A Chinese-language version of this report is available from the Institute for Climate Change and Sustainable Development at Tsinghua University.

Executive Summary

Countries around the world are shifting away from the use of coal to decarbonize their economies in the fight against climate change. Yet this move away from coal poses big challenges to regions where the economy still relies heavily on coal and people’s jobs and lives are highly dependent on coal. How can coal mining regions transition away from coal while remaining economically prosperous and ensuring that people continue to have decent jobs and a good quality of life? This is a critical question to answer since, if addressed well, a just transition will mitigate the challenges with moving away from coal and enable faster progress on decarbonization.

China’s coal production accounts for more than half of the world’s coal production, and its coal industry employees account for about half of the world’s total. In 2020, China announced that it would “peak carbon emissions before 2030 and achieve carbon neutrality before 2060” (a.k.a. the “dual carbon targets”). In the context of the global wave of carbon neutrality and the green industrial revolution, the “dual carbon goals” are China’s commitment to the international community and also an important step toward promoting high-quality development of the domestic economy and realizing the “Beautiful China” initiative. However, limited by its resource endowment and industrial structure, China will face more arduous just transition challenges in the process of achieving its “dual carbon goals.”

“Just transition” is a term coined in the 1970s by the labor movement in the United States. Academic research on just transition started at the beginning of this century, and there are currently no unified concept and research frameworks for just transition. Still, the concept has played an important role in international climate governance and national policymaking in recent years, in recognition that a move away from coal can leave the affected workers, their families, and their communities vulnerable and in need of support. As China has half of the coal employment in the world, ensuring a just transition is a critical priority. Does China have a just transition policy? If so, how does it compare to just transition policies internationally? And what should China do to ensure a just transition as it meets its carbon neutrality goal?

To answer these questions, this report examines the experiences of two coal cities in China, Wuhai in Inner Mongolia, and Tongchuan in Shaanxi. Wuhai and Tongchuan, both situated in western China, have relied on coal mining as their pillar industry for many years. Both cities have been making efforts to transition away from coal as the country has gone through different stages of economic growth and implemented new environmental policies. Around 2010, the central government designated both cities, among others, as resource depletion cities and required them to shift to non-coal-based economies. In 2013, due to the severe air pollution issue, the central government called for environmental policies including coal consumption reduction. In 2016, the central government embarked on the reform to reduce surplus capacity of coal production at the national level, which led to coal workers’ potential unemployment issues that both cities had to deal with. While the efforts were not driven by the need to decarbonize, the goal is the same, which is to retain economic prosperity in a region less reliant on coal.

The two case studies indicate that even though “just transition” is a term that originated in the United States and has not been widely used in China, this type of approach is a key consideration for governments designing coal-transition policies. Recognizing the difficulty in moving away from coal and the challenges faced by coal regions and coal workers, the central government in China has allocated billions of dollars of special funds toward covering the basic living expenses of coal workers and created job training and other programs customized to meet the needs of coal workers based on their age, education, and other characteristics. In the state-owned enterprises, these supports and measures have proven effective at helping ensure a just transition for coal workers and have been well received by society.

In addition to providing compensation to individual coal workers, China’s just transition approach focuses on economic diversification with strong industrial policies that drive economic growth and create non-coal-mining job opportunities. Both cities have achieved some successes in this regard. Wuhai has become an important hub for coke chemical and chlori-alkali chemical industries in China and is expanding to the fine chemical, biodegradable BDO materials, and organic silicon industries. The strategic emerging industries accounted for 10% of the city’s industrial GDP in 2020 and its chemical manufacturing industry today employs more people than the coal mining industry. Similarly, Tongchuan’s strategic emerging industries produced 13.5% of the city’s industrial GDP in 2020.

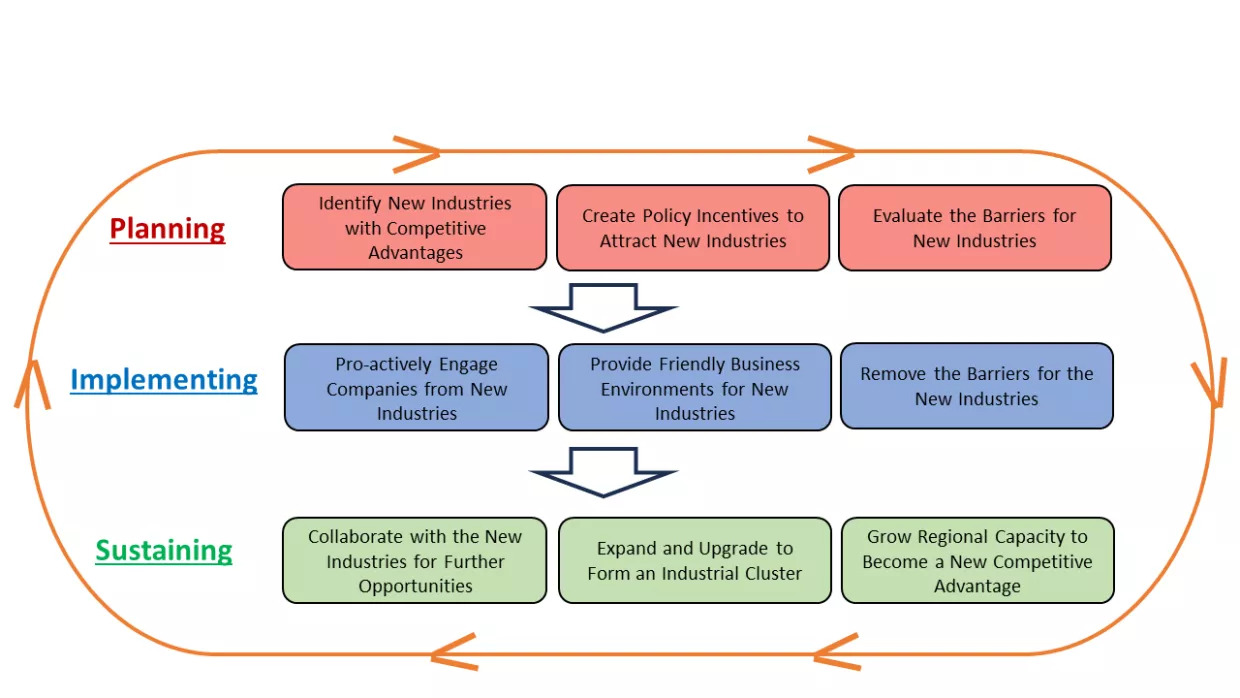

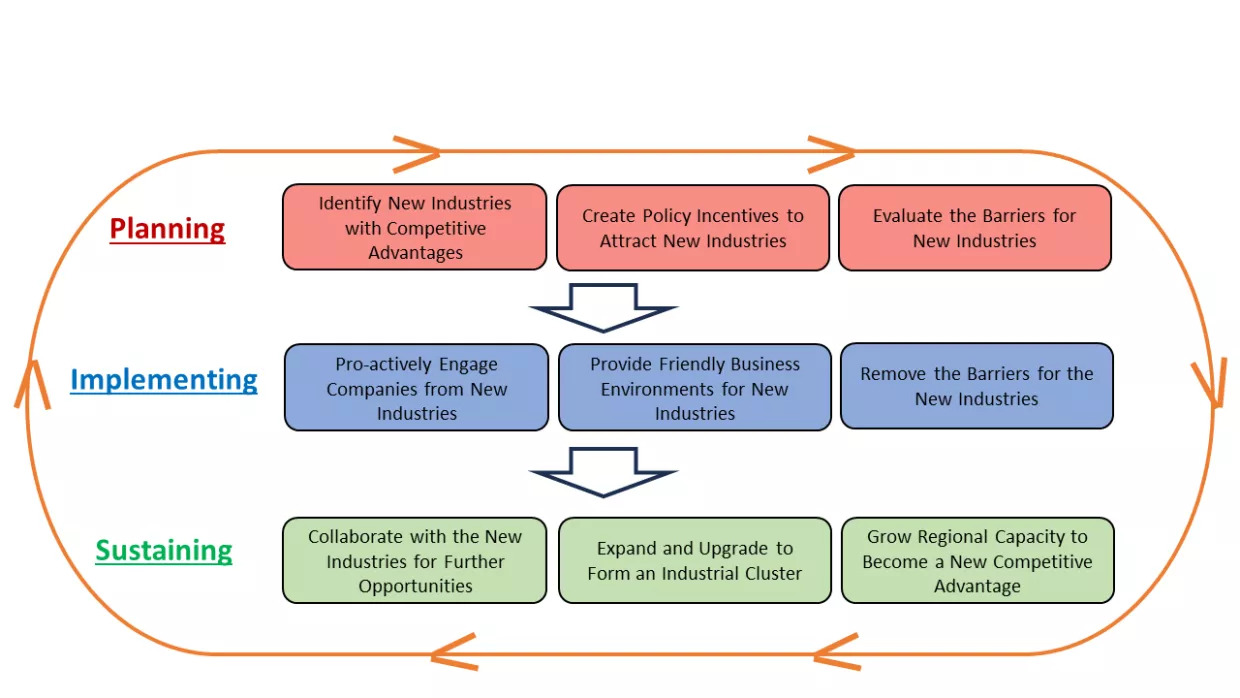

As the executors of central and provincial policies and the owners of local economic development, city governments play a crucial leadership role in coal cities’ economic transformation. The following policy framework summarizes the experiences of Wuhai and Tongchuan to diversify coal region economies and to develop new industries:

- Strategic Planning: It is critical to identify new industries by strategically assessing the competitive advantages of the regions.

- Effectively Implementing: To attract investment from targeted new industries, the government should be proactive in engaging the private sector, providing the right incentives, eliminating barriers, and addressing the specific needs of companies.

- Continued Sustaining: For a new industry to scale up and become a pillar industry that replaces coal, prior efforts must be continuously expanded and upgraded.

Despite the progress that has been made, Wuhai and Tongchuan’s experiences show that developing non-coal industries at the scale required to replace coal is extremely challenging and requires a long, continuous process. In both cities, the share of non-coal industries is still not large, and coal remains the dominant contributor to the industrial sector. The non-coal industries are mostly energy and carbon-intensive. These regions traditionally do not have the knowledge, talent, and infrastructure that new industries require, nor do they have economies of agglomeration that can compete against more developed regions. As such, even with policy incentives or subsidies to attract investment, new businesses often become a one-off investment and do not create the continuous funds needed to scale up over the long term. Similarly, new industries in these cities face a dearth of innovation, as it can be difficult to attract talent willing to relocate to these regions.

As China embarks on the path to decarbonization, the challenges faced by coal regions are likely to intensify and, there will be a more urgent need to address the resulting unemployment problem, due to the size of the industry, the increased number of impacted regions, and a relatively shorter time window.

Based on the two cities’ transition experiences, we provide a few policy recommendations on the approach to just transitions in coal regions in China:

- The central government should develop customized schedules for each coal mining region, to allow more time for regions to consider the unique challenges they confront.

- Local governments should consider more diversified policy tools for the financial support to ensure a just transition. These should include not only the fiscal approach used by the Ministry of Finance in helping coal miners’ just transition in the past, but also financial instruments to provide continuous support for the low-carbon transition of the economy and society at large scale. In addition, national and provincial governments should consider requiring coal enterprises to establish coal transition funds that can be used for just transition in the future.

- Local governments should avoid falling once more into a “resource trap” and tackle the challenge of being locked into low-value, high-carbon industries when developing new industries for economic diversification. In particular, against the current backdrop of industrial transfer from the east to the west, coal cities in western China should shift the paradigm of development from focusing on using resources as a competitive advantage to building a path to achieve high-quality, green urban development.

- Provincial governments should provide all-around strategic coordination, guidance, and support for the development of new industries that will help coal cities address the challenge of not knowing how to choose new industries, the lack of talent and technology, and head-to-head competition from neighboring regions.

- Local governments should establish a principle that prioritizes people’s livelihoods and promote deep changes in the social governance system. Unemployment issues in the coal industry and the service industry to support the workers, population contraction, loss of labor force, and the social integration of aborigines and new citizens will all profoundly change the societal ecosystem. Thus, in addition to promoting employment through the economy, a new social governance system should also be considered in order to achieve a just transition in coal cities.

