due to the high penetration of renewables in the grid. In other words, I see this business more like a series of peaking plants.