1. Introduction

China’s electricity sector is key to addressing many of the country’s most pressing public policy challenges, from mitigating climate change and local environmental pollution to providing affordable inputs to economic growth. Over the last three decades, numerous reforms have sought to increase efficiency in the sector, yet full-fledged electricity markets have yet to take hold. Partly as a result of this incomplete transition away from central planning, the sector now faces generation overcapacity across the country, high levels of renewable energy curtailment (i.e., waste), and an uncertain path for innovation in technologies of the future low-carbon grid.

Yunnan province in southern China presents a particular set of challenges. While it has plentiful hydropower resources, it regularly curtails large amounts of this low-carbon energy (exceeding 20% in some months). Coal power plants provide energy needed mostly in the dry winter months, but rely on significant subsidies to do so, at high cost to the system. Growing fractions of intermittent renewable energy (run-of-river hydro, but also wind and solar) further complicate efficiently managing the system using old planning models.

Yunnan has pushed further than most provinces in establishing market-based mechanisms in the electricity sector, with three-fifths of energy in the province sold outside of government-administered plans. Medium-term markets (monthly to annual), in particular, have proliferated with a variety of designs and much differentiation based on fuel types, which can have significant impacts on efficiency and distribution of revenues. Crucially, Yunnan lacks a standard short-run electricity market (“spot market”)—a pricing system that holistically incorporates all supply and network characteristics and provides efficient prices with the associated incentives for operation and investment. In addition, many non-market elements, such as coal power subsidies and priority generation plans, have been implemented to maintain solvency of some electricity sector firms but with negative impacts on efficiency and environmental performance.

In this report, we propose a market reform pathway for Yunnan that is both feasible and applicable to address some of these challenges immediately, while aiming for a standard design based on well-documented international experience. Our proposal includes at its heart a pay-for-performance monthly capacity auction that can help cover revenue deficiencies in the energy market. Building on international experience with capacity markets, this approach provides incentives for availability when generation is needed most and is compatible with the adoption of a single energy market for all electricity resources. Out-of-market payments to cover stranded costs of certain firms can thus be minimized. Finally, engaging consumers in both these energy and capacity markets can create high-powered incentives to shift consumption to low-cost months and hours, benefitting the entire province.

2. The Yunnan electricity system

2.1 Overview of power sector development

China’s power sector grew out of a vertically-integrated ministry. Independent producers were introduced in the 1980s and various elements of electricity market restructuring were embraced in the late 1990s and early 2000s [1]. These reforms resulted in unprecedented annual growth of 12% in electricity generation and capacity between 2002-2012 [2]. Nevertheless, tariffs for generation were determined by the government separately by energy type and province, resulting in challenges such as inefficient dispatch, barriers to trading power, and power shortages coexisting with oversupply across the country [3, 4]. Difficulties in integrating increasing amounts of renewable energy have also highlighted the inconsistencies among the goals of national and local governments and grid companies, resulting in significant curtailment—i.e., waste—of non-fossil energy sources.

Yunnan, in southwestern China, has a unique geography giving rise to abundant energy resources: six major river systems with more than 180 tributaries[5]. The exploitable capacity of hydropower in Yunnan exceeds 100 GW, 15% of the national total (660 GW) [6]. Yunnan’s proved coal reserves reach about 24 billion tons (ninth in China) and wind and solar resources are plentiful [7]. Electric power was thus identified early on as a pillar industry of the province, particularly with the West-East Electricity Transfer (WEET) project beginning in the 1990s.1

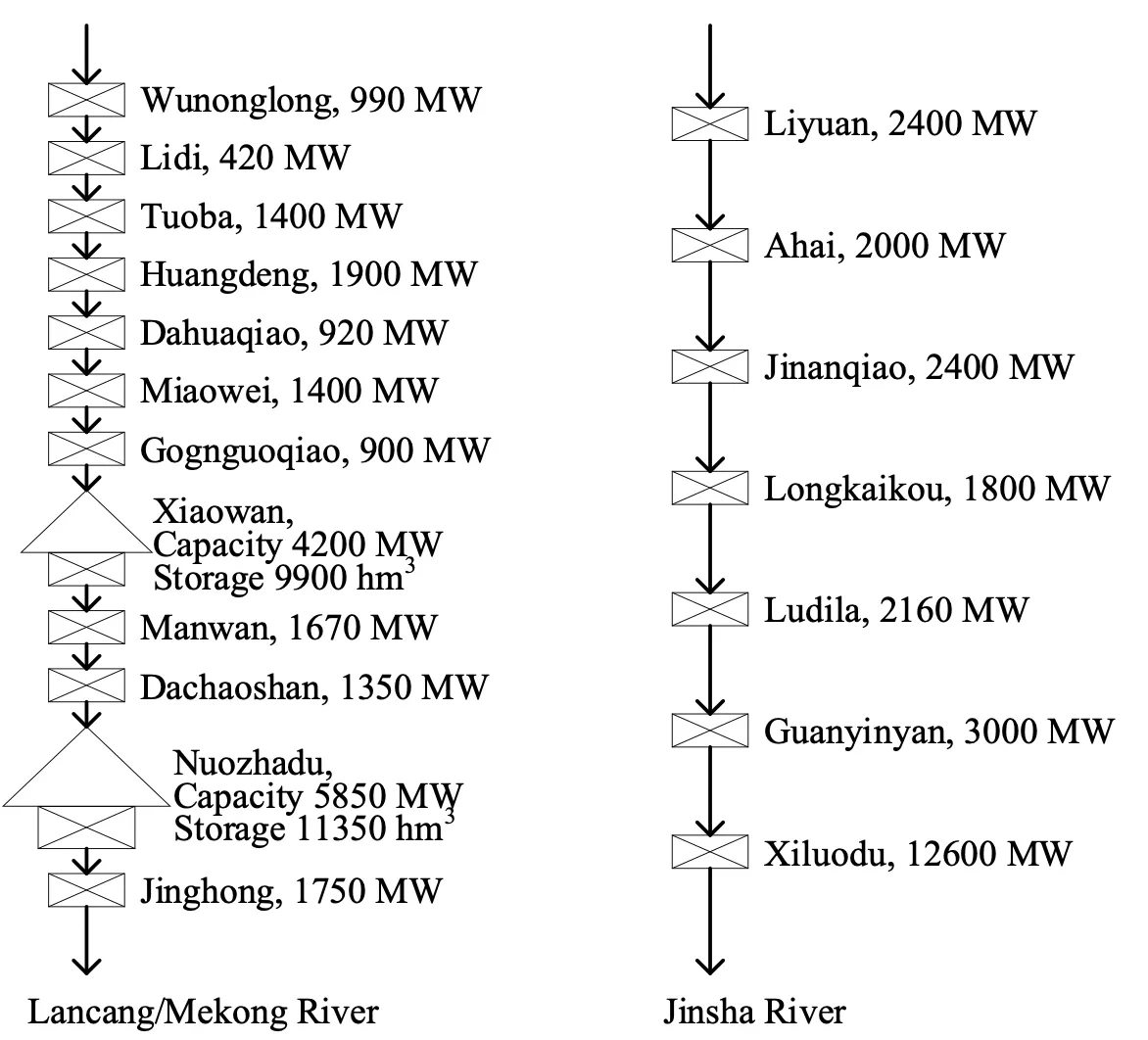

Power generating capacity in Yunnan has consistently exceeded national growth rates, expanding by 17% annually in the 12th Five-Year Plan (2011-2015). This was driven by large, cascading hydropower plants on the Lancang and Jinsha rivers. Smaller run-of-river plants installed in previous years—primarily controlled by sub-provincial grids—also maintain a large fraction of hydropower. In addition, several new coal plants came online in 2012, resulting in 92 GW of total installed capacity in 2018 (see Table 1).

In terms of generation, hydropower, coal, wind and solar PV account for 83%, 9%, 7% and 1%, respectively.

Table 1 Yunnan’s generation mix in 2018.

Source: [8, 9]

| Capacity by dispatch jurisdiction (MW) | Generation (TWh) | |||

|---|---|---|---|---|

| Provincial | Sub-provincial2 | Subtotal | ||

| Hydropower | 56 621 | 9 963 | 66 584 | 263 |

| Coal | 12 400 | 1 599 | 13 999 | 29 |

| Wind | 8 475 | 98 | 8 573 | 22 |

| Solar PV | 3 099 | 200 | 3 299 | 3 |

| Total | 80 595 | 11 859 | 92 455 | 317 |

To accommodate this rapid growth in generating capacity, the Yunnan Power Grid (YNPG) has strengthened provincial transmission networks to connect to local demand centers, and China Southern Grid (CSG) has expanded inter-provincial WEET interconnections to facilitate exports. Inter-provincial transmission capacity now stands at 31 GW.3 Additional transmission projects (e.g., Kun-Liu-Long UHVDC) are further planned, which would expand export capacity by an additional 8 GW [12]. WEET exports are expected to reach 140 TWh in 2020 [13].

However, common to many other regions of China, electricity demand within Yunnan and provinces it exports to did not keep pace with these investments in supply. Beginning around 2013, oversupply became an important challenge for Yunnan, resulting in hydropower curtailment. New coal plant development has been restricted, and electricity markets have been adopted to help spur greater local consumption of electricity, discussed further below. Yunnan’s demand is projected to grow annually only at 4.5% over the 14th FYP, reaching around 330 TWh in 2030 [14].

2.2 Energy pricing and dispatch

2.2.1 Administrative pricing

Administrative prices typically distinguish between generation tariffs (prices received by generators) and retail tariffs (prices paid by consumers). Yunnan has historically implemented benchmark generation tariffs like the rest of China, and in 2014, began differentiating between wet- and dry-season prices—resulting in roughly 20% cheaper electricity from May to November, when hydropower is plentiful. In 2015, hydropower plant tariffs were further segmented according to reservoir storage capacities: 0.33 RMB/kWh for reservoirs with annual storage capability, 0.3 RMB/kWh for seasonal storage capability, 0.27 RMB/kWh for run-of-river plants with capacity of greater than 25MW, and 0.235 RMB/kWh for plants below 25MW [15]. Newly built run-of-river hydropower plants on major rivers such as Lancang, Jinsha, and Nujiang received slightly higher on-grid prices of 0.3 RMB/kWh.

Benchmark coal tariffs are periodically adjusted to reflect changes in cost inputs such as fuel prices, most recently in 2015 to 0.3358 RMB/kWh [16]. Wind and solar benchmark tariffs are set according to the central feed-in-tariff (FIT) policy,4 which are currently 0.45 RMB/kWh and 0.75 RMB/kWh in Yunnan [17]. The difference between the FIT and the coal benchmark tariff is covered by a subsidy financed by the national government.

Retail prices faced by consumers in Yunnan are differentiated according to sector and are mostly constant regardless of location within the province, with seven minor independent areas where the pricing is subject to the prefectural government [18]. The difference between retail and generation tariffs is revenue for the grid company, which prior to 2016 did not receive proper cost accounting. The province has only recently begun to enhance regulation over natural monopoly companies like transmission and distribution grid companies, which is necessary to prevent overcompensation and ensure efficient operation [19], see Table 2.

Table 2 Retail prices (pre- and post-reform) of YNPG in 2016–2018.5

Source: [20, 21]

| Sector | Tariffs (pre-reform) | Tariffs (post-reform) | ||||

|---|---|---|---|---|---|---|

| per kWh | per MW-month | Market price (per kWh) |

T&D (per kWh) |

Other (per kWh) |

T&D (per MW-month) |

|

| Large industry | 0.48 | 37000 | 0.1756 | 0.06 | 0.1205 | 37000 |

| Small industry | 0.53 | -- | -- | -- | -- | -- |

| Commercial | 0.65 | -- | -- | -- | -- | -- |

| Residential | 0.45-0.8 | -- | -- | -- | -- | -- |

2.2.2 Market pricing

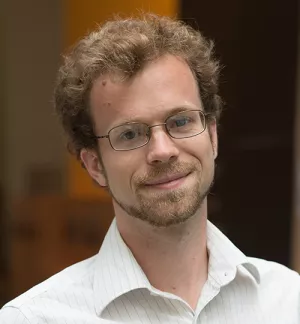

Since 2014, Yunnan has gradually deregulated transactions on a monthly and annual basis between power plants and industrial consumers to encourage market competition. Figure 1 shows the monthly and annual average energy prices received by generators in 2016–2018, reflecting seasonal changes in demand and supply. With the introduction of new grid regulations (first supervision period of 2016–2018), a fixed transmission and distribution tariff (0.1464 RMB/kWh on average) is added to consumer bills [20].

