Henry Lee: I'd like to welcome you all to the Energy Policy Seminar. This is a weekly event that is co-sponsored by the Belfer Center for Science and International Affairs, the Mossavar-Rahmani Center for Business and Government, and the Salata Institute. Thank you all for coming.

Today's talk is entitled “Breaking the Cost Escalation Curse on Nuclear Power.” Our speaker is Shangwei Liu. He is a postdoctoral research fellow at the Belfer Center, and his research focuses on accelerating clean energy innovation and deployment to minimize greenhouse gas emissions and costs while maximizing co-benefits and equity.

He has worked on nuclear power, green hydrogen, and solar energy. He holds a doctorate in science, technology and environmental policy from Princeton University's School of Public and International Affairs. He also co-hosts a Chinese podcast about climate science and policy. We're very privileged that he is with us today. Let me turn it over to Shangwei.

Shangwei Liu: Thanks, Henry, for the introduction, and thanks everyone for coming. Today, my talk is about nuclear power, and especially the economics of nuclear power in China. This work is a collaboration with Professor Minghao Qiu at Stony Brook University and Professor Gang He at the City University of New York.

Before I jump into nuclear power, I want to give a brief introduction of my research, so that you can understand what motivated me to focus on nuclear power projects. As Henry said, I'm a postdoctoral fellow here and I graduated from Princeton's Public Policy School. My research covers everything about energy technology, its innovation, its deployment, and its policy. Most of the time, I'm a modeling person. I do a lot of system modeling, like integrated system models, power system models, and building energy models. Sometimes I also do empirical studies, either using econometrics or statistical analysis.

Today's work is more of a simple empirical analysis focused on energy innovation. I think the overarching question for energy innovation is basically to understand why some energy technologies fail and others succeed. From my perspective, people usually talk about this question from three key dimensions.

The first factor is the nature of the technology, that is, the inherent characteristics of different technology. If you talk about the development of solar and nuclear power, they're different. People will say, "The two technologies are different. Nuclear power is large-scale, it's risky, it's complicated, and solar panels are very different. Solar panels are simple. It's a granular technology, it's easy to produce.” That's the first factor.

But even for the same technology, sometimes what we observe is that one technology works in one country but doesn't work in another country. So this comes to the innovation system: different institutions, different culture, different supply chain, different financing situation, different infrastructure. One example I give here is the railway system in the United States versus in China. People will say, "Why is this?" You can see this difference stems from the different population densities, different resources, different infrastructure.

The third one is public policy. Policy also matters. It depends on what regulations you can give to people or what incentives you can give to people. One example I give here is the development of solar panels. We have to go back to the 2000s and think about one policy that was really important for solar panel development. That's Germany's feed-in tariff policy, introduced in, I think, the 2000s, in their Renewable Act, which basically gave solar developers guaranteed revenue.

So when people think about the whole of energy innovation, usually they are talking about the interactions between these three key factors. What I'm going to do today is really simple: it’s to tell people a story about nuclear power. I'm not an expert on nuclear power, but rather, I'm talking about this problem from the energy innovation perspective.

There is growing interest in nuclear power from the traditional nuclear players. Nuclear power, I think, it's one of the few things that gets bipartisan support in the United States, and there's a lot of new legislation, new policies coming out.

In France, the government wants to build six more new nuclear power plants. You can see the same thing in Japan, in South Korea. A lot of traditional players, they are thinking about nuclear power resurgence. On the other hand, you see a lot of emerging countries either building their first nuclear power plants or considering building their first nuclear power plants.

Besides the public sector, you see a lot of interest from the private sector, especially driven by the demand from AI and also data centers. Microsoft is seeking to reopen the Three Mile Island power plants to power their data center, and Amazon and Google are investing in small module reactors to power their data centers.

But on the other hand, nuclear power is always a debatable issue. A lot of things we can debate. We can debate safety. Do we want another nuclear accident, a disaster? And others might argue that the risk of nuclear accidents is actually pretty low and is declining because the technology is improving.