1. A Just Transition in China’s Coal Regions: Policies and Challenges

1.1 Role of Coal in China’s Energy System

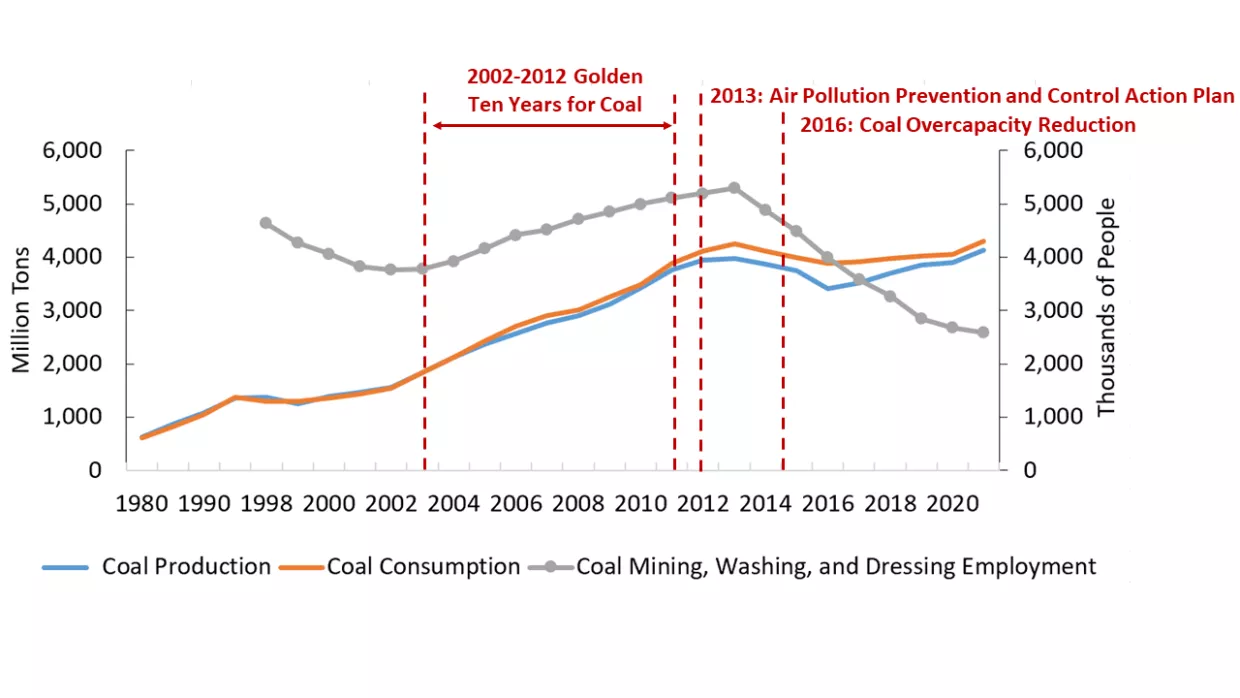

China’s resource endowment is characterized by “rich coal, poor oil and little gas.” For a long time, coal dominated both energy production and consumption. Figure 1-1 shows China’s coal production, coal consumption, and employment in coal mining and dressing from 1980 to 2021. After China joined the World Trade Organization (WTO) in 2001, the industrialization process was accelerated, and the surge in energy demand led to a rapid increase in coal production capacity. The following decade (2002-2012) was regarded as the “golden period” of the coal industry. However, the rapid expansion of coal production capacity from 2002 to 2012 soon brought about a crisis of overcapacity. At the same time, the rapid growth of coal consumption resulted in serious environmental pollution problems.

Beginning in 2013, the Chinese government embarked on a massive effort to address both the energy transition and air pollution control. One of its major measures was to reduce coal consumption. Due to its limited oil and gas resources, China has mainly adopted the practice of replacing coal with renewable electricity. From 2012 to 2021, the proportion of coal in total energy consumption decreased from 68.5% to 54%, and the proportion of non-fossil energy increased from 9.7% to 16.7%.

The rapid capacity growth of the coal industry during the “golden period” also led to a surge in employment, with the number of employees in the coal mining, washing, and dressing industry increasing from 3.8 million in 2002 to a peak of 5.3 million in 2012. Following the Chinese government’s large-scale energy transition and air pollution control measures in 2013, the central government introduced an overcapacity reduction policy of coal industry in 2016. As result, the number of employees began to decline, reaching 3.5 million by the end of 2017. Although coal production has gradually increased since 2017, the number of coal jobs has maintained a continuous downward trend due to productivity improvement, falling to 2.6 million as of June 1, 2023. Despite the significant decline in the number of employees, China’s coal industry still accounted for more than 51% of the world’s total coal employment in 2022.1

Another characteristic of China’s energy system is the geographical mismatch of production and consumption. Coal-producing provinces are concentrated in the western, central, and northern regions, while coal-consuming provinces are concentrated in the southeastern coastal region. In recent years, coal production has been further concentrated in areas with excellent resource endowment, good mining conditions, and low costs, while large-scale modern coal mines have become the main coal producers. Compared with 2013, the number of coal-producing provinces in 2021 fell from 25 to 22, and the coal production of 17 provinces fell sharply. As of 2021, coal production has been further concentrated in Xinjiang, Shaanxi, Inner Mongolia, and Shanxi; these four provinces together account for 80% of the country’s coal production. Most of these provinces reached the peak of coal employment around 2012, with numbers declining ever since.2 As with production, coal employment opportunities have also become more concentrated in the major coal-producing provinces. For example, coal employment in Shanxi province accounts for more than one-third of total coal employment in China now. After China announced a goal of “carbon peaking by 2030 and carbon neutrality by 2060,” these provinces will face severe social and economic challenges related to just transition.

1.2 China’s Policies on Coal Transition

Although just transition is still a new concept in China, the policies originated more than twenty years ago. With the continuous development of China’s economy and society, the policies related to the just transition are also evolving into three categories: the transformation and development policies of resource-based cities, the coal industry policy to reduce overcapacity, and the financial policy in the 1+N climate change policy package. The just transition was originally one dimension of social policy for the transition of resource-depletion cities, and subsidies mainly came from fiscal transfers. With the acceleration of the energy transition, the financial sector is playing an increasingly important role.

1.2.1 Policies focused on the transition of coal resource-based cities (2001-present)

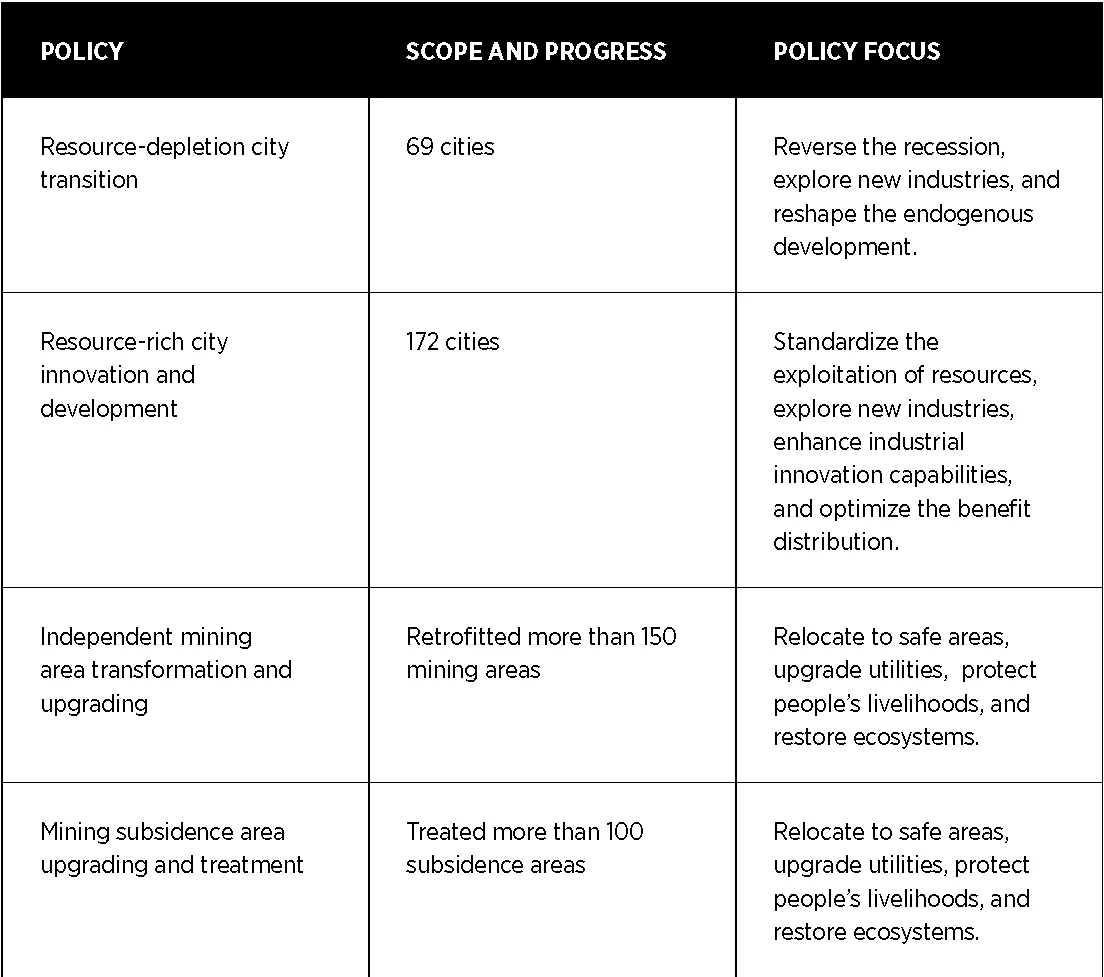

- Resource-depletion city transition. China’s rapid economic growth has led to a massive demand for coal and other minerals, as well as the gradual depletion of resources in some cities. In order to help these cities find new industries, the central government initiated a pilot program on the transition of resource-depletion cities. In 2001, China approved Fuxin City in Liaoning province as the first pilot, and six more pilot cities followed in 2005. Then, in 2007, the Chinese government promulgated a regulation named the Several Opinions of the State Council on Promoting the Sustainable Development of Resource-based Cities. From 2008 to 2012, China made significant progress in implementing this regulation by identifying 69 resource-depletion cities (including 39 coal cities) in three batches. Since then, the central government has provided financial transfer funds to these cities, and the annual scale has increased from more than 800 million RMB (USD $105 million) to more than 23 billion RMB (USD $3.5 billion) in 2022, with a focus on improving social security, education and health, environmental protection, etc.3 Since 2013, pilot programs have been set up to restore the mining areas with serious environmental damage, and special funds have been allocated to support the implementation of two policies: the Comprehensive Project for Coal Mining Subsidence Area and the Project of Transformation and Upgrading of Independent Mining Area (see Table 1).

1.2.2 Industrial policies focusing on small coal mines phase-out (2000-2020) and coal overcapacity reduction (2016-2020)

- Small coal mines phase-out: This is a policy priority due to serious safety issues with coal mining that arose in the early 2000s. As the result of more than 20 years of policies and actions, the number of small coal mines (annual capacity ≤ 300,000 tons) decreased from 22,000 in 2005 to 1,129 in 2020.

- Overcapacity reduction of coal industry: Beginning in 2012, due to the slowdown of economic growth, the demand and prices for coal and steel kept decreasing and the production capacity for coal and steel became significantly higher than the demand, which resulted in severe economic challenges for coal and steel companies and their employees. In 2016, the central government called for efforts to reduce coal production capacity from 2016 to 2020, targeting a reduction of 800 million tons of coal capacity annually while increasing more efficient coal capacity by 500 million tons annually.6 It was estimated that the coal mining sector alone needed to lay off around 1.3 million employees nationally. The Ministry of Finance set up a special fund of 100 billion RMB (USD $13.9 billion) dedicated to resettling unemployed workers in the steel and coal industries.7 In addition, the Ministry of Human Resources and Social Security launched the Special Training Program for Employees of Enterprises with Excess Capacity.8 These policies were aimed at solving the unemployment and retraining problems in the steel and coal industries. By the end of 2020, around 1 billion tons of coal capacity had closed (about 5,500 small- and medium-size coal mines) and around 1 million employees had been resettled.9

1.2.3 Climate policies with the 1+N Package and transition fund (2021-present)

In order to achieve the targets of carbon peaking by 2030 and carbon neutrality by 2060, the central government began in 2021 to introduce a series of climate policies known as the 1+N climate package. Improving the existing fiscal and financial system and supporting large-scale low-carbon transition are important objectives of the package. Meanwhile, the G20 Transition Finance Framework was adopted at the G20 Leaders’ Summit in Bali in 2022, and the People’s Bank of China, as co-chair of the G20 Transition Finance Working Group, is not only co-leading the development of the framework with the U.S. Department of the Treasury, but also vigorously promoting the construction of the domestic transition finance system.10

Specific measures include:

- Transition finance: To achieve the carbon peaking and carbon neutrality targets, it is necessary to promote the low-carbon transition of high-carbon emission industries and economic activities in an orderly manner. The People’s Bank of China published research on transition finance since 2021 established the principles of transition finance and organized research on standards-making in fields such as steel, coal power, building materials, and agriculture. The Interbank Market and the Exchange Market are formulating the review rules and standards for the issuance and listing of the transition financial instruments. In August 2023, the Postal Savings Bank of China launched the country’s first just transition loan of 100 million RMB in Datong City, Shanxi Province. The loan was aimed at supporting the just transition actions of Jinneng Coal Industry Group Corporation.11 In 2023, Shanghai issued the Shanghai Transition Finance Catalogue (Trial), and the first batch of supported industries including water transportation, ferrous metal smelting and rolling processing, petroleum processing, chemical raw materials and chemical products manufacturing, automobile manufacturing, and air transportation. Subsequently, Shanghai Pudong Development Bank launched the first transition loan in Shanghai, providing 310 million RMB for Spring Airlines Co., Ltd.12

- National transition fund: In May 2022, the Ministry of Finance promulgated the Opinions on Financial Support for Carbon Peak and Carbon Neutrality, which proposed to establish a national Low-carbon Transition Fund that would support the green transformation of traditional industries and resource-dependent areas. Another national investment fund established in 2020, the National Green Development Fund (USD $12.8 billion), plays an important guiding role in the fields of green industry and green economy.

- Central bank lending: The People’s Bank of China launched two monetary policy tools in November 2021. One is the Carbon Emission Reduction Support Tool. The policy provides financial support for national banks at 60% of the loan principal at an interest rate of 1.75%, encouraging national banks to issue eligible carbon emission reduction loans to relevant enterprises in areas such as clean energy, energy conservation, environmental protection, and carbon emission reduction technology.13 Another policy tool is the Special Reloan to Support Clean and Efficient Use of Coal (USD $31 billion), which was used to guarantee the energy security during a worldwide energy crisis. The policy supports efficiency improvement on coal mining, coal processing, coal power, industrial combustion, industrial and civil heating, and comprehensive utilization of coal resources and coalbed methane.

1.3 Challenges with Coal Region Just Transition in China

Compared with industrialized countries, China’s regional coal just transition has the following characteristics:

- More regions and cities are involved than in any other country. Despite the decline in recent years, as of 2021 there were still 22 coal-producing provinces and 73 coal-based cities in China, making coal transition a challenge for many regions, and making it very difficult to design transition support policies at the central government level. In the long-term future, the challenges of coal transition will be concentrated in the four big coal-producing provinces, where the economy and industry are more dependent on coal and have greater employment concentration compared to the rest of the country.