Figure 1. Average electricity market prices in Yunnan, 2016–2018

2.2.3 Power dispatch

The principle of electric power dispatch in Yunnan is largely similar to the rest of China—based on annual and monthly balancing of allocations and market contracts and ensuring stable grid operation. While broad principles of equity and fairness apply to the system of dispatch,6 in Yunnan, a large portion of electricity is also considered “priority generation,” including reliability-must-run (RMR) coal units necessary for grid stability, designated priority hydropower plants, coal power plants that cogenerate heat, wind and solar power, and small hydro plants under sub-provincial jurisdiction. Following this, what remains are market contracts, which are first dispatched for hydro and then coal [23].

Yunnan faces some congestion in its grid—roughly 10% of hydro curtailment can be attributed to these transmission bottlenecks. In this case, dispatching in congested areas conforms to the principle of equity by distributing the transmission capacity equally to each power plant ex-ante in line with their installed capacities, serving as constraints for the market transactions.

2.3 Seasonal resource adequacy and oversupply challenges

2.3.1 Hydropower seasonal availability

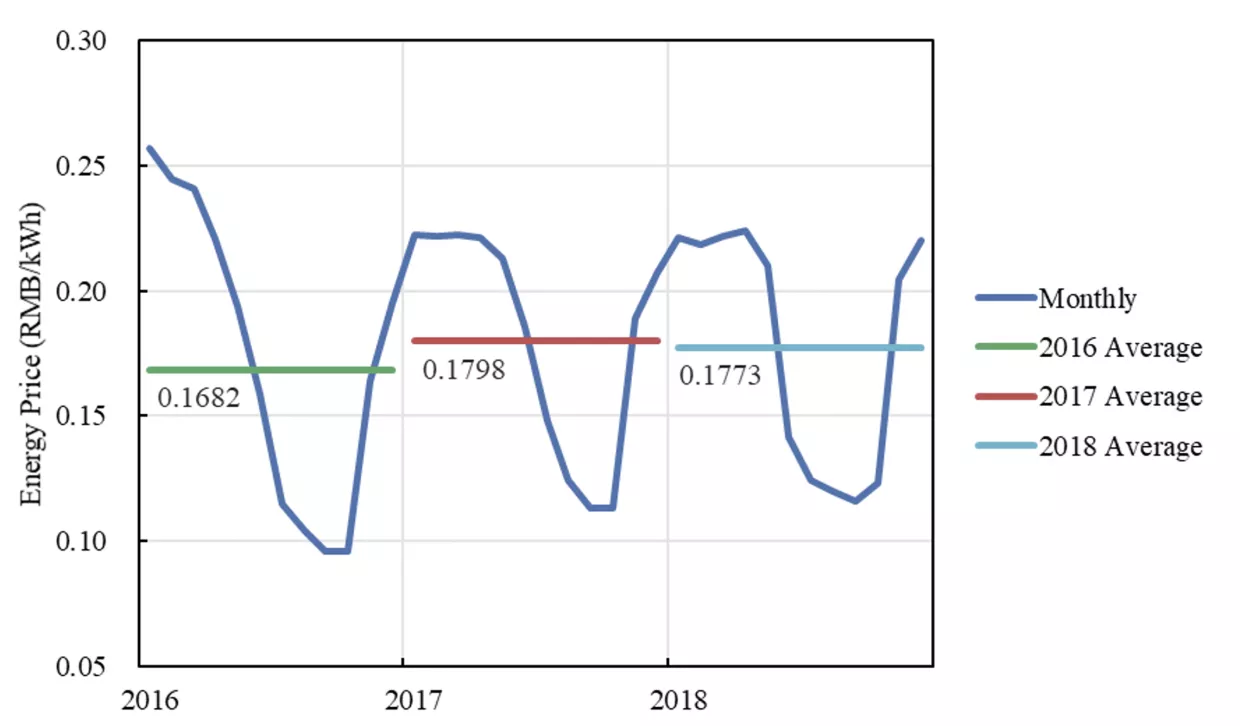

Controllable hydropower reservoirs account for less than one-third of the total hydropower capacity, with the remainder from run-of-river hydro. The large degree of uncontrollable hydro plants results in roughly 60–70% of hydropower generation occurring in the wet season from June to October. For example, poor control of water inflows of the cascading hydro plants on the Jinsha River (with installed capacity of over 20 GW) leads to an approximate generation ratio of 3:7 in the dry and wet seasons (Figure 2). Moreover, newly installed cascading hydropower plants on the upper reaches of the Lancang River, have decreased the overall operability of hydro reservoirs downstream, further exacerbating the seasonal hydropower availability and curtailment. In addition, there are some low demand areas where hydropower plants are concentrated, inducing local transmission network-related congestion curtailment of around 2 TWh per year.

Figure 2. Illustration of the hydropower availability

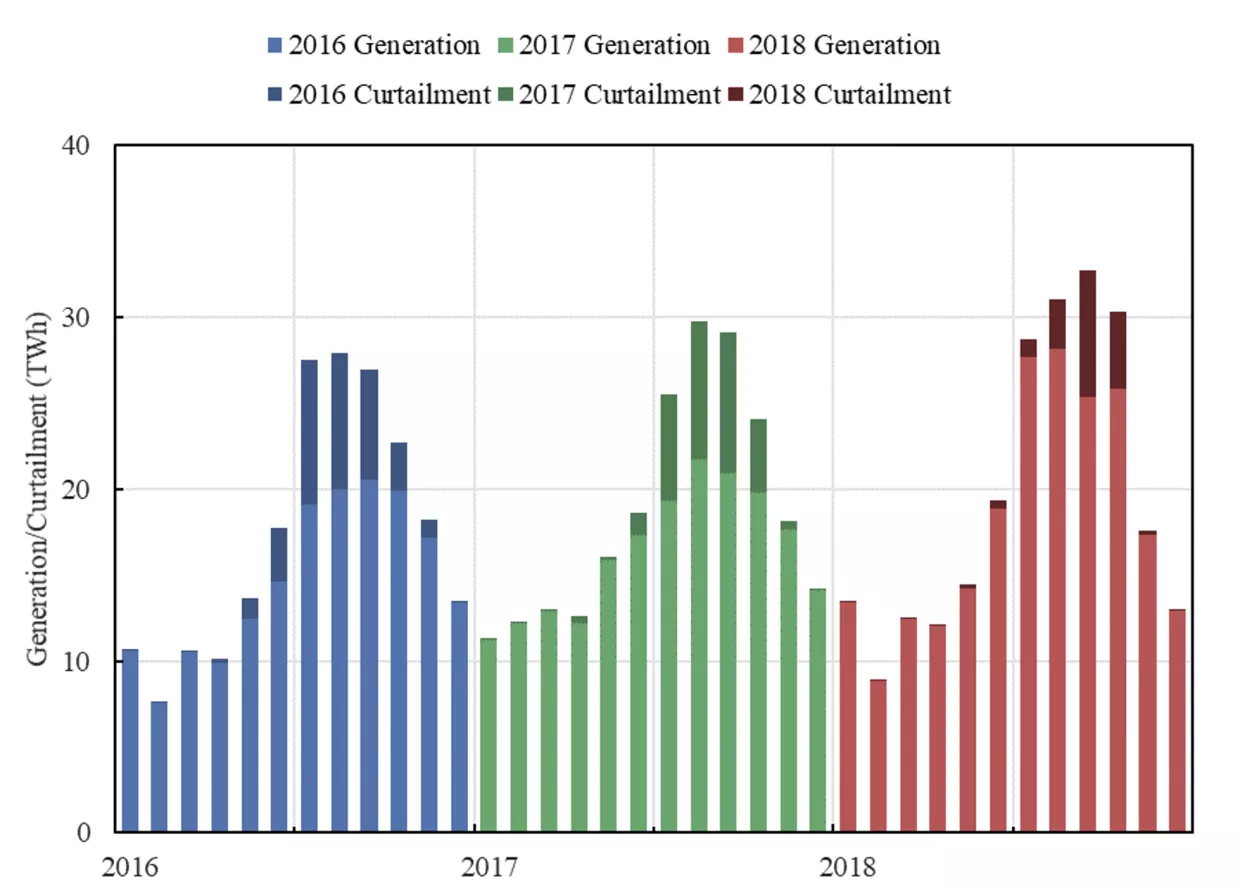

Responding to energy price signals as well as general seasonal variability in other inputs to production, demand also follows a significant seasonal pattern, with low periods in late winter (February to March) and peak periods in fall (September to October). In terms of net peak demand (including both provincial and exports) and peak hydropower capacity, there is still some misalignment, which might present an opportunity for responsive demand to lower overall system costs. With new hydropower installations, there is an increasing gap of hydropower supply exceeding demand by a large margin in 20187 (see Figure 3).

Figure 3. Monthly peak demand and projected hydro capacity availability in Yunnan, 2016-2018

2.3.2 Hydropower operation

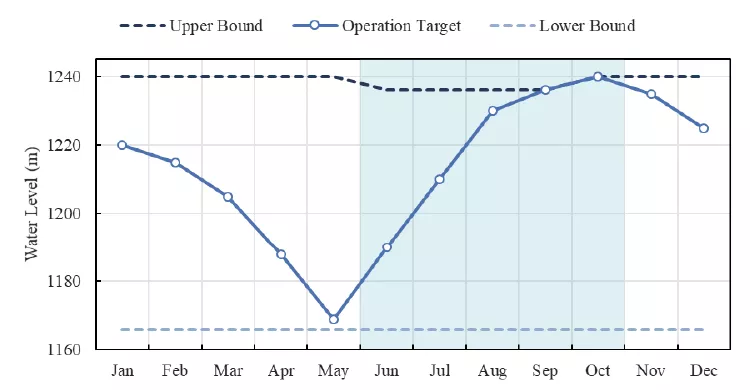

Operating hydropower systems involves the management of water storage across months and even years, interactions among upstream and downstream generation facilities, competing uses for water resources such as irrigation, and uncertainties in rainfall. Various approximations can be used to attempt to optimize these decisions [24]. In Yunnan, the general principle is to deplete the controllable reservoirs steadily in the dry season and replenish them in the wet season accounting for storage volume for flood control. By the end of the wet season, the controllable reservoirs are required to be refilled to ensure sufficient supply for the coming winter and next dry season. In order to give way to hydro plants with poor controls upstream (e.g., run-of-river), the Xiaowan and Nuozhadu reservoirs, the two largest reservoirs in YNPG, are usually required to be depleted prior to the wet season (see Figure 4). Storage targets are determined ex-ante for each month in line with the inflow prediction and balancing scenarios, and the associated energy amount also serves as constraints in the market transactions for the two reservoirs (see Figure 5).

Figure 4. Cascading hydro plants on the Lancang and Jinsha River. Source: Kunming Power Exchange

Figure 5. Typical operational trajectory of the Xiaowan Reservoir. Source: Kunming Power Exchange

Reservoirs with minor control or no control over water inflows usually operate at high water levels to maintain operating efficiency in the dry season and at the lower flood-control water levels in the wet season to reserve storage capacity for flood mitigation. The usable storage capacity of the minor reservoirs is only used as a balancing resource by the power dispatch for meeting fluctuations in demand and emergencies such as outages. Other integrated reservoirs with competing uses such as irrigation and navigation operate according to these requirements.

