Carbon offsets were everywhere at COP28, but while carbon finance can help fund clean energy infrastructure, somehow offsets are being both over-maligned and under-appreciated.

Carbon finance dominated discussions at COP28. It’s easy to see why – carbon markets appear to offer an easy win: one party pays another to reduce CO2 emissions. The seller gets cash while the buyer gets credit for their emissions targets, national climate goals, or carbon tax liabilities. For cash-strapped clean energy projects, particularly in the Global South, this feels like free money.

At COP28, a new carbon market governed by Article 6 of the Paris Agreement was a key sticking point amongst negotiators. Agreement on the final rules for a central UN trading mechanism collapsed, with critical decisions postponed to next year. Despite the policy gridlock however, private companies, national governments, and international organizations forged ahead at the sidelines of COP with hundreds of millions of dollars in new carbon deals. These were both in the non-governmental voluntary market, and through a flexible part of Article 6 that allows parties to transact bilaterally even without the UN trading architecture.

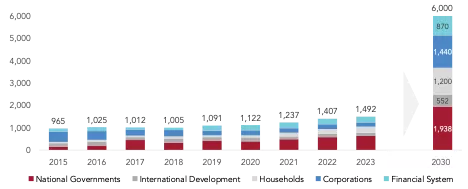

What should we make of this? First, remember that for the time being, on the scale of the energy transition, voluntary carbon markets are a rounding error. Figure 1 shows global energy transition investment, which over the last decade has been led by public spending. The key message is that by 2030 we need $6 trillion of annual investment, up from $1.5 trillion today, and the private sector must shoulder the bulk of that burden – these figures are simply too high for governments to afford.

Figure 1 – Global Energy Transition Investment by Source ($Bn)

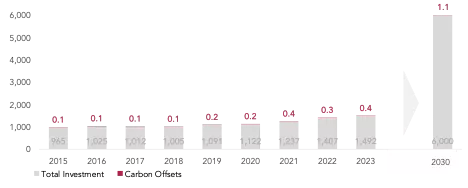

Now, let’s investigate the voluntary carbon markets. In Figure 2 below, the thin red line shows annual offset issuance. The 2030 prediction comes from a Boston Consulting Group report that declares voluntary carbon markets to be “thriving.” If you can’t see the line, that’s because on current predictions, carbon offsets will account for less than 0.1% of the total financing required.

Figure 2 – Voluntary Carbon Offsets Relative to Global Energy Transition Investment ($Bn)

This is not to say that momentum on carbon finance isn’t a good thing. Ajay Banga, President of the World Bank, has made voluntary carbon markets a priority. This is serious stuff, but look at Figure 2 again. For voluntary offsets to make a real difference, corporations will need to willingly give up tens of billions of dollars, multiplying spending by a factor of a thousand or more. On this, unfortunately, I’m a pessimist.

How can carbon finance become a genuine tool to fund the energy transition? First, structural change is needed. Currently, most carbon credits constitute “results-based climate finance” - you get the money after you reduce emissions. But transforming the global energy system is a capital-intensive business, and projects need financing before they can start reducing emissions. Second, demand must grow far beyond what corporations will voluntarily pay, for instance by mandating companies to pay carbon taxes in offsets, as Switzerland has done.

Encouragingly, both challenges could potentially be addressed by Article 6. Article 6 creates a new type of carbon offset where each credit is linked to a debit, known as a corresponding adjustment. Under Article 6, a country hosting infrastructure paid for by carbon finance deducts any emissions reductions they sell from their own national carbon accounts. This adjustment could turn Article 6 offets into tax credits for national carbon pricing schemes, creating much more demand, as is already the case in Singapore.

To supplement this progress, at COP27 last year my colleague Daniel Schrag and I proposed a new approach to Article 6 in a report published by Harvard Kennedy School’s Belfer Center. Our idea is to leverage Article 6 for upfront investment, where carbon investors finance clean energy projects via concessional loans, equity, grants, or guarantees. Under our proposal, the more an Article 6 investment reduces a project’s cost of capital, the more emissions reductions the investor receives. Building on our work, E.ON, one of the largest energy companies in the world, published a report via its climate subsidiary Seagrass at COP28. The E.ON report, which I co-authored, presented a pilot $45 million transmission line in Rwanda, and predicted that Article 6 investment could unlock up to $930 billion in funding per year.

If a trillion dollars a year mobilized by Article 6 investment is the optimist’s view, it’s important to note the inverse narrative. Pessimists fear these markets could be mere greenwashing and even “carbon colonialism.” Consider the controversy around “Blue Carbon,” a UAE-based company developing carbon credits. Blue Carbon’s agreements give them the right to sell carbon credits on behalf of many African governments, sharing the revenue from the sales. This has led to accusations that carbon finance is instituting a “new scramble for Africa.”

This is not the right way to think about carbon finance. A company or country willing to invest in carbon emissions mitigation abroad, be it clean energy or forest preservation, is a good thing. For the first time, the natural resources of developing countries are not being extracted or destroyed, they are being preserved.

“Carbon colonialism” conjures images of carbon being shipped out of Africa. But developers such as the UAE are not actually extracting any carbon. Extracting carbon would be drilling for oil and gas or cutting down trees for timber, all of which can wreak havoc on local biospheres. Carbon finance represents exactly the opposite; what is being taken is a certificate to guarantee the resources stay in the country and in the ground. One indicative headline has decried that “Liberia is set to concede 10% of its territory to Emirati company for carbon credit production.” This is not true. The Emirati company is being contracted by the government to ensure forests are not cut down, which is what carbon credit “production” is.

We should without doubt scrutinize companies like Blue Carbon. We know from experience that foreign investment often does not produce the promised results for developing countries. But the principle is a good one – a project developer gets rights to develop a national asset, funds the development, invests its capital and expertise, and pays the government in exchange.

In an ideal world, African governments could invest and develop carbon resources without foreign capital and expertise. But we do not live in an ideal world - carbon mitigation is urgent. The issues at stake are the same as any foreign investment: ensuring transparency, an equitable sharing of profits, and provisions for local communities. A main caveat is that governments in Africa will need to make sure the sale of carbon credits does not jeopardize their ability to reach their own targets, as Rwanda has done by insisting on “credit sharing.” The draft terms of the Blue Carbon deal, including a royalty on credits and share of profits for the local government, compare favorably to classic natural resource deals signed all over Africa.

Carbon finance is not a silver bullet, but nor is it a ploy by cynical capitalists. It is an opportunity to lower the cost of capital in the Global South, and that’s a good thing. Unfortunately, negotiators at COP28 failed to reach agreement on the latest guidance for a centralized Article 6 exchange, but bilateral deals already being led by a mix of national governments and private investors. These represent real funds going to real projects. The question isn’t whether carbon finance is good, it is how to make it happen at scale.

This is the second of two articles on carbon finance. The first dealt with the legacy of COP28. The Belfer Center’s work on climate finance is in part supported by a gift from Abu Dhabi Commercial Bank.

Sandler, Ely. “Carbon Finance Is Becoming Part of the Paris Agreement Toolkit – But Isn’t Ready Yet.” Belfer Center for Science and International Affairs, Harvard Kennedy School, December 18, 2023