- The scale of coal industry unemployment is larger than that of any other country. As of June 2023, employment in the coal mining and dressing industry still exceeded 2.6 million, let alone that of related energy-intensive industries. Over the past decade, about 300,000 coal industry jobs have been lost annually, making unemployment a huge challenge for most provinces, especially for the least economically developed ones.

- The coal region transition started later and the transition time window is shorter. Some industrialized countries began energy transitions as early as the 1970s, while China’s policies began in the early 2000s for the transition of resource-exhausted cities and in 2013 for large-scale energy city transition. Ever since the country pledged “carbon peaking by 2030 and carbon neutrality by 2060,” the transition time window has been greatly shortened.

- The transitions of some coal regions faces multiple challenges. For example, cities in northern and northeastern China are facing multiple barriers, such as mine depletion, aging populations, and economic decline (Yang et al., 2022).14

2. Study Scope and Approach

2.1 Concept and Practices of Just Transition

The concept of just transition originated in the American labor movement in the early 1970s, while scholarly debates on transition did not appear until the 2000s. In theoretical studies, scholars focusing on the historical roots of just transition have mainly understood this concept as a labor-oriented framework that links the energy transition to economic transition. Some studies recognized the linkages between just transitions and other concepts of justice, particularly environmental, climate, and energy justice, and have developed just transitions into comprehensive frameworks on justice. These frameworks emphasize the significance of distributive and procedural justice when taking into account transition benefits and costs, and argue that the implementation and effects of transitions must be fair and equitable. There are also studies that incorporate just transition as a justice principle into the framework of socio-technological transition, a phenomenon of governance and a perspective of public perceptions of low-carbon energy transitions.15

At the global level, the concept of a labor-led just transition is increasingly intertwined with calls for future-oriented climate policies and economic development plans in fossil-fuel-dependent countries. When the adjustment costs of the energy transition are imposed on different industries and stakeholders, there are both winners and losers. On the supply side, the fossil energy industry and its employees, as well as the resource cities and regions, will become disadvantaged stakeholders. On the demand side, consumers will ultimately bear the costs of transition, while groups that are more sensitive to cost changes, such as low-income groups and regions, are less able to assume the risks and harms of transition.16 Therefore, the formulation of policies for different stakeholders to reduce transition risks and promote social equity has become a core concern of many governments. Geographically, just transition research has mainly focused on a small number of industrialized countries, while research on emerging economies has gradually increased in recent years. Global just transition is still in its infancy. While some industrialized countries have made weaning themselves off coal a priority in their political agenda, most low- and middle-income countries still see coal as a critical driver of economic growth. Some studies have examined the different drivers, policy measures, and conditions that characterize just transitions across countries,17 to conclude that different levels of economic development, energy structure, transition pathways, policies, and institutional arrangements will lead to varying paces of clean energy transition. As a result, the international community needs to formulate distinctive policies that meet local conditions.18

As there is currently no unified concept and research framework for just transition and the definition of just transition is not consistent under different research scopes, in this report, we refer to “just transition” as it is defined in the Paris Agreement: “the imperatives of a just transition of the workforce and the creation of decent work and quality jobs in accordance with nationally defined development priorities.”

2.2 Study Questions and Approach

Just transition has become an important issue in global climate governance and various countries in the low-carbon transition. Due to the constraints of resource endowment and high proportion of heavy industry, China will face huge just transition challenges in the process of achieving carbon neutrality. As a labor-oriented concept with short history of scholarly debates, just transition is still a new and foreign concept for China. Localizing this concept and integrating it with the existing policy system is crucial. This study focuses on whether there are policies in China that fall within the scope of just transition, especially for coal cities. If China has just transition policies, what are the best practices and lessons from the past? In addition, how should China enhance and improve its policies to ensure a just transition for its coal regions, as it meets its carbon neutrality goal?

To answer these questions, this study assesses the transition experience in two coal cities in China, Wuhai in Inner Mongolia, and Tongchuan in Shaanxi, over the past two decades or so, driven by economic development needs and the central government’s energy and environmental policies. While these drivers differ from those pushing decarbonization, the purpose of the efforts is the same, that is, to achieve sustainable economic and social development while ensuring people’s livelihoods and employment in the process of gradually reducing dependence on coal resources and industries. Thus, the transition experience in these two cities can provide valuable insights into coal regions in China—and other countries—as they decarbonize.

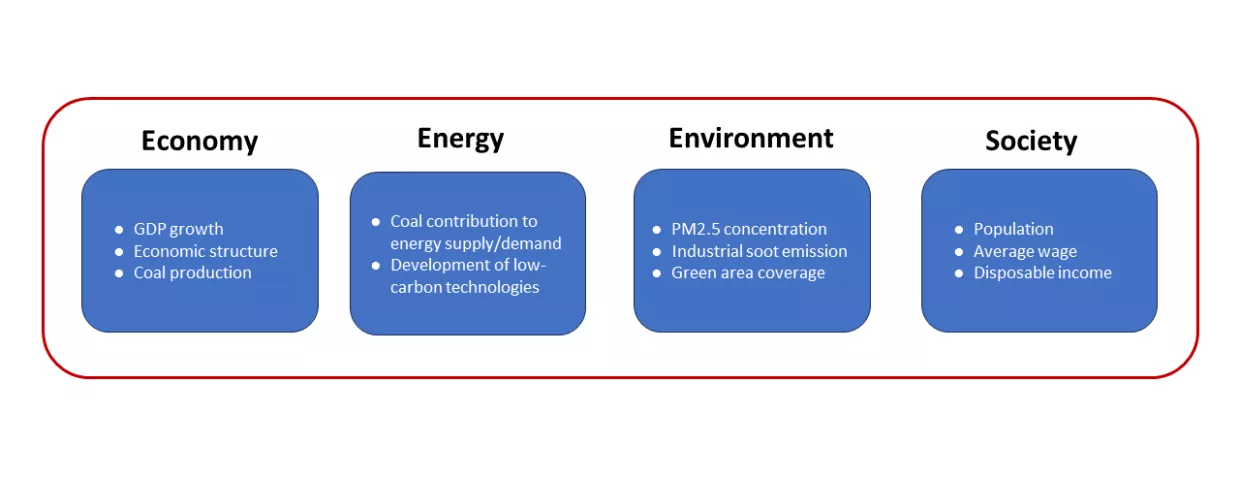

In order to study the experiences of the two coal cities, we used combined approaches of quantitative and qualitative research: A 3E+S (Economy, Energy, Environment, and Society) framework is applied to assess the transitional experience in economy, energy system, environment, and society over the past two decades or so. To obtain first-hand information, opinions, and insights, field interviews were carried out with people who had experienced the transition. The interviewees include government officials, coal miners, coal mining companies, and new industries settled in these two coal cities. In this study, we focus on two aspects related to just transition: (1) the city’s effort to address coal miners’ unemployment issues during the transition; and (2) the city’s effort to diversify the economy to create non-coal mining job opportunities.

3. Case Study 1: Wuhai, Inner Mongolia

3.1 Overview

The city of Wuhai is located in southwest Inner Mongolia. It has a population of around 560,000. Established in 1958 by the central government as a coal supplier to a state-owned steel maker, the region was officially designated as a city in 1976.19 Wuhai’s economy has been largely dependent on coal production, with its first two decades of development made possible by mining coal and exporting it to other regions. In 2011, Wuhai was named by the central government as one of the ‘resource depletion’ cities and required to diversify its economy away from coal.

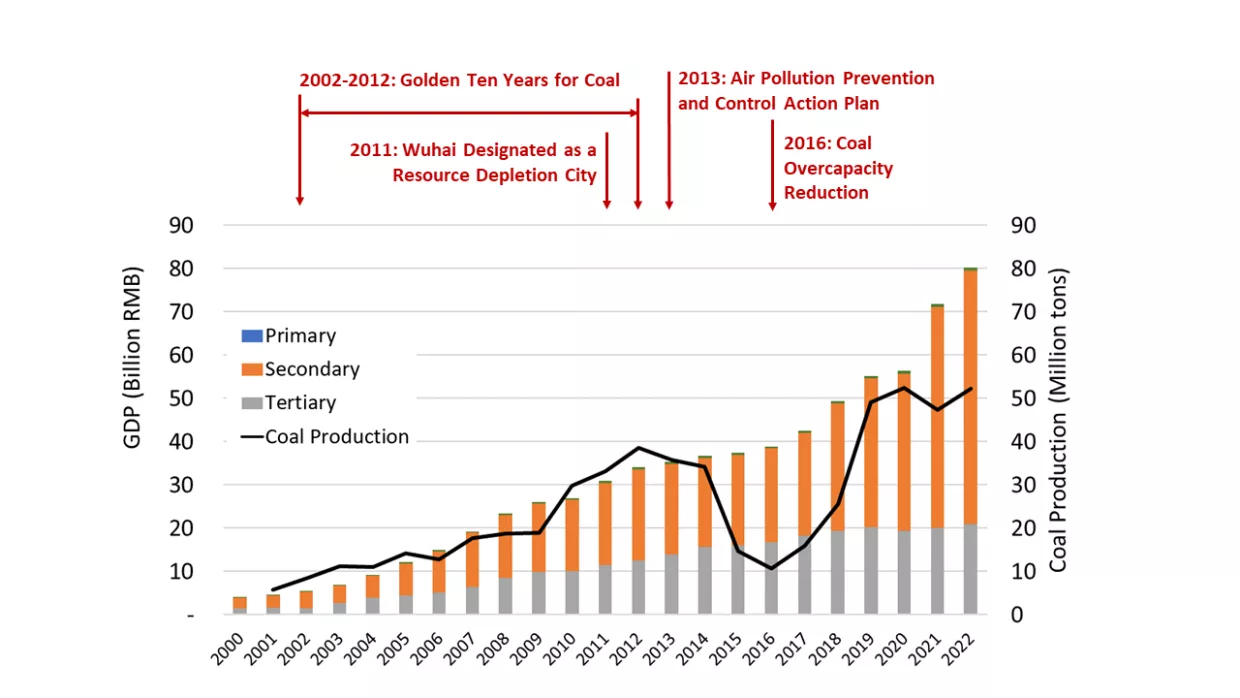

- Economy: Wuhai’s economy has grown rapidly over the past two decades; in that time, its GDP has increased about twentyfold. From the perspective of economic structure, the primary (extraction of raw materials – e.g. mining, fishing, and agriculture), secondary (production of finished goods - e.g. construction sector, manufacturing, and utilities), and tertiary (provision of intangible goods and services to consumers – e.g. retail, tourism, banking, entertainment, and I.T. services) accounted for 1%, 73%, and 26% of GDP in 2022, respectively. During the past two decades, the scale of the primary industry has not changed much, and economic growth was mainly driven by the secondary and tertiary industries. In recent years, the secondary industry has maintained rapid growth, and the output value of the tertiary industry has stabilized. Figure 3-1 below shows Wuhai’s GDP and its dependency on coal production. From 2000 to 2012, coal demand surged due to the need for steel production, cement production, and electricity to power economic growth. Coal production in that period increased from around 5 million tons to almost 40 million tons. As a result, the city’s GDP grew at double-digit rates. The relentless mining during the golden ten years of 2002 to 2012 resulted in severe air pollution and environmental damage to the land. In 2013, when the central government took measures to control air pollution, including the regulation of coal consumption, coal production in Wuhai plummeted and the GDP stayed stagnant between 2013 and 2016. Since 2016, as the central government took on the supply-side structural reform by reducing coal production capacity and concentrating production in a few provinces including Inner Mongolia, coal production in Wuhai has bounced back, as has the GDP. By the end of 2022, coal production had reached 55.25 million tons, close to the highest level in history, about 1.4 times that of 2012.

-

Energy: Wuhai’s economic development is reliant on energy-intensive and resource-based industries. As a result, its energy intensity index (energy consumption per unit of GDP) was 2.5 times the average of Inner Mongolia and 7.2 times the national average in 2020.20 Meanwhile, Wuhai’s energy consumption is still predominately based on coal while natural gas, renewables, and hydro have been increasing in recent years. In 2020, coal provided about 90% of the city’s primary energy consumption. Non-fossil-fuel energy provided 1.8% of the primary energy consumption in 2020 while the target for 2025 is 9%.21

In terms of electricity generation, the total installation capacity in 2021 was 4.5 GW, including about 3.9 GW of coal-fired power plants, 457 MW of solar PV, and 90 MW of hydro. The total electricity generation in 2021 was 21.7 TWh, 93.87% from coal-fired power plants, 3.21% from solar, and 2.92% from hydro. Wuhai also announced its hydrogen industry plan in 2020.22 Because hydrogen is a byproduct of the coke chemical and Chlor-alkali chemical industries, Wuhai is at an advantage when it comes to establishing the upstream production for the hydrogen supply chain.