The operation of Yunnan’s hydro reservoirs has a large impact on curtailment. Among the six river systems, curtailment is primarily concentrated in the cascading hydro plants on the Jinsha River and Lancang River. Curtailment in the hydro plants on the Jinsha River accounts for approximately two-thirds of the total. Lancang River is slightly moderated by the two large reservoirs, the Xiaowan and Nuozhadu reservoirs, which have storage capacities of 9900 hm3 and 11350 hm3, respectively, equivalent to about 23 TWh of energy. Nevertheless, by August, the two reservoirs often are unable to further store water, which leads to curtailment in the cascading plants, accounting for over 10% of the total curtailment. Curtailment in the hydro plants on the remaining four river systems accounts for about 25% due to the smaller installed capacities.

2.3.3 Seasonal generation adequacy requirements

Yunnan’s plentiful renewable resources have led to a low-carbon power system with low electricity prices. However, the season- and weather-dependent nature of these power sources presents challenges from the perspective of generation adequacy—i.e., maintaining sufficient generating capacity available to meet peak demand. These are compounded by poor coordination of investment planning and inefficient price signals, which has led to overcapacity and large curtailment during the wet season while facing the potential for scarcity in the dry season.

In response, Yunnan has installed eleven coal plants with total capacity of 12 GW—most of this in the past ten years—which provide some localized grid stability benefits (i.e., RMR) but are mostly designed to provide generation during the when water inflows are low. The low utilization rates of these coal plants have created a complicated issue of subsidy payments for their “reserve” capabilities, which we will explore in the next section.

3. Yunnan’s electricity market efforts

3.1 Fundamentals of electricity market design

Decades of liberalization experiences in the electricity sector have generated many lessons for reforming vertically-integrated utilities to incorporate competition, ranging from appropriate industry structure to the design of regulatory institutions necessary to support non-discrimination and open access [25]. At the core of successful restructuring is a “spot market”—a short-term market for energy (e.g., for intervals of five minutes to one hour) that incorporates the relevant aspects of electricity production and delivery, creating locational marginal prices (LMPs) at each node in the system [26].8 Market participants can also engage in forward contracting, ahead of the spot market, generally to hedge against price volatility—however, in these cases, the spot market is still an essential reference.

Beyond short-run efficiency, whether and how spot markets can incentivize sufficient investment to meet projected demand (i.e., generation adequacy) has been a key issue since the beginning of restructuring [27]. In a decentralized market, each resource individually needs to make enough revenues to cover all costs—fixed and variable. While it can be shown that an ideal spot market will generate such revenues [28], many markets deviate from these conditions—for example, by imposing price caps—which can result in the classic “missing money” problem for less-frequently used generators. The typical resolution adopted by regulators is to establish requirements for load-serving entities to procure “capacity” from generators in the hopes of avoiding shortfalls in resources and potential reliability issues [29].

Capacity markets are fraught with challenges. Some procurement contracts have little or no locational signaling and are over long time horizons, resulting in “paper capacity” that is not available when and where it is needed. Regulators have responded either by making adjustments to how capacity is credited or by establishing must-offer requirements9 for capacity resources in the energy markets, yet each has its own drawbacks [30]. Consumers also do not see the full system cost in many capacity markets, limiting their incentives to reduce demand when the system is under stress.

3.2 Yunnan’s electricity market development

In March 2015, China launched a new round of power sector reform, with the goals of standardizing prices for transmission and distribution, reforming the pricing for selling and buying energy, and gradually eliminating cross-subsidies [31]. Every province now has a power exchange—in addition to two multi-provincial power exchanges in Beijing and Guangzhou—and there is a wide range of experimentation in markets. Most market transactions are forward contracts (month to year), but by 2020, eight spot market pilots have begun trials.

The Yunnan electricity market began in 2014—largely to address mismatches between supply and demand, compounded by falling industrial facility utilization—which was accelerated following the nationwide reform [32]. Yunnan was approved as one of the first pilot provinces for comprehensive reform of the power sector [33]. It primarily consists of forward trading between large provincial industrial consumers and allowed “market” power plants—typically, larger power plants designated by the provincial exchange. Since extending the electricity market to all large industrial consumers and all power plants of 110 kV and above, the market share in the provincial electricity consumption continued to expand, accounting for 58% of total consumption as of 2019 [34].

A secondary set of market transactions takes place for the WEET through the regional Guangzhou Exchange Center, though these markets are smaller than Yunnan’s within-province markets and are given less preference in terms of design and overall scope, in order to give advantages to Yunnan’s provincial consumers. The market model is supplemented by short-term day-ahead transaction; however, unlike organized day-ahead markets, Yunnan’s day-ahead transaction is designed to manage deviations from monthly market contracts, and thus do not generate true values of energy on a daily basis. In the past three years, the Yunnan electricity market has resulted in 30 billion RMB electricity price reductions for provincial consumers and helped contribute to increasing industrial capacity factors.

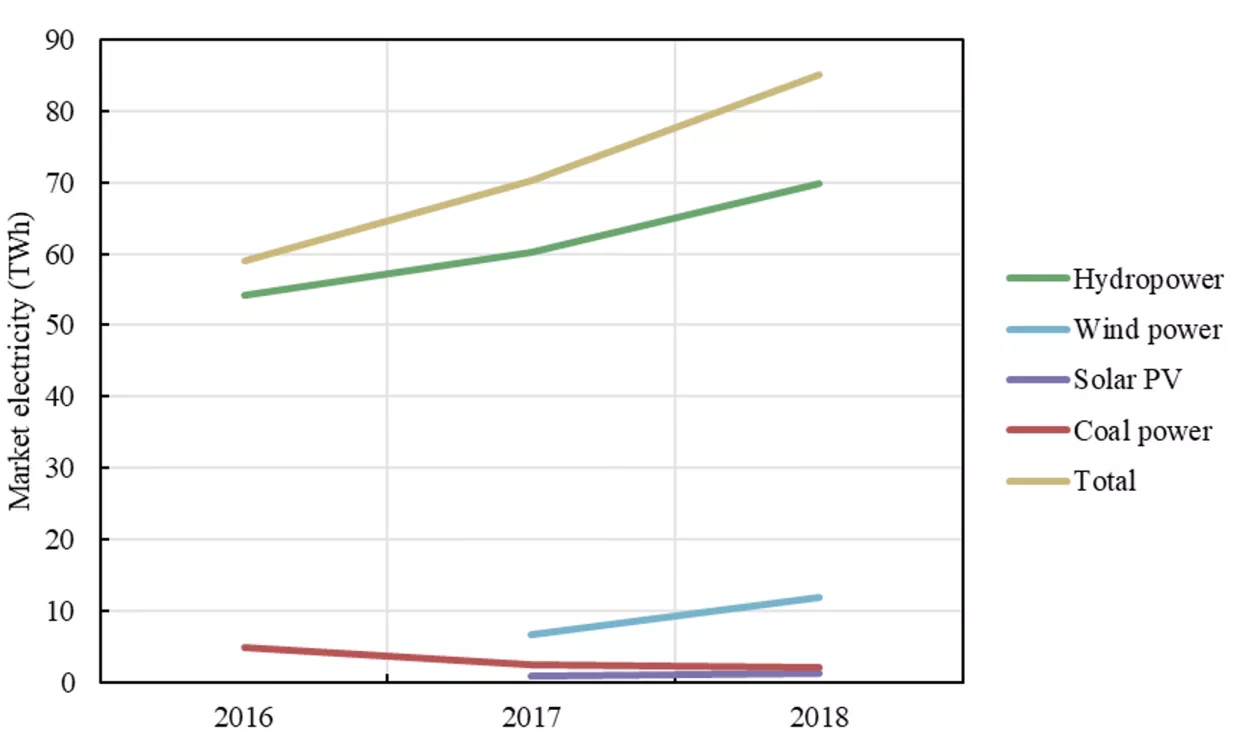

As of 2019, there were approximately 28,000 market entities (suppliers, large consumers, retailers) in the Yunnan electricity market. By the end of 2019, market generation capacity consisted of 17% coal, 68% hydropower, 11% wind and 4% solar PV. Renewable energy participation in the markets has been growing steadily as a means to address curtailment and overcapacity pressures (see Figure 6). At the same time, coal’s participation in the market has been declining, with increasing shortfalls in revenues made up through out-of-market payments such as “reserve” subsidies.

Figure 6. Market electricity by energy source

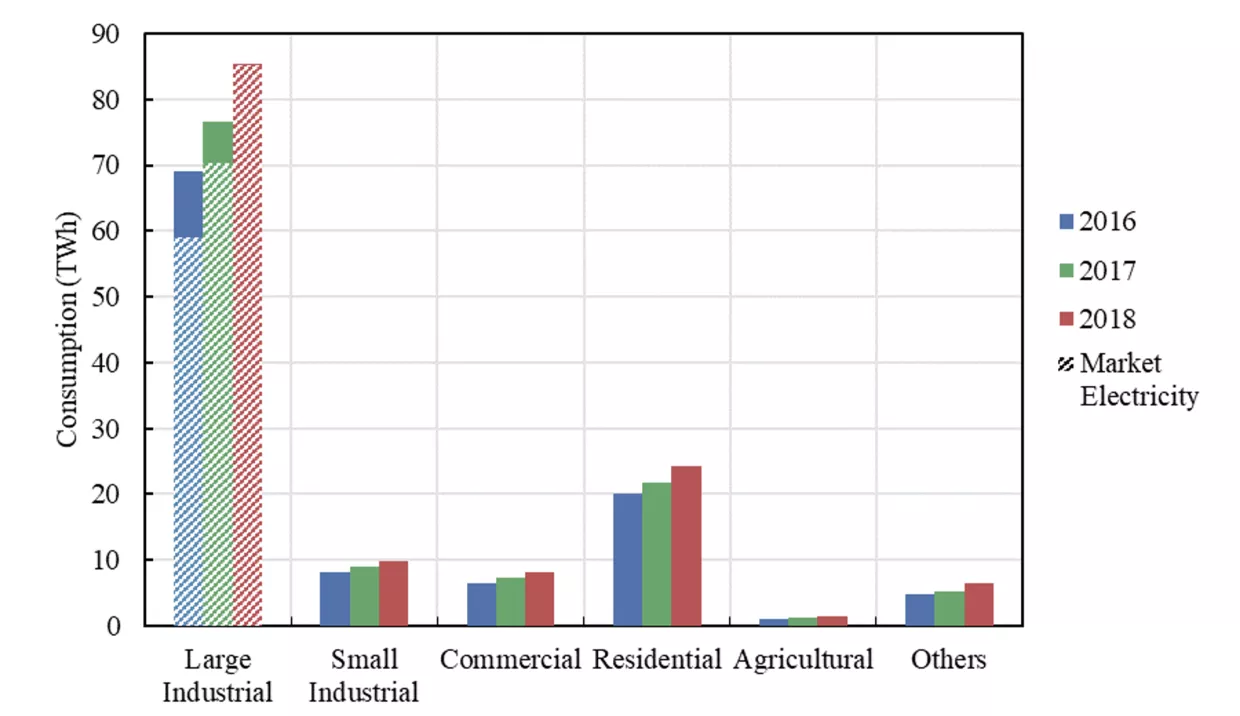

The vast majority of large industrial electricity consumption in Yunnan is now purchased through market transactions (see Figure 7). Small industry, commercial and residential customers still pay the government-determined benchmark tariffs. Collectively, market volume has reached 104.5 TWh in 2019, 95% of large industry, and 58% of all of the province’s consumption.

Figure 7. Electricity consumption and market shares by consumer group.

