Introduction: What Are Critical Minerals?

In 21st-century geopolitics and economic policy, few terms have risen in prominence as quickly as critical minerals.1

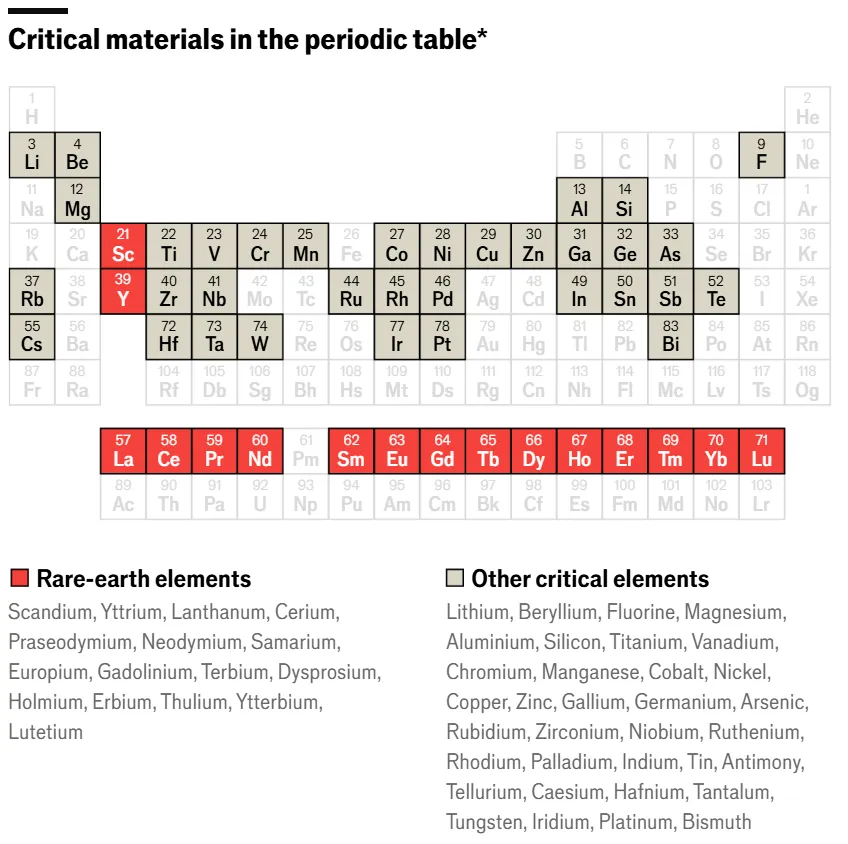

The U.S. Energy Act of 2020 defines a mineral as “critical” if it meets three conditions: it is essential to economic or national security, its supply chain is vulnerable to disruption, and it performs a function in manufacturing that cannot be replaced without serious consequences, whether higher costs for key technologies, slower deployment of clean energy, or risks to defense and communications systems.2 Put more simply, critical minerals are raw materials without which modern economies cannot function but whose supply is at risk, minerals such as lithium for EV batteries or gallium for semiconductors. Other critical minerals include cobalt, graphite, manganese, and nickel, each with distinct uses and supply chains. They are strategic assets, forming the base for clean energy systems, advanced technologies, and national defense. The U.S. Geological Survey manages the list of critical minerals, updating it every three years. The 2022 list contained 50 minerals.3 A draft for 2025 expanded this to 54.4

The risk to critical minerals comes from geopolitics and from changes in technology. Geopolitically, a mineral mined in a partner country may still be “critical” if it is refined or processed elsewhere, particularly by a strategic rival. An example of this is China’s dominance in rare earth refining. Even if rare earth elements are mined in Australia or the United States, a large part of global processing takes place in China.5 This concentration gives Beijing leverage over downstream supply processes, creating a growing risk to U.S. supply chains.