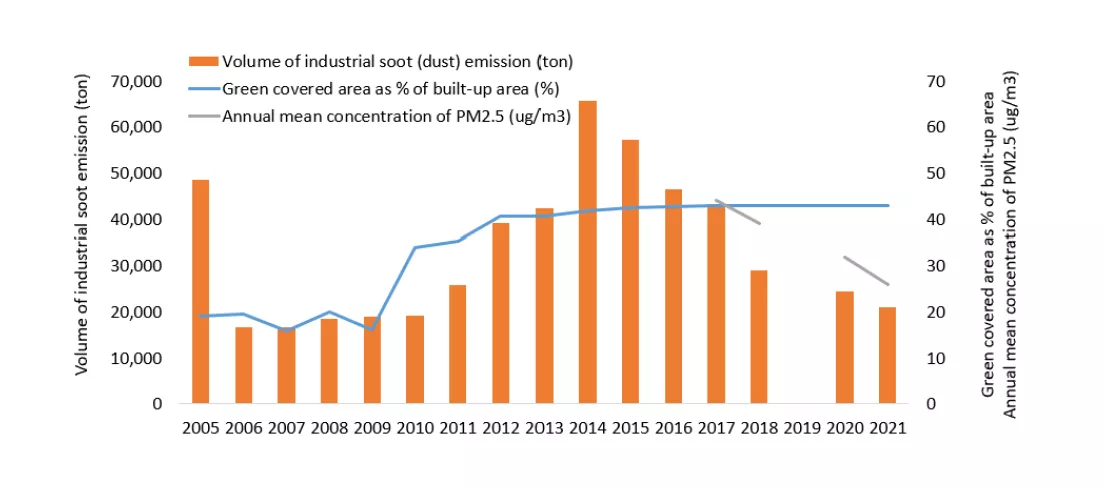

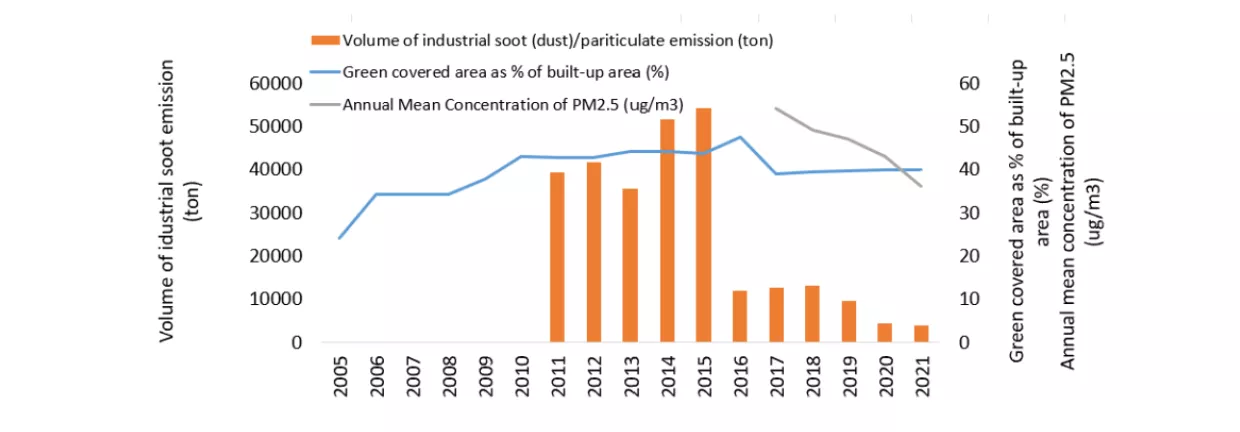

- Environment: Many years of mining and heavy industry development in Wuhai has led to severe air pollution and land damage. Since 2013, under the requirement and support of the central government, Wuhai has made significant environmental efforts in improving air, land, and green area coverage. Figure 3-2 below shows the environmental indicators. The PM2.5 level has decreased to 25 ug/m3 in 2022 from 40 ug/m3 in 2017. While it, is still much higher than the international standard, it is better than China’s average PM2.5 in 2022, which was 30 ug/m3. The green area coverage in built-up areas also doubled and reached the national standard of above 40%. Since 2014, industrial soot emissions have decreased rapidly, and the emission level in 2021 fell to a third of 2014 levels. During the “13th Five-Year Plan” period (2015-2020), the ecological restoration of mining areas was a policy focus, and mining enterprises invested more than 1 billion RMB to the restoration of 39 square kilometers.23

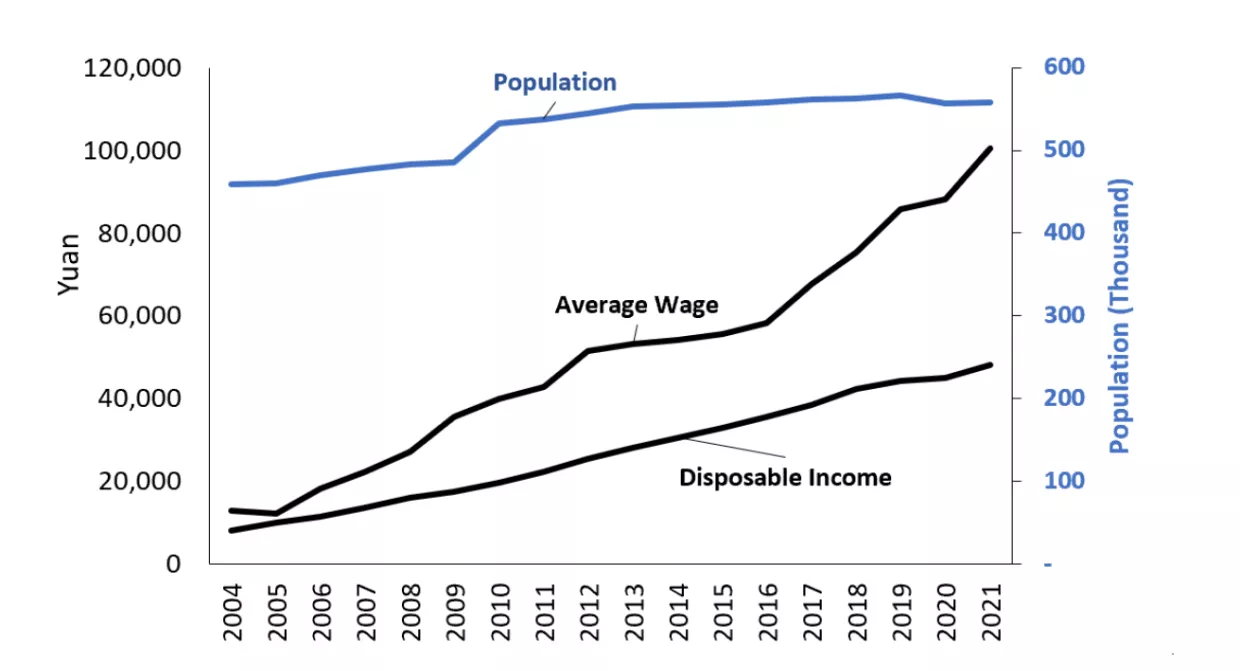

- Society: Between 2004 and 2021, the population gradually increased from around 450,000 to over 550,000. The average wage of urban workers in non-private units and disposable income also increased during that period. The continued growth during this time period indicates that the economic conditions for people in Wuhai have improved largely because of coal. As a prefecture-level city in western China, Wuhai’s population maintains a growth trend, and the income of residents is also higher than the national average, which reflects the city’s good employment and economic development.

3.2 Efforts to Address the Coal Worker Unemployment Issue

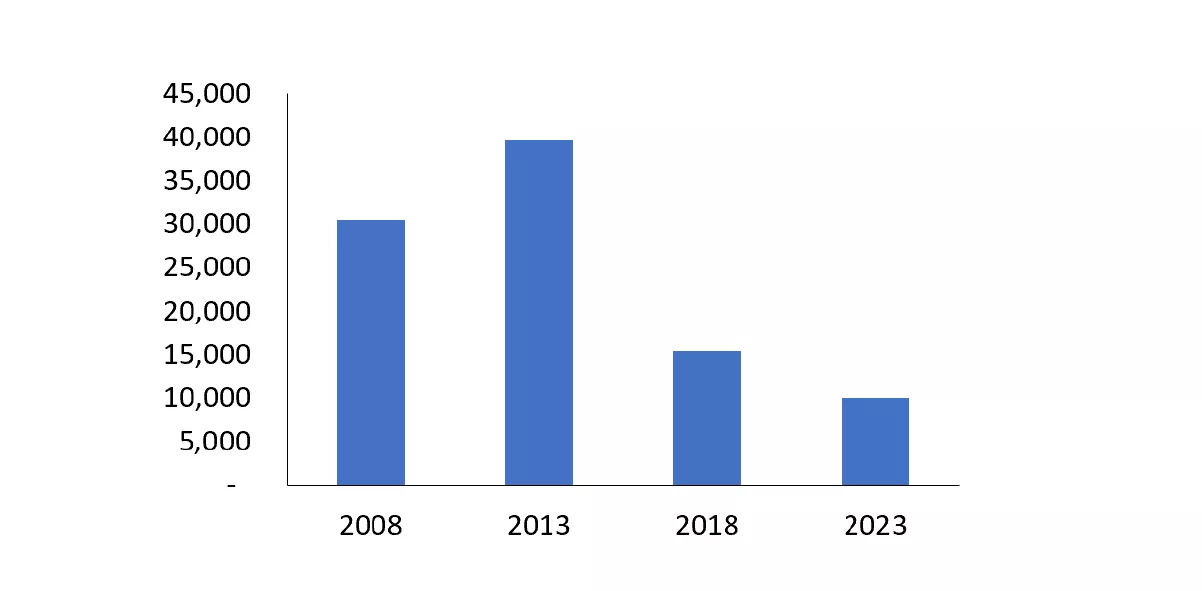

Because of efficiency improvement, economic slowdown, and government policies to reduce coal production capacity, total job employment in coal mining and dressing in Wuhai has decreased from about 40,000 in 2013 to about 10,000 in 2023, a 75% reduction.24 Coal mining and dressing employment as a percentage of total employment in the secondary and tertiary industries dropped from 24% in 2013 to 12% in 2018.25

As discussed in Section 1.2, in 2016, the central government called for a reduction in coal capacity across the country. Wuhai is among the regions required to reduce their coal mining capacity. From 2016 to 2020, Wuhai reduced 1.2 million tons of production. To address the coal worker unemployment issue, the central government worked with the provincial government and coal mining companies to ensure workers still had the economic resources to support their families. Those methods are discussed below.

- Support from the central government: At the central government level, the Ministry of Finance allocated funds to support the state-owned enterprises for the employees’ resettlement. The fund includes special transfer payments to state-owned enterprises (SOEs) and is used to cover benefits for employees who retire early, severance packages for the unemployed, delayed salary payment, etc. Out of the total funds, 80% is allocated based on factors such as the amount of production capacity reduction targets, the number of employees to be resettled, and the degree of difficulty (such as the fiscal status of the provincial governments). The remaining 20% is linked to the completion of the targets and will be allocated to those who exceed the target task amount. The fund is mainly targeted at employee settlement in state-owned enterprises but is allowed to be used for qualified non-SOEs at the discretion of the provincial governments.27

-

Measures taken by a state-owned coal mining company: Shenhua Wuhai Energy Company is one of the companies that received such funding. It is a subsidiary of Shenhua Energy, which is the largest coal producing company in China and owned by the central government directly. By 2016, the company had been losing money for five consecutive years. At that time the total loss had reached more than 9 billion RMB, with total liabilities of 21.628 billion RMB, an asset-liability ratio of 161%, and company-wide loans totaling 16.5 billion RMB. Employees’ wages had not been paid for four months.