Source: YNPG

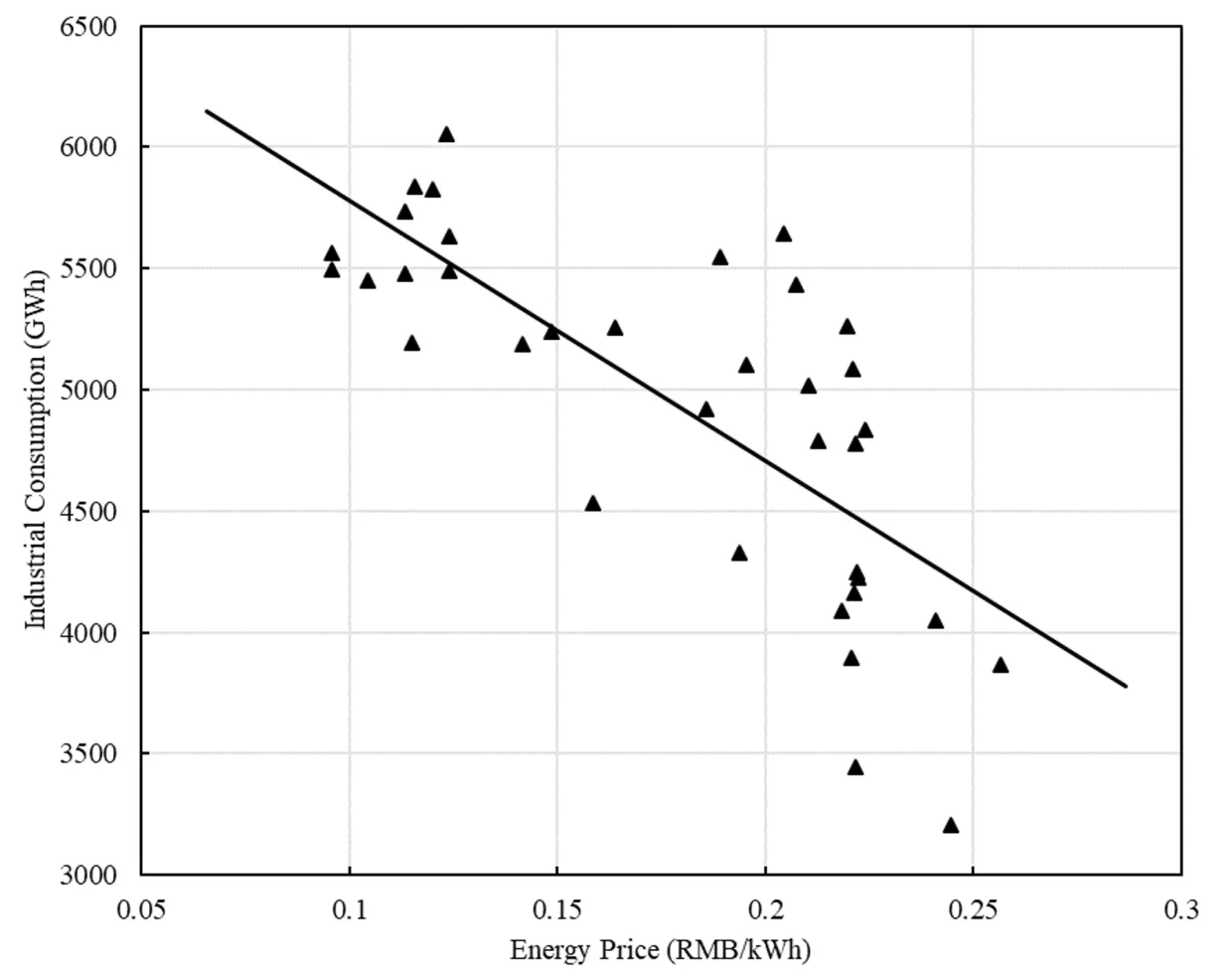

Industry in Yunnan is energy-intensive and generally responsive to electricity price (see Figure 8). Yunnan’s electricity market efforts to date have leveraged this elasticity to shift utilization to lower price seasons (i.e., wet seasons). There are, of course, other inputs to production that affect utilization such as labor availability. For example, responsiveness during certain periods (e.g., the “transition” period between dry and wet seasons in May and November) is muted.

Figure 8.Responsiveness of industrial consumption to electricity prices, monthly data 2016–2018. Source: YNPG.

3.3 Coal “reserve” capacity subsidy

3.3.1 Structure and outcomes (2016-2018)

Utilization of coal power plants has undergone a sharp downturn in recent years as a result of overcapacity, incurring persistent losses in operation and maintenance. However, this coal power capacity cannot be allowed to exit the market entirely as some is still needed for resource adequacy during the dry season and peak-load periods with poor hydropower availability.

Without sufficient markets for energy when the system is constrained, Yunnan has introduced a long-term coal “reserve” capacity subsidy in 2016 to compensate coal power plants. The capacity subsidy was benchmarked relative to revenue received by coal plants in 2015, approximately 2 billion RMB per year—and continued with roughly the same amount in subsequent years. This subsidy is similar to the existing method of administrative compensation for ancillary services [35]. Over 2016-2018, the annual revenue of coal power plants was around 6–7 billion RMB with an average capacity subsidy of 2.1 billion RMB per year.

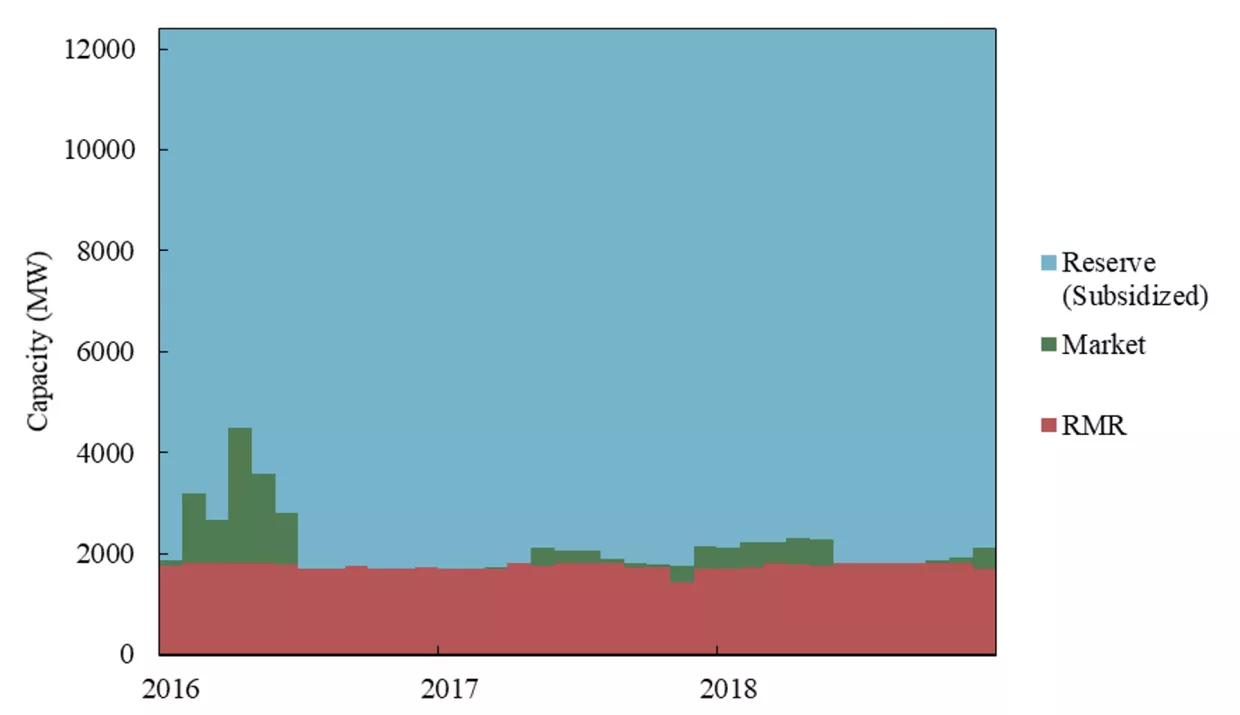

The “reserve” subsidy goes to all coal capacity not already reserved for system operation and reliability or engaged in markets (see Figure 9). Equivalent RMR and market capacities are determined by dividing the total energy quantity for the month by full utilization of the capacity. Some performance-dependent incentives are adopted in the subsidy as well—e.g., a coal generator that fails to generate when called upon could forfeit their subsidy—but these are weak incentives and, in practice, not implemented consistently. The subsidy has also contributed to a general transfer of coal capacity away from the market, and hence, away from efficient price signals.

Figure 9. Coal capacity designations by month, 2016–2018.

Source: Kunming Power Exchange.

Coal “reserve” subsidies are funded through transfers from renewable energy generators in a manner that discriminates based on generators’ participation in energy markets.10 For example, as Table 3 shows, in 2016, the first year of the subsidy, the ratio between market and benchmark prices is used to form a “reduction ratio” which then produces a required payment to coal on the part of the priority plants that do not participate in the market. Beginning in 2017, this was replaced with fixed payments of 0.02 RMB/kWh for priority renewable plants and 0.01 RMB/kWh for market renewable plants (see Table 3).

Table 3 Numerical example of payments to coal “reserve” subsidy (Unit: RMB/kWh)

| Year | Renewable Plant Type | Benchmark On-Grid Price | Market Price /Settled Price | Coal Subsidy Payment |

|---|---|---|---|---|

| 2016 | Market | 0.28 | 0.19 | 0 |

| Priority | 0.235 | 0.16 | 0.075 | |

| 2017–2018 | Market | -- | 0.18 | 0.01 (fixed) |

| Priority | 0.235 | 0.235 | 0.02 (fixed) |

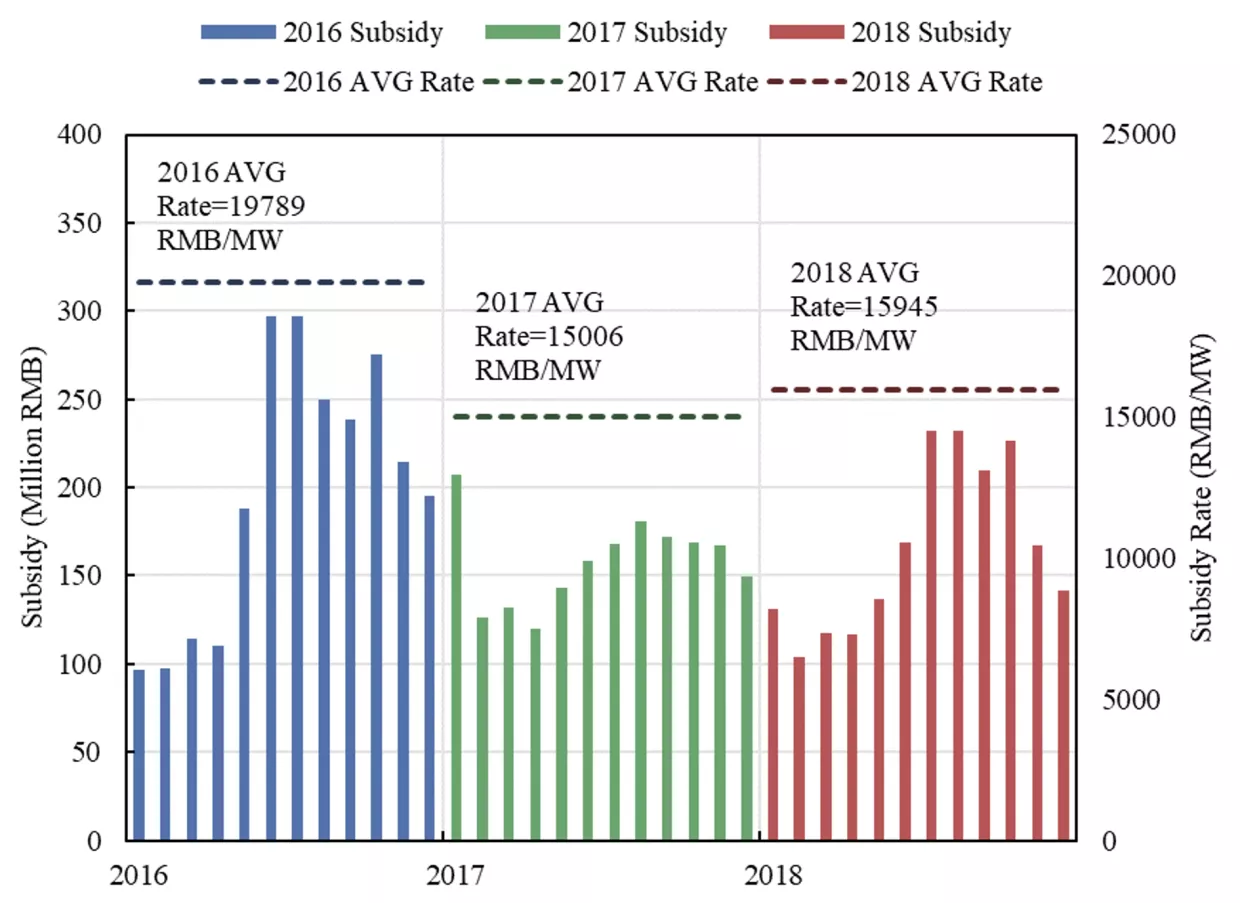

As a result of these fixed payments, the total subsidy to coal varies seasonally, with higher rates in the wet season—counterintuitive from the perspective of a capacity mechanism, which generally pays for availability when capacity is needed. Average payments to coal for the last two years were roughly 15,000 RMB/MW-month. (see Figure 10).