Geopolitics is only part of the challenge. Technology shifts which drive increased demand can outpace the ability to increase production, which intensifies the competition for minerals. Lithium, now central to batteries for electric vehicles, and gallium, used in semiconductors, are clear examples of this trend. Two decades ago, demand for these materials was limited. Today, global markets for EVs and semiconductor chips are worth tens of billions of dollars.6 7 Yet while the demand from new technologies can dramatically increase in just a few years, increasing supply by bringing a new mine into operation often takes a decade or more. This gap between rapid technology adoption and slow resource development leaves governments and industry under constant pressure to secure new sources of supplies. Addressing these risks requires both near-term responses and long-term industrial planning.

What Are Critical Minerals Used for?

Critical minerals underpin clean energy, electronics, defense, and heavy industry such as steelmaking, fertilizers and chemical production. Because of this, demand for critical minerals is projected to at least triple by 2040.8

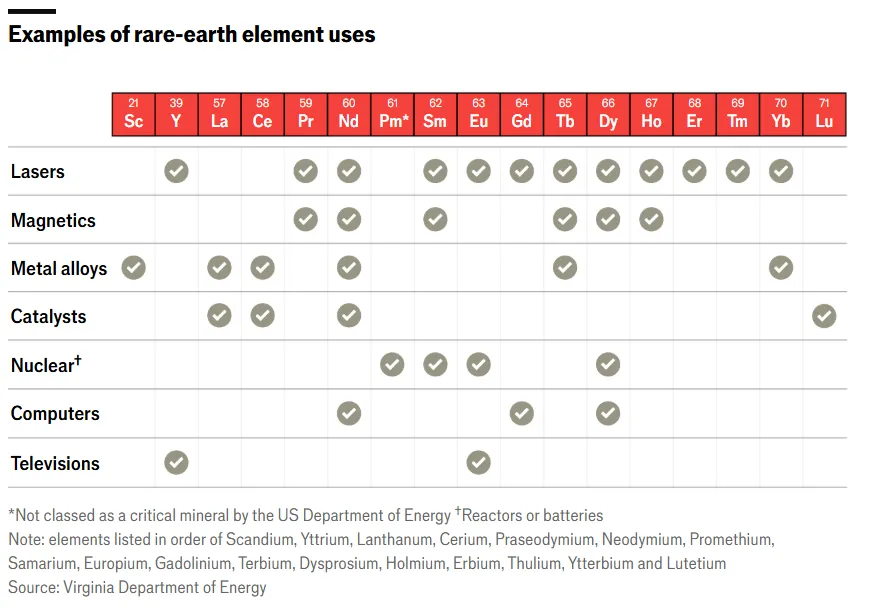

In clean energy, lithium, nickel, cobalt, and graphite power EV and grid batteries; rare-earth magnets made of neodymium and dysprosium enable efficient turbines and motors; copper and aluminum wire up the grid; platinum and iridium drive hydrogen fuel cells. 9

Consumer electronics pack 30+ minerals into a single smartphone: indium for touchscreens, tantalum for capacitors, rare earths for displays and speakers, lithium and cobalt for batteries, and gallium and silicon for chips.10 Ethical sourcing challenges, especially around cobalt, are spurring a turn to recycling: Apple now pledges 100% recycled cobalt in its batteries.11

Defense industries use rare earths in guidance systems, titaniumand nickel alloys in jet engines, gallium and germanium in radars and night vision, and tungsten and neodymium in munitions.12 High-performance turbines, especially military engines, also rely on scandium, yttrium, tantalum, and dysprosium for superalloys that enhance strength and ductility.

Finally, industrial sectors rely on tungsten-carbide tools, platinum-group catalysts, niobium and vanadium in steel, and phosphate and potash for agricultural fertilizer. Even obscure gases like neon are critical for chipmaking.

The Rare Earths Distinction

Within critical minerals, rare earth elements (REEs) attract particular attention. They are a group of 17 metals, made up of the 15 lanthanides plus scandium and yttrium, used in a range of advanced technologies.13 Their most important role is in permanent magnets that power EEV motors, wind turbines, smartphones, and missile guidance systems.

The term “rare earth” is misleading, since many are more common in the Earth’s crust than metals like lead or silver. The problem is not that REEs are scarce, but that they occur in very low concentrations, so mining them is costly without special methods.14 Further, REEs are distinct from other critical minerals because they are usually found grouped together in the same rocks, not as single minerals. Their similar properties make them hard to distinguish so turning them into usable materials through refining takes extra steps and adds cost.15 This makes REE supply chains more fragile and costly than most other critical minerals.