What's the role of power in decarbonization? Some people will argue that nuclear power is cheap, it's a firm resource, it's reliable, but others might say, "We can totally do decarbonization without nuclear power." Not to mention its cost and its construction time - some people will argue that it's really expensive to build nuclear power plants in the United States today, but other people will say, "If you have regulatory stability, if you can do standardization, you can make it cheaper and build it faster."

There’s the issue of nuclear waste. We still don't have any permanent solution for nuclear waste, but people can argue that this is totally manageable and you only have a relatively small amount of waste. A lot of things we can debate, but today I'm really going to focus on the economics of nuclear power. What's the fundamental barrier for nuclear power today? It’s cost. It's too expensive. I have called out here, that's from MIT's The Future of Energy Studies. Their conclusion is that the fundamental problem of nuclear power today is the cost. So, my talk today is really going to focus on the cost of nuclear power.

Nuclear power is a form of electricity. When we talk about electricity's cost, we usually use the LCOE, the levelized cost of electricity. What I'm showing here is a classic equation to calculate the levelized cost. Basically, you have the capital recovery factor and construction cost, operational cost, maintenance cost, fuel cost, and you divide all costs by the electricity produced.

For nuclear power, its operational cost, maintenance cost, and fuel cost are relatively stable. Its electricity production is also pretty stable because it’s usually used as a base load with a high capacity factor. So what really matters in this equation here is the construction cost, and the construction cost can be divided into two parts.

The first part is basically everything except the financing costs. People call that overnight construction cost. The second part is the financing cost, the interest during construction, which depends on your construction time and interest rate. So today, my talk will focus on the overnight construction cost, and I will also discuss the construction time.

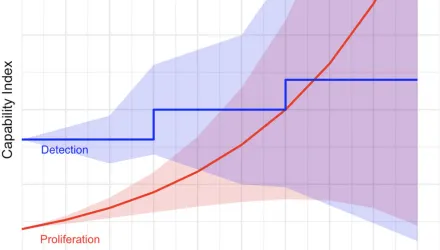

The reason why construction cost is a problem is because historically we have observed an interesting and concerning fact, which people call the cost escalation curve of nuclear power. If you think about a lot of technologies like solar, wind, batteries, electric vehicles, when you produce more, when you build more, you can produce cheaper, you can build cheaper, but nuclear technology is very different. Historically, when you build more nuclear power plants, your build is more expensive.

What I'm showing here is the overnight construction cost of nuclear power in the United States. You can see the cost increased dramatically over time. This one, that's Vogtle, the two nuclear power plants commissioned last year in the United States. It's very expensive, about $15 per watt. One thing I want people to notice here is that the cost increase happened before the Three Mile Island accident, and it increased dramatically after the Three Mile Island accident.

What are the reasons for this cost escalation curve in the United States? The first is very interesting: a fragmented market. Every nuclear power plant in the United States is built differently. So basically, a lack of standardization. A second reason is that the labor costs and the material costs increased over time. The labor productivity decreased over time, and for the material part, if you're building nuclear power plants you need a lot of steel, a lot of cement. In many cases, you need special steel and cement for nuclear power, and that special steel cement concrete is getting more and more expensive over time.

Another thing in the United States is regulation. Especially after the Three Mile Island accident, regulation got more and more stringent and kept changing over time. So you can imagine, if you want to build nuclear power plants and the regulation is changing, in many cases you have to remove your previous work and redo the work to meet the new standard. That increases the cost.

The cost escalation curve is a global phenomenon. It's not only happening in the United States but also in France. What I'm showing here is the overnight construction cost in France. One thing that's very different is in France they have a centralized regulatory regime for nuclear power, and they really try hard to standardize. You can see they chose different models from the CPO, CP1, CP2, P4, revised P4, N4, and recently the EPR model.

If you look at the figure, you can see that the construction cost actually remains stable within the same model design, but cost escalation happened when switching to a new model. That's the difference between what happened in the United States and what happened in France. And why are they switching to more expensive models? When nuclear power plants get larger and larger, they simultaneously get more and more complicated.

