The 2006 hurricane season began on June 1. Floridians approached this date with dread. During the last two seasons we have suffered some of the most damaging hurricanes in modern history. In the calm months since then, yet another storm has arisen -- the increasing cost and shrinking availability of insurance for wind driven damage for homes and businesses.

The symptoms of this storm are all about us. Some of the largest casualty insurers in the state are refusing to renew the policies of existing home customers. Almost all insurance companies are dramatically increasing premiums. For commercial customers, starting with the small businesses upon which most Floridians depend for their jobs, but now threatening the medium and large scale businesses of Florida, the availability of insurance has reached a crisis point, threatening the economic growth of Florida.

It has been a disastrous two years for property insurance companies in Florida. Eight hurricanes have inflicted $30 billion in insured losses. The states insurer of last resort, Citizens Property Insurance Corp., has been left with a $2 billion deficit which all property insurance policyholders are paying through surcharges on their insurance premiums.

To put it up close and personal, I own a 20-year-old concrete block home in Miami Lakes and a 60-year-old wood frame cottage in Hingham, Mass. They have approximately the same market value. The casualty insurance on the Florida home will be almost 2 ½ times higher than the one in Massachusetts.

If these are the symptoms, what are the underlying causes? Starting with the most obvious, we live in the tropics and are subject to the cycles of hurricanes. Through the decades of the 1970s and 1980s we were spared the frequency of damaging hurricanes we had felt in the previous two decades. Beginning with Hurricane Andrew in 1992, that changed.

We are at the mid-point of a cycle of more numerous hurricanes. Florida has grown by 25 percent since Andrew, with more than four million new residents. There are that many more people, homes, businesses at risk. That many more are competing for a limited amount of insurance coverage. The pattern of growth has concentrated on the coastal regions of our state, the areas which represent the greatest vulnerability to hurricane damage.

Insurance companies, meanwhile, are practicing increasingly sophisticated forms of modeling. Through this, risk profiles are identified, categorized and segregated. Those who live in the most threatened communities more likely to have their insurance cancelled or, if insurance coverage is continued, paying substantially the full cost of that risk, rather than the more traditional practice of spreading the risk over a wider range of insurance payers.

You can see this within Florida. Insurance premiums on similar homes in a coastal city like Panama City are more than twice those of an interior city like Tallahassee. This is a partial explanation of the phenomenon that while rates are skyrocketing in Florida, the national insurance companies are profitable, benefiting by tranquil conditions in other parts of American.

The unhappy conclusion is that with the exception of hurricane cycles where relief might come in 10 to 15 years, the other factors are relatively permanent and even likely to increase in their contribution to hurricane damage and the cost to Floridians of insuring against that threat.

The somewhat happy response is that there are practical things that each of us, our communities and America can do to reduce the pain. We must get serious about the impact of global warming and get on with the things that will blunt its effect. The major sources of pollutants that add to the heat of the planet are our cars and trucks. America cannot wait another year to begin the process of moving toward a more energy conservative, less polluting and energy independent nation.

Florida, with more at risk from global warming than any other state, should be in the lead. State and local building codes and code enforcement need to be re-examined, strengthened when they are found to be inadequate, and enforced to withstand the intensity of the hurricanes we will be facing. Most of the homes and buildings we will be using in the next 20 years are already built.

There are things that individuals can do to protect their property -- strengthened roof tie downs and storm shutters are two that come to mind. The state and federal governments should assist in the cost of installation, as has been done to encourage energy conservation. Local emergency preparedness agencies should serve as a clearinghouse of information as to best practices and sources of reliable assistance to homeowners and businesses.

The federal government should stop the practice of using taxpayers' money to subsidize the true cost of coastal development. Cheap federal flood insurance has made development in risky coastal areas financially possible. These structures have also contributed to increased wind insurance rates as it is exactly these coastal structures which are the most exposed to wind as well as flood water. As the insurance companies become more compartmentalized in their underwriting, the federal government has a responsibility to assist those regions of America that are more vulnerable to the ravages of hurricanes.

Hurricanes are not a Florida problem; they are an American problem. Earthquakes are not a California problem nor are terrorist attacks solely a New York City problem; they, too, are American problems.

Bill Nelson, our senior U.S. senator and former Florida insurance commissioner, is proposing the creation of an emergency commission to recommend to the president and Congress proposals to establish a national disaster fund. This federal assistance should be supported by state and local commitments to strong building codes and their enforcement.

It's time to stock up with the batteries, bottled water, plywood for this year's hurricane season -- it could be another Charlie, Ivan, Dennis or Wilma. But the real challenge is to recognize that the toll of hurricanes on Floridians is not going to subside unless together we are prepared to take even tougher steps for our safety.

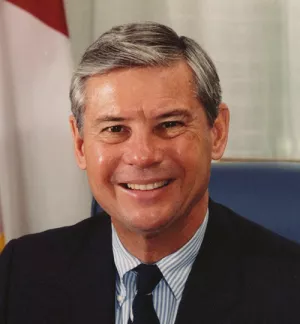

Bob Graham,a former U.S. senator and governor of Florida, is the author ofIntelligence Mattersand a senior fellow at Harvard University's Kennedy School of Government.

Graham, Bob. “Hurricanes are an American Problem.” Miami Herald, June 18, 2006