Figure 10. Coal “reserve” capacity subsidies by month, 2016–2018.

3.3.2 Deficiencies of current subsidy system

The current capacity subsidy for coal power plants has ameliorated the financial difficulties of coal power plants caused by overcapacity and restructuring to some extent, ensuring the survival of coal power plants under low capacity factors. It is plausible to compensate coal for its reserve capabilities, particularly given the highly seasonal nature of Yunnan’s hydropower.

However, the coal subsidy scheme presents numerous challenges. First, it is not tied to the cost of providing available coal capacity, as payments are fixed according to generation from renewable energy. It is challenging for regulators to determine the exact amount of and price for capacity reserve ex ante. Second, the need for coal capacity is in the dry season, thus prices should ideally reflect the importance for availability of coal in this period, not compensate them during the wet season. The lack of high-powered performance incentives can further reduce availability when needed. Third, as Figure 9 shows, the capacity subsidy arbitrarily subsidized all idle capacity, which could create perverse incentives for coal plants to leave the market. Finally, the design presents no incentives to consumers, the ultimate beneficiaries of reliability—and which have already been demonstrated to be very responsive to price.

4. A market reform proposal for Yunnan

4.1 Spot market for energy

An efficient electricity market must recognize the unique physical nature and constraints of electricity production and delivery. A short-run spot market operating on hourly or shorter time intervals with locational marginal prices (LMPs) for every node in the network is the only solution that provides consistent prices for efficient system operation including congestion management [26]. Market actors may choose to contract a fraction (even a large majority) of energy through forward contracts, but efficiently pricing these contracts depends on a foundation of expected prices in the spot market.

Yunnan is no exception. In fact, the province’s range of marginal costs—from low-cost hydro and variable renewable energy to higher-cost coal power—creates an even stronger impetus to adopt a marginal—not the current average—pricing system. This has the added benefit of further enhancing the role of consumers in increasing the efficiency of the system, in particular by encouraging demand to shift to lower marginal cost hours and months.

Large hydropower reservoirs create additional, but manageable, complexities in a spot market that deserve scrutiny by Yunnan’s market designers and participants. While the marginal cost of hydropower production is near zero when reservoir water levels are between their lower and upper bounds (Figure 5), there is nevertheless an opportunity cost to producing as opposed to storing for use at a later period when prices are potentially higher. When reservoirs are full, this opportunity cost—and hence, the marginal costs of production—approach zero, reflecting the possible need for curtailment. Cascading reservoirs—as well as connected run-of-river plants—also lead to complicated dynamics in water availability, as well as additional avenues for certain generators to exercise market power.

A necessary paradigmatic shift is to eliminate the complex array of market and administrative pricing mechanisms for energy that have developed in Yunnan in favor of a single market platform where all supply and consumers compete with a set of common clearing price(s). Current designs adopted in Yunnan and elsewhere could easily be adapted to take the form of a monthly, province-wide auction ignoring network constraints, with all generators receiving energy revenues in each time step11 according to:

(1)

where pEne is the market price for energy and y is energy production.

While facilitating more efficient prices than current markets (Figure 1), regulators should recognize that this is a sub-optimal design. Monthly energy auctions will not generate as useful price signals as hourly and shorter markets, and a single price for the entire province (one zone) will be unable to capture the impacts of and incentivize efficient responses to congestion as would be possible under nodal prices. These can lead to inefficient outcomes through strategic bidding and congestion management mechanisms where contracts are infeasible, as well as possible “missing money” situations as prices will likely not rise high enough to allow generators to recover all of their fixed costs.

4.2 Out-of-market “top-up” payments for grid reliability

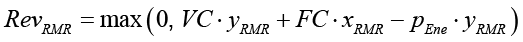

A number of coal plants in Yunnan, due to their location, provide necessary grid services and are recognized as “reliability must-run” (RMR). This RMR capacity—which must be dispatched to maintain system reliability (e.g., local voltage support)—should be distinguished from the challenge of maintaining resource adequacy (e.g., sufficient coal capacity to meet demand in winter). As RMR plants may not recover their fixed and variable costs from energy market revenues alone, additional “top-up” payments should be arranged, subject to cost auditing by regulators. For example, a simple revenue scheme for RMR plants:

(2)

where xRMR, yRMR are the capacity and production at RMR levels, VC is the variable cost of production, and FC is the fixed cost per capacity. Over time, this could be replaced by separate ancillary services markets (e.g., for reactive power)—appropriately monitoring for market power—to encourage competition in providing reliability services from newer technologies such as battery storage.

4.3 Pay-for-performance monthly capacity auction

Under a monthly energy auction, there will likely be under-recovery of some fixed costs for generators (i.e., “missing money”). A spot market may create similar challenges if regulators prevent or limit scarcity pricing, wherein prices rise above marginal costs of generation when the system is constrained and help support the cost of low-utilization “peaking” power plants. Combined with the high degree of seasonality in Yunnan’s dominant hydropower resources, “missing money” creates the threat of market exit of some capacity (e.g., coal generators) that may be needed from a system perspective.

To address this twin challenge, we propose a pay-for-performance forward capacity auction for each month among all suppliers and consumers. Consumers (e.g., retail companies and large consumers directly participating in the energy market) should face particular capacity requirements to cover peak demand over the month, with penalties for under-procurement. Similarly, penalties for generators with capacity contracts that are not available when needed should be particularly high to ensure availability and reduce forced outages. These two elements—monthly differentiation and penalties for non-availability—present significant advantages over Yunnan’s current coal “reserve capacity” subsidy scheme.

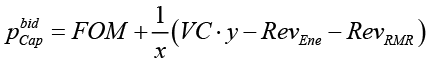

Existing coal generators bidding into the capacity auction should consider fixed costs of operating during that month as well as expected revenues from the energy market and RMR payments, if any, which results in the following “zero-profit” bid12:

(3)

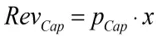

where FOM is fixed operation and maintenance cost per capacity. This relies on an expectation of revenues from the energy market and can result in non-increasing bids in certain situations—leading to non-convexities in the solution. The former will likely result in some bids at above-cost levels, which could degrade some efficiency and may require some regulatory intervention in terms of cost auditing. The latter non-convexities are likely not an issue computationally given the limited size of the problem. Capacity revenues depend on the cleared capacity price—not their individual bids—according to:

(4)

Hydropower capacity available to meet monthly peak demand depends on various factors, including expected inflows and reservoir management, and is currently planned on an annual basis by the grid company as described in Section 2.3.1. Assuming no change to this method of projecting hydropower availability, hydro generators have certainty of capacity obligations over the entire year. In this case, an audited cost-based approach such that hydro generator bids are regulated to be annual averages of their revenue shortfall makes sense. Over time, as individual hydro generators develop their own capabilities of forecasting availability—and obtain greater autonomy over reservoir management—this requirement could be relaxed. Variable renewable energy—wind and solar—are ignored, for simplicity, in this capacity market analysis.

With Yunnan’s existing generator fleet, the system does not currently face a resource adequacy problem. However, if demand grows such that capacity becomes constrained, this might induce new entry, and thus capacity auctions will reflect the higher cost of investment of new entry. Several details of the market are left for further research and deliberation by regulators: for example, how much in advance to operate this market (e.g., 1–3 years), and at what level to set penalties for non-availability. The market design should also maintain the ability to trade capacity obligations on a secondary market.

4.4 Transition payment scheme

A final, important element of introducing markets in the Yunnan electricity system is addressing the potential stranded costs associated with decisions under previous regulation. Transition payments (e.g., subsidies) to generators may be desirable to avoid sudden dislocation of uneconomic assets. These should be structured so as to minimize distortion of the operation of the various markets, and should not be conditioned on participating in or clearing any of the markets. There are various methods of calculating appropriate compensation—e.g., “book value” of the existing assets, foregone revenues, etc.—all of which require regulators to decide fair allocation of costs among generators and consumers. There are also incorrect methods of compensating.13

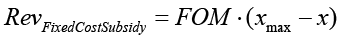

A rough estimate of the order of magnitude of these transition payments can be calculated by the fixed costs associated with keeping the full capacity (xmax) operational year-round. This is certainly a loose upper bound as investments of both coal and hydropower were likely made assuming that the full capacity would only be operational part of the year. This simple “fixed cost subsidy”:

(5)

4.5 Simulation results

To estimate the impact of the proposed market reforms on Yunnan’s grid, we create a simulation of the three year period (2016–2018) that evaluates the least cost way of meeting monthly energy demands and monthly peak demands (including exports) given the variable and fixed operation and maintenance costs of the province’s generators and any RMR requirements. For these purposes, the network is ignored (i.e., single zone), demand is treated as inelastic (i.e., a very high cost of non-served energy), all hydro generators are aggregated into a single hydro generator (assuming the costs of large reservoir hydro), and wind and solar generators are given dispatch priority. The 11 coal generators in the province are modeled separately. Non-energy revenue streams are evaluated using the above equations, with the cleared capacity prices taken as the maximum of the derived bids by month. The full optimization model can be found in the Appendix.

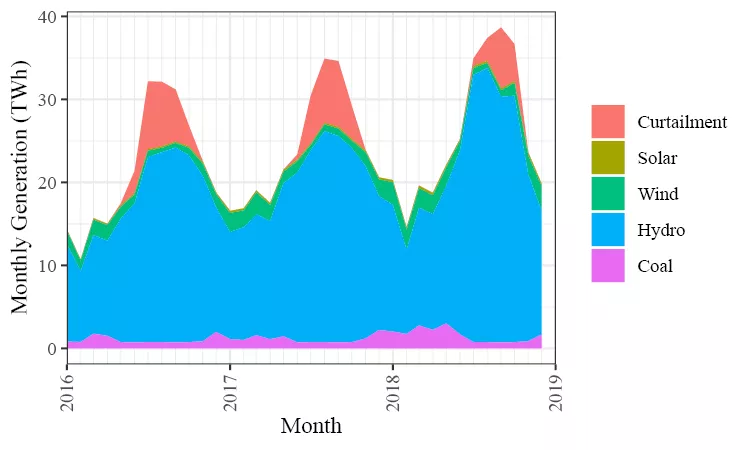

There is much historical curtailment, predominantly hydropower, which can have a range of causes once keeping inter-provincial exports fixed: local transmission congestion, insufficient provincial demand, short-term inflexibilities in the coal fleet, etc. In this model, we assume 10% of historical curtailment is unavoidable, due to (unmodeled) local transmission congestion, while the remaining 90% is theoretically available given provincial demand. Modeled monthly energy production in Figure 11 reproduces expected curtailment during the wet season (roughly July–October).

