Situation:

The date is Monday, April 6, 2009. You are a senior policy advisor to National Security Advisor James Jones.

Over the weekend, you have been reviewing reports from London, Strasbourg, Prague, and Ankara, reporting on the President's meetings at the G20, NATO, and EU summit meetings and bilaterals. You have read with particular interest the minutes of Obama's first meeting with the President of the People's Republic of China, Hu Jintao, which took place last Wednesday, April 1. After the meeting, the presidents announced a "strategic and economic dialogue," to be jumpstarted with a series of high-level working visits over the summer.

Reflecting the President's impressions of his meeting, and the muted Chinese reaction to North Korea's missile/satellite launch, General Jones called this morning instructing you to speed up the strategic reassessment of U.S. relations with China that you had previously been assigned. He wants a three-page sketch of your answer to that assignment for his review by April 13. General Jones noted that the President was a bit taken aback by the assertiveness of a number of the leaders he met with. He suspects that his Chinese interlocuters agree with Brazilian President Lula's zinger: This global financial crisis was "caused and encouraged by the irrational behavior of white people with blue eyes, who before the crisis appeared to know everything but are now showing that they know nothing." Obama noted that the last time he checked, he did not have blue eyes.

Hu quizzed Obama about what he thought of Nobel-prize winning economist Paul Krugman's argument that America is "looking like the Bernie Madoff of economics: for many years it was held in respect, even awe, but it turns out to have been a fraud all along." Had the Obama administration liberated itself from what Krugman called "the grip of the market mystique?" Or was Krugman right in arguing that "American fiscal policy is still in denial?"

According to General Jones, President Obama came away with the impression that China's leadership is schizophrenic. On the one hand, China is feeling its oats. They take some satisfaction in the fact that the American brand of unbridled capitalism is discredited; that their rejection of America's campaign to persuade them to liberalize their credit markets has saved them from the worst consequence of the financial meltdown; that the huge surpluses they earned by selling and saving provides a security blanket. As the only other major economy to match the U.S. Keysian stimulus, they believe they are owed more respect and a larger say.

On the other hand, Hu revealed a deep sense of vulnerability. Having bet their growth strategy on exports, they have seen demand for their products collapse. Having accumulated huge surpluses, mostly dollar denominated, they are worried that the U.S. stimulus will shrink the value of their holdings. But beneath these economic factors, Obama's hunch is that they are fearful of the possibility of civil unrest and even instability. Hu spoke passionately about the tragedy of the cultural revolution and its consequences for his own family. That nightmare may be more vivid today than at any point since China began to fast march to economic modernization.

Context:

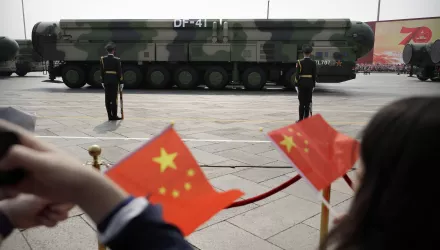

U.S.-Chinese relations have remained on a fairly consistent trendline over the decades since Beijing started its policy of reform and opening. Chinese leaders have emphasized their commitment to economic growth über alles, characterizing China's emergence as a "peaceful rise," and restraining expansionist political ambitions in the region and beyond. American leaders have sought to entice China into the existing order through the global trading system and other international institutions, while hedging against the country's increasing might. In 2005, Robert Zoellick famously summarized U.S. expectations to accommodate China as an emerging power, to the extent that Beijing transforms itself into a "responsible stakeholder" in global affairs.

On the U.S. side, the fact that China is not democratic, violates basic human rights, prohibits a free press, and dominates Tibet, complicates the relationship. Especially in electoral seasons, the left of the Democrat Party and right among Republicans highlight the extent to which China is "not like us." Last summer, in the months leading up to the 2008 Olympic games, China's human rights record, continued crackdown in Tibet, and economic ties to the Sudanese government despite the genocide in Darfur, were on display across the globe. Western political leaders, including President George Bush, were criticized for attending the Games. At the end of the day, however, both Democratic and Republican administrations have come to believe that cooperation is in the best interest of the U.S. and have thus worked hard to maintain a cooperative, deepening bilateral relationship. In part, this reflects admiration for China's lifting hundreds of millions of people out of poverty; in part, the business community's judgment that China is too big and important a market to miss.

On the Chinese side, questions about the legitimacy of Communist Party rule could potentially become a destabilizing factor. The Communist Party maintains a strict monopoly of political power and rules with a firm hand. This status quo has been acceptable to citizens as long as the Party delivered rapid economic growth. Chinese commentators have noted that 8% growth is required for the Party to deliver its side of the bargain. In effect, there has been an unwritten social contract according to which citizens defer to Chinese Communist Party rule as long as it continues to deliver double-digit increases in their income. In recent years, when rural citizens in the hinterland experienced economic stagnation, they grew distant to the Party. As long as urban and coastal areas boomed, the Party continued to have a support from a large number socially upward-mobile citizens.

