In recent days a coalition of Mexican advocacy groups has been protesting in front of Televisa, the country’s largest TV network, to contest the legitimacy of President-elect Enrique Pena Nieto’s July 1 victory.

These protests are the second in a string of such demonstrations scheduled before Pena Nieto takes office in December. They bode ill for Mexico’s near-term political future, pointing to a rocky transition at a time when the challenges facing the country are anything but modest. Americans might assume that tackling the drug trade that has resulted in more than 47,000 deaths since 2006 would top the agenda. But a strong case can be made that energy reforms are at least as urgent, for if Mexico can’t stem its sharply deteriorating energy situation, its ability to tackle other systemic problems will be severely compromised.

Despite some recent progress in diversifying its economy, Mexico still relies on oil for 30 percent of its fiscal revenue. Yet oil production has plummeted from 3.4 million barrels a day in 2004 to 2.5 million in 2011, with most experts predicting acontinuing decline over the next decade. Absent changes, Mexico could be a net importer of oil by 2020, ceasing exports to the U.S. altogether.

Oil Reserves

This assessment might sound odd to Americans who are getting used to the idea that their energy future is brightening significantly on account of burgeoning resources at home and among their neighbors. There is no question that Mexico, with the 12th-largest oil reserves in the world, has the geological resources to maintain and even improve its ranking as the eighth-largest oil producer. Equally striking is Mexico’s recently acknowledged endowment of shale gas. Not surprisingly, the prolific formations in Texas do not end at the border; Mexico is thought to have the fourth largest deposits of shale gas in the world, after Argentina, China and the U.S.

But, as is often the case, politics trump natural endowments in determining the energy profile of a geological giant. Mexico’s constitution makes it illegal for foreign companies to develop the country’s natural resources; Petroleos Mexicanos, the national oil and gas company known as Pemex, holds the exclusive ability to explore and bring to market vast petroleum reserves. Pemex, however, doesn’t have sufficient capital and technology to do so, and is burdened by a bloated bureaucracy and persistent interference by the state. Without significant reform, Pemex won’t be up to the task of reversing Mexico’s energy decline.

Just one month ago, Mexico’s prospects for energy reform -- though still far from a sure thing -- looked more promising than at any point since the industry was nationalized in 1938. The top two presidential contenders -- Pena Nieto of the Institutional Revolutionary Party and Josefina Vazquez Mota of the National Action Party -- were advocating substantial reforms to Pemex. Both spoke openly about allowing more private sector participation in Pemex and eventually listing it on the stock exchange. Pena Nieto declared the need for “audacious steps” if Mexico was going stabilize its energy sector and reposition it as the engine of Mexican economic growth.

Pena Nieto’s interest in applying the “Petrobras model” to Pemex seemed particularly promising. Brazil introduced reforms that allowed private and foreign capital to flow into its national oil company, Petroleo Brasileiro SA (PETR4), without the appearance or reality of selling national assets to foreign entities. Although there have been some bumps in the road, the infusion of capital has allowed for more investment in exploration and production, and has fueled a major research initiative that led to Petrobras becoming a world leader in deep-water technology.

Similar reforms could spur positive results in Pemex. Listing it on the stock exchange could also bring greater shareholder accountability, improve corporate governance and give the company the ability to operate more like a corporation and less like an arm of the state.

Protest Movement

A number of developments since the presidential election, however, have made such reforms seem more fantasy than reality. First, the protest movement against Pena Nieto has altered the president-elect’s priorities from energy reform to transparency and anti-corruption. This shift may not placate the protesters, many of whom are students. But stirring up popular sentiment against private-sector involvement in the energy industry will be an easy target for the new president’s opponents. To understand the emotion with which many Mexicans regard the issue, one only need know that, every March 18, the nation commemorates the day in 1938 when President Lazaro Cardenas del Rio expropriated all oil reserves.

Second, the composition of the new Congress does not bode well for major energy reforms, which would probably require constitutional revisions and thus two-thirds support from lawmakers. Pena Nieto’s PRI did not win the majority of seats in the 500-member lower house, the Chamber of Deputies. Thus it can only reach the critical two-thirds threshold with support from PAN, whose members are likely to remember the vigor with which the PRI opposed efforts at reforming Pemex by the outgoing president, PAN’s Felipe Calderon.

Despite these additional challenges to an already ambitious agenda, Pena Nieto should not back away from his statements or his intentions to reform the oil and gas behemoth. Given the centrality of Mexico’s energy sector to the country’s future, his ability to govern over the long run may depend on it. To do so, he will need to mount a multipronged effort with a flavor of national unity.

The first step must be a sober education initiative aimed at getting Mexican voters to appreciate the direness of the situation and the critical nature of energy reforms to the vitality of their economy. The government’s new National Energy Strategy, which blithely assumes that oil production will be 3.3 million barrels a day in 2026, is an indication of how the state has misled its citizens. Pena Nieto needs to begin by leveling with Mexicans about the faltering direction of their energy future.

Reaching Accommodation

Second, the PRI, back in power after 12 years, will need to reach an accommodation with thePAN on the way ahead in energy. Building a joint front will not be easy, despite the now-common agenda of both parties on this issue. Winning the PAN’s support will probably require a negotiation on a larger agenda of items that produces a recognizable win or two for the PAN on other fronts.

Short of that grand bargain, Pena Nieto could build on Calderon’s more modest energy reforms. He could begin by modifying the new Mexican integrated service agreements -- the first were issued a year ago -- to allow foreign companies to be paid in oil. This arrangement would technically give international oil companies no ownership of the resources, but might enable them to book the reserves -- a critical factor in attracting foreign, private interest.

The U.S. is not a bystander in this high stakes game. Not only is Mexico its third-largest source of oil imports, but the U.S. has an even greater interest in the solvency and stability of its southern neighbor. When the next U.S. administration develops a long-overdue and much-needed U.S. energy strategy, it should look for ways to encourage a Mexican energy recovery, be it through treaties, private-sector involvement, infrastructure development or the resolution of disputed claims.

Those on both sides of the border will benefit from success -- or suffer from failure.

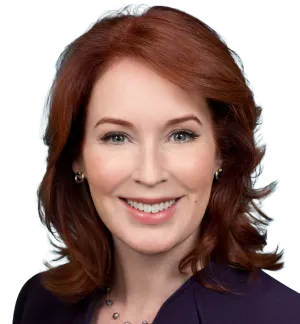

O'Sullivan, Meghan. “Mexican Oil Reforms Are Vital on Both Sides of the Border.” Bloomberg Opinion, July 30, 2012