Who Controls Critical Mineral Supply Chains?

Critical minerals are unevenly distributed across the world. While deposits exist on many continents, the capacity to process raw ores into usable materials is concentrated in only a few countries, in particular China, Chile, Australia, the DRC, and Indonesia. This has created a new form of geopolitical influence, where control over supply chains translates into geopolitical leverage.

China’s dominance in critical minerals

China holds the strongest position in the global critical minerals market. In 2023, China accounted for about 69 percent of ore extraction for the world’s REEs and was the top raw-ore producer of almost two-thirds (29) of the 50 minerals on the USGS critical minerals list.16

However, China’s position is built on scale and control across the supply chain rather than on geological abundance or raw ore extraction alone. Its dominance is greatest in refining and processing. The International Energy Agency reports that China refines about 90 percent of REEs and is the leading refiner for 19 of 20 key energy-related minerals, with an average global market share of around 70 percent.17 18 What is striking is that for many high-demand minerals such as lithium, nickel, and cobalt, China’s share of raw extraction is only 10 to 30 percent, yet its share of refining and processing reaches 60 to 70 percent. By controlling these conversion stages that turn ores into battery-grade and magnet-grade materials, China has built the leverage that underpins its dominance in global clean-energy manufacturing.

China has used its dominance in mining and, more importantly, processing as leverage in its global relationships. In 2010, China curbed REE exports to Japan after a maritime dispute, which sent prices higher.19 In 2023 China imposed new licensing requirements on gallium and germanium exports and tightened controls on some REE products. Exports of gallium fell from nearly 6,900 kilograms in July to zero by September, and germanium shipments dropped from about 8,000 kilograms to just 1 kilogram.20 Based on 2022 production shares, this effectively removed around 60 percent of global germanium supply and 90 percent of gallium supply from international markets, disrupting chip and defense supply chains and demonstrating Beijing’s ability to weaponize export licensing. In October 2025, China widened these restrictions to cover twelve REEs, magnets, processing equipment, and related technologies, extending control beyond raw materials to the entire value chain and signaling a shift from managing exports to shaping the terms of global manufacturing itself.21

This dominance is the result of deliberate state policy. Since the 1980s, Beijing has backed early investment in mineral extraction and processing, given subsidies to both state-owned and private companies in mining, refining, and magnet or battery-material production, and applied looser environmental rules than countries like the United States and Australia.22 It also secured foreign mining assets in developing countries through the Belt and Road Initiative. Chinese-backed entities have invested nearly US$57 billion in mineral projects across 19 countries.23 This ensures raw material flows into China’s refining industry, reinforcing its role as the central hub of global mineral processing.

While China dominates the midstream in the global critical minerals supply chain, other resource holders are asserting themselves in different ways, using their position in mining to capture more of the value chain.

Resource nationalism

Countries that produce raw critical minerals are tightening control to keep more value at home. Indonesia banned nickel ore exports in 2020 to force local smelting, attracting major refinery investment.24 Zimbabwe has restricted chromium exports to push in-country processing.25 These measures disrupt global flows, squeeze spot availability, and highlight how state policy can redirect supply. The EU’s Critical Raw Materials Act caps reliance on any single supplier country at 65 percent and pushes mining, processing, and recycling in Europe.26

This tightening by producers has accelerated allied efforts to rebuild secure, non-Chinese supply chains.

