The Road to Electrification: Challenges and Opportunities for the Domestic Auto Industry

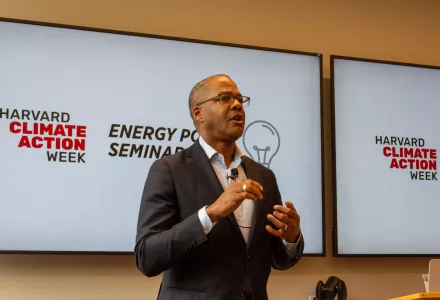

At an Energy Policy Seminar, Ford Motor Company’s Christopher Smith emphasized the “existential necessity” of electrifying vehicles.

At an Energy Policy Seminar, Ford Motor Company’s Christopher Smith emphasized the “existential necessity” of electrifying vehicles.

U.S. auto manufacturers face major roadblocks in their pursuit of vehicle electrification: uncertain consumer demand, Chinese competition and subsidized oversupply, a “chicken-and-egg” charging infrastructure dilemma, supply chain vulnerabilities, and dramatic policy shifts under the second Trump administration, among other challenges.

Despite these challenges, electrifying vehicles is an “existential necessity” for Ford Motor Company, the company’s Chief Government Affairs Officer Christopher Smith emphasized at a September 15 Energy Policy Seminar hosted on the first day of Harvard Climate Action Week 2025.

“Ford is a 120-year-old company,” said Smith, who formerly served as Assistant Secretary for Fossil Energy under the Obama administration. “If we're going to be a 240-year-old company…we're not going to just be able to sit on our laurels of making the vehicles that we've made in the past.”

According to Smith, customer demand and a desire to stay competitive with global automakers, not regulation, are primarily driving the company’s electrification efforts. “We're not going to be driven by environmental policy, because we're a car company,” he said. “What I will say is that it is going to be incredibly important for us to win this segment, and you see that through our actions.”

During the talk, Smith shared his ideas about the challenges of electrification and what Ford needs to do to compete internationally, the policies that would support a strong domestic auto industry, and how the global market for electric vehicles is shaping up.

Read on for the recording and key takeaways.

While Ford has successfully electrified its two most popular cars, the F-150 pickup truck and the Mustang Mach-E crossover, Smith said that one of the company’s biggest challenges lies in moving away from retrofitting internal combustion engine (ICE) vehicles and designing completely new electric vehicles unlike anything the company has previously produced. To this end, Ford is experimenting with alternative battery chemistries and geometries, and it has opened a “skunkworks” plant in Long Beach, CA, to develop advanced EVs.

Affordability is a major concern for the second-generation Ford EVs, said Smith. No longer competing for enthusiastic first-adopters, but rather a broader and more price-sensitive customer base, Ford is exploring ways of reducing its manufacturing costs, including a major update to the assembly process at its Kentucky plant. Smith also pointed to the difficulties caused by supply chain breakdowns and an insufficient charging network.

From Ford’s perspective, an ideal policy framework is one that is consistent, unified, and achievable, said Smith.

Currently, U.S. automakers have to meet multiple sets of emissions standards set by agencies like the Department of Transportation and the Environmental Protection Agency, or by individual states like California. “That creates a lot of complexity for a company like Ford,” said Smith, who added that the company has pushed for a single standard for decades.

Smith defined achievable standards as those that pushed companies to stay competitive on the global market while still allowing them to operate profitably. Standards need to grow more stringent over time in a predictable way so that companies can confidently plan, invest, and build for the future, he said. The retention of the production tax credit in the Trump administration’s reconciliation bill was a big win for U.S. automakers, many of whom had made large investments on the basis of that tax credit being available.

Smith called the competition from the Chinese EV industry “prodigious.” Chinese automakers have made “enormous investments that have been heavily subsidized by the Chinese government, but have yielded really, really impressive results,” he said.

During the audience Q&A, Smith acknowledged the double-edged nature of tariffs: on one hand, tariffs can create space for the United States to stand up domestic EV manufacturing, but if poorly designed, tariffs can remove pressure to innovate and raise costs and reduce choice for consumers. While some level of protection is needed for domestic auto companies, he said, “building a moat around the United States” also won’t work since Ford is an international company that sells vehicles internationally and relies on an integrated North American supply chain for its manufacturing.

“We compete in the United States, we compete in Asia, we compete in South America, we compete in Australia,” said Smith. “That competition is going to continue to get stronger, be it with securing our supply chain, with extracting and refining the critical minerals that we need in order to support our supply chain, the issues around battery chemistry and battery manufacturing. So staying abreast of that global market is going to be something that's of incredible importance to Ford.”

Hanlon, Elizabeth. “The Road to Electrification: Challenges and Opportunities for the Domestic Auto Industry.” Belfer Center for Science and International Affairs, September 15, 2025