Figure 11. Modeled energy production by type and curtailment

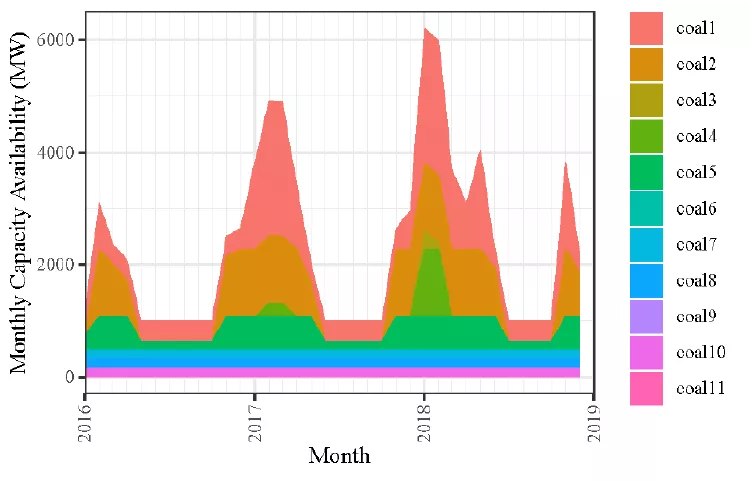

Available coal capacity varies throughout the year, maintaining RMR levels during the wet season and reaching a peak in the dry season (Figure 12). The capacity market appropriately reflects scarcity in dry and transition seasons, ramping up in October and dropping off by May. No additional payments are given to coal plants during the wet season when they are not needed.

Figure 12. Modeled available coal generating capacity

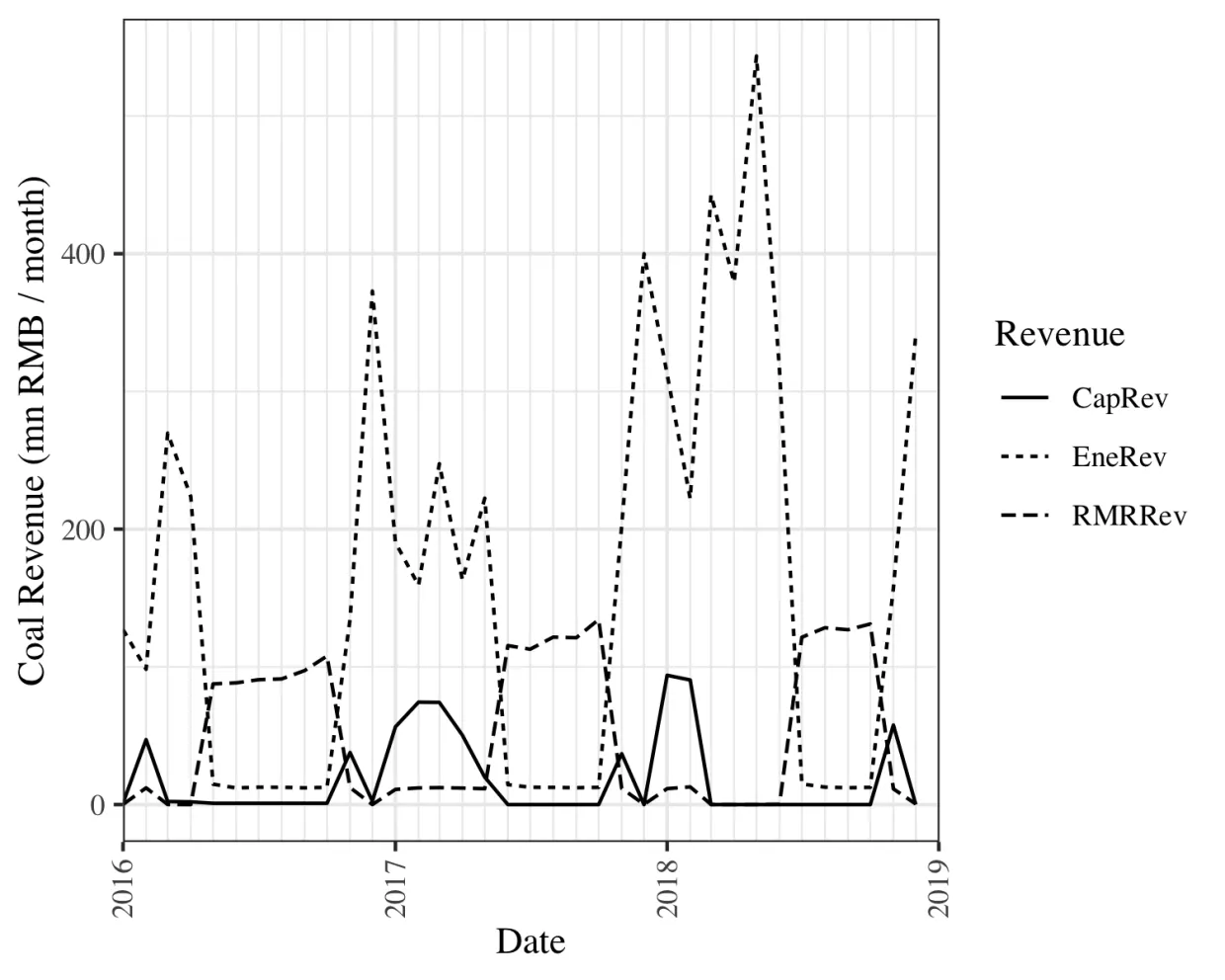

The breakdown of revenues for the coal power sector is in Figure 13. Given the surplus of low marginal cost hydropower in the wet season, energy prices fall. RMR coal thus must receive some additional revenue during these months. Conversely, during the dry season, when coal capacity is necessary to meet peak demand, capacity market prices rise to cover fixed costs. Energy revenues are essentially sufficient to cover all of hydropower’s fixed operation and maintenance costs. In only one of the years—2016—does hydropower face a potential annual revenue shortfall. This leads to hydropower bidding a small, positive amount into the capacity market.

Figure 13. Monthly capacity, energy and RMR revenues for coal generators

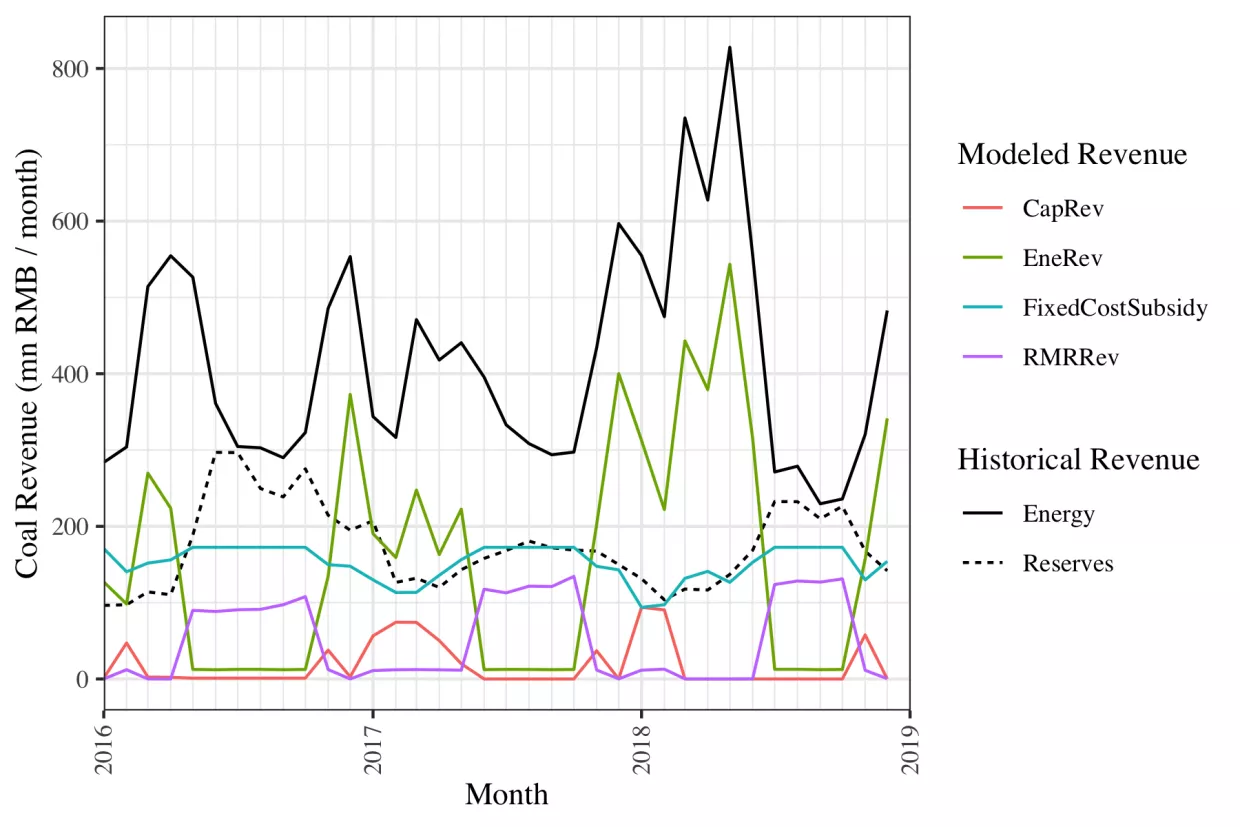

Compared to historical revenues—of which there are only two types, energy and capacity “reserves”—these new revenue streams create more targeted incentives for performance, and help to reduce the amount of out-of-market payments to Yunnan’s coal generators (see Figure 14). For example, coal generators receive capacity revenues only during the dry season, when their availability is most important, not during the wet season when they are not needed. The loose upper bound of transition payments (“fixed cost subsidy”) to support uneconomic coal generators is comparable to or less than the historical “reserves” subsidy.

Figure 14. Historical and modeled coal revenues

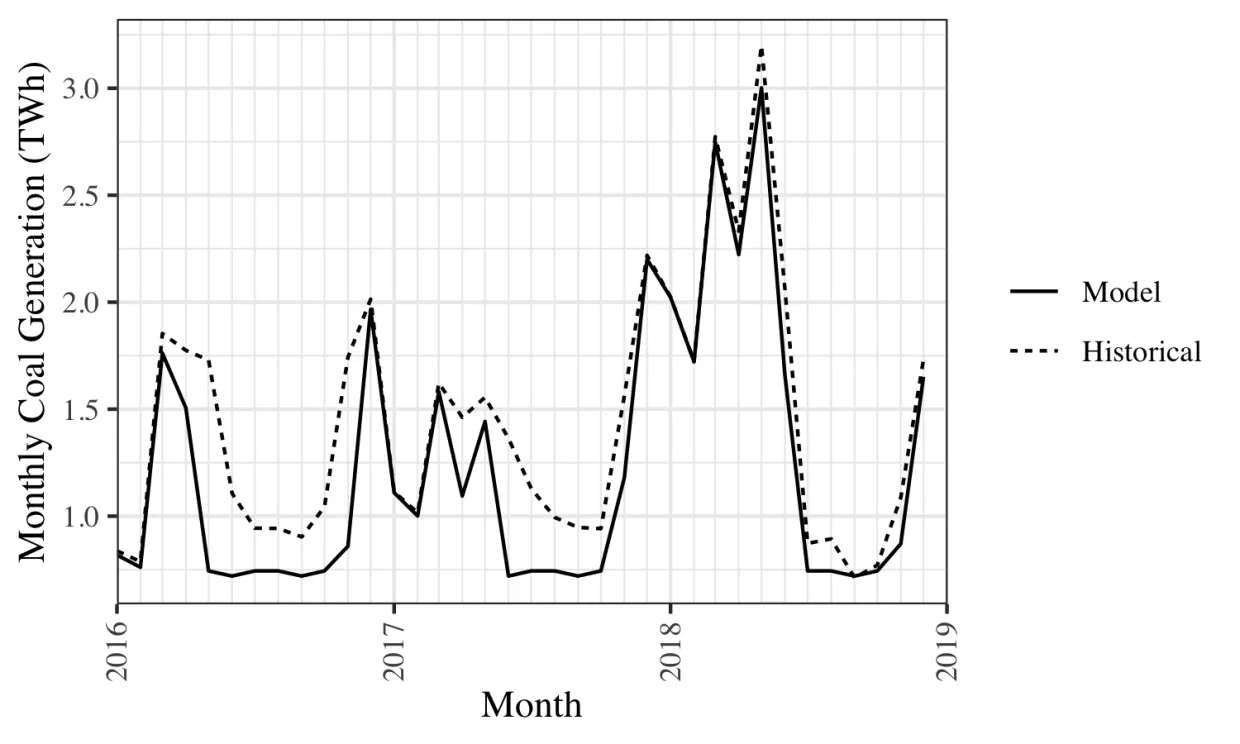

In addition to these incentive benefits, modeled coal generation in earlier years is less than historical generation, saving both costs and emissions (see Figure 15). In the recent year—2018—modeled generation approaches historical levels, the result of more hydropower capacity coming online and possibly more efficient dispatch practices. Under the proposed market reforms, only RMR coal generation would be generating during low-price periods.