The western alliance: USA, Canada and Australia

The United States and its allies are working to reduce dependence on Chinese supply chains. Canada and Australia are central to this strategy. Canada has deposits of more than half of the minerals on the U.S. critical list, including lithium, graphite, nickel, cobalt, copper, and REEs.27 It is the only Western nation with all the raw materials needed for advanced EV batteries. Canada is proactively expanding is capacity for mining and processing. For instance, their 2022 Critical Minerals Strategy seeks to accelerate exploration, streamline permitting, and expand domestic processing.28

Australia is also a leading mining nation. In 2023, it supplied nearly half of global lithium and ranked among the top five producers of cobalt, manganese, and REEs. Until now, much of this output has been exported in raw form, leaving other countries to capture the higher returns from refining and processing. The Australian government’s Critical Minerals Strategy 2023–2030 seeks to change that by developing more domestic refining and processing capacity, so the country can supply not just ores but also battery-grade chemicals and advanced materials. To back this effort, Australia has created a $4 billion Critical Minerals Facility to fund projects and attract investment under high environmental and governance standards.

Even with Canada and Australia scaling up, no single country can meet the demand. The U.S. and its allies are therefore turning to friendshoring, which involves building supply chains through trusted partners. This approach is being advanced through a series of alliances and agreements:

- U.S.–Australia Compact: aligns finance, permitting, and offtake for critical minerals and clean energy projects, along with at least USD 1 billion in financial from each country.29 30

- U.S.–Canada Joint Action Plan: coordinates supply chains and co-funds processing facilities.31

- Minerals Security Partnership (MSP): brings together the U.S., EU, Japan, South Korea, Australia, Canada, and others to co-finance projects in trusted countries.32

The goal is to build dependable feedstock and non-Chinese midstream capacity so that export curbs or supply shocks do not derail EV production, electrical grids, or defense.

These alliances also complement efforts to secure emerging frontiers, where large reserves are drawing strategic interest but remain underdeveloped or contested.

Strategic frontiers and contested areas

Recently, new regions are emerging as flashpoints in the competition for mineral resources. They hold large, underdeveloped reserves and are drawing geopolitical interest. Their importance as sources of critical minerals gives these nations additional strategic importance.

Greenland has deposits of 39 of the 50 minerals on the U.S. critical minerals list.33 These include REEs, graphite, platinum-group metals, and niobium. Greenland’s REE reserves are about 1.5 million metric tons, close to the U.S. total. If developed, these reserves could meet a large share of global demand, with some estimates placing it near a quarter. Both the United States and China have shown interest in Greenland’s resources. The US has financed Greenland’s Tanbreez heavy REE project.34 Tanbreez is one of the world’s largest eudialyte deposits and is projected to produce about 85,000 tonnes of concentrate each year, with significant volumes of heavy REEs such as dysprosium and terbium. U.S. backing is intended to secure feedstock for domestic facilities like Ucore’s Louisiana refinery. At the same time, Chinese companies, often with state support, have pursued stakes in competing projects such as Kvanefjeld.35 This highlights Greenland’s strategic weight in the Arctic and in the critical minerals competition.

Ukraine holds Europe’s largest reserves of lithium and titanium, as well as significant uranium, graphite, manganese, and REEs.36 These resources are concentrated in the eastern and southern regions, many of which are under Russian occupation. By the end of 2022, Russia had occupied 63% of Ukrainian coal mines, as well as half of its manganese, caesium, tantalum and REE deposits.37 Seizing these resources is both an economic and strategic objective for Moscow.

India has the third largest REE reserves globally but contributes less than one percent to global supply.38 To address this gap, the National Critical Minerals Mission is working to cut import dependence while promoting domestic exploration, recycling, and overseas acquisitions.39 Through the state-owned firm KABIL, India has secured exploration and mining rights for five lithium brine blocks, or designated exploration areas, in Argentina.40 Further, India and Australia are jointly funding due diligence to identify lithium and cobalt mining projects for potential investment and offtake, with five projects already shortlisted.41 These agreements strengthen India’s position as a partner in the U.S.-led Minerals Security Partnership.

South Africa is central to global supplies of manganese, chromite, vanadium, and platinum-group metals. It holds 80 percent of known manganese reserves and more than 70 percent of chromite. It is also a leading producer of vanadium and platinum. Historically, the country exported raw ores. Today, government policy is shifting toward building downstream industries such as smelting, alloy production, battery materials, and platinum-based fuel cell and catalytic converter manufacturing to capture more value within Africa.

What Does the U.S. Critical Mineral Policy Landscape Look Like?