One reason why it got complicated is that the French company introduced U.S. technology from the Westinghouse company. They wanted to make it more ‘French style’, more innovative. But when you make it more innovative, you make it more complicated and increase your cost.

The debate around the cost escalation problem is like, "Is this problem a technology problem, a policy problem, or an innovation system problem?" Remember the three factors here? I think this debate's really important, because if this has to do with the inherent nature of the technology, if nuclear power is a bad technology, what we should do is redesign the technology. If this is an issue with policy or the innovation system, then we redesign the policy and innovation system.

I think that maybe China's experience with nuclear power can contribute to this debate. The reason I think the Chinese experience is valuable is not only because I'm Chinese, but also if you look at recent nuclear power expansion, the figure I'm showing here, the left one, that's the global operating capacity since the 1970s, and you can see the largest country today is United States, the second one is France, and the third one is China.

Most countries actually stopped building nuclear power plants after the 1990s. China's the only country that has substantially expanded its nuclear power capacity over the past two decades. The right figure here, that's new capacity. You can see China is constructing a lot of nuclear power plants and a lot of nuclear power plants are in the pipeline. So what I'm thinking is, it will be pretty interesting to consider what happened in China. Are there any cost escalation curves in China?

What I did is very simple. I tried my best to collect the construction costs of Chinese nuclear power, and let me just show people the results. The whole presentation will be focused on this figure. What I'm showing here is the overnight construction cost of the Chinese nuclear power plants. The circle, that's the operating units. The triangle, that's the units under construction. Before I go into any detail, let me tell people my data source and methodology.

Collecting cost data for nuclear power is challenging everywhere, and it's really impossible to get third party audited data. It's basically impossible everywhere. People usually rely on the greater literature, like news reports, to get the data. That's how people get the data from the United States and France. I do the same thing for China. The advantage is I can read Chinese so I can have a lot of sources.

So I use a lot of data from news, industrial reports, and statistical yearbooks. I actually get a lot of data from the environmental impact assessment reports, because before nuclear power plants start construction and operation, they need to submit an environmental assessment report to China's Environmental Department. Their reports usually have, "The total investment for this project is blah blah billion." So I actually get a lot of data from there, and also interviews.

Let me give one example here. This is the Taishan Nuclear Power Plant. I think it's probably one of the largest nuclear power reactors in the world. And I got it from news that the Taishan Nuclear Plant’s cost was $85 billion. So I know its capacity, I know its total investment. I really try to use the final cost of these nuclear power plants. You definitely will have, in many cases, cost overruns.

In the failed cases, I observed the cost underruns, but I really tried to use the final cost in this figure. For this basic project, the initial cost was like $50 billion, so that's a huge cost overrun for this project. That's the first thing. I use the final cost. And what I get here is the total investment cost. And I wanted to compare the overnight cost, so I converted the total investment cost to overnight cost based on their construction time and an interest of 3.5 percent.

The reason I use 3.5 is because Chinese nuclear power companies are usually state-owned and the interest rates they get, from my data sources, is like 3-4 percent. So it's very low and pretty consistent. So that's how I convert it to overnight cost. I also adjusted it to 2020 prices based on the consumer price index and converted it to U.S. dollars. That's how I get this figure.

One thing I want to show here is that most nuclear power plants in China build two units. So you build two nuclear power units simultaneously, or one shortly after another. They are roughly identical units, so I assume they have the same overnight cost. That's why you see a lot of double dots here. Sometimes they build four units simultaneously. So you can see four units here, and in this case, that's six units simultaneously. So that's basically how I get the data in this figure.

For the next part, I want to give a brief history of the Chinese nuclear power industry. The Chinese nuclear power industry has a very short history, from the 1980s to today, roughly 50 years. The 50 years can be divided into three phases. The first phase is the early stage of Chinese nuclear power. Since the 1980s, after China's reform and opening up, electricity demand increased and people looked at using more nuclear power.

At that time, China introduced a lot of foreign technology. It collaborated with a French company, with a Canadian company, with a Russian company, and introduced their technology. Simultaneously, China also developed its own domestic models, the CNP model and the CPR model based on the French technology, and also on the previous nuclear marine experience. That's the first phase, and you can see the cost quickly decreased over time.

