US dollar dominance has underpinned American economic and geopolitical leadership since World War II. It’s no stretch to say that Washington’s strong hand in trade relationships, military power, and alliances depend on the dollar’s pre-eminence. This structural advantage, however, will begin to crumble over the next several years unless the federal government prioritizes a central bank digital currency (CBDC).

Just a few years ago, the concept seemed fanciful. Now, nations not adopting a CBDC risk being left behind. The global monetary system is undergoing a generational transformation, with over 80 countries exploring CBDCs. Two recent developments stand out. On July 14, the European Central Bank launched its digital euro project. A day later, the People’s Bank of China released a white paper acknowledging the digital yuan’s long-run internationalization potential.

Meanwhile, the US is stuck in preliminary discussions about a digital dollar, falling behind its largest rival while admiring its chief ally’s innovation. As CBDCs proliferate, the era of unchallenged dollar dominance is giving way to one of competition and choice among a basket of currencies, most importantly the digital yuan.

Complacency is the kryptonite of the dollar. To preserve its strength, US policymakers must prioritize “dollar innovation” as a key national security objective on par with a great power competition strategy. This innovation must be built on confidence, trust, and proactivity that secures America’s leadership of the global monetary system.

Dollar preeminence is central to US leadership. Amid the COVID crisis, the Fed stabilized the global financial system with trillions in liquidity, and the US government raised low-cost funds thanks to the dollar’s reserve status. The dollar empowers the US to imprint our values on rules in areas like money laundering and levy powerful sanctions.

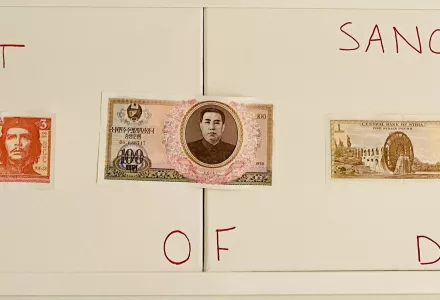

China has tried but so far failed to unseat the dollar; the traditional yuan simply lacks macroeconomic and institutional appeal. But CBDCs give Beijing a massive edge in this competition: China can eschew reform and threaten the dollar with seamless international payments through the digital yuan.

Dollar dominance has endured thanks to America’s sizable economy, independent courts, deep capital markets, and the liquidity of dollar assets. The dollar accounts for about 59% of foreign exchange reserves, half of international trade, 40% of international payments, and 85% of foreign exchange transactions. This inertia, however, won’t withstand the global pivot to digital finance.

While this displacement would not be immediate, the development of cross-border wholesale CBDC arrangements could enable international financial flows, trade invoicing, and currency exchange without dollar intermediation. For example, China has launched a pilot program with Hong Kong, Thailand, and the UAE to establish an “m-CBDC Bridge” enabling real-time, cross-border currency transactions. This furthers China’s goal of establishing the digital yuan as Asia’s regional currency to build influence and neutralize sanctions while avoiding the burdens of global reserve status. The US cannot prevent this cooperation, but it must lead to ensure that interoperability standards match our preferences, not China’s. Building a digital dollar would turbocharge this leadership while providing an alternative cross-border flow mechanism. Without innovation, the US will be on the outside looking in as international transactions shift to currencies like the digital yuan.

Beyond transactions, CBDCs set the stage for a third iteration of Bretton Woods: an opportunity to set the global financial system’s ground rules for the digital age. The US must seize this fleeting moment. Once the rules are set, their momentum is impossible to slow. Central bankers around the world are looking to the US for guidance. Without it, they will turn to countries like China.

The US can rise to the occasion with three steps.

First, the Biden administration should establish a presidential-level working group with European leaders to frame a digital Bretton Woods. This transatlantic vision should establish guidelines to govern the global financial system for the coming decades.

Second, the US and EU should establish a technocratic working group to create a “digital wall of innovation” against China. This working group should coordinate key standards for interoperability, privacy, cybersecurity, and illicit finance, and build a new framework with the Financial Action Task Force for combatting money laundering and terrorist financing. US and EU innovation can fill the current vacuum of standards and de facto become the global norm. Rather than asserting influence via “dollar dominance,” the US will lead via “dollar innovation.”

Third, this “dollar innovation” goal should be enshrined as a core objective in the 2022 US National Security Strategy. The dollar’s global use is a national security asset critical to US geopolitical power and economic influence, and the digital yuan’s threat must be elevated on policymakers’ agenda.

These steps must be underpinned by accelerated research on CBDC technology and policy to ensure the US has a seat at the table. Existing efforts like Project Hamilton and the Fed’s forthcoming paper must be complemented by private innovation and strengthened by Congressional authorization and resources.

We stand at a pivotal moment. To maintain dollar preeminence, the US must become a global CBDC leader. American complacency cedes room to authoritarianism. However, through confident leadership and a dollar innovation strategy, the US can build a global monetary system that upholds our power while advancing our core values.

Statements and views expressed in this commentary are solely those of the authors and do not imply endorsement by Harvard University, Harvard Kennedy School, or the Belfer Center for Science and International Affairs.

Michael B. Greenwald is Director at Tiedemann Advisors and Director for Digital Asset Education. He was the first US Treasury attaché to Qatar and Kuwait, acting as the principal liaison to the banking sector in those nations, while serving in two presidential administrations and under three treasury secretaries from 2010-2017. He is a fellow at Harvard Kennedy School’s Belfer Center for Science and International Affairs, a Senior Fellow at the Atlantic Council Geoeconomics Center, and Adjunct Senior Fellow at Center for New American Security.

This article is supported by research advisors William Howlett, Andrew Gabel, and Logan Weber. Howlett is a student at Stanford University and Gabel is a J.D. candidate at Duke University School of Law. Weber is a graduate of Harvard University and graduate student at Texas A&M University studying International Affairs.

Greenwald, Michael. “A National Security Strategy for Dollar Innovation.” Belfer Center for Science and International Affairs, Harvard Kennedy School, December 2, 2021