The United States underwent a historic shift in the late 20th century from relative critical mineral self-sufficiency to import dependence. In the 1950s and 1960s the United States was dominant in REE production thanks in large part to the Molycorp mine at Mountain Pass, California. Over subsequent decades, rising production costs, environmental concerns, regulatory delays, and rapid Chinese investment shifted the industry to China’s control. By the early 2000s the U.S. had moved from dominance to heavy import dependence.

Coordinated focus on critical minerals began in 2017 with Executive Order 13817, which created the first White House–level strategy and a list of 35 critical minerals.42 In 2020, Executive Order 13953 went further, declaring import reliance a national emergency and authorizing the Defense Production Act to expand domestic mining, recycling, and allied supply chains.43 Congress followed with the Energy Act of 2020, enshrining the critical minerals list into law.44 The Biden administration built on this framework, invoking the Defense Production Act in 2022 for battery minerals, funding recycling and processing plants, and striking supply agreements with allies including Japan.

In his second administration, President Trump has doubled down in his focus on critical minerals. The March 2025 Executive Order on Immediate Measures to Increase American Mineral Production established the National Energy Dominance Council, broadened the critical minerals list to include uranium, copper, potash, and gold, and directed agencies to expedite permits and mobilize financing. In April 2025, a second Executive Order launched an offshore minerals strategy, directing Bureau of Ocean Energy Management (BOEM) and National Oceanic and Atmospheric Administration (NOAA) to inventory seabed deposits of nickel, cobalt, copper, manganese, titanium, and REEs, and fast track permits for exploration and mining on the US Outer Continental Shelf. It also calls for building domestic refining capacity, integrating seabed minerals into national security planning, and partnering with allies to develop seabed resources responsibly while countering China’s influence

Conclusion

Critical minerals are the new oil. Every country needs them, but mining and refining are concentrated in a few hands. China’s dominance in processing gives it significant leverage over supply chains. At the same time, producing nations are tightening export rules to keep more value at home, and new discoveries in Ukraine, Greenland, and Africa are reshaping where future supply may come from.

The United States and its partners have started to respond. Canada and Australia are expanding mining and processing. Japan, Europe, and the United States are coordinating through new agreements and financing tools. These efforts have begun to reduce exposure, but they remain limited compared with China’s scale and coordination. Most public funding still targets individual projects, and the middle of the supply chain, refining, separation, and component manufacturing, remains thin.

The next step is to focus where the gap is widest. The middle of the supply chain remains the weakest link, and building capacity there will determine how durable these efforts become. Governments can align financing and permitting across allied markets, set clearer offtake and pricing rules, and develop shared facilities that reduce the cost and risk of new projects. This needs to be tied to a stronger system for research and innovation that supports substitutes, material efficiency, and new design approaches to build longer-term resilience. Coordinated R&D pipelines can link advances in processing, recycling, and product design, while shared standards and intellectual property frameworks can speed up their adoption across allied industries. Past industrial policy experience shows that lasting advantage comes from connecting public research, patient capital, and private execution. Over time, these efforts would shift the focus from securing raw inputs to building an innovation-driven industrial base that is both resilient and globally competitive.

Gupta, Chaitanya. “Critical Minerals Explained: Why They Matter for Geopolitics, Clean Energy & Tech .” October 30, 2025

- Terminology note: The term critical minerals is sometimes used interchangeably with critical materials, though the latter covers a broader range of strategically important inputs beyond mined resources. Critical materials can include refined metals, alloys, semiconductors, polymers, and engineered materials. In this report, critical minerals refers specifically to raw materials that are mined and processed.

- U.S. Department of Energy. (2020). Energy Act of 2020 (Background document).

- U.S. Geological Survey, U.S. Department of the Interior. (2022). Final list of critical minerals.

- U.S. Geological Survey, U.S. Department of the Interior. (2025). Draft list of critical minerals: Notice of opportunity for public comment.

- Baskaran, G., & Schwartz, M. (2025). Developing rare earth processing hubs: An analytical approach. Center for Strategic and International Studies.

- Benchmark Mineral Intelligence. (2023). Battery powered: 20 years of lithium demand.

