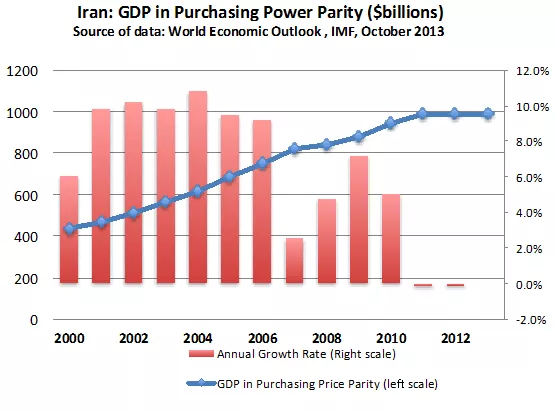

I want to expand on my earlier post about the size of sanctions relief in the November 24 Geneva Agreement. First, here is a look at the performance of the Iranian economy under sanctions:

This is partly why ordinary people, businessmen, and many politicians welcomed the interim agreement as soon as it was announced. While the government officials presented the deal as a victory for Iran’s nuclear program (since it allows Iran’s to enrich uranium up to 3.5%), what caused joy and celebration for most Iranians was the sanctions relief package that Iran received in return for its concessions. The negative impact of sanctions on Iran’s economy has become so severe in the past two years that what most people were looking for in these negotiations was a partial rollback on sanctions.

As I mentioned in my previous post, the sanctions relief that the group of 5+1 have offered in this agreement can have a significant positive impact on Iran’s dire economic conditions despite being temporary. Some experts have claimed that this package will only have a positive psychological impact on Iran’s economic climate, but a look at the specific components of the relief package point to a potentially deeper impact.

The relief package has five major components: 1) Iran will gain access to a limited amount of its export revenues that have been inaccessible because of the financial sanctions; 2) removal of restrictions on exports of petrochemicals; 3) lifting of sanctions on sea transport services and cargo insurance; 4) lifting of restrictions on imports of parts and technology for Iran’s automobile industry; and 5) lifting of sanctions on gold trade.

Each of these components will make a difference for Iran’s economy depending on how it is interpreted and implemented. Iran currently has a substantial amount of deposits in financial institutions of its oil clients that it cannot transfer to domestic banks because of financial sanctions. These include $5.3 billion in India, $5.56 billion in South Korea, $5.5 billion in Japan, and an even larger deposit in China, which has not been disclosed. Under the interim agreement, Iran will be able to repatriate a portion of these revenues, although the exact amount has not been specified. Furthermore, the relief package allows Iran to maintain its current level of exports for six months and gain control of the corresponding export revenues.

Lifting of sanctions on Iran’s auto industry is also a substantial economic relief.

Auto Industry

Iran’s auto sector suffered a severe setback in 2011-2013 as a result of the sanctions. The industry expanded its joint venture partnerships with European and Asian automakers after 2000 as auto production grew rapidly. The automobile industry is Iran’s second-largest industry after the oil and gas sector. In recent years its contribution to Iran’s GDP has risen to as high as 10 percent and its annual output reached a peak of 1.65 million vehicles in 2011 before suffering a 40% setback as a result of the sanctions in 2012. Lifting of sanctions on Iran’s auto industry can lead to a significant increase in production activity in the short-run and allow auto manufacturers to recall thousands of laid-off workers.

In 2012, three major international partners--Renault, Peugeot and Kia Motors--suspended their cooperation with Iran in response to international sanctions. Now both Renault and Peugeot corporations have announced their readiness to quickly resume their cooperation with Iran’s auto industry. The top representatives of both corporations attended an auto industry convention in Tehran on December 1st to negotiate the renewal of their cooperation with their Iranian partners.

In addition to forcing the withdrawal of foreign partners, the sanctions also led to a sharp devaluation of Iran’s currency, which increased the cost of parts and machinery for Iran’s auto industry. On average, each vehicle needs $1,300- to $1,500-worth of imported materials. Since Iran’s currency depreciated by more than 70% in 2012, the cost of these imported components rose sharply.

Petrochemical Industry

Iran’s petrochemical industry will also benefit from the sanctions relief package. Iran exported between $2 and $2.5 billion worth of petrochemical products to Europe annually before the sanctions, and it looks forward to restoring these exports under the Geneva agreement. Petrochemical exports to Asia and Africa did not suffer a substantial decline as a result of sanctions, but even exports to these regions are expected to increase with the reduction of restrictions on sea cargo transportation and cargo insurance. It is no wonder that the executives of Iran’s petrochemical companies were among the first groups to welcome the Geneva agreement on November 24th.

Removal of sanctions will not only lead to increased volume of petrochemical exports, but it will also allow the petrochemical firms to import badly-needed parts and machinery that have been subject to sanctions in the past two years. Industry insiders believe that lifting sanctions will have an immediate impact on profitability of petrochemical firms and their level of production. As a result of its abundant supply of oil and natural gas, Iran has a natural advantage in petrochemical industries, and the government has invested heavily in this sector in an effort to diversity the economy. Petrochemical exports have emerged as the second largest source of export revenues after crude oil in recent years. Export revenues stood at $11 billion in 2012, and a similar amount has been projected for 2013. Nevertheless, both production and export levels have remained below potential because of the sanctions.

Value of the Sanctions Relief Package

In response to the conservative critics of the November 24th Geneva agreement, Obama administration officials have argued that the temporary sanctions relief package in this agreement is very limited and will benefit the Iranian economy by no more than $7 billion. Indeed, it is likely to have a more substantial impact on Iran based on what was described above. The value of oil revenues that can now be repatriated legally can be more than this amount by itself. The increased economic activity and job creation in the auto and petrochemical industries (and thousands of associated small industries) can also be substantial.

The International Monetary Fund reported Iran’s economic output (GDP at PPP levels) at $988 billion in 2012 and $987 billion in 2013. This lack of growth was mainly a result of the international sanctions and bad economic policies during the final years of Ahmadinejad. During 2000-2011, this measure of economic activity grew by an average of 7.7% per year (see the chart above). The sanctions relief package and the investor optimism that it has generated can return the Iranian economy to this trend growth rate in 2014 if the government adopts a sound economic policy. Even if we adopt a cautious projection and assume that Iran will be able to experience a 5% annual growth rate in the first half of 2014, then the value of the sanction relief package will be approximately $24.5 billion. The significant value of Iran’s gain from the sanctions relief package is likely to increases the Iranian government’s desire to fulfill its obligations and work toward a permanent agreement.

Rouhani Emphasizes Economic Prosperity

In a meeting with university students on Iran’s Students Day (Rooz Daneshju), President Rouhani introduced a variation on a popular slogan of the regime. In his speech he said, “economic prosperity is our undeniable right.” This slogan is significant because it rhymes with the well-known slogan “nuclear energy is our undeniable right,” which is often heard in official political demonstrations. Rouhani’s slogan appears as a direct challenge to the official view that all costs are justified for the realization of Iran’s right to develop its nuclear program. Rouhani’s comment is likely to result in a conservative backlash. Rouhani is implicitly suggesting that in thinking about the nuclear policy we should take the economic costs into account. The policy implication of this statement is it is justifiable to forego some components of our nuclear program is the associated economic costs (sanctions) are too high. It is also interesting to note that President Rouhani made this statement in the same day that President Obama advocated granting Iran the right to low-grade enrichment in a final agreement. He also called the zero-enrichment demand “unrealistic.” While there is no evidence of coordination, both presidents defended their deal against domestic opponents on the same day.

Habibi, Nader. “A closer look at sanctions relief.” December 9, 2013