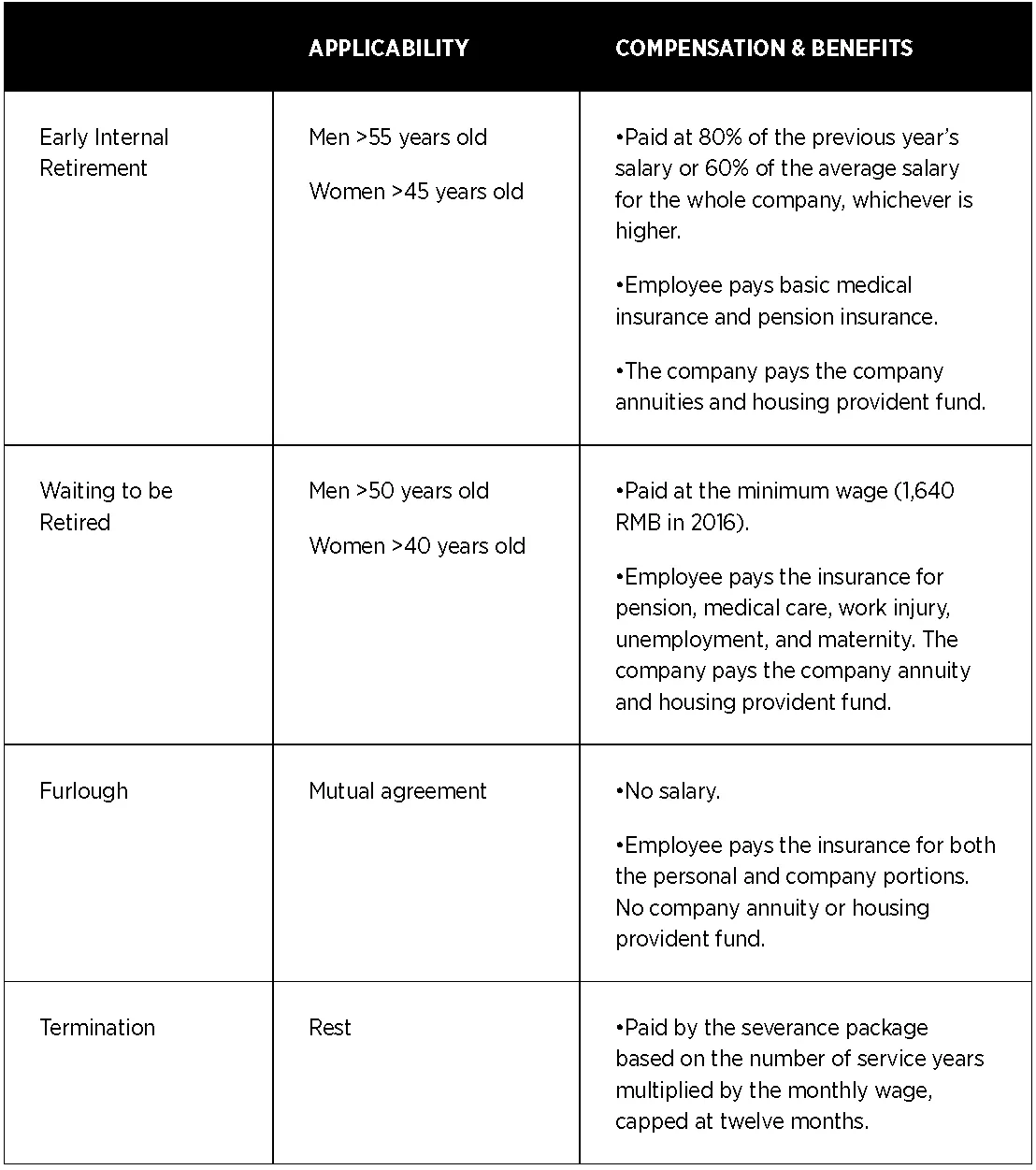

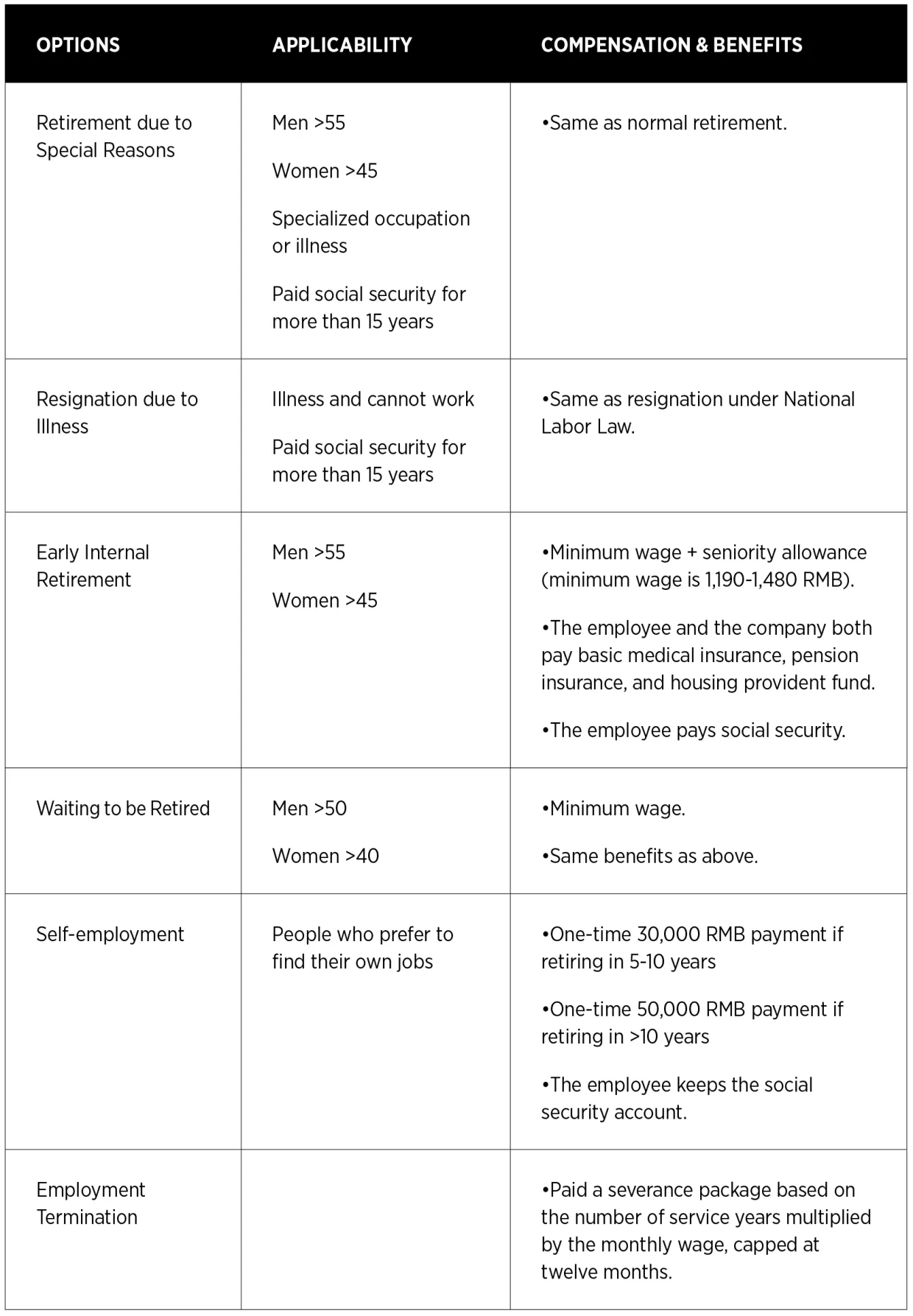

Shenhua had around 22,000 employees in 2016 before the resettlement; this number decreased by 13,500 to 8,500 following the resettlement, for a reduction of around 60%. With the funding allocated by the central government, some funds from the Inner Mongolia provincial government, and the company’s own financial support, Shenhua Wuhai Energy Company issued the resettlement policy for their employees shown in Table 3-1.28

In addition, other subsidiary companies of Shenhua Energy provided some job opportunities to Shenhua Wuhai Energy Company. Around 4,500 employees were transferred to a company separate from Shenhua to focus on coke production. Around 5,000 employees took the early internal retirement option. The remaining 4,000 people took one of the other options.29

- Measures taken by the city government: The city government took various measures to help the reemployment of coal workers, including (1) providing training for reemployment; (2) providing subsidies for enterprises with no or low layoffs; (3) providing the unemployed who want to start their own businesses with supporting policies and encouraging these individuals to join the incubator base; and (4) creating public interest job opportunities for those struggling to get reemployed.30

With these efforts from the central government, the state-owned companies, and the city government, the coal workers who worked at the state-owned coal mining companies were provided with adequate support to meet basic life needs. Some workers like the ones who took the early internal retirement option were even better off since they didn’t have to work but received only slightly lower compensations than before. As a result, unemployment didn’t cause social instability and no petitions were reported.31

However, not all coal workers who were unemployed in Wuhai during this time were given such options and benefits as the ones working for Shenhua. Coal workers who worked at privately owned coal mining companies faced unemployment without any severance package. This is because there was no formal long-term contract signed between the private companies and the coal workers, as was the case for state-owned companies. These coal workers also did not protest or file petitions against their companies because they did not expect the companies to solve the unemployment issue for them.32

3.3 Economic Diversification to Create Non-coal Jobs

3.3.1 Economic Diversification Strategies

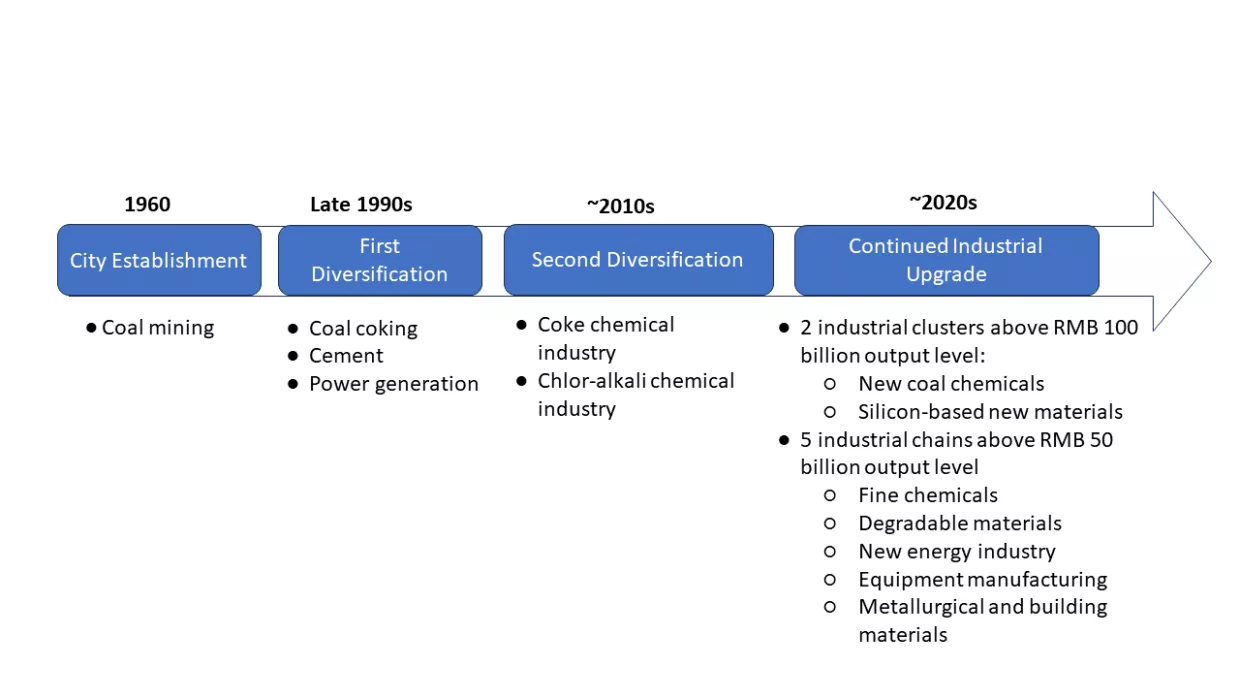

While the designation of Wuhai as a resource-depletion city by the central government required Wuhai to diversify away from coal mining, the city’s diversification efforts started in the late 1990s and still continue today. Figure 3-5 below summarizes the key industries Wuhai introduced to diversify its economy away from coal mining over the years.

- Late 1990s – Extension of Coal Mining to Energy-Intensive Industries Relying on Coal and Electricity: In the late 1990s, the price of coal was low and Wuhai had limited railroad transportation to export its coal to other regions, so the city faced a severe economic quandary. To reduce its reliance on coal exports, Wuhai started to promote the development of local industries that consume coal locally, such as coal coking for steel production, coal-fired power plants, and cement production. All these industries are energy-intensive and resulted in severe air and water pollution, but economic development took priority.

-

2010s – Further Extension to Coke Chemicals and Chlor-Alkali Chemical Industries: The coke chemical industry is a further extension of the coal mining-washing-coking supply chain in Wuhai and uses the waste products of the coking process, such as coal tar and coke oven gas, to make chemical products such as carbon materials and liquified natural gas.33 This circular industrial process enhances the economic value of the coking industry and the downstream chemical industries and helps to reduce the pollution associated with the coal tar and coal gas released in the coking process. Wuhai also has a competitive advantage in the chlor-alkali industry because it has abundant limestone, salt sources, and cheap electricity (as the result of cheap coal mined locally). These critical raw materials are used in the chlor-alkali industry to produce the basic chemicals needed to make downstream products for the agricultural, petrochemical, pharmaceutical, construction, and light chemical

industries.During this period, economic development still relied on energy-intensive and resource-based industries, and the secondary industry showed the characteristics of high energy consumption and low added value. By 2020, the six traditional industries altogether accounted for 96.6% of the added value of industrial enterprises above designated size, and 99% of the energy consumption of industrial enterprises above designated size. At the end of the “13th Five-Year Plan” period, the increase in energy consumption exceeded the control target of 3.2 million tons of coal equivalent, and the energy consumption per unit of GDP was 2.5 times the average level of the Inner Mongolia and 7.2 times the national average.34

-

2020s – Continued Upgrades to Strategic Emerging Industries: In more recent years, Wuhai continues to upgrade and deepen the development of the coke chemical and chlor-alkali industry to include strategic emerging industries that are high-tech, more intelligent, and green. It currently aims to build two industrial clusters at the 100-billion-RMB output level (“new coal chemicals” and “silicon-based new materials”) and five full industrial chain clusters at 10 billion RMB output (fine chemicals, metallurgical building materials, equipment manufacturing, new energy, and degradable materials).35,36 The goal for the total GDP contribution for these industries is 400 billion RMB by 2025, seven times that of the total GDP contribution from the industrial sectors in 2022.37

In addition to the industrial sectors, Wuhai is investing heavily in its agriculture and tourism industries by leveraging its natural and cultural resources. As part of the Haibo Bay water conservancy project completed in 2014, Wuhai now has an artificial lake that has improved the climate and ecosystem and completely changed its natural landscape. The surrounding deserts have become the site of desert races and sand games. Thanks to supportive government policies, the city’s wine industry, which once had almost no economic value, now employs more than 10,000 people, and four Wuhai companies produce multiple wine brands sold in China and other countries.38 In 2018, Wuhai received visits from 3.5 million people, and tourism revenue reached RMB 7.6 billion (about USD $1.1 billion), a 17.5% growth from 2017.39

3.3.2 Strategy Implementation

To implement their strategies and attract investments from private companies in the identified industries, Wuhai’s government made the following efforts:

Constructed four industrial parks to remove infrastructure barriers. In the late 1990s, when Wuhai’s limited railroad infrastructure made it difficult to export coal to other regions, the economically struggling city decided to develop high energy-intensive industries as a way to diversify its economy away from a reliance on coal mining. While the city had a competitive advantage thanks to the cheap electricity produced from coal, there was a “chicken-or-egg” issue. The city lacked the developed infrastructure the new industries needed for manufacturing, such as water, electricity, transportation, and telecommunication. By building the four industrial parks, the city was able to quickly address this specific infrastructure problem without having to develop infrastructure for the entire city.