Figure 15. Modeled and historical coal generation

This analysis neglected any demand-side flexibility. However, given the large price elasticity of electricity demand for some industries (see section 3.2), we expect that passing these energy and capacity price signals onto demand could beneficially shift demand to low-cost periods and reduce overall electricity prices. For example, demand currently peaks 2–3 months after hydro and falls off more slowly, a mismatch that must be filled in with coal (Figure 3). Under the proposed arrangement, this results in an increase in capacity prices during November (Figure 14), which could encourage shifting demand to earlier months if these prices were passed through to customers. Capacity prices approach 15000 RMB / MW-month in a handful of the dry months, roughly one-quarter of the current fixed T&D demand charges.

5. Discussion

5.1 Feasibility and deficiencies of the proposed framework

Over several years of exploration and trials, Yunnan has shifted the process of power generation and consumption from exclusively regulated arrangements to a mixture of competitive and administrative pricing. These initial reforms did not cause any safety or reliability problems in system operation, reduced the cost of system operation, and helped rekindle lagging provincial economic growth. However, local governments in China are taking a cautious approach to implementing internationally accepted power market designs with an LMP-based spot market as its core. Eight ongoing pilots have raised various issues, some common to all LMP implementations (e.g., inexperience with bidding), others more specific to China’s power sector evolution (e.g., accommodating various regulated generation and consumption categories). Unusually low prices in some pilots reflect distortions in bidding and market design and could prevent further market developments due to generator opposition. Furthermore, customers—an untapped source of system flexibility and cost-savings—have been prevented from seeing the true costs of energy, resource adequacy and ancillary services [36].

The proposed market framework builds upon the existing reforms, addresses many (though not all) of their underlying defects, and is likely to be acceptable to market participants. Without imposing new costs or extra constraints on system operation, the proposed auctions revise the distorted cost-allocation and move in the direction of realizing the basic principle of “beneficiaries pay”. As the simulation results demonstrate, it can effectively displace the current reserve subsidy mechanism for coal power plants and eliminate a variety of complex auctions and discrimination in the market.

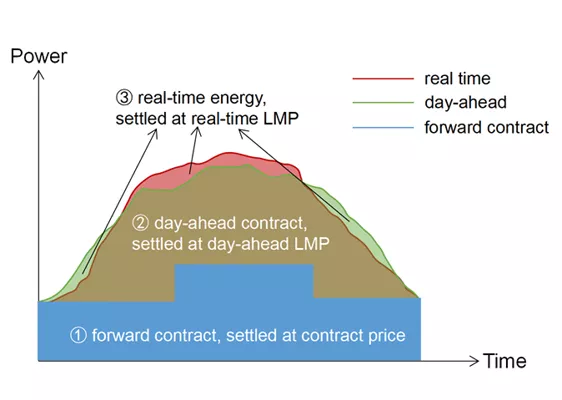

Despite advantages in terms of feasibility, it should be noted that the proposed framework does not fully address a core aspect of electricity markets—real-time dispatch. The proposal ignores network constraints and does not incorporate spot price signals. As mentioned above, this increases the likelihood of infeasible market outcomes that require the system operator and/or regulatory agency to intervene, and creates a real threat of out-of-merit-order dispatch whereby more costly resources are dispatched due to contractual obligations. Current approaches to decompose monthly totals to daily commitment plans and day-ahead schedules can be used in the interim, which include re-dispatching based on security constraints and schedule adjustments mid-month in order to deliver contracts fairly. We expect that deficiencies in these ad-hoc interventions will, in fact, create demands for greater reforms over time, including a full LMP-based spot market. As more granular price signals are established through day-ahead and real-time markets, the proposed framework for energy markets can be integrated via a settlement process such as outlined in Figure 16, where payments are determined according to various contract and market outcomes, while final dispatch is determined in real-time with knowledge of supply, demand, and network conditions.

Figure 16. Illustration of potential settlement process for forward and spot markets

The proposed framework also ignores potential efficiency gains from incorporating exports and local consumption into a single market. This has proved difficult in existing reforms due to both logistical and political considerations; as a result, exports (e.g., WEET) are often given preference with respect to dispatch and market clearing. A regionalized version of the framework operating simultaneously over Southern Grid and with network constraints would reduce costs and take advantage of complementarities in provincial resource mixes.

5.2 Learning from the Brazilian experience

From the perspective of energy mix, Yunnan has much in common with Brazil. The Brazilian electricity sector was reformed twice, in the 1990s and in 2004, with the goals of promoting reasonable electricity tariffs, encouraging investment, and ensuring resource adequacy and grid reliability [37-39]. After almost two decades under the current structure, Brazilian system operators have amassed considerable expertise in managing a complex set of reservoirs and related seasonal adequacy issues. At its core, the Brazilian model requires long-term power purchase agreements (PPAs) with generators cover all electricity consumption in a “firm” manner through associated physical guarantees of energy that can be delivered reliably [40]. The forward contract market guides infrastructure investment, maintains resource adequacy, and helps reduce volatility in electricity tariffs, though possibly at the cost of higher prices [41]. Separately, a centralized dispatch ensures least-cost short-run economic dispatch after incorporating an estimation of the opportunity cost of hydropower [40].

Forward PPAs are divided into regulated auction (ACR) and free contract (ACL) markets, where the majority of distributors are in the regulated auctions and the latter is dominated by large industrial customers [41]. The ACR distinguishes energy generated by existing plants (“old energy”) and by new plants (“new energy”): old energy is usually auctioned one year prior to delivery (A-1) with contract lengths of 5-8 years. New energy auctions take place further in advance (3-5 years) and result in concessions of between 15 and 30 years [42]. Generators can either sign energy quantity contracts denominated in MWh over a given time period (generally reserved for hydropower) or energy availability contracts that include fixed payments for availability and variable costs based on actual usage [43]. Each of these ACR auctions operate as “pay as bid”, with no single market clearing price. In the ACL, customers negotiate with generators through bilateral contracts. Customers can also switch between the ACR and ACL, as long as specific notification requirements are satisfied. ACL customers who opt out of the ACR entirely are required to inform the regulator 5 years in advance [41].

On a weekly basis, the system operator conducts a novel cost-based economic dispatch incorporating estimations of hydropower opportunity costs—not marginal production costs—through detailed reservoir inflow models. The “short-term market” thus requires no bids or offers and is used solely as a settlement mechanism when contracts differ from actual dispatch. On the basis of three levels of assumed load for the coming week—heavy, medium and light—Marginal Operation Costs (MOC) and Difference Settlement Prices (PLD) are calculated ex ante for 4 price zones (submarkets) [44]. The PLDs represent the differences between contracted (ACR and ACL) and actual generation and demand and are the closest analog to a spot prices, but frequently diverge from actual system marginal costs, thus raising concerns about market distortion [43]. In the day-ahead period, additional rescheduling to better align with the load is undertaken, though it does not modify the week-ahead merit order dispatch or MOCs. In 2018, the Brazilian government presented a draft of a sweeping third round of power sector reforms, including proposals to open the ACL to more customers and further disaggregate products such as energy, capacity, and reserves currently bundled in PPAs [43].

Due to their large shares of seasonally varying resources, both the Brazilian system and the current proposal for Yunnan focus on ensuring resource adequacy while trying to minimize excess costs for procurement of “firm” power. The Brazilian experience contains elements that Yunnan power sector reformers would be wise to consider and possibly pilot (e.g., hydropower opportunity cost optimization) as well as cautionary tales to study (e.g., market distortions in difference settlement prices). Two decades of operation and an active reform discussion in Brazil represent a wealth of practical knowledge that can help inform detailed designs of market reforms for China presented in this report.

6. Conclusions

Owing to massive renewable energy deployment and mismatches between supply and demand, Yunnan’s seasonal variability of supply creates particular challenges to maintain resource adequacy while minimizing costly renewable curtailment. Despite progress in exploring market mechanisms in the electricity sector, Yunnan is still faced with many persistent challenges in designing reforms.

In this report, we propose a market reform pathway for Yunnan to replace the current out-of-market subsidy for coal generators and address the conflicts of resource adequacy and seasonal hydropower supply. Building on international experience with capacity markets, we demonstrate that the proposed approach (a) reduces the amount of out-of-market payments to cover stranded costs of coal generators, (b) covers revenue deficiencies in the energy market, (c) provides differentiated price signals for consumers, and (d) enhances competition for generators. In addition to the incentive benefits, evidence is also found that coal generation could be reduced relative to historical generation, leading to less hydropower curtailment and saving both costs and emissions.

Moreover, the proposed approach includes adoption of a single energy market for all resources—beginning with monthly auctions and an eventual move to an LMP-based spot market—providing high-powered incentives for demand-side participation and supply competition. The proposed approach of a pay-for-performance capacity market satisfies certain political constraints around price volatility and is applicable to other hydropower-rich areas of China such as Sichuan and Hubei provinces, and can also provide a reference for parts of northern China when higher fractions of seasonally variable renewable energy increase. Nevertheless, regulators should recognize that the sub-optimal design of monthly energy auctions instead of short-run spot markets has efficiency penalties.

Implementing such a reform proposal in practice will require more detailed analysis including network constraints and should carefully consider how and when to incorporate full demand-side participation in the market, which we expect could beneficially shift demand to low-cost periods (e.g., wet months) and reduce overall electricity prices. Several details—how long in advance to operate the market, what level to set penalties for non-availability, and how to trade capacity obligations on a secondary market, for example, are left for further study.

Appendix: Simulation model

The model aims to identify the least cost method of meeting demand for an historical period (considering both energy and peak demand) while also calculating the required additional revenues to ensure coal and hydro plants are “made whole” (i.e., recover their full costs). It is based on existing—not newly planned—generators, though the approach could be modified to include options for new builds, in which case prices for capacity would rise to the level required to support this investment. The model proceeds in four steps:

- Optimization: Find the least method of providing energy and capacity to meet demand inclusive of variable and fixed costs. This creates the energy price and revenues.

- Grid reliability compensation: Calculate required “top-up” for reliability must-run (RMR) coal generators based on revenue shortfall in energy market.

- Capacity market: Evaluate capacity bids from coal and hydro plants necessary to break-even after accounting for energy and RMR revenues.

- Transition payments: Estimate a loose upper bound on the amount of necessary side-payments to coal plants to cover stranded costs.

Optimization Model

The optimization model minimizes variable production costs and variable and fixed operation and maintenance (O&M) costs of a set of generators (coal1…coal11, hydro, wind, solar) over monthly time steps for 3 years (2016-2018), subject to:

- Energy supply/demand balance constraints (including loss rate)

- Capacity supply/demand balance constraints to meet monthly peak demand (including loss rate)

- Maximum energy generation and capacity constraints by generator

- Minimum energy and capacity requirements for RMR generators14

Capacity variables are the available capacity by generator for each month—thus, generators are assumed to be able to decide whether to turn on for that month and incur fixed O&M costs or else not turn on and incur no costs. Hydropower’s available capacity for each month (Figure 3) is set according to 110% of the calculated projected availability by the grid company at the beginning of the year or 110% of the actual peak generation, whichever is largest.