- Young, A. (2024). Critical minerals: the quiet achievers gallium and germanium. CSIRO.

- Willige, A. (2025). What are the critical minerals for the energy transition — and where can they be found? World Economic Forum.

- International Energy Agency. (2021). The role of critical minerals in clean energy transitions. IEA.

- U.S. Geological Survey. (2016). A world of minerals in your mobile device (General Information Product 167).

- Apple. (2023). Apple will use 100 percent recycled cobalt in batteries by 2025.

- SFA (Oxford). Critical minerals in defence and national security.

- U.S. Geological Survey. (2024). Rare earths (Mineral Commodity Summaries 2024).

- U.S. Department of Energy, National Energy Technology Laboratory. Rare earth elements: A subset of critical minerals.

- de Naoum, K. (2025). Rare earth supply chain: Importance, challenges, and opportunities. ThomasNet.

- U.S. Geological Survey. (2024). Mineral Commodity Summaries 2024.

- International Energy Agency. (2023). Energy Technology Perspectives 2023: Clean energy supply chains vulnerabilities.

- International Energy Agency. Diversification is the cornerstone of energy security, yet critical minerals are moving in the opposite direction.

- Baskaran, G., & Schwartz, M. (2025). The consequences of China’s new rare earths export restrictions. Center for Strategic and International Studies.

- U.S. International Trade Commission. (2025). Germanium and gallium: Executive briefing (EBOT—Germanium and Gallium).

- Reuters. (2025). China expands rare earths restrictions, targets defense and chips users. October 10

- Tang, R. (2012). China’s rare earth industry and export regime: Economic and trade implications for the United States (CRS Report R42510). Congressional Research Service.

- Escobar, B., Malik, A. A., Zhang, S., Walsh, K., Joosse, A., Parks, B. C., Zimmerman, J., & Fedorochko, R. (2025). Power Playbook: Beijing’s bid to secure overseas transition minerals.

- International Energy Agency. (2024). Prohibition of the export of nickel ore – Policies. IEA.

- Global Trade Alert. (2021). Zimbabwe: Export ban on chrome ore.

- European Commission. (2024). Critical Raw Materials Act.

- Government of Canada. Critical minerals: An opportunity for Canada.

- Government of Canada. Canada’s Critical Minerals Strategy.

- Australia-United States Climate, Critical Minerals and Clean Energy Transformation Compact (Joint statement).

- Reuters. Trump, Australia’s Albanese sign critical minerals agreement to counter China. October 21, 2025

- International Energy Agency. (2024). Canada-U.S. Joint Action Plan on Critical Minerals Collaboration.

- U.S. Department of State. Minerals Security Partnership.

- Nathanielsen, N. H. (2025, January 16). Greenland welcomes American investment in mineral sector. The Washington Post.

- Menon, P. (2025, August 26). Critical Metals signs agreement to supply rare earth to U.S. government-funded facility. Reuters.

- Gronholt-Pedersen, J., & Onstad, E. (2021, March 2). Mining magnets: Arctic island finds green power can be a curse. Reuters.

- Liepins, A. (2024). Ukraine’s resources. Critical raw materials. ENSEC COE.

- Nathanielsen, N. H. (2025). What minerals does Ukraine have and what are they used for? BBC News.

- India’s REE Strategy: Turning Resources into Capacity. (2025, August 11). Observer Research Foundation.

- Government of India. (2025). National Critical Mineral Mission: Powering India’s clean energy future.

- Government of India, Press Information Bureau. (2024). KABIL is exploring opportunities for acquisition of overseas critical minerals assets in Argentina, Australia and Chile.

- International Energy Agency. (2023). Australia-India Critical Minerals Investment Partnership

- Executive Office of the President. (2017). A Federal Strategy to Ensure Secure and Reliable Supplies of Critical Minerals (EO 13817).

- Executive Office of the President. (2020). Addressing the Threat to the Domestic Supply Chain From Reliance on Critical Minerals From Foreign Adversaries and Supporting the Domestic Mining and Processing Industries (EO 13953).

- U.S. Department of Energy. Energy Act of 2020 (Background document).