Proactively engaged investors and private companies in new industries. Rather than waiting for new industries to come to Wuhai, the city proactively sourced companies in each targeted industry. They first conducted due diligence to identify the regions with the targeted industries, and then reached out to the chamber of commerce in each identified region and organized visits. They also worked with industrial trade associations such as China Petro-chemical Industry Federation and asked these groups for their help in identifying and introducing potential companies. Further, the city partnered with local governments from other regions to hold investment promotion conferences. At these events, reciprocal policies, incentives, planning, and industrial foundations were introduced to attract investments from the targeted companies.40 In the first seven months alone, Wuhai attracted 12.6 billion RMB investment and signed contracts with 62 projects worth a total of 134 billion RMB.41

Closely partnered with the companies to help the settlement and attract more companies. To help the new companies settle in the industrial parks, the government assigned a management committee to each park. The responsibilities of the management committees include planning and development of infrastructure, planning the industrial development, providing all administrative services to the companies, and coordinating the work of different government departments in the industrial parks. The management committees removed the burden of dealing with complicated administrative processes from the companies, and took care of any issues and barriers the companies may have encountered as they got settled. This arrangement created a trusting, collaborative relationship between the government and the companies. More importantly, once the companies were settled and enjoying services and support from the Wuhai government, they shared their experiences with other companies in their home regions, who later followed them to Wuhai. These word-of-mouth endorsements have proven very effective in bringing more companies to Wuhai, and have helped the city become a hub for fine chemical industry with an impressive product range.42

3.3.3 Evaluation on Just Transition and Conclusion

Today, Wuhai has emerged as an important coke chemical and chlor-alkali chemical industry base with a deep processing capacity of 900,000 tons of coal tar each year and a PVC deep processing capacity of 200,000 tons per year as of 2018.43 Wuhai City has been further upgraded to a fine chemical center and is the production base of about 130 kinds of fine chemical products. The fine chemical industry’s GDP accounts for 9.5% of the industrial sectors’ GDP above designated size.44,45 Strategic emerging industries contribute about 10% of industrial GDP, and Wuhai has attracted well-known enterprises to invest and build factories.46

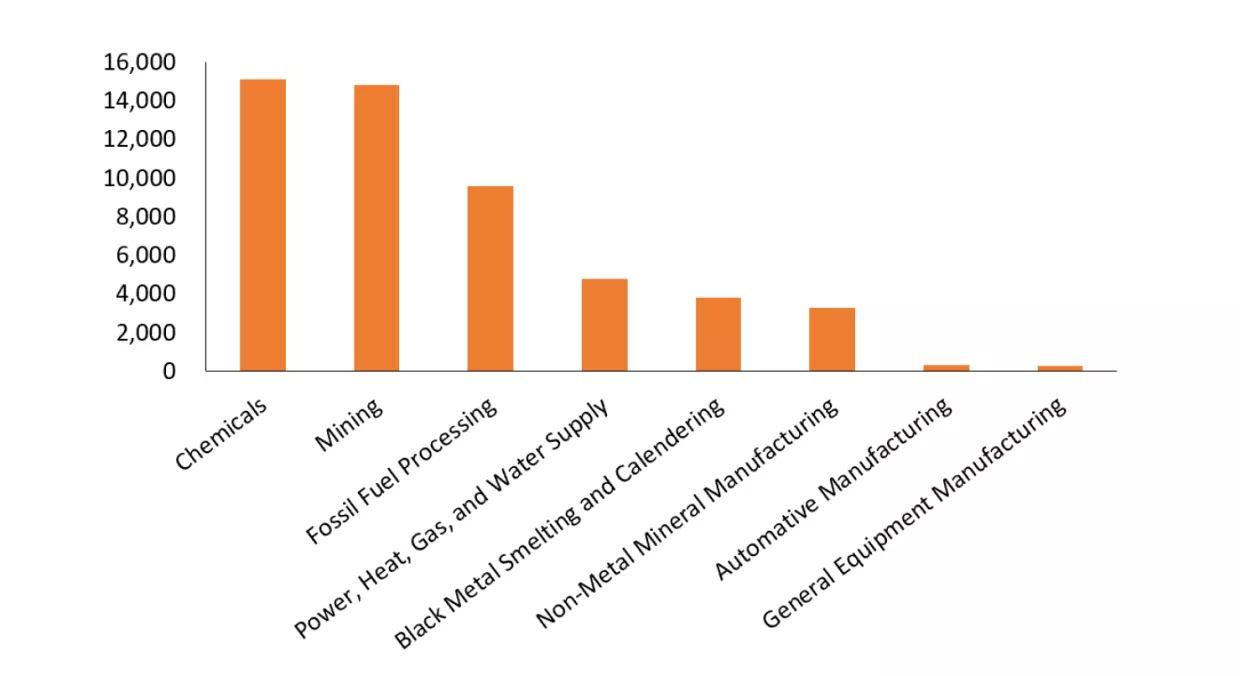

The aforementioned diversification efforts have had a positive impact on job creation. As seen in the following charts, the current job employment in the chemical industry exceeds the job employment in the coal mining industry, reaching 15,000 as of 2020.

While the economic and job employment impacts of the new industries are still not sufficient to replace coal mining, Wuhai’s economic diversification efforts show promising results. These results are driven by the city’s identification of new industries based on its competitive advantages and its strong, consistent, and continued efforts to implement the strategies. These achievements are benefited from the following efforts:

- Establishing new industries based on regional competitive advantage. Wuhai identified and attracted the coal coke chemical and chlor-alkali chemical industries based on its competitive advantages of abundant coking coal, low power and energy costs, and sufficient limestone resources, which in turn will bring a price competitive advantage to these two industries. In particular, the raw materials used in the downstream products of coal and coke chemical industry are by-products after coking, which not only reduces the raw material cost, but also improves the comprehensive utilization of resources and increases added value of the coal and coke process.

- Consistency of policies for industrial extension and upgrading. The non-mining industries developed by Wuhai in the past 20 years are mainly concentrated in the chemical industry, including the established coal coke chemical industry and chlor-alkali chemical industry, as well as the fine chemical industry, silicon chemical industry, etc. Later, industrial upgrading extended to the field of new energy and new materials, but it is still connected to chemical industries. Such policy consistency has enabled Wuhai to form a scale effect for new industries, and then form a competitive advantage. This is invaluable in an environment with a long time span and a constantly changing domestic and international situation.

- Creation of a good business environment to attract investment. By forming cooperative relationships with enterprises and endeavoring to help them solve problems, the municipal government of Wuhai earned a positive reputation among the enterprises which helped attract other enterprises to settle in Wuhai.

At the same time, Wuhai has also encountered challenges in the process of economic diversification. These challenges include:

- Fierce competition with the surrounding local government. In terms of resource endowment, Wuhai is similar to the surrounding areas, so investment decisions often depend on the preferential policies that local government can give to enterprises. This kind of competition makes attracting investments.

- Difficulties attracting talent. Located in the remote northwest China, it is difficult for Wuhai City to attract high-tech talent for new industry development. In particular, industrial parks for new industries are far away from the city and have no recreational and entertainment facilities, making it difficult to recruit talent even with high salaries. Therefore, industrial parks need to be supported by living, educational, medical and other facilities.

- Constraints on water and land resources. Wuhai City is in an arid area where water resources per capita are less than 20% of the national average. However, water resources are important for the chemical industry. The lack of water resources limits the potential to develop the chemical industry. At the same time, although Wuhai has many sunny days annually, it does not have a lot of land that can be used to develop solar power, which in turn restricts the development of low-carbon manufacturing industries.

- Coal-dependent energy consumption and heavy industry-dependent industrial structure. By the end of 2021, the city’s enterprises had produced a total of 46.56 million tons of raw coal,47 while the consumption of raw coal was as high as 75.99 million tons.48 The transformation of Wuhai City still follows the pathway of industry extension to coal resources and chemicals, and the efforts to extend the economic structure to emerging industries are only just beginning. The city will face huge challenges as China moves toward a low-carbon economy.

4. Case Study 2: Tongchuan, Shaanxi

4.1. Overview

Tongchuan City is located in central Shaanxi province, with a total area of 3,882 square kilometers. The city’s coal mining area is about 1,300 square kilometers, accounting for 33.4% of the city’s area. In 2020, the city’s resident population was 698,000. Tongchuan City is a typical resource-based city. Its residents have been mining coal in the mountains or underground since the Tang and Song dynasties more than one thousand years ago. After the founding of the People’s Republic of China in 1949, Tongchuan was positioned by the new national government as an important energy and building materials base, producing coal and cement in the northwest; it was later designated as a city in 1958. In 2009, Tongchuan was selected in the second batch of resource-exhausted cities, and in 2013, it was identified as one of cities in the Adjustment and Transformation of the Old Industrial Base in China. Since then, the economic transformation away from coal has become the main line of Tongchuan’s economic and social development.

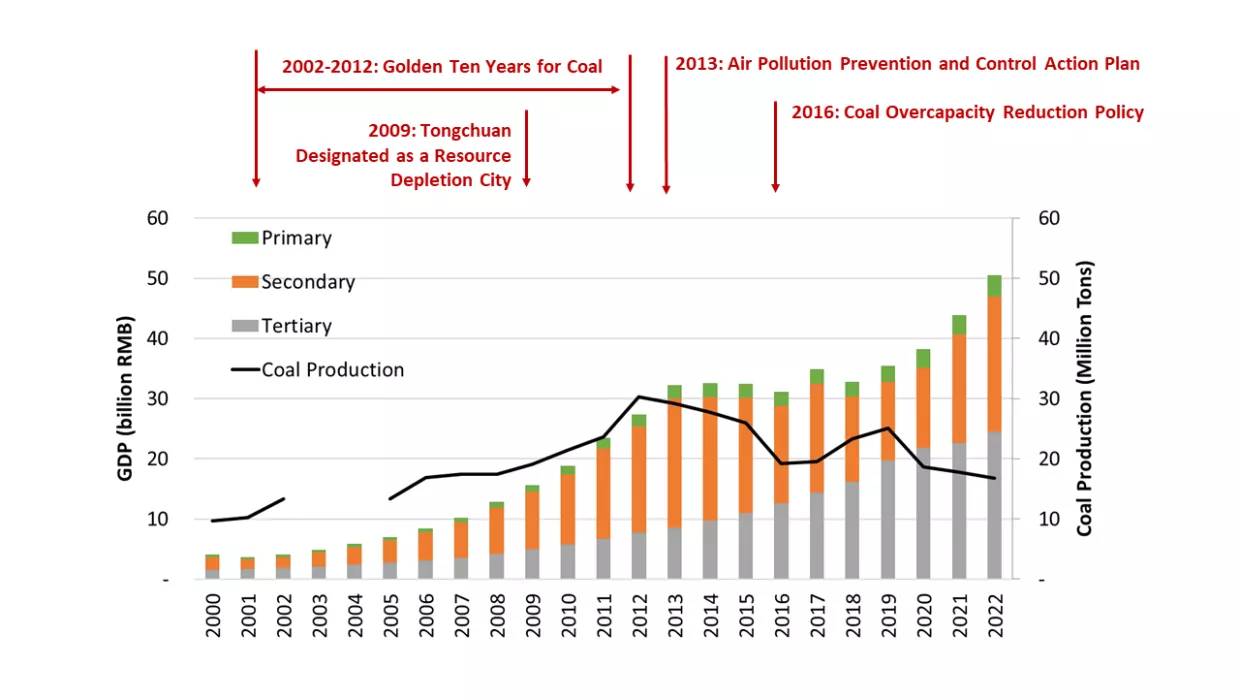

Economy: Figure 4-1 shows Tongchuan’s GDP and coal production over the past two decades. Similar to the situation in Wuhai, the output of coal in Tongchuan rose from 2000 to 2012, reaching a peak in 2012 at around 30 million tons. After 12 years of economic growth, in 2013 coal production in Tongchuan began to steadily decrease (other than a short increase from 2018 and 2019) due to requirements from the government in 2013 to reduce coal consumption to address the air pollution issue. A 2016 overcapacity reduction policy followed, further contributing to the decrease in coal production. GDP stayed stagnant from 2013 to 2018 as coal production decreased. But from 2019 to 2022, the GDP rapidly picked up even though coal production kept declining, an upturn largely attributed to the tertiary industry, mainly the real estate sector. By 2022, Tongchuan’s coal production had fallen to 55% of 2012 levels.

- Energy: Energy consumption in Tongchuan is predominantly based on coal, but natural gas and renewables are increasing rapidly. Non-fossil fuel energy provided 9.4% of the energy consumption in 2021. The industrial sector consumed 82% of the energy, which includes the energy-intensive industries, such as cement production, aluminum production, and coal-fired power plants.49 Similarly, the energy supply in Tongchuan is predominantly from coal, but renewables have rapidly increased in recent years. The total installed capacity for coal-fired power plants is 2,600 MW, with 1,900 MW connected to the grid and in operation as of 2022. Non-fossil fuel power plant capacity in 2022 is around 1,000 MW, including 169 MW wind, 833 MW solar, and 420 MW hydro. The total generation increased from 6.5 TWh in 2012 to 10.6 TWh in 2021. Renewables and hydro generation increased from 0 in 2021 to 14.4 TWh in 2021, 11.6% of the total generation. Crude oil production increased from 0 in 2021 to 39,200 tons in 2021.50 For the 14th Five Year Plan period, the target for non-fossil energy consumption is 15% in 2025.

- Environment: Like other resource-based cities, Tongchuan’s industrial and economic development came at the expense of environmental pollution and damage. Tongchuan was once called “the city invisible on satellites” due to severe dust and soot pollution from cement production. Large-scale coal mining activities led to 267 square kilometers of goaf and subsidence areas. Around 2009 there were 46,000 households and 130,000 people living in shanty towns and subsidence and landslide areas in the city.51 As part of its efforts to solve the environmental issues befalling resource-based cities, since 2001 the central government has been providing significant financial support to Tongchuan. As a result, Tongchuan’s environmental condition has significantly improved, as indicated by the reduction in particulate matter and industrial soot emissions and increases in green space. As shown in Figure 4-2, PM2.5 has dropped from nearly 55 ug/m3 in 2017 to 36 ug/m3 in 2021, still a little higher than the national average. Industrial dust emissions decreased by two-thirds from 2016. Meanwhile, green coverage in built-up areas has remained steady at 40%.