Renewable energy generators have very low variable costs and an upper limit of generation for each month set as follows: solar and wind—actual generation; hydro—actual generation + 90% of the curtailed generation (removing the estimated 10% of curtailment which is due to local transmission congestion). The loss rate is adjusted based on historical values, ranging from 5.1% - 6.5%, and coal prices are taken from historical provincial average benchmarks. Demand—which includes net exports—is assumed to be inelastic.

Capacity Market

Assuming perfect foresight for the cost-minimizing set of energy and capacity variables, and additional revenues for RMR plants, coal and hydro plants are expected to bid what is necessary to cover all fixed costs. The highest bid of those generators that are turned on in the optimization sets the clearing price (≥0). Because of hydropower’s seasonality, it is expected to smooth out fixed costs over the entire year—not recover fixed costs separately for each month. Hydropower thus averages any fixed cost shortfall into an annual bid. For both generator types, the possibility of any bids above marginal costs is ignored.

References

[1] Andrews-Speed P. Chapter 18 - Reform Postponed: The Evolution of China’s Electricity Markets. In: Sioshansi FP, editor. Evolution of Global Electricity Markets. Boston: Academic Press; 2013. p. 531-67.

[2] China Electricity Council. Overview of Electric Power Industry (multiple years).

[3] Ming Z, Song X, Lingyun L, Yuejin W, Yang W, Ying L. China’s large-scale power shortages of 2004 and 2011 after the electricity market reforms of 2002: Explanations and differences. Energy Policy. 2013;61:610-8.

[4] Ma J. On-grid electricity tariffs in China: Development, reform and prospects. Energy Policy. 2011;39:2633-45.

[5] Hennig T, Wang W, Feng Y, Ou X, He D. Review of Yunnan’s hydropower development. Comparing small and large hydropower projects regarding their environmental implications and socio-economic consequences. Renewable and Sustainable Energy Reviews. 2013;27:585-95.

[6] National energy Administration. The 13th five-year plan for hydropower development. 2016. <http://www.nea.gov.cn/135867663_14804701976251n.pdf>.

[7] Yunnan Provincial Government. Yunnan Province Overview. <http://www.yn.gov.cn/yngk/gk/201904/t20190403_151767.html>.

[8] National Bureau of Statistics of China. Data of provinces. <http://data.stats.gov.cn/>.

[9] Yunnan Provincial Bureau of Statistics. Statistics data. <http://www.stats.yn.gov.cn/tjsj/>.

[10] China State Council. Power grid dispatching regulations. 1993. <http://www.nea.gov.cn/2017-11/02/c_136723008.htm>.

[11] YNPG. 2018 operation arrangement of Yunnan power grid. 2018.

[12] National Development and Reform Commission, National Energy Administration. The 13th Five-Year plan for electric power development. 2016. <http://cape.ndrc.gov.cn/zcfg/201701/P020170112341246054484.pdf>.

[13] YNPG. 2019 operation arrangement of Yunnan power grid. 2019.

[14] Yunnan Provincial Government. Yunnan Energy Development and Planning (2016-2020). 2016. <https://www.xsbn.gov.cn/files/2016/12/20161206101354661.pdf>.

[15] Yunnan Provincial Price Bureau. Notice of Yunnan Provincial Price Bureau Forwarding the notice of National Development and Reform Commission on the on-grid price of new hydropower plant in Yunnan. 2015.

[16] Yunnan Provincial Price Bureau. Notice of Yunnan Provincial Price Bureau Forwarding the notice of National Development and Reform Commission on reducing the on-grid price of coal-fired power generation and the electricity prices of general industrial and commercial industries. 2016. <http://xxgk.yn.gov.cn/uploadfile/document_20151222/20160215104540428.pdf>.

[17] Yunnan Provincial Price Bureau. Notice of Yunnan Provincial Price Bureau Forwarding the notice of National Development and Reform Commission on adjusting the on-grid prices of solar PV and offshore wind power generation. 2017. <http://xxgk.yn.gov.cn/uploadfile/document_20151222/20170221153912863.pdf>.

[18] Yunnan Development and Reform Commission. Notice of the pricing catalogue of Yunnan Province 2016. <http://www.yndpc.yn.gov.cn/files/2018-8/%E4%BA%91%E5%8D%97%E7%9C%81%E5%…>.

[19] Joskow PL. Incentive regulation in theory and practice: electricity distribution and transmission networks. Economic Regulation and Its Reform: What Have We Learned?: University of Chicago Press; 2014. p. 291-344.

[20] National Development and Reform Commission. Notice of Yunnan power grid’s 2016-2018 transmission and distribution prices. 2016. <http://www.ndrc.gov.cn/zwfwzx/zfdj/jggg/201606/t20160612_807011.html>.

[21] Kunming Power Exchange. Data of Yunnan electricity market. <https://www.kmpex.com/web/kmdljyzx/80>.

[22] State Electricity Regulatory Commission. Temporary Measures for Transparent, Fair, and Just Electricity Dispatch. 2003. <http://www.gov.cn/gongbao/content/2004/content_62904.htm>.

[23] Yunnan provincial industry and Information Technology Commission. The dispatching principle of Yunnan power grid in 2018. 2018.

[24] Ramos A, Cerisola S, Latorre JM. A Decision Support System for Generation Planning and Operation in Electricity Markets. In: Rebennack S, Pardalos PM, Pereira MVF, Iliadis NA, editors. Handbook of Power Systems II. Berlin, Heidelberg: Springer Berlin Heidelberg; 2010. p. 315-35.

[25] Joskow PL. Lessons Learned from Electricity Market Liberalization. The Energe Journal, Special Issue on the Future of Electricity. 2008;29:9-42.

[26] Schweppe FC, Caramanis MC, Tabors RD, Bohn RE. Spot Pricing of Electricity. Boston, MA: Springer; 1988.

[27] Joskow PL, Schmalensee R. Markets for power: An analysis of electric utility deregulation. Cambridge, MA: MIT Press; 1983.

[28] Perez-Arriaga IJ, Meseguer C. Wholesale marginal prices in competitive generation markets. IEEE Transactions on Power Systems. 1997;12:710-7.

[29] Newbery D. Missing money and missing markets: Reliability, capacity auctions and interconnectors. Energy Policy. 2016;94:401-10.

[30] Rodilla P, Batlle C. Security of Generation Supply in Electricity Markets. In: Pérez-Arriaga IJ, editor. Regulation of the Power Sector. London: Springer London; 2013. p. 581-622.

[31] CPC Central Committee, China State Council. Opinions on further deepening the power sector reform. 2015. <http://tgs.ndrc.gov.cn/zywj/201601/t20160129_773852.html>.

[32] Yunnan Provincial Industry and Information Technology Commission. Notice of the market implementation plan for excess hydropower integration in wet season. 2014. <http://www.ynetc.gov.cn/Item/11187.aspx>.

[33] National Development and Reform Commission, National Energy Administration. Notice of the approval of the pilot prgrams of Yunnan and Guizhou on comprehensive electricity sector reform. 2015. <http://www.ndrc.gov.cn/gzdt/201605/t20160510_801235.html>.

[34] China Electricity Council. National Electricity Market Trading Information of 2019. <https://cec.org.cn/detail/index.html?3-277103>.

[35] Gu F. Reunderstanding of the standard of ancillary service. China Power Enterprise Management. 2019:34-7.

[36] Guo H, Davidson MR, Chen Q, Zhang D, Jiang N, Xia Q, et al. Power market reform in China: Motivations, progress, and recommendations. Energy Policy. 2020;145:111717.

[37] Hochstetler RL, Cho JD. Assessing Competition in Brazil’s Electricity Market If Bid-based Dispatch were Adopted. Revista de Economia Contemporânea. 2019;23:1-37.

[38] Arango S, Dyner I, Larsen ER. Lessons from deregulation: Understanding electricity markets in South America. Utilities Policy. 2006;14:196-207.

[39] Dutra J, Menezes FM. Electricity market design in Brazil: an assessment of the 2004 reform. 2015.

[40] Calabria FA, Saraiva JT. Brazilian electricity market: Problems, dilemmas and a new market design aiming to enhance flexibility while ensuring the same level of efficiency and security of supply. Revista Econômica. 2015;16:77-96.

[41] Rosa LP, da Silva NF, Pereira MG, Losekann LD. The evolution of Brazilian electricity market. Evolution of Global Electricity Markets: Elsevier; 2013. p. 435-59.

[42] Moreno R, Barroso LA, Rudnick H, Mocarquer S, Bezerra B. Auction approaches of long-term contracts to ensure generation investment in electricity markets: Lessons from the Brazilian and Chilean experiences. Energy Policy. 2010;38:5758-69.

[43] Agora Energiewende, Instituto E+ Diálogos Energéticos. Report on the Brazilian Power System. 2019. <https://www.agora-energiewende.de/fileadmin2/Projekte/2019/Brazil_Count…>.

[44] Munhoz FC. The necessity of more temporal granularity in the Brazilian short-term electricity market. Sustainable Energy, Grids and Networks. 2017;11:26-33.

Liu, Shuangquan and Michael Davidson. “China Trading Power: Improving Environmental and Economic Efficiency of Yunnan’s Electricity Market.” March 2021

- WEET (西电东送) is a broad project of transmission lines and other infrastructure to encourage electricity exports from Yunnan to demand centers in Guangxi and Guangdong provinces.

- Aggregate of plants dispatched at the prefecture and county levels. China’s electric power dispatching is divided into five levels: national inter-provincial, regional inter-provincial, provincial, prefecture and county levels [10]. In Yunnan, many small hydro plants are dispatched by sub-provincial dispatch.

- YNPG’s provincial grid is based on 500 kV double-loop network and interconnects with CSG via 8 circuits of ultra-high voltage DC (UHVDC) (3 ±800 kV and 5 ±500 kV) and 1 voltage-source-converter (VSC)-based HVDC, for a total WEET transmission capacity of 31.15 GW [11] YNPG. 2018 operation arrangement of Yunnan power grid. 2018.

- A policy designed to encourage investment in renewable energy technologies by offering long-term contracts to renewable energy producers based on the cost of generation of each technology.

- Aggregate tariffs of different voltages. Multi-step tariffs for residentials: 0.45 RMB/kWh for 0–170 kWh per month; 0.5 RMB/kWh for 171–260 kWh per month; 0.8 RMB/kWh for 261 kWh per month and beyond. Market prices are averages.

- “Equity, fairness, and transparency” (gongkai gongping gongzheng, or abbreviated sangong) are central principles of dispatch in China [22] State Electricity Regulatory Commission. Temporary Measures for Transparent, Fair, and Just Electricity Dispatch. 2003. <http://www.gov.cn/gongbao/content/2004/content_62904.htm>.《关于促进电力调度公开、公平、公正的暂行办法》.

- Several hydro plants (Huangdeng, Dahuaqiao, and Miaowei) came online on the Lancang River in 2017 and 2018 (Figure 4), exacerbating the oversupply situation and giving rise to the need for hydropower curtailment during the wet season given insufficient reservoir capacity.

- LMPs represent the marginal cost of delivering power at a given location and time in the system. Given the physics of electricity flows and the engineering requirements of electricity generators, these prices can vary widely from hour to hour and over sub-provincial geographic distances.

- A must-offer requirement is a constraint posed on generators to offer a certain amount of generation capacity to ensure the availability of capacity for reliability when needed.

- Starting in 2016, priority plants that do not participate in the market are required to pay for the coal subsidy—that is, generation of the priority plants is adequately procured, without any curtailment, by the grid company, but their benchmark prices are cut according to average market price reductions, with the differences paid to the coal subsidy.

- For Eqn (1) and subsequent, the time index is dropped for simplicity.

- A “zero-profit” condition occurs when marginal costs equal marginal revenues and, in the case of a single generator, is the minimum acceptable price for clearing the market.

- For example, generation rights trading, adopted in various Chinese provinces, requires some generators to purchase the rights to generate from legacy plants. This raises the marginal cost of production for the purchasing plants and distorts the merit order.

- RMR are assigned to specific generators, for a total capacity of 1,000 MW year-round.