The second phase is from 2005 to the Fukushima accident in 2011. In 2005, the Chinese government announced a very ambitious plan to develop nuclear power. They wanted to build a lot of nuclear power plants using the domestic CNP and CPR models. That's phase two here. Most of these nuclear power plants started construction before Fukushima and finished their construction after Fukushima. As you can see, the domestic models’ costs are relatively low.

After Fukushima, the Chinese government thought they needed safer and more efficient technology to avoid a similar accident. So, they introduced what we call the third generation nuclear power technology. All the previous model designs were second generation. China wanted to introduce third generation technology, so it collaborated with a French company to introduce the EPR model. It also collaborated with the U.S. Westinghouse company to introduce the AP1000 model, and it also developed a domestic third generation model, the HPR model.

People usually call these units first-of-a-kind units, or FOAK units, because it’s the first time you build a nuclear power plant using this design. So it's understandable that they have higher costs and longer construction time. These ones are all the FOAK units here. After 2019, the Chinese government felt more confident in the third generation technology and they started to build more nuclear power plants. That's why you see a lot of nuclear power plants under construction here.

Okay, that's the history. From an energy innovation perspective, what is striking to me is, in general, you see the cost trend is decreasing. Overall, it's decreasing. Very different from what we observed in France and what we observed in the United States. How to explain this? In the next 20 minutes, I want to persuade people that the key driver of this cost decrease is an indigenization process.

A lot of conventional mechanisms people use to explain the downward cost trends of solar, wind, and batteries don't work for nuclear power. Like the size, the economic skill, learning by doing, changing construction time, they don't really have any impact on this cost decrease.

So first, my key argument. Indigenization drives the cost reduction in China. This is a figure showing the domestic content rate of nuclear power plants in China versus its overnight cost. And you can see, that's a very strong linear relationship. The domestic content rate is basically reported by the nuclear power company because that's an achievement, so they will make that public. And they usually calculate that based on the contract value.

If you build nuclear power plants and you sign a lot of contracts, sometimes you give the contracts to the foreign company and other times you give them to the domestic company, and they basically calculate the domestic content rate based on the contract value. And if you read the Chinese nuclear power history, you can get a lot of stories about when replacing foreign equipment with Chinese equipment, it gets cheaper. When replacing foreign labor with Chinese labor, it gets cheaper. So, I would argue that what we observe here is basically an indigenization story, a supply chain story. That's my key argument here.

Another thing I want to persuade people of is that a lot of conventional mechanisms, as I said, that work for solar, wind, or batteries, don't work for nuclear power. The first thing is the reactor size, or people that call that the economic soft scale. Basically, there are two conflicting arguments. People can say you have the economic scale, because if you build a larger nuclear power plants, you can increase the building efficiency and you can spread your fixed cost over a larger capacity so you can lower your cost.

But on the other hand, you also have the diseconomy of scale. When you build a larger nuclear power plant, it also gets more complicated, more complex. So you have the mega project syndrome which increases your cost. Historically, what we observed in the United States and in France is that diseconomy of scale usually dominates the process. So it's more likely the current nuclear power plants are too large. I think this has also motivated people to think about SMRs, small module reactors, or smaller nuclear power plants.

Anyway, in China this isn’t really important because what I'm showing here is the relationship between size and overnight cost. In China, most nuclear power plants are about one gigawatt, and the reactor size isn't really important here. That's the first part. The economy of scale isn't really important in explaining the cost trend.

The second part is learning by doing, and I think that's hard work. I would argue that the learning effect for nuclear is very limited, because of the inherent nature of advanced nuclear power. To explore the learning effect from three channels, I will discuss one by one. Basically, learning means if you have cumulative experience, can you build nuclear power plants cheaper or faster?

So, let me talk about the first channel. The hypothesis here, if you have learning, you have cumulative experience, you can probably build the nuclear power plant cheaper if it has a similar reactor design. If we go back to the figure, most of the Chinese nuclear power plants actually use two models today, the CNP model and CPR model. So my question, is there any learning in the CNP model or the CPR model?