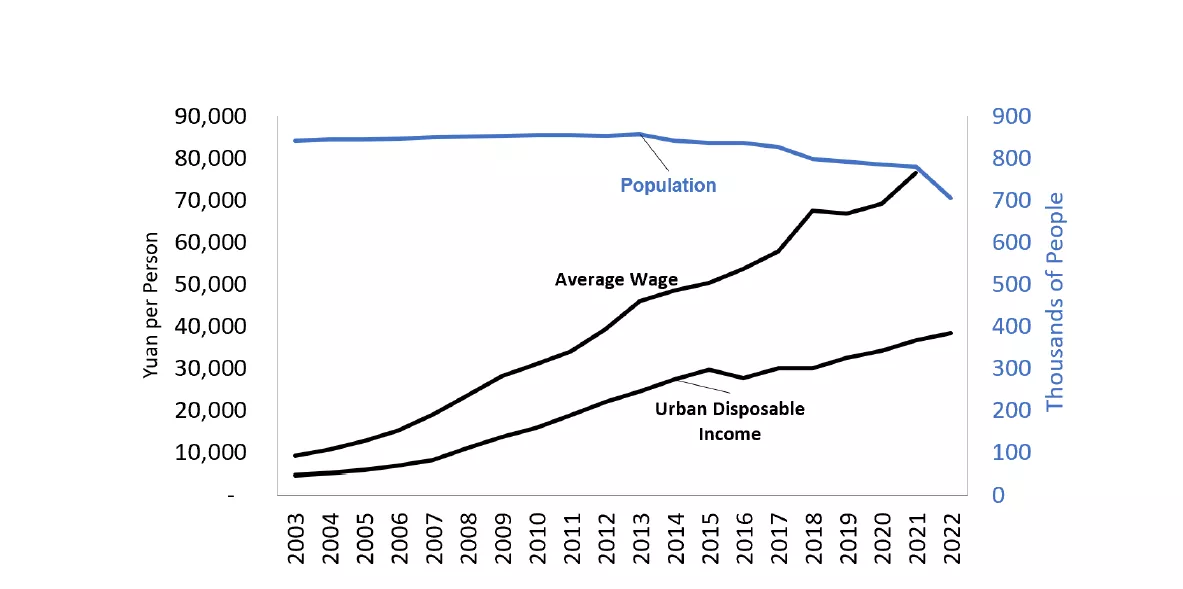

- Society: The population in Tongchuan has been declining over the past ten years or so from around 800,000 before 2012 to around 705,000 in 2022 because of reduced coal production. As a result of the growing GDP, the GDP per capita also has been increasing. The average disposable income per person increased from 5,000 RMB in 2003 to 30,000 RMB in 2015. In 2016, Tongchuan closed 21 coal mines, equivalent to more than one third of production capacity in Shaanxi province. The impact on disposable income also can be seen in Figure 4-3.

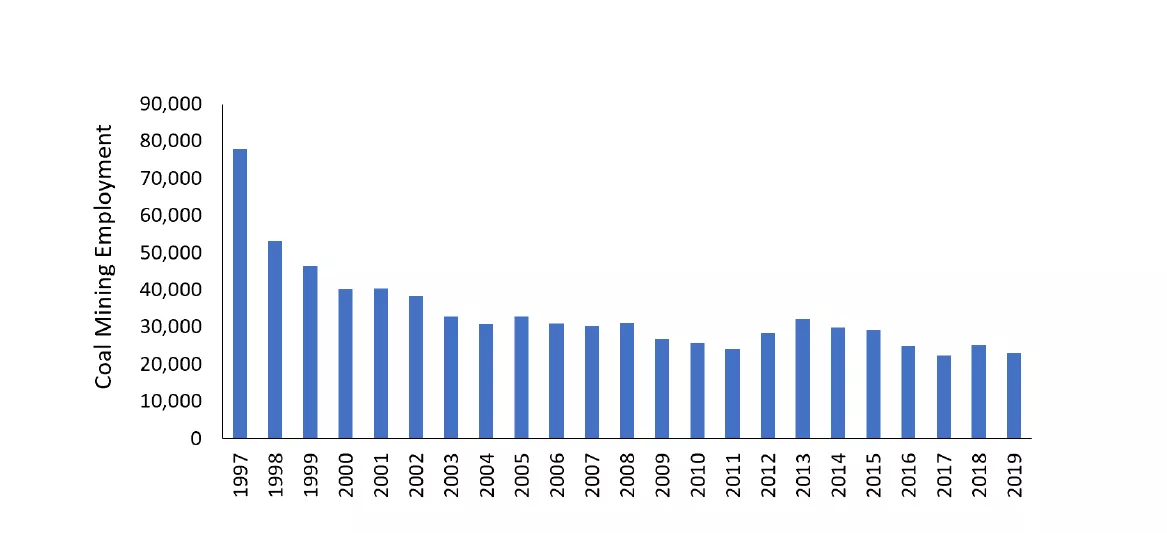

4.2 Efforts to Address the Coal Worker Unemployment Issue

Coal mining employment in Tongchuan has seen an overall decrease over the past 20 to 25 years due to efficiency improvements, economic slowdowns, and government policies. In the late 1990s, Tongchuan’s coal mining employment was between 45,000 and 78,000. At that time, coal mining workers and their families numbered more than 200,000, accounting for a quarter of the city’s population. But by 2019, coal mining employment had dropped to around 23,000, about a 70% reduction from 1997 and a 30% reduction from 2013.

In 2016, under the national policy to reduce coal overcapacity, Tongchuan closed 21 local coal mines with a total of 10.58 million tons of coal, which accounted for 36.5% of the closed coal mine capacity in Shaanxi province that year. These closures had a significant impact on Tongchuan’s GDP and the coal mining workers. Tongchuan Mining Company, the largest state-owned coal mine in Tongchuan, laid off 70% of its employees—more than 13,000 people. Multiple factors made finding new employment challenging for these workers. The coal mines were far away from the city, and the job market around each coal mining area was small. Employees tended to be less educated, older, and highly dependent on the state-owned enterprise. And their traditional, conservative mindsets meant they were less likely to embrace change and lacked the ability and enthusiasm to start a new business.

To address these challenges, the central government, the city government, and the state-owned coal mining company took a series of steps to help the coal mining workers’ resettlement.

- Support from the central government: The Ministry of Finance’s policy with dedicated funds for coal worker resettlement, as mentioned in the section on Wuhai, is applicable to Tongchuan as well.

- Measures taken by the state-owned mining company: Similar to Wuhai, under the guidance of the central government, Tongchuan provided different options for people depending on their age or preferences, as shown in Table 4-1. Costs were covered with the allocated funding from the central government, support from the provincial government, and the company’s own financial resources. In addition, the company launched several initiatives aimed at helping the employees find new jobs, including (1) establishing a coal mine management company and cooperating with companies in areas rich in coal resources to provide technical services for coal production safety, railway operations, and project contracting; (2) investing in subsidiaries under the parent company in non-coal industries such as life science, new energy and new industries, tourism, and agriculture; and (3) building a job transfer and employment platform in close collaboration with the provincial and city governments.52

- Measures taken by the city government: The city government sought ways to provide job opportunities for the unemployed coal workers and other people in the community, including: (1) improving the job information sharing system; (2) improving the government employment service system to better serve the public, including organizational setup, policy support, financial support, entrepreneurship training, and entrepreneurship services; (3) strengthening cooperation between Jiangsu and Shaanxi to encourage the transfer of migrant workers to cities with labor shortages in Jiangsu; (4) optimizing the entrepreneurial environment and promoting entrepreneurship as an employment avenue by providing guaranteed loans and improving loan application procedures; (5) providing reemployment training within new industries; and (6) providing job market platforms for finding temporary work.

Through the support and efforts of the central government, the local government, and the company, most of the 13,000 coal mining workers at risk of unemployment were able to keep their livelihoods thanks to either the compensation and benefits provided to them or alternative job opportunities.

4.3 Economic Diversification to Create Non-coal Jobs

4.3.1 Economy Diversification Strategies

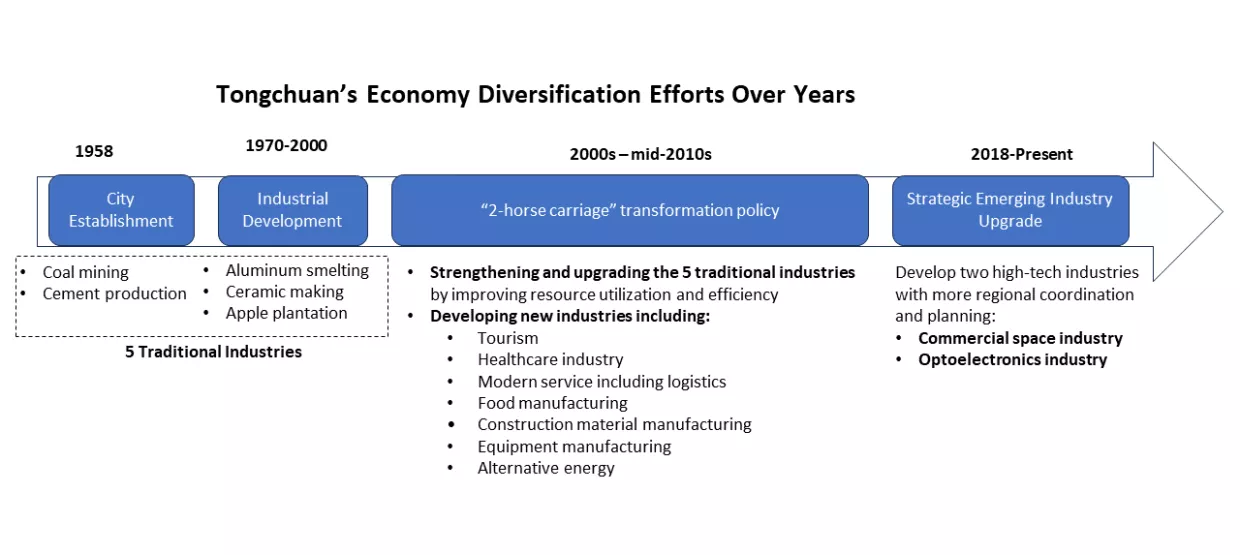

The founding of Tongchuan was made possible thanks to its two pillar industries: coal mining and cement production. Over the years, aluminum smelting, ceramic manufacturing, and apple growing also became traditional industries in the city. However, in the late 1990s, after many years of mining activities, Tongchuan’s coal industry faced severe challenges as coal prices fell and the companies sustained economic losses. Tongchuan started to explore other ways to develop its economy. Later, as coal resources were depleted and the pollution issue became severe, the pressure to move away from coal intensified, driving more efforts for diversification. The resulting path taken is summarized in the Figure 4-5.

-

2000s - mid-2010s: Two-horse carriage policy. Tongchuan has identified two parallel paths—the so-called “two-horse carriage”—to address its economic challenges and drive economic growth while addressing the land damage caused by relentless mining in the past:53,54,55

Strengthen and expand five traditional industries. During this period, Tongchuan attracted investments for big projects focused on coal-fired power plants, energy efficiency technology improvements of its aluminum smelting process, and cement production. In an effort to improve the utilization rate of its resources, the city experimented with using methane and heat waste from the cement process for power generation and explored alternative sources of energy, such as shale oil. The city also developed a fruit plantation base for apples, cherries, and peaches, as well as for walnuts and peppercorns.

Develop new industries that cause less environmental damage and are less reliant on resources. These industries include Chinese medicine, tourism, food production, and equipment manufacturing. The city secured an investment from Wangwang food company, a leading company with wide brand recognition in the national food market, to build a manufacturing facility. By leveraging Tongchuan’s long history, the city is now home to a burgeoning tourism industry. Tongchuan is where Medicine King Simiao Sun resided during the Sui and Tang dynasties and where the famous monk Xuanzang Tang translated Buddhist scriptures from India more than 1,500 years ago.

- 2018-present: Strategic emerging industry upgrade with more regional coordination. In recent years, while continuing to implement the two-horse carriage policy, Tongchuan has initiated the development of two strategic emerging industries: the commercial space industry and the optoelectronics industry.56,57 Both industries require advanced technologies, yet Tongchuan lacks competitive advantages for these technologies compared to other developed cities. However, Tongchuan is strategically taking part in the regional planning of Shaanxi province, which has traditionally been a hub for the country’s aerospace industry. The provincial capital Xi’an is home to many elite universities that can provide an innovation and talent pipeline to these two industries. By being part of Shaanxi’s plan, Tongchuan can leverage its technology, human resources, and industry assets to develop these two emerging industries.

4.3.2 Strategy Implementation Efforts

Tongchuan has made great progress on policy implementation, which has similar elements to the policy in Wuhai:

- Construct industrial parks. In order to develop new industries, Tongchuan’s city government built eight industrial parks to attract investments for large projects hosted by these parks. The Dongjiahe industrial park is one example of the circular economy in the aluminum industry. The park hosts 55 companies along the chain of coal – electricity - aluminum smelting – deep processing of aluminum - aluminum products. Currently it has an aluminum smelting capacity of 300,000 tons and produces different automotive parts made of aluminum, such as wheels, axles, and brake pads, with a total output value of 15 billion RMB.58 The park plans to extend to renewable aluminum, which uses recycled waste aluminum to produce aluminum as a way to reduce the carbon emissions of aluminum production.

- Proactively engage private companies to invest in Tongchuan. To attract investment in these industries, the city government organized close to 40 conferences to promote Tongchuan and invited 300 groups of potential business owners to visit between 2009 and 2013. Contracts or agreements for more than 700 projects were signed during that period, with investments totaling 211 billion RMB. Some of the companies represented in these deals include Taiwan’s Wangwang Company in food manufacturing, Xi’an Heavy Equipment and Daqin Aluminum Industry for equipment manufacturing, and Fenghe and Fangzhou for pre-processed Chinese medicine.59

- Closely partner with companies to facilitate settlement and operation. Similar to Wuhai, Tongchuan also formed management committees to provide needed services to the new companies, reduce their administrative burden, and brainstorm with them on additional new industries the industrial parks could attract.

