The United States has reached its statutory debt limit of $31.4 trillion. As Washington gears up for yet another partisan showdown over whether to raise the debt ceiling, with congressional Republicans seeking concessions from Democrats in exchange for their votes, many are understandably nonchalant about it. Americans feel they have seen this movie before, and the story usually ends with the bickering politicians reaching a last-minute compromise. So, no need to ring the alarm bells.

But this reboot could have a different, tragic ending. In the 1955 movie Rebel Without a Cause, James Dean’s character survives a deadly game of “chicken” by jumping out of his car at the last moment while his rival miscalculates and drives off a California cliff. With the US economy barreling toward the cliff’s edge, it is clear that intransigent Republicans have no intention of hitting the brakes. This could mean a once-unthinkable US government default.

Unfortunately, letting Republicans drive the US economy off a cliff may be President Joe Biden’s best option right now. But the US still has at least five months to jump out of the car. Treasury Secretary Janet Yellen said last week that she will pursue a set of “extraordinary measures” (all of which have become rather ordinary in recent decades) to postpone America’s day of reckoning until early June.

Raising the US debt ceiling does not mean that the government has decided to increase spending. It means only that the government will honor the debt it assumed due to spending and tax decisions that Congress has already made. If Congress wants to reduce the budget deficit – a worthy aim – it should cut spending, raise taxes, or both.

How should the Biden administration respond in the likely event that Republicans refuse to back down? Several untested (and imperfect) creative solutions that have been proposed during previous debt-ceiling standoffs could enable policymakers to stave off the threat of an imminent Treasury default.

First, Biden could invoke the Fourteenth Amendment, as former President Bill Clinton suggested during the debt-ceiling standoff of 2011. Adopted in the immediate aftermath of the Civil War and ratified in 1868, the amendment states that the “validity of the public debt of the United States … shall not be questioned.”

The argument in favor of invoking the Fourteenth Amendment is that the debt limit and the spending and tax bills included in the budget clearly contradict each other. When forced to choose between these conflicting laws, the argument goes, the executive branch should opt to fulfill the US government’s financial obligations and let the courts decide the legality at a later date. The counterargument is that Republicans would accuse Biden of flouting the law in an effort to increase federal spending, the confrontation would trigger a constitutional crisis, and it is unclear how the conservative-dominated Supreme Court would rule.

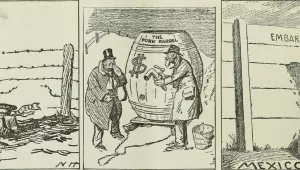

The most outlandish-sounding proposal is for the Treasury to mint a trillion-dollar platinum coin. The Federal Reserve could then buy the coin in exchange for conventional money, which the Treasury could use to pay its bills. Proponents of this idea argue that as crazy as it sounds, it could actually work. The counterargument is that it would compromise the Fed’s independence and that the legality of this gimmick is unclear.

Meanwhile, the Treasury will likely have enough tax revenues to meet at least 80% of already-legislated outlays without borrowing. But which 80% would it cover? Some suggest that prioritizing interest payments to bondholders over other expenses would prevent a default and a rating downgrade, thereby avoiding higher interest rates on future debt.

But even if bondholders continue to be paid, failing to pay other bills on time (for example, to federal contractors and salaried government workers) could be viewed as the US government dodging its legal obligations. Moreover, to keep paying creditors, the government would have to cut politically sensitive big-ticket budget items such as payments to Social Security recipients, Medicare providers, and active soldiers. Biden’s political opponents could then use that to stir up populist outrage.

While the Treasury claims that it could not prioritize payments even if it wanted to because its computer systems and administrative apparatus are not set up that way, several House members have been trying to develop plans for giving precedence to interest payments, mandatory spending (such as Social Security, Medicare, and veterans’ benefits), and military spending (such as soldiers’ salaries).

But even if the Treasury could prioritize certain payments over others, these three categories account for at least 85% of federal spending. There would not be enough incoming revenue to pay for all of them. Hypothetically, even if diehard fiscal hawks managed to eliminate all non-military discretionary spending, including the budgets of vital agencies such as the Federal Aviation Administration and the Food Safety and Inspection Service, the gap between spending and revenue could not be closed without cutting one of the three protected categories.

Do the consequences of a government default outweigh the drawbacks of these gimmick solutions? Ten or 20 years ago, the answer might have been yes. After the 2011 debt standoff provoked S&P to downgrade the US credit rating for the first time, some argued that a default would be so disastrous that avoiding it was worth the political embarrassment of minting a trillion-dollar coin or invoking the Fourteenth Amendment.

But the world has changed since then. Even if technically workable, these creative solutions would obscure who is to blame. Worse, they would not prevent global markets from doubting the reliability of the US government’s commitment to meeting its financial obligations.

Ultimately, Republicans would have to back down. Because the GOP’s rebels without a cause have become even more intransigent over the last decade, the standoff will probably go down to the wire, and the government may be forced to shirk some obligations for a few days, or even weeks. By then, hopefully, crashing securities markets, outraged beneficiaries, and shifting voter attitudes would finally persuade enough holdouts to raise the debt ceiling. In the meantime, we have no choice but to let this game of chicken play out.

Frankel, Jeffrey. “Why This Debt-Ceiling Fight Is Different.” Project Syndicate, January 19, 2023