For the CNP model, I found that the learning rate is not statistically significant and the cost up and down here can be explained by the indigenization process pretty well. The CPR model is concentrated in southern China and it's more standardized. So we do observe some learning, but this learning is really a mixed effect of learning by doing of the indigenization process, and also multi-unit siting. As you can see with the CPR model, at first, that's two units simultaneously, and then four units and six units. I think that also helps the cost reduction of the CPR model.

But this is also suggestive evidence, because we do not have any detailed data. So, maybe we do not look at the cost, but rather we can look at the construction time. Because the construction time of nuclear power plants is accurate and widely accessible. So our question here is, if you have cumulative experience building nuclear power plants, can you build one faster?

Before I go to the results, I need to tell people how to build the nuclear power plants. That's a skill people can learn. So basically, if you want to build nuclear power plants, the first thing is you need to have is a first concrete date. That's the start of a nuclear power plant. Basically, you pour the concrete into your reactor size, and that shows people you started building the nuclear power plant.

Next, you do a lot of construction, like all the reactor buildings, a lot of infrastructure. When you finish the work, you start to install the dome. I always think it's a really fancy process. You lift out the dome and position it exactly on the reactor building. After that, you finish all your structural construction and you start to install equipment. There is a lot of equipment, like nuclear reactors, the steam system, the ventilation system. You install all this equipment into the nuclear power plant.

The next stage is a testing and commissioning stage, and you start with the cold test, then the hot test, and then you load the fuel and test the nuclear reaction. After that, you start the commercial operation. So basically, that's how you build a nuclear power plant. In most of Chinese nuclear power plants, they follow these three stages: structural construction, equipment installation, and testing and commission.

Usually, they have different firms doing this work.You'll have the construction firm do the structural construction. You will have the installation firm. The testing and commission stuff, usually that's conducted by the owners of the nuclear power plants. So, our thinking is, if you have learning and follow those construction firms or installation firms, they probably have cumulative experience so they can build nuclear power plants faster. That's a hypothesis.

Let me show people the data here. The Y-axis, that's all the Chinese nuclear power plants ordered by their construction start date. The color is their construction duration. The yellow is their structural construction period, and the blue is their installation period. And finally, that's the testing and commission period.

We used a regression model to understand whether there was any learning on the construction time for these firms. When they have more experience, can they build faster? Our results basically show that the learning factor is very limited in reducing construction time of nuclear power. But there are two things that I think are very interesting and they are statistically significant. We find the firm-specific positive learning in the structural construction period, and firm-specific negative learning in the installation equipment period.

I think it's not surprising, right? The structural construction period, that's a relatively standardized process. For every nuclear power plant, you do the same thing, so it's something you can learn. But for the equipment installation, the equipment for different models is very different, so it's really hard to learn. Also, it's become more and more complicated over time. So, in the regression, that's a negative learning. That's the second channel.

The third channel of learning, we know that most Chinese nuclear power plants have two units. So you build two nuclear power plants simultaneously. Our hypothesis is, if you have learning from the first units, you can reduce the construction time for your second units. But as you can see here, the figure shows the construction time for the first units and the second units, and statistically there's no significance.

I think this is also not surprising, because you really want to build your first unit as soon as possible so you can get revenue, you can catch the government guidelines, and you can attract media attention.

So, I think the learning is pretty limited to off-site, this first unit effect. So there's basically no significance here. My argument is trying to say learning is very limited. A lot of people say that if you have cumulative experience, you can make the advanced nuclear power plants cheaper. Historically, we haven't observed any evidence for that in the United States, in France, and also in China. That's a second mechanism.

The third mechanism is the change in the construction time. What I'm showing here are the construction times of all nuclear power plants globally from the 1960s. You can see the construction time for nuclear power plants in the United States nearly doubled from the 1960s to the 1990s, and it also doubled in France. But in East Asian countries, in Japan, in China, in South Korea, the construction time stayed relatively short and stable. So still, in China this is not a key factor.