- Introduce funds and projects through inter-governmental cooperation between Jiangsu and Shaanxi. Jiangsu and Shaanxi are partners under the central government’s East-West Targeted Assistance Framework. Under this framework, Tongchuan City actively introduces strong enterprises from Jiangsu and promotes regional industrial clusters to extend and supplement the chain. By 2021, 10 cooperation projects have been completed, including Damei Wheel Hub, Yijun Tianxing Photovoltaic, and Shaanxi Qinjiu Cultural Exhibition Center among others, with annual investment of 270 million RMB and 123 rural laborers absorbed. Damei, the largest joint venture between Jiangsu and Shaanxi, has an annual output of 6 million automobile wheels, filling the gap in aluminum alloy wheel products in Shaanxi Province. In addition, Jiangsu has also become a sales market for Tongchuan agricultural products.60

4.3.3 Evaluation of Just Transition and Conclusion

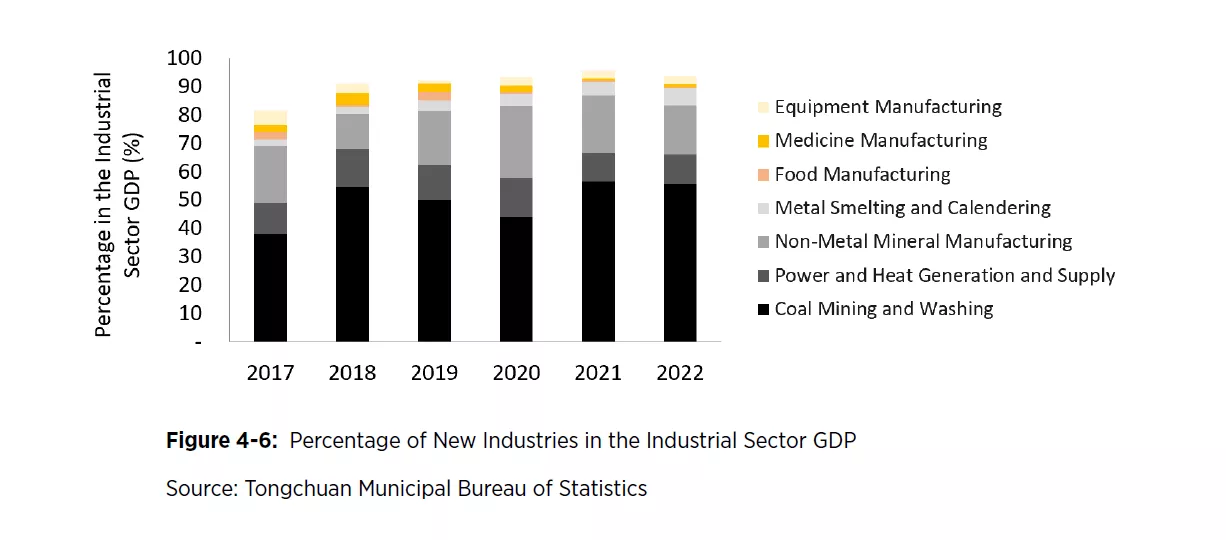

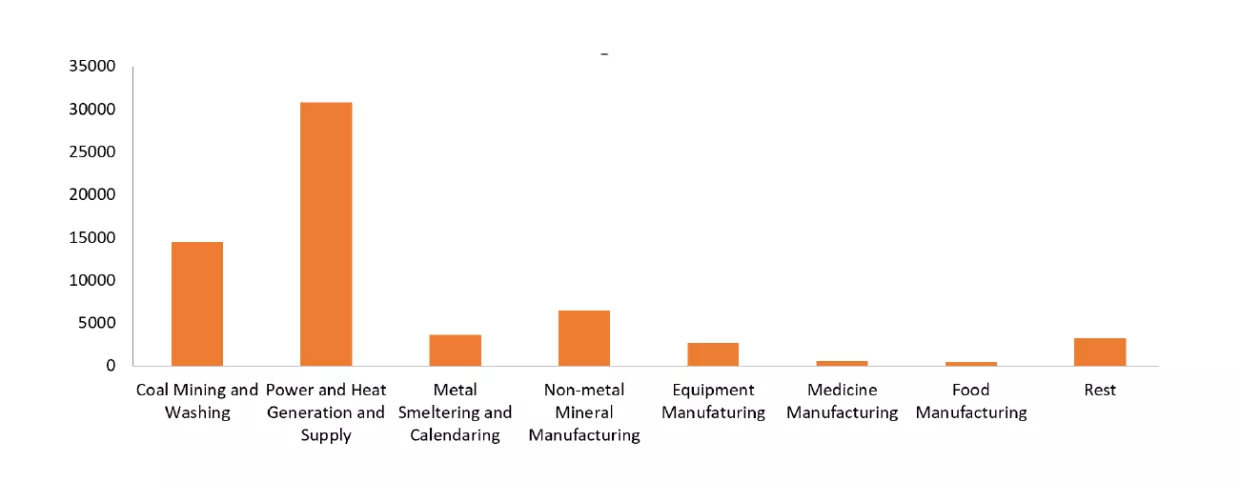

Figures 4-6 and 4-7 show the results of years of economic diversification efforts for the city of Tongchuan’s industrial sector. Traditional industries, including coal mining and dressing, cement, aluminum, and power generation, still contribute most of the industrial GDP at around 90%. The three new industries that Tongchuan has been developing—food manufacturing, equipment manufacturing, and medicine manufacturing—in total contributed to around 5% of the industrial sector above designated size. These industries have not yet generated many job opportunities. In 2021, total employment in these three industries was 3,800.

In comparison with Wuhai, Tongchuan’s economic diversification efforts so far have produced less of an impact on the economy and job opportunities. Potential reasons for this disparity may include:

- The lack of focused and consistent policies to support new industry development. Tongchuan identified around ten new industries to develop, as compared to two industries in Wuhai. An overly ambitious goal may have created distractions and led to an inability to provide the resources needed to make any new industry successful. Further, targeting too many industries also created the potential for inconsistent support over time, due to changes in the city government’s leadership. Ultimately, none of the new industries received enough sustained support to reach the desired scale.

- The lack of strong competitive advantages for developing new industries. For example, Tongchuan identified the bio-pharmaceutical industry as a potential new industry. However, this industry requires highly educated workers with specialized pharmaceutical knowledge that Tongchuan does not have. It is unclear what competitive advantage Tongchuan has to develop the bio-pharmaceutical industry.

- Limited efforts to extend upstream and downstream products to form the industrial cluster and scale. Food manufacturing is one such example. Tongchuan was able to attract investments from one of the industry leaders, Wangwang. However, this win did not create spillover effects for the city, such as broadening upstream or downstream product manufacturing. In comparison, after establishing the coke chemical and chlori-alkali chemical industries, Wuhai was able to build on these successes and expand to fine chemical industries.

5. Conclusions and Policy Recommendations

5.1 Conclusions

Based on our research on the just transition of two coal cities, Wuhai and Tongchuan, we draw the following conclusions:

- The two case studies indicate that even though “just transition” is a term that originated in the United States and has not been widely used in China in the past, this type of approach has been a key consideration for the central government in the policymaking and implementation of the coal transition. Recognizing the difficulty in moving away from coal and the challenges faced by coal regions and coal workers, the central government in China has allocated billions of dollars of special funds toward covering the basic living expenses of coal workers and created job training and other programs customized to meet the needs of coal workers based on their age, education, and other characteristics. In the state-owned enterprises, these supports and measures have proven effective at helping ensure a just transition for coal workers and have been well received by society. On the other hand, within the private companies, a just transition for coal workers is a concept that seems to have received relatively little attention.

- In addition to providing compensation for individual coal workers, China’s approach emphasizes economic diversification with strong industrial policies to drive economic growth and create non-coal mining job opportunities. Both cities we studied have achieved some successes in this regard. Wuhai has become an important hub for coke chemical and chlori-alkali chemical industries in China and is extending its reach to the fine chemical, biodegradable BDO material, and organic silicon industries. The strategic emerging industries contributed 10% of the city’s industrial GDP in 2020 and its chemical manufacturing industry today employs more employees than coal mining. Similarly, Tongchuan’s strategic emerging industries contributed 13.5% of the city’s industrial GDP in 2020.

- China’s city governments demonstrate great leadership and entrepreneurship and play a crucial role in developing diversified economy for coal cities. We propose the following framework for coal regions in China and the rest of the world to consider as they develop new industries and transition to a clean energy future:

- Strategic Planning: It is critical to identify new industries by strategically assessing the competitive advantages of the regions. As shown in Wuhai’s and Tongchuan’s cases, developing new industries is challenging and requires a great deal of resources, effort, and time. Without clear competitive advantages, attracting new investments will be hard, and even when some initial investments are made, to reaching the scale needed to have a substantial economic and employment impact will be difficult.

- Effective Implementing: To attract investment from targeted new industries, the government should be proactive in engaging private sectors, providing the right incentives, eliminating barriers, and addressing the specific needs of companies. The construction of industrial parks and the formation of management committees in both cities provide references for effective ways to attract new industries.

- Continued Upgrading: For a new industry to scale up and become a pillar industry that replace coal, prior efforts must be continuously expanded and upgraded. In this regard, Wuhai’s case demonstrates that gaining the trust and confidence of the new companies so that they can promote the region to other companies in their industries and networks can be a very effective way to attract new companies and investments.

The challenges faced by coal regions in China will likely only grow as they continue on the path to decarbonization. Coal cities in China are mostly relying on new energy-intensive industries that are carbon-intensive. Wuhai and Tongchuan chose different paths for their urban transformations. Wuhai chose to develop the coke chemical and chlor-alkali chemical industries, and further extended and upgraded the industrial chain for silicon chemical industry, fine chemical industry, new energy and other strategic emerging industries. Tongchuan, in contrast, has relied on the energy advantages of coal and electricity to develop energy-consuming industries such as aluminum and building materials as well as light industry and high-tech industry. Tongchuan also tapped new resources such as its history and culture, its ecological landscape, and Chinese medicine.

5.2 Policy Recommendations

Given the size of the coal industry, the scale of potential unemployment, the number of regions affected, and the relatively short window of time for transition, China’s coal regions are likely to face greater challenges on the path to decarbonization than other countries. Based on the two cities’ experience ensuring a just transition, we provide the following policy recommendations to governments to address the challenges faced by coal regions as they pursue a clean energy transition:

The central government should develop customized schedules for each coal mining region, to allow more time for regions to consider the unique challenges they confront. This gives the coal mining regions adequate time to develop new industries and address unemployment issues without affecting the overall timetable for reaching decarbonization goals.

The central government should consider more diversified policy tools to provide the financial support needed for coal regions’ just transition. While Wuhai’s and Tongchuan’s experiences show that the Ministry of Finance provided significant financial support in the form of billions of dollars in funds and was effective in helping coal miners’ just transition, reaching carbon neutrality will likely require much more support given the scale of the impact. China needs to continue to improve its fiscal policy tools and actively promote the financial instruments with leveraging capital resources from private capital to provide continuous support for the low-carbon transition of the economy and society at large scale. In addition, national and provincial governments should consider requiring coal enterprises to establish coal transition funds that can be used for just transition in the future.

Local governments should avoid falling once more into a “resource trap” and tackle the challenge of being locked into low-value, high-carbon industries. Recent years have witnessed a significant wave of cross-regional industrial transfer from eastern to western regions which coincides with the needs to diversify and transform the economies of the coal regions. Due to the increasingly stringent environmental regulations, the “high energy consumption, high pollution” enterprises in eastern coastal areas are being transferred to resource-rich cities, including coal mining cities, such as Tongchuan electrolytic aluminum enterprises. Many coal regions also choose to develop coal chemical industries to leverage its resource advantage. All of these make it easy for the coal regions to fall into the resource trap. Instead, coal cities should shift the paradigm of development from focusing on resources to ecological product value and build a path to achieve high-quality and green urban development. When diversifying its economy, they should be actively, systematically, and selectively undertaking cross-regional industrial transfer, in order to transform to a low carbon economy.

Provincial governments should provide all-round strategic coordination, guidance and support for the development of new industries in coal cities. Coal cities often face the challenge of not knowing how to choose new industry, the lack of talent and technology, and the head-to-head competition from the neighboring regions. All of these can result in the failure to develop alternative industries at scale with differentiated development. Coal cities should participate in the regional planning and coordination and identify their own role function as part of the regional development strategy. This allows them to attract high-quality development factors such as talents and technologies by means of synergetic cooperation and resource integration.

Local governments should establish a principle that prioritizes people’s livelihoods and promote deep changes in the social governance system. Coal region transformation have a direct impact on workers in the coal mining industry, but also the indirect impact to the jobs that support the workers in the coal industry. Further, along with the change in the employment structure in the coal industry, population contraction, loss of labor force, and the social integration of aborigines and new citizens will all profoundly change the societal ecosystem. Thus, in addition to promoting employment through the economy, a new social governance system should also be considered in order to achieve a just transition in coal cities.

Acknowledgements and Statements

We thank Energy Foundation China and the Fairbank Center for Chinese Studies at Harvard University for their financial support to this project, without which it would not have been possible. We thank the Belfer Center for Science and International Affairs at Harvard University’s Kennedy School of Government and Tsinghua University’s Institute for Climate Change and Renewable Energy Research for their support and assistance in this research. We sincerely thank the interviewees in the two cities, Wuhai and Tongchuan, for their help, support and time. Last but not least, we thank Professor Henry Lee, Professor Zheng Li, Elizabeth Linos, Gabrielle Garneau, and Lin Wu for their tremendous help, review, feedback, and suggestions on this paper.

The research and analysis in the report are limited by data availability. In addition, the conclusions in the report are based on two case cities only. The development of any industry requires a long process, and each city has its own unique and complex situation that poses different challenges to the city’s industry. Our analysis aims to provide some references and perspectives for the transformation of coal cities in China and around the world.

The views expressed in this paper are those of the authors and do not necessarily represent the views of the authors’ organizations.