Today, Sino-American interdependence has reached unprecedented levels. International trade has been essential to China's economic success. Joining WTO in 1999 was vital for Beijing to secure export markets in the U.S. and beyond. Chinese industry has become world consumers' manufacturing workshop, supplying U.S. and European consumers, through just-in-time delivery to American Wal-Marts, with everything from clothing to flat screen TVs. In return, China has been accumulating huge surpluses, now standing at more than $2 trillion, more than $1 trillion of which is held in U.S. Treasuries. Australia's national daily newspaper characterized last week's encounter between Obama and Hu Jintao as "a meeting between the world's biggest debtor and creditor." China's export growth and its accumulation of foreign reserves is a direct result of an artificial Yuan-$ exchange rate.

In sum, both countries have become vitally dependent on each other, a situation that could be described as an economic equivalent of the Cold-War strategic reality of Mutually Assured Destruction (MAD). Advocates of these arrangements consider this interdependence as an inherently stabilizing factor. During the Cold War, after the U.S. and Soviet Union had acquired superpower nuclear arsenals, neither party could attack the other, since an attack would trigger a retaliatory response that assured the destruction of the attacker. Under those conditions, a decision to attack would be equivalent to a decision to commit mutual suicide. Interdependence in the economic realm, it has been argued, has a similarly stabilizing effect.

As Cold War theorists pointed out, however, systems of MAD are vulnerable to accidents. In the realm of nuclear weapons, an unauthorized or accidental launch of one or several nuclear-armed missiles by one of the parties could lead to a nuclear Armageddon. In the economic realm, China stands vulnerable not only to decisions by the U.S. government to limit Chinese imports, but also to an unintended global recession or even depression, in which demand for its products would fall sharply.

Indeed, as a result of this "accidental" recession, Chinese exports have fallen by 26% year-on-year in February 2009. A quick back-of-the-envelope calculation reveals a potentially devastating effect of such a drastic drop in exports. If as World Bank data for 2007 reported, exports account for 40% of the country's GDP, a 26% decrease of exports mathematically translates into a 10% decrease in GDP. Forecasts by The Economists predict recession of about that magnitude throughout East Asia: Japan -5.9%, Hong Kong -5.9%, South Korea -10.1%, Taiwan -6.5%.

In contrast, China's leaders have continued to insist that the Chinese economy will grow at 8%. Their stimulus package of $586 billion (14% of GDP) in the 2009 budget is designed to partly offset the effect of reduced exports. The World Bank recently adjusted its growth estimates for China downward to 6.5%, although The Economist reported a year-on-year industrial growth rate of only 3.8% in the first months of 2009, and some suspect that growth is below zero. One immediate effect of the crisis has been rising unemployment. Even according to the conservative estimate of China's official news agency, 15% of China's 150 million migrant workers have lost their jobs, without much warning and at times without receiving due salary. Growing social unrest all over the country has led the government to ramp up its early warning mechanisms. China's official news agency openly warns: "We are entering a peak period for mass incidents."

Moreover, it is clear that the crisis will affect China's ability to overtake the U.S. in terms of its GDP. In 2000, Paul Krugman estimated that China would become the world's largest economy around 2025. All such calculations are fraught with uncertainties. For examples, meaningful comparisons must take into account differences in purchasing power: Obviously, holding in your hand $100, you can buy more goods and services in China than you could afford in the US. This can lead to surprising statistical miscalculations. In 2007, World Bank economists recalculated purchasing power parities and found that China's GDP was in fact worth 40% less than previously thought. After the crisis, when the dust settles, the relative prospects of the two economies will look very different from today.

Finally, the economic crisis has exposed weaknesses in what had sometimes admiringly been called "Anglo-American capitalism". As last Sunday's New York Times has put it, "English-speaking capitalism is on trial." Previous confidence in the superiority of U.S. institutions has been undermined world-wide, threatening America's soft power.

Assignment:

Last month, President Obama had asked National Security Advisor Jones to conduct a strategic reassessment of the U.S. relationship with China, taking account of the current global economic crisis. In this morning's phone call, General Jones has asked you to prepare a three-page preview of the assessment that he can share with President Obama. In giving you the earlier assignment, General Jones had asked for a comprehensive strategic reassessment of Sino-U.S. relations in the next four years and beyond, recognizing a presumption in favor of continuity, but focusing on new risks and opportunities for both the U.S. and China presented by the current global economic crisis. Moreover, he asked you to formulate three options. The first should be continuation of the current trendline. But you should also present two significantly different alternatives that President Obama should consider taking into account current risks and opportunities for the U.S. He noted that you should expect that similar calculations are likely being made on the Chinese side.

Allison, Graham and Meghan L. O'Sullivan. “Case Study: The Rise of China and the Global Economic Crisis.” May 6, 2009