The bonus backlash tells once again a tale of two cities which are sharply divided by culture----New York (driven by money) and Washington (driven by power). Where is our latter day Dickens to illuminate the endless themes and sub-themes, especially in this worst of times?

With $18 billion in bonuses, we have another example of corporate leaders failing to understand that, as a general matter, they must pay far greater attention to broad "business in society" issues than they have in the past and stop being so parochial about their internal mores and measurements. The general issue is even more eye-popping in the specific case of the financial services industry which has just exhibited the worst business leadership in recent history. It has been the primary cause of driving the world economy to the brink of collapse and has taken billions of taxpayer dollars to avoid this from happening. Even more particularly, lax compensation practices-- which rewarded the churning of paper and not the creation of economic value, and greed over a sound balance between risk-taking and risk management-- are a fundamental cause of the financial sector's failure.

And, incredibly, it apparently never occurred to Wall Street, in the midst of this firestorm, to make a sustained communications effort to explain their bonus practices in 2008 to Washington and to the public-- what is a reasonable level of compensation in such a terrible year; how much of that compensation is in the form of end of year payments; which types of employees are taking a severe hit due to bad performance; which types of employees helped sustain the bank and deserve fair recognition; how to deal with senior executives, etc. Wall Street inexplicably served up an unadorned $18 billion softball for the President to stroke over the populist center field fence.

The causes of this insularity and insensitivity are many. We can start with business school education which for years has trained students in the ways of finance and shareholder value with far less attention to the critical business in society issues which any big company CEO must make a priority. We can end with a self-absorbed New York culture which, until recently, truly believed that it was the capitol of the United States which had to tolerate shenanigans in a small so-called capitol to the South. In between, and most importantly, the financial sector had a potent money culture created by often myopic boards and one-dimensional CEOs which fixed its gaze short-term rewards and bonuses and failed to focus on the fundamental balance so central to successful, durable enterprises: the balance between risk-taking and risk management, the fusion of high performance with high integrity.

The solutions within business range widely: changing business education to redefining the job spec for the CEO (to make balance the central virtue), redesigning executive compensation so it rewards that balance, hiring key staff leaders (CFO, Risk, General Counsel, HR leader) who have the courage to argue against short-termism and for sound decisions, constituting boards who, not only compensate the CEOs who picks top priority issues (like massive leverage or excessive capital allocation to one sector), but also get their hands dirty, ask hard questions and are truly constructive critics. One particular point: too often business decision-making on major deals or capital allocation decisions consistent of a proponent coming in and trying to blow a decision past a cross-examining CEO or board. Businesses too rarely generate real options for important calls---and have red teams and blue teams arguing strenuously against each other before decision. And too often critical questions involving reputation aren't even seen as such because of the "business in society" indifference.

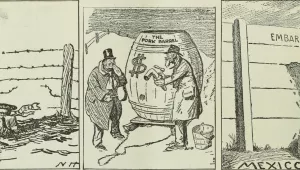

Of course, part of the solution is going to come through public regulation---which the bonus backlash has whipped into a yet greater frenzy. With credibility shredded, the financial sector is going to have as much success pleading its case---if they ever choose to be public about what went wrong and how to fix it---as a Parisian aristocrat did in the 1790s begging for his life before the Jacobins and the Committee of Public Safety. But what can it expect when, to mix eras, the sector's unexplained $18 billion bonus number gives the general impression to the public and Washington (even if the reality is much more nuanced) that the bankers are still dining well at a fancy French restaurant and, over a glass of fine wine, listening to Edith Piaff sing: "Je ne regrette rien" (I don't regret nothing).

Heineman, Ben. “A Tale of Two Cities.” On Leadership at washingtonpost.com, February 2, 2009