One more figure on the construction time. The horizontal axis is all the nuclear power units ordered by their commercial operation and date. So that's the first units, that's the most recent units. The rectangle here, that's their expected construction time. The circle, that's their actual construction time. As you can see, over time, the construction time in China is relatively stable. Only for the first of the 10 units do you have the really long construction time. The first units for the CNP model, the first units for the APR and AP 1000, they take longer to build.

So, I hope I have persuaded you that the Chinese construction cost was decreasing over time and this decreasing was largely driven by the supply chain buildout and labor cost. It's an indigenization process. A lot of conventional mechanisms we can use for solar, wind, and batteries don't really apply here.

Finally, I want to answer some frequently asked questions. The first question is the export of China's nuclear power. Can China export cheap nuclear power plants to other countries? My idea is basically that the cost trend we observed in China is an innovation problem. It is an innovation system and a policy problem. So, what happened in China does not really apply to other countries.

The only country China has exported nuclear power technology to is Pakistan. The data shows if you build the HPR model in China, it's about $2 per watt, but if you build the same thing in Pakistan, you double your cost. So this is really an innovation and policy problem. Currently, Russian technology still dominates the international nuclear export market.

Second, it's not surprising that Chinese nuclear is cheaper. Everything in China is cheap. Chinese solar is cheap, Chinese wind is cheap, Chinese energy storage is cheap. For China, the real question is, can cheap Chinese nuclear power compete with cheap Chinese renewables and storage? The IEA has asked me, must Chinese nuclear power reach $2 per watt to compete with renewables and storage? And I would say, based on my data, currently nuclear power is in that range, from $1.80 to $2.50 per watt.

Third, is this a unique story to China? Is this a Chinese story? I'm actually not sure. I think probably South Korea also has a similar experience. This is from a previous literature, but I cannot read Korean so I cannot really validate the data. But I think what happens in South Korea will be very similar to China.

The Japanese story is very different. But because of the limited data, I think it's really important to understand what the differences are between South Korea, China, and Japan, because they all have centralized supportive policies for a long time, but their performances are a little bit different. But anyway, this is really suggestive evidence. I do not have enough data to say that.

So finally, let me conclude this presentation. The key question here is the nature of this cost escalation course. I think people can already feel that this is a mixed or a combination effect of the nature of technology and the system policy problem. On one hand, nuclear power is a very special technology. It's large scale, it's lumpy, it's risky, and you need to put a lot of money on the capital investment. And it's also a strategic technology.

By strategic technology, I mean in many cases, companies want to make this more innovative, to showcase their achievements, and by doing so, they actually make it more expensive. That's the characteristic of this technology. But on the other hand, we also see differences in innovation systems like in France, in South Korea, in China, where there are centralized regimes. In the United States, that's a fragmented regime, and different supply chains. From a policy perspective, we also see different regulations and different financing policies.

So the final takeaways. Historically, we observed the cost escalation curves, especially in the United States. The United States is really special. The cost increased dramatically. This is a global phenomenon, but here I want to show people we do have some different examples, like China, like South Korea. This shows the cost escalation curves of nuclear power are due to a mix of the technology limitations and policy or system failures.

One thing I want to emphasize again is that a lot of things that work for solar, wind, or batteries don't work for nuclear power, especially the learning process. A lot of people will say if you have cumulative experience you can make nuclear power cheaper or build it faster. We didn't see any historical evidence for that. Even in China, where you have a supportive regime, we didn't see any learning in nuclear power. This really seems like the inherent nature of nuclear power technology.

The Chinese approach to break the cost escalation curves is basically supply chain buildup. You're doing indigenization. You build the domestic supply chain, make it cheaper, do some standardization with stable and supportive policies. But people may ask, is there any other approach to breaking the cost escalation curves, because the Chinese approach may not really work in other countries?

Another debatable issue is, can we redesign nuclear power technology to break the cost escalation curves? If we use a small module reactor, you might be able to do factory learning. That's an open question. I have no answer. And with that, I'm happy to answer any questions.