President Xi Jinping’s pledge during the 2020 United Nations General Assembly, that China would reach peak carbon dioxide emissions by 2030 and achieve carbon neutrality before 2060, is a significant step in the fight against climate change. Since China is the world’s top contributor of greenhouse gases, there is no doubt that Beijing needs to be front and center of any effort to curb global emissions.

In 2019, China accounted for almost 30 percent of global emissions, about twice as much as the second largest emitter, the United States.1 But while U.S. emissions have been on an overall decline since 2007,2 China’s have increased, raising concerns over whether Beijing can actually deliver on its targets. This reality should not distract from the fact that China is also the world’s top developer of renewables and other clean energy technologies. For example, China was the world’s largest installer of photovoltaics (PV) by 2013 and, in less than two years, also became the global leader in solar module manufacturing. At the same time, China leveraged its industrial might and economies of scale to drive down modules’ costs—which, by the end of 2018, were 90 percent lower than only ten years before.

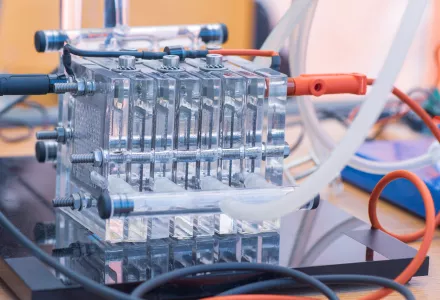

In this context, renewable hydrogen could significantly accelerate China’s transition to a low-carbon economy, increasing the likelihood of meeting its carbon neutrality goal. Renewable hydrogen offers significant advantages for China. It can help Beijing meet its climate and pollution goals—at a time when coal continues to dominate—while avoiding increased reliance on imported fuels. As a readily dispatchable means of storing energy, hydrogen can help to address intermittency and curtailment issues as renewable energy increases its share of China’s energy mix. As a sustainable mobility energy carrier, it can power fuel-cell electric vehicles or be the base for synthetic fuels. Finally, renewable hydrogen can open new avenues for developing clean technology manufactured goods for both internal and export markets.

Today, most of China’s hydrogen is produced from coal via 1,000 gasifiers, accounting for 5% of the country’s total coal consumption. Hydrogen costs vary significantly as a function of production technology and prices of fossil fuels and electricity. Production from coal remains the lowest cost option: about 30 percent cheaper than hydrogen from natural gas. Therefore, reducing the carbon footprint of coal-based hydrogen will be critical in a low-carbon economy. In the medium term, coal-based hydrogen with carbon capture, utilization and storage will likely remain China’s lowest-cost clean hydrogen production pathway. Hence, the underlying question is whether Beijing will prioritize cost considerations or put its full industrial might behind the development and deployment of renewable hydrogen.

In March 2019, the Chinese government took a significant step forward by announcing measures to promote the construction of hydrogen facilities for new energy vehicles. Wan Gang, who is known as China’s “father of the electric car,” called for China to “look into establishing a hydrogen society” and “move further toward fuel cells.”3 Given that Gang made a similar call two decades ago on vehicle electrification, which played a key role in China’s current battery electric vehicles market dominance, close attention is warranted.

Figure 1. China’s annual solar and wind potential (Global Solar and Wind Atlas 2021)

This broad vision on hydrogen has also been underpinned by significant investments at the provincial level aimed at spurring adoption of renewable hydrogen. In 2020, Guangdong province released a “New Energy Industry Fostering Plan” to promote “clean energy-based” hydrogen production. Hebei province is now home to four high-priority renewable power-to-gas projects and Baicheng city (located in Jilin province) intends to establish a hydrogen hub based on wind energy, supported by local renewables majors such a SPIC and Goldwind.4 These are just a few examples.

Looking forward, in order for renewable hydrogen to become a significant part of China’s low-carbon energy mix, Beijing will need to define new and innovative policies while developing appropriate market structures aimed at spurring innovation along the value chains; scale technologies while significantly reducing costs; and deploy enabling infrastructure at scale. A comprehensive Chinese hydrogen strategy needs to tie together all aspects of the hydrogen value chain, ranging from research, production, storage, and transmission, to end uses.

A key barrier to renewable hydrogen adoption at scale is the geographical distribution of required renewable energy and freshwater resources. On one hand, while China’s largest renewable potential is inland (see Figure 1), the key industrial and urban demand centers are located on the East coast. Similarly, while China as a whole is not water-constrained, freshwater availability varies greatly among regions. Water scarcity is already a serious issue in some areas, especially impacting the urban centers and industrial zones of the North. Eleven provinces are already water-constrained: Beijing, Gansu, Hebei, Henan, Jiangsu, Liaoning, Ningxia, Shandong, Shanghai, Shanxi, and Tianjin. And seven more are at risk of becoming water-constrained: Anhui, Chongqing, Guangdong, Hubei, Inner Mongolia, Jilin, and Shaanxi.5

At a national level, renewable hydrogen could be most efficiently and effectively produced in the Southwestern region. This region has rich renewable resources and less constrained water resources, but is far from China’s economic heartland, thus requiring significant infrastructure investments to connect supply with demand, potentially making regional imports from neighboring countries more attractive. Furthermore, if water scarcity issues are addressed, China could become a renewable hydrogen export champion, supplying international markets in Southeast Asia and beyond.

From a geopolitical perspective, renewable hydrogen could become a key part of the Belt and Road Initiative, symbolizing China’s technological prowess while increasing export opportunities and potentially enhancing Beijing’s status as a leader in the global fight against climate change.

China still has a long way to go before a hydrogen society reaches fruition, but if Beijing were to replicate the success it has had with other clean technologies like solar PV, it could significantly lower costs and accelerate adoption around the world, while emerging as a renewable hydrogen superpower.

This policy brief is based on the report ‘Is China’s Hydrogen Economy Coming? A Game-Changing Opportunity’ published by the Harvard Kennedy School’s Belfer Center for Science and International Affairs in July 2020.

Notes

1 Statista (2021), “Carbon dioxide emissions in 2009 and 2019 by country” https://www.statista.com/statistics/270499/co2-emissions-in-selected-countries/, accessed April 2021.

2 EIA (2021), “U.S. Energy-Related Carbon Dioxide Emissions” https://www.eia.gov/environment/emissions/carbon/, accessed April 2021.

3 Bloomberg (2019), “Wan Gang, China’s father of electric cars, thinks hydrogen is the future” https://www.bloomberg.com/news/articles/2019-06-12/china-s-father-of-electric-cars-thinks-hydrogen-is-the-future, accessed April 2021.

4 Energy Iceberg (2020), “China’s Green Hydrogen Effort in 2020: Gearing Up for Commercialization” https://energyiceberg.com/china-renewable-green-hydrogen/, accessed April 2021.

5 China Water Risk Project (2020), “Who is running dry?” http://www.chinawaterrisk.org/the-big-picture/whos-running-dry/, accessed April 2021.

De Blasio, Nicola and Fridolin Pflugmann. “China: The Renewable Hydrogen